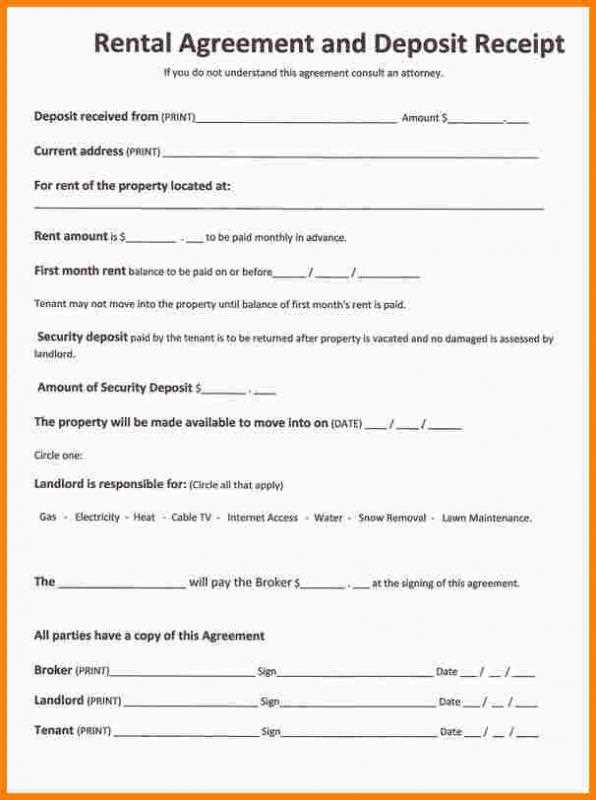

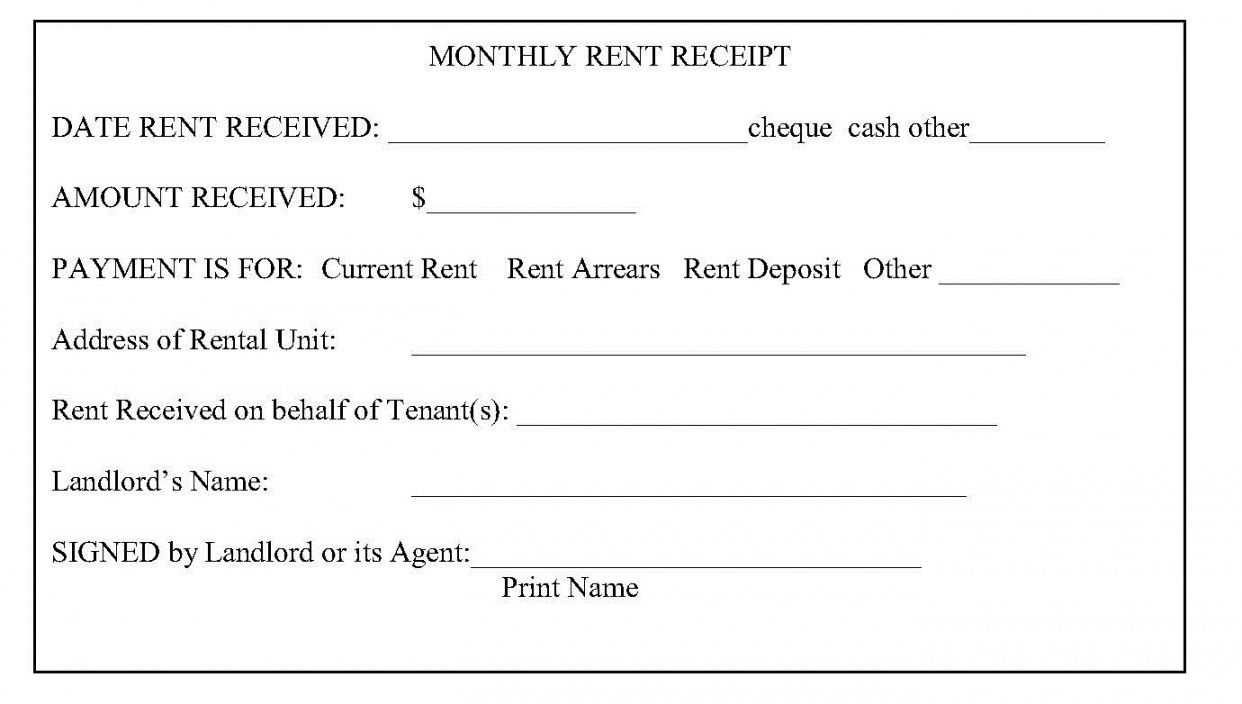

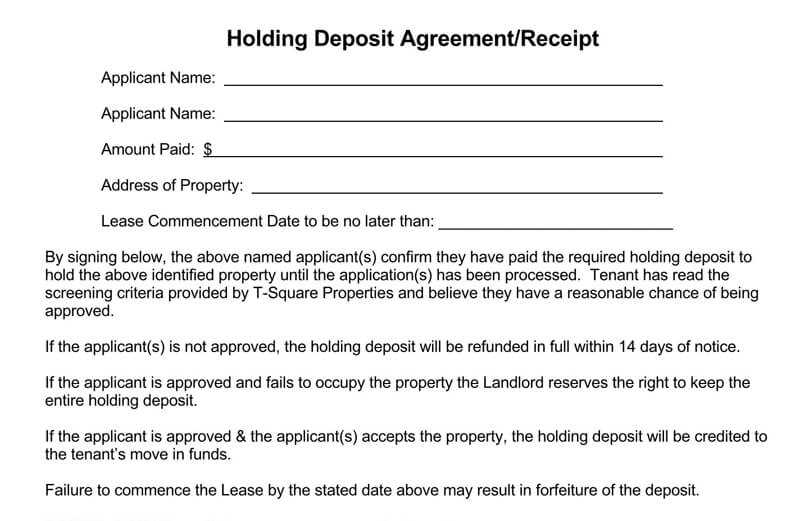

A commercial lease deposit receipt serves as proof of payment for the deposit amount made by a tenant to secure a lease agreement. It outlines key details such as the amount deposited, the date of payment, and any terms related to the deposit’s return or forfeiture. This document is essential for both landlords and tenants, providing transparency and legal protection throughout the lease term.

Ensure the receipt includes accurate information: the names of both parties, the rental property address, the deposit amount, and a statement specifying the purpose of the deposit. For clarity, it’s helpful to include a reference to the lease agreement that outlines the terms for refunding the deposit, especially if certain conditions need to be met. An effective receipt template eliminates confusion and helps resolve any disputes that may arise over the deposit in the future.

Incorporating clear language and avoiding ambiguity in the receipt template will protect both the tenant’s and landlord’s interests. By providing a well-structured document, you ensure smooth communication regarding financial matters throughout the leasing process.

How to Create a Legally Binding Commercial Lease Deposit Receipt

To create a legally binding commercial lease deposit receipt, ensure the document includes the following key elements:

