For a smooth transaction experience, utilize a deposit receipt form template. This template streamlines record-keeping, ensuring both parties maintain accurate financial records. Customize the template to fit your specific needs, making it user-friendly and accessible.

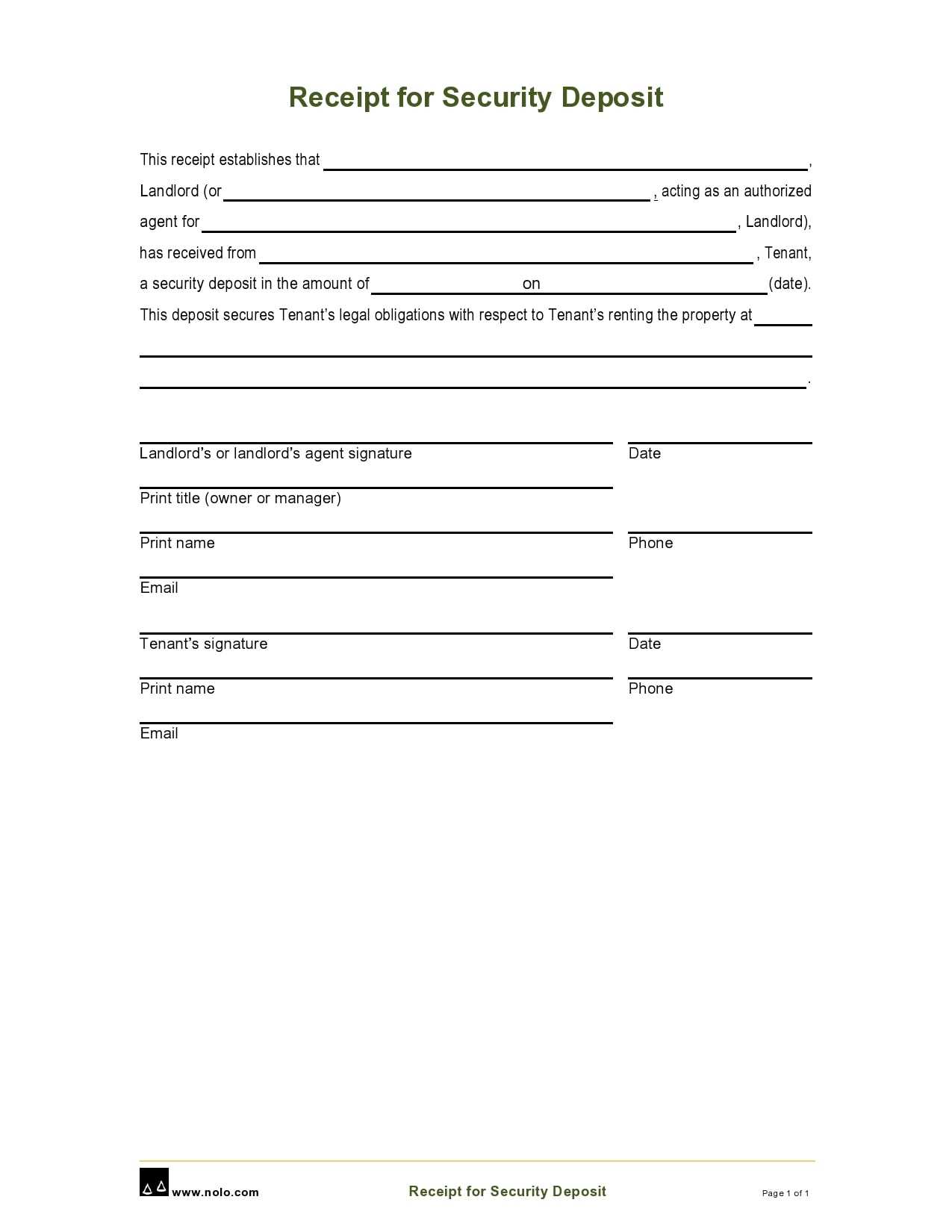

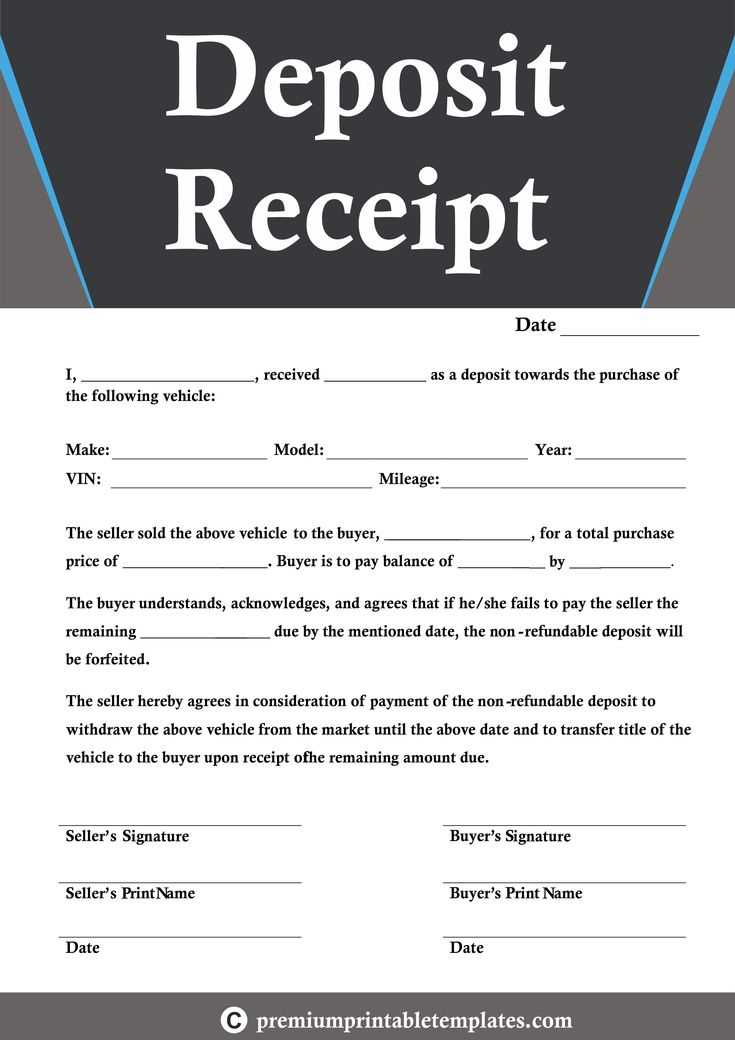

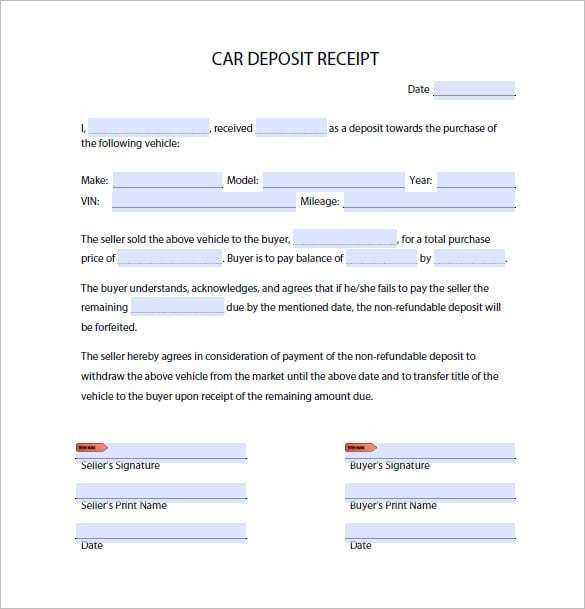

Include essential fields such as the date, depositor’s name, amount deposited, and purpose of the deposit. This clarity prevents potential misunderstandings and establishes trust between involved parties. Incorporate a signature line for both the depositor and the receiver, adding an extra layer of authenticity to the document.

Using a deposit receipt form template not only enhances professionalism but also protects against future discrepancies. Keep copies of each completed receipt for reference, providing a safeguard for any future inquiries. A well-structured template supports clear communication and organized documentation.

Here’s a refined version of your text with reduced word repetition:

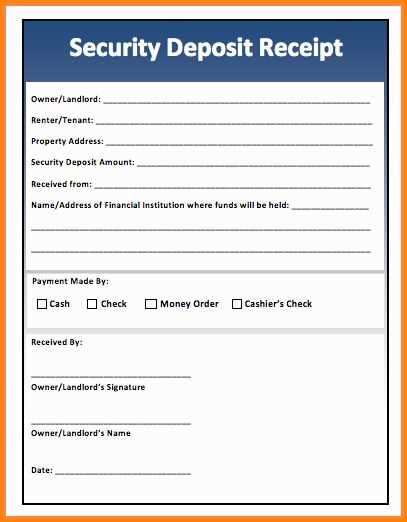

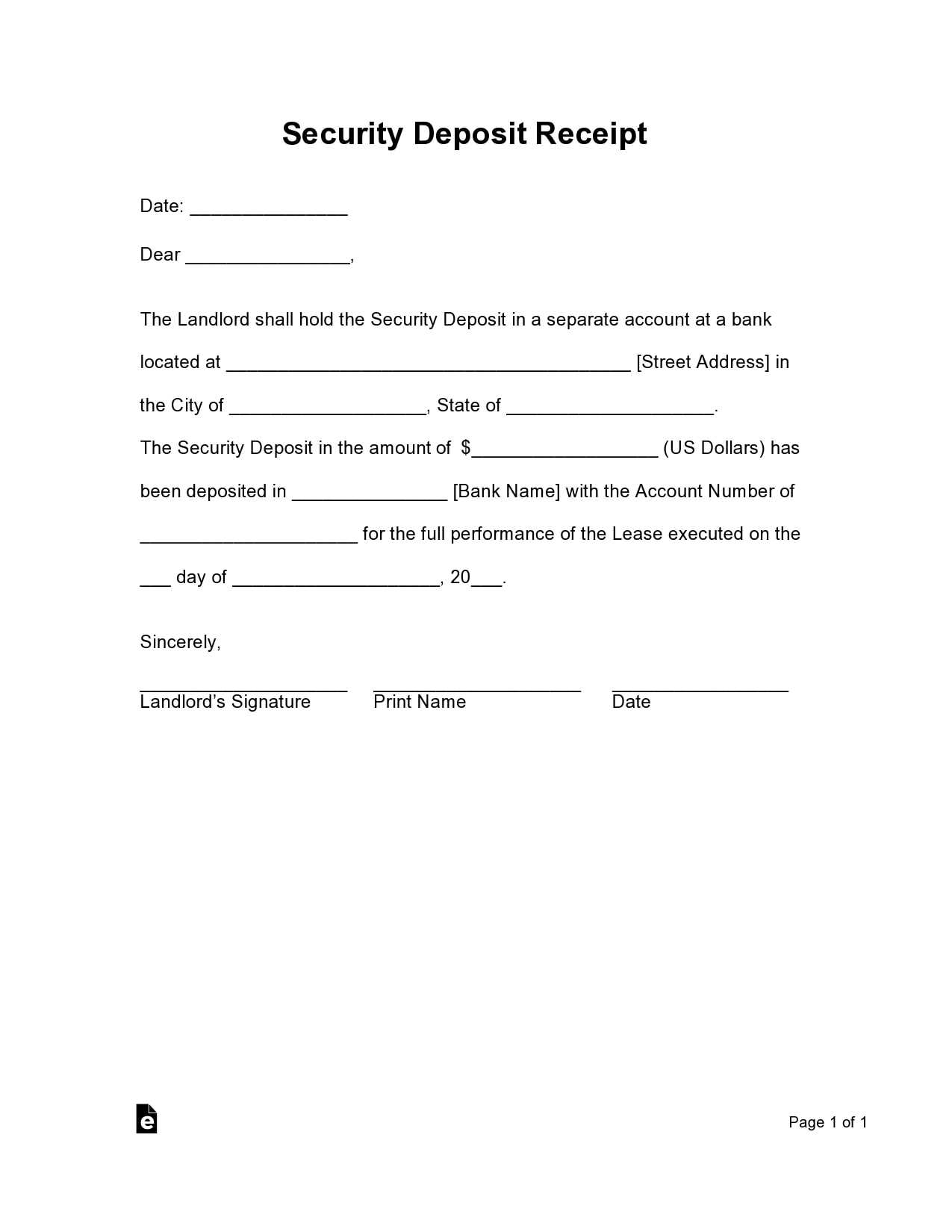

Begin by outlining the key elements required in a deposit receipt form. Include sections for the depositor’s name, account number, and date of deposit. Clearly specify the amount deposited and the method of payment, whether cash, check, or electronic transfer.

Utilize a clean layout to enhance readability. Incorporate spaces for signatures from both the depositor and the bank representative to authenticate the transaction. Ensure the receipt includes a unique transaction ID for easy tracking and reference.

Formatting Tips

Choose a legible font and maintain consistent font sizes for headings and body text. Use bold formatting for important information such as total amounts and dates. Consider adding a logo or watermark for branding purposes.

Final Review

Before finalizing the template, review all sections for accuracy. Test the form by filling it out with sample data to ensure all elements function properly. Make adjustments based on feedback to enhance clarity and usability.

Deposit Receipt Form Template

Include the date of the transaction prominently at the top of your deposit receipt form. Clearly label fields for the amount deposited, the account holder’s name, and the type of deposit, whether cash or check. This information provides clarity and ensures accuracy.

Essential Elements of a Deposit Receipt

Ensure your deposit receipt contains the following elements: a unique receipt number for tracking, the financial institution’s name and logo, and contact information. Also, incorporate a signature line for both the depositor and the teller, which adds authenticity and accountability.

How to Personalize Your Deposit Receipt Template

Customize your template by adding branding elements, such as your company’s colors and fonts. Adjust the layout to fit your needs, ensuring it remains professional and easy to read. Consider including terms and conditions related to deposits, as these can provide additional context for users.

Be vigilant about common errors. Double-check all entries for accuracy, avoid cluttered layouts that can confuse users, and ensure that all required fields are included to prevent incomplete receipts.