Creating a reliable deposit receipt is simple with the right app. With a deposit receipt template app, you can easily generate a professional document that covers all necessary details, from transaction amount to payer and payee information. These templates save time and ensure accuracy, whether you’re managing personal or business-related deposits.

Choosing the right app means considering features like customizable fields, clear formatting, and the ability to save or email receipts instantly. A template app can also help you track past transactions with just a few taps, making it easier to stay organized and keep records in order.

For added convenience, many apps allow you to store templates for different types of deposits, so you’re always prepared. Whether you’re dealing with rental payments, business deposits, or personal loans, a deposit receipt template app streamlines the process, ensuring your receipts are accurate and professional every time.

Here’s the revised version:

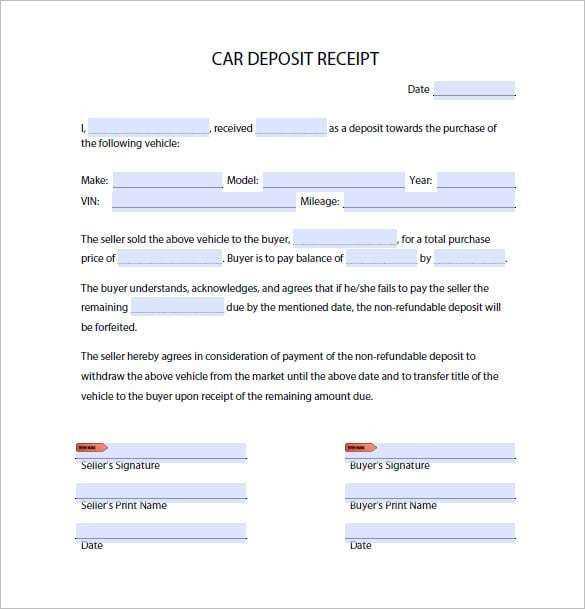

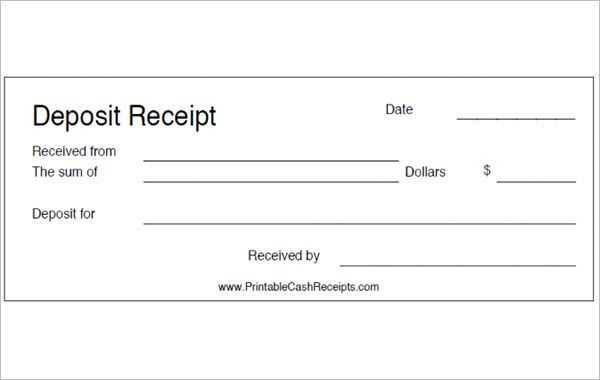

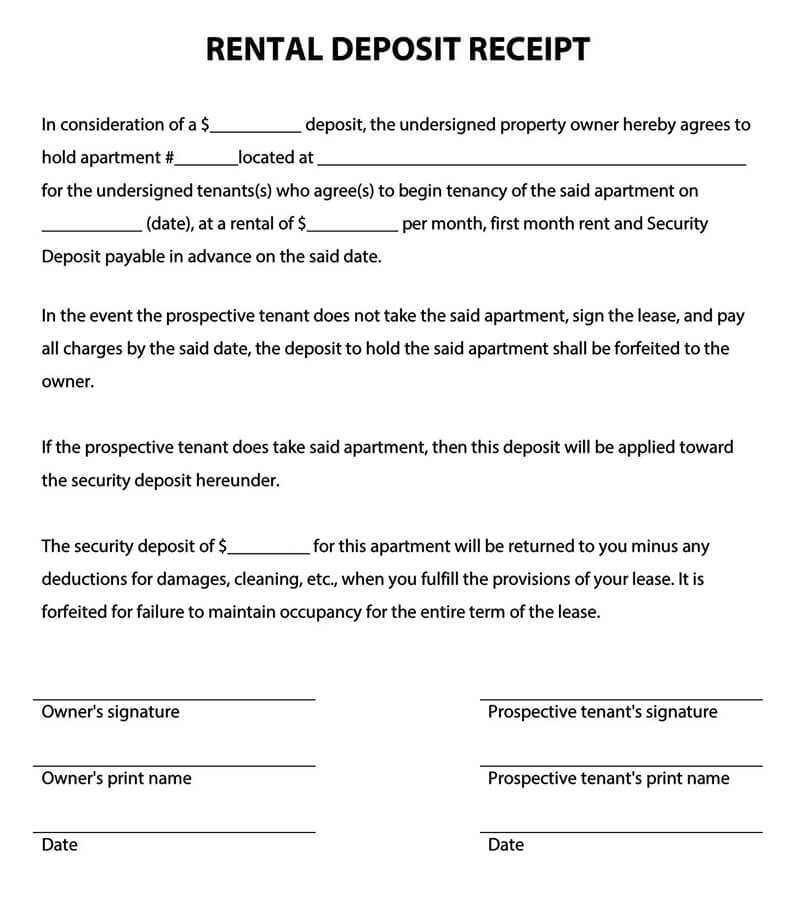

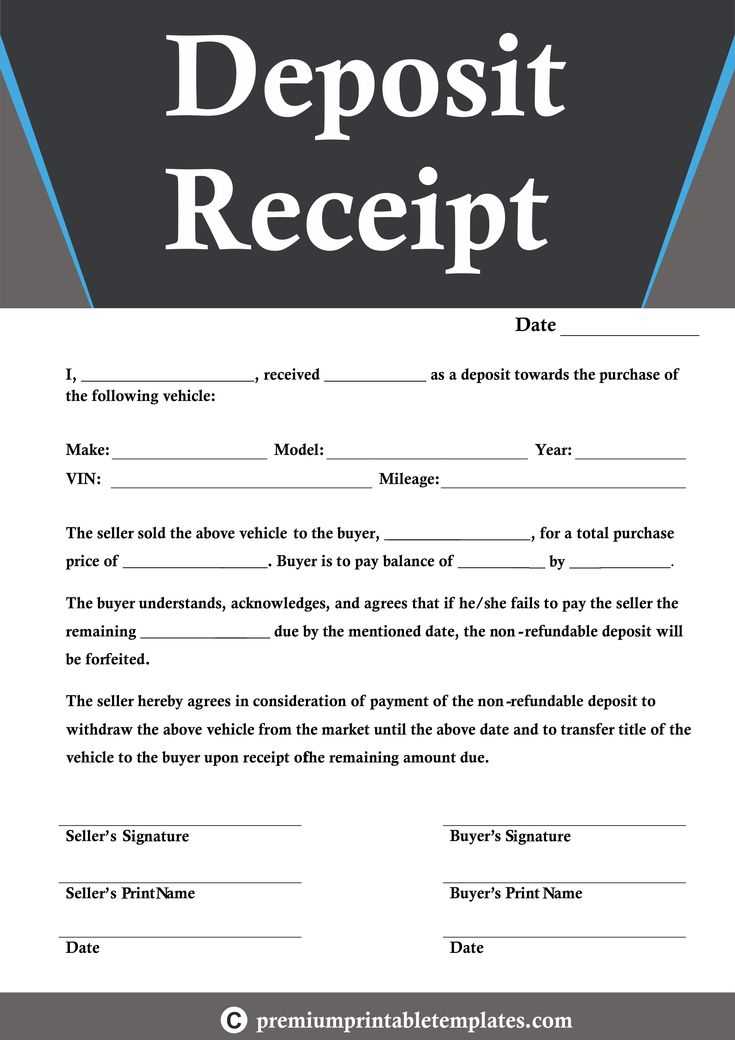

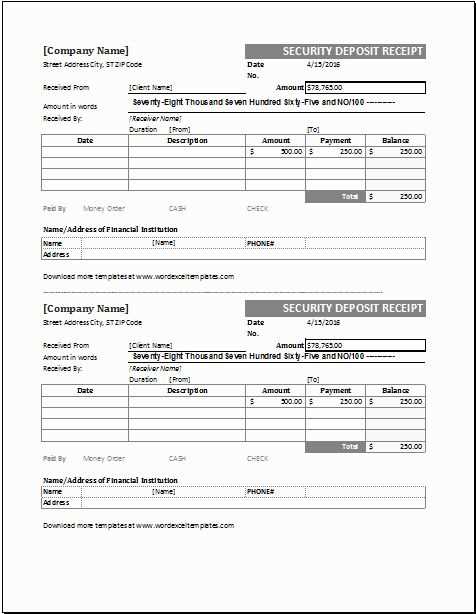

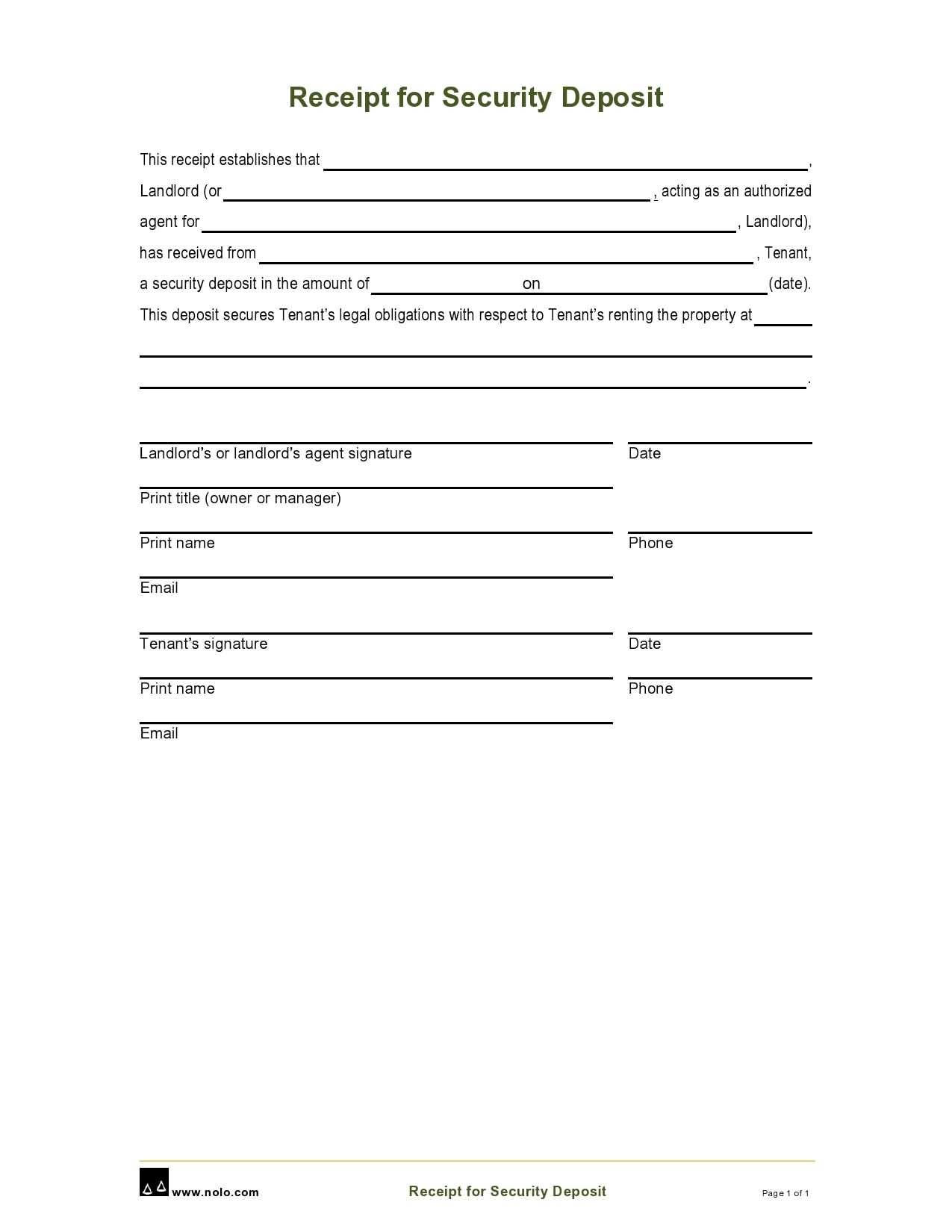

The deposit receipt template should clearly list the transaction details, such as the amount, date, and method of payment. It’s important to include both the payer’s and the payee’s contact information, ensuring no ambiguity about who is involved in the transaction. This makes the receipt legally valid and traceable if necessary.

Structure of a Deposit Receipt

Begin with a header stating “Deposit Receipt” prominently. Include fields for the transaction number, which is essential for referencing in the future. Following this, specify the deposit amount, currency, and the payment method–whether cash, check, or bank transfer.

Additional Key Details

Don’t forget to include a section for notes. This could be useful for indicating the purpose of the deposit or any other special conditions. A signature line at the bottom confirms the transaction’s authenticity, which may be required in certain legal situations.

- Deposit Receipt Template App

Deposit receipt template apps simplify the creation of professional and accurate receipts. By using templates, users can quickly customize and issue receipts for deposits, ensuring consistency and reducing errors. These apps typically offer features such as pre-filled fields for common deposit details, customizable branding, and secure storage options for easy retrieval.

