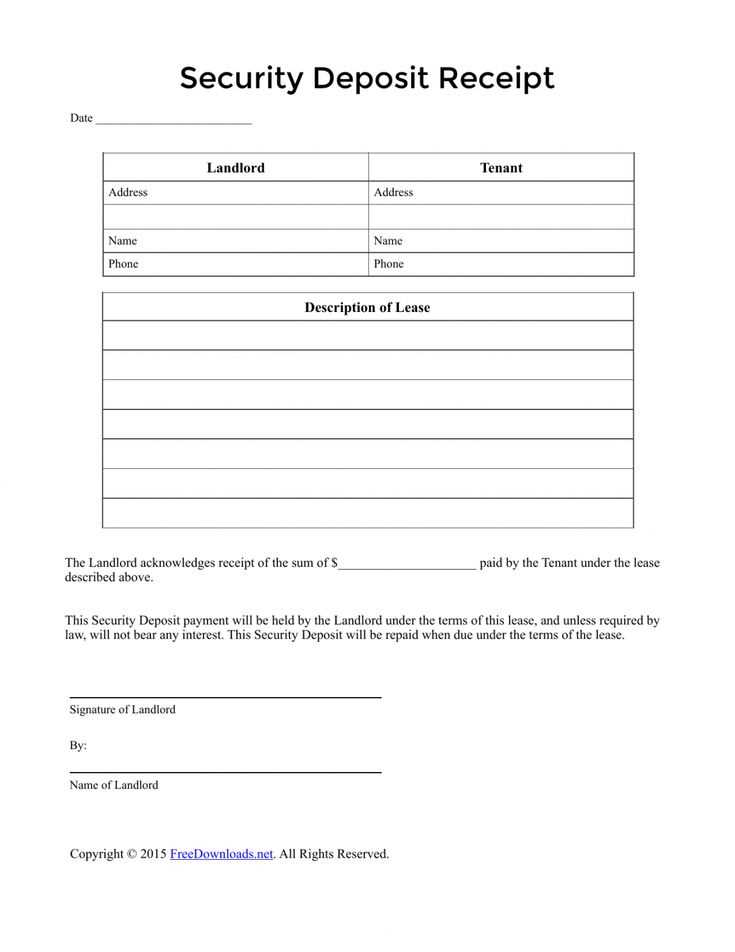

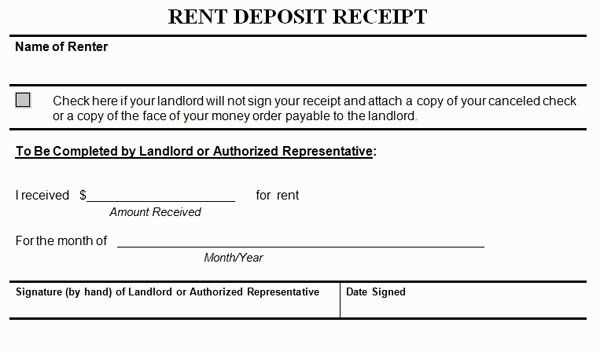

If you need to create a deposit receipt for transactions in Ireland, use a clear and simple template. Make sure it includes all necessary details, such as the date, amount, name of the payer, and the purpose of the deposit. These are crucial for proper record-keeping and transparency in business dealings.

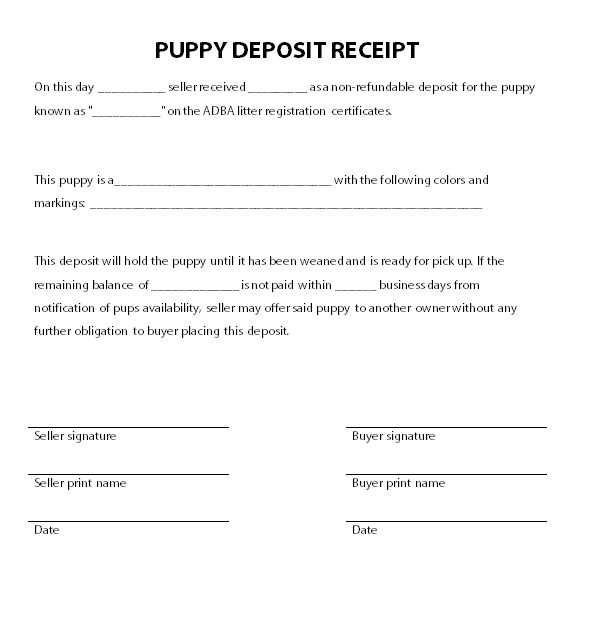