1. Identify the Parties Involved

- The name and address of the landlord.

- The name and address of the tenant.

- The name of the business or the individual leasing the commercial property.

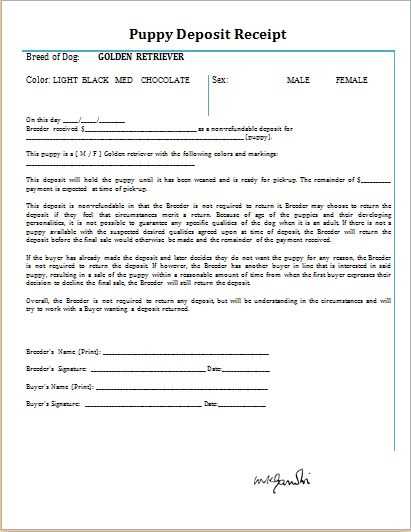

2. Specify the Deposit Amount

- Clearly state the exact amount of the deposit received.

- Indicate whether the deposit is refundable or non-refundable.

- Include the payment method (e.g., check, wire transfer, cash).

Next, outline the purpose of the deposit. This could include damage coverage, last month’s rent, or securing the lease.

3. Provide Lease Details

- Include the address of the leased property.

- Provide the lease start and end dates.

- Clarify whether this deposit is part of the total lease amount or an additional charge.

4. State the Terms of the Deposit Refund

- Outline conditions under which the deposit may be refunded or withheld (e.g., property damage, unpaid rent, or other violations).

- Specify the timeline for refunding the deposit after the lease ends, usually within a set number of days.

5. Signatures

- Both landlord and tenant must sign and date the receipt.

- Ensure each party receives a copy of the signed document.

Once the deposit receipt includes these elements, it becomes a legally binding document that protects both the landlord and the tenant. Ensure all terms are clearly defined to avoid future disputes.

Key Components of a Commercial Lease Deposit Receipt and Their Importance

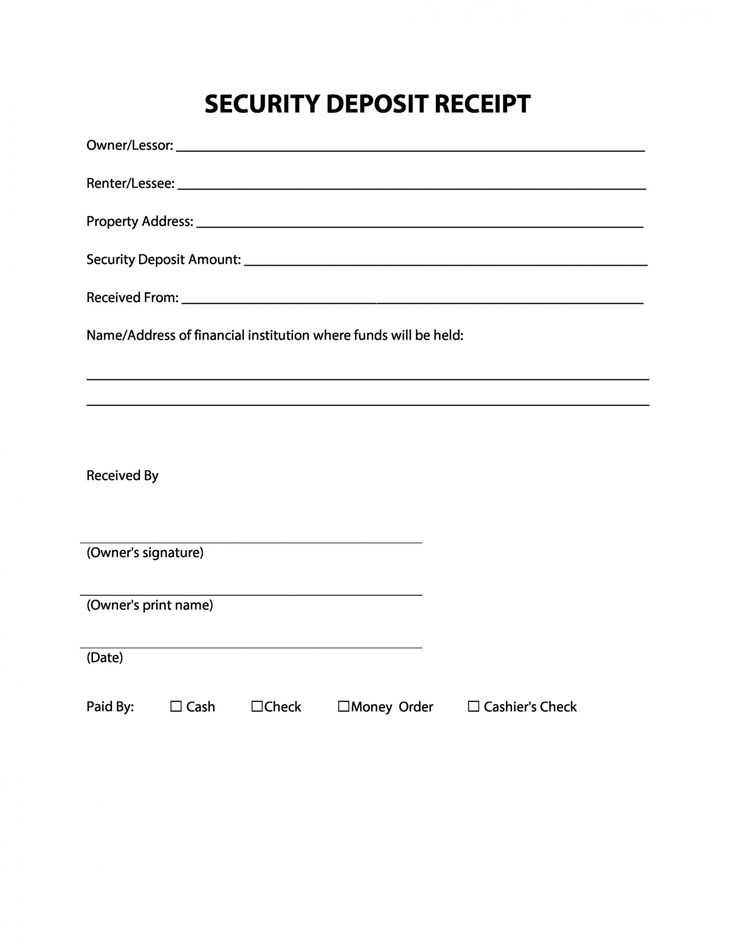

A commercial lease deposit receipt serves as a legal record of the deposit made by the tenant. It protects both parties by detailing the deposit terms and conditions. Below are the critical components and their significance.

1. Tenant and Landlord Information

This section includes the names and contact details of both parties. It is vital for confirming the identities of the individuals involved in the lease agreement. Clear identification ensures that any disputes can be directly linked to the responsible party.

2. Deposit Amount and Terms

The exact amount of the deposit, along with the payment date, should be clearly stated. This section prevents confusion about the amount deposited and establishes expectations regarding its return. It also clarifies if the deposit is refundable or non-refundable under specific conditions.

The receipt should also outline how the deposit will be held and if interest is applicable, providing transparency on how funds are managed.

3. Purpose of the Deposit

This explains the reasons for the deposit, such as covering potential property damage or unpaid rent. Clearly stating the purpose ensures that both parties understand the deposit’s role in the lease and prevents future misunderstandings on its use.

4. Conditions for Deposit Return

Include specific details about when and how the deposit will be returned. This might include the inspection process, any deductions for repairs, and the timeline for refund. Setting these expectations in writing helps avoid disputes over the return of the deposit.

5. Acknowledgement of Receipt

Both tenant and landlord should sign the receipt, confirming that the deposit was paid and accepted. This signed document acts as proof in case of any future disagreements regarding the deposit.

Common Mistakes to Avoid When Using a Commercial Lease Deposit Receipt Template

Ensure the deposit amount is clearly stated. Ambiguity around the amount paid can lead to disputes later. Double-check that the exact sum, including any partial payments or adjustments, is reflected correctly on the receipt.

Not Including Payment Details

Always include specific payment details, such as the method of payment (cash, check, bank transfer) and the date of payment. This provides a clear record for both parties and helps avoid confusion if the deposit is questioned at a later time.

Ignoring the Deposit Terms

Do not leave out the terms regarding the deposit, such as whether it is refundable and under what conditions it may be withheld. Without this information, the receipt may not fully protect the landlord or tenant in case of disagreements.

Make sure to also include any conditions related to the return of the deposit, such as deductions for repairs, unpaid rent, or other expenses. This ensures transparency and avoids future conflicts.

Failure to Specify the Parties Involved

List both the landlord’s and tenant’s full names and addresses. This avoids any confusion in identifying the parties involved and helps confirm that the correct individuals or entities are bound by the agreement.

Overlooking Signature Requirements

A receipt without signatures may not hold legal weight. Ensure both the landlord and tenant sign the document to acknowledge the transaction and terms of the deposit. If it is an electronic receipt, make sure that there is a clear method for both parties to authenticate the document.

Leaving Out Important Dates

Clearly note the date the deposit was received. Without a date, it can be difficult to prove the timing of the deposit, which could be significant in the case of disputes about payment deadlines or lease terms.

By taking these steps, you can avoid common mistakes and ensure the lease deposit receipt serves its intended purpose of protecting both the tenant and landlord.