When choosing a deposit receipt template app, look for one that allows you to:

- Customizable fields for deposit amount, date, and payer details

- Options to include payment method and reference numbers

- Export functionality for sharing receipts as PDF or email

- Data security features like encryption to protect sensitive financial information

Ensure that the app integrates well with other tools you use, such as accounting software or cloud storage services. This integration can save time and improve data accuracy by automatically syncing deposit records. Some apps also support multiple users, making it easier for teams to manage receipts collaboratively.

Here is a quick comparison of features in popular deposit receipt template apps:

| App | Customizable Templates | Export Options | Security Features | Team Collaboration |

|---|---|---|---|---|

| Receipt Maker | Yes | PDF, Email | Encryption | No |

| DocuSign | Yes | PDF, Email, Cloud | High Security | Yes |

| Invoice Generator | Yes | PDF, Excel | Basic Encryption | Yes |

Consider how often you need to issue receipts and whether you require advanced features like team collaboration or integration with other tools. For occasional use, a simple app with basic templates may suffice, while businesses handling frequent transactions may benefit from a more feature-rich solution.

Use a receipt template app to simplify the process of creating professional receipts. Customize it with your business logo, contact details, and specific payment information for a cohesive look that reflects your brand.

Personalize Receipt Layout

Design the layout to match your business style. Adjust the font, color scheme, and spacing to ensure your receipts are easy to read while maintaining a professional appearance. Add fields for details like customer name, date, itemized list of products or services, and total amount due. Make sure your receipts are clear and concise to avoid confusion.

Include Business Information

Ensure all relevant business details are present. Include your business name, address, phone number, and website. You can also add a unique receipt number to track transactions efficiently. These details help build trust with your customers and serve as a reference for both parties in case of disputes.

Integrating these customizations into your receipt template app not only makes each transaction smoother but also enhances your business image. Keep your receipts organized and consistent across all sales, making it easier to manage finances and improve customer satisfaction.

Link your payment system to the receipt template app directly through API integrations. This method automatically generates receipts upon successful payment transactions. Choose a payment gateway that offers an API, like Stripe or PayPal, for seamless communication between both systems.

Ensure that your app can fetch transaction details from the payment provider in real time. This data should include amounts, payment methods, and customer information. Having this information populated automatically into your receipt templates will reduce manual entry errors and increase the speed of receipt generation.

Incorporate secure tokenization or encryption standards during the integration process to protect sensitive payment data. Most payment gateways provide built-in security measures like SSL and PCI-DSS compliance to ensure your system meets industry standards.

To further enhance the experience, implement customizable templates for receipts, allowing users to modify the look and feel according to their branding needs. Include key information like transaction ID, payment status, and any applicable taxes, and give users control over what details appear on each receipt.

Lastly, set up automated email or SMS notifications to send receipts directly to customers after a successful transaction. This eliminates the need for manual follow-ups and enhances customer satisfaction. Be sure to test your integrations regularly to ensure smooth operation across all platforms involved.

Look for an app that allows you to include required legal details such as business identification, tax numbers, and addresses. These details ensure receipts meet regulatory standards and remain valid in case of an audit.

Automated Tax Calculations

Select an app that automatically calculates taxes based on your region’s rules. The app should update tax rates regularly, keeping receipts accurate and in compliance with local tax laws.

Customizable Legal Text Fields

The best apps offer customizable text fields, allowing you to add necessary legal disclaimers, return policies, or terms of service. This feature ensures you meet consumer protection regulations, safeguarding your business from potential legal issues.

Ensure the app provides export options such as PDF or email to keep organized records. This feature is valuable for legal compliance, particularly when receipts need to be easily accessed during tax or legal inquiries.

When choosing a deposit receipt template app, focus on features that streamline the process and ensure accuracy. Look for apps that allow easy customization of templates to suit your specific needs. Avoid unnecessary complexity and choose tools that prioritize simplicity and ease of use.

- Ensure the app supports clear itemization of deposits and associated details like amount, date, and payment method.

- Check for automatic calculation features to avoid manual errors when adding deposit amounts.

- Look for apps that let you save and store receipts digitally for future reference or easy retrieval.

- Opt for apps with a mobile-friendly interface, allowing you to create and manage receipts on-the-go.

- Consider apps with built-in templates that follow common standards for deposit receipts.

Additionally, ensure the app is compatible with your device and integrates smoothly with your existing workflow. These steps will help maintain organization and accuracy with your receipts while saving time and effort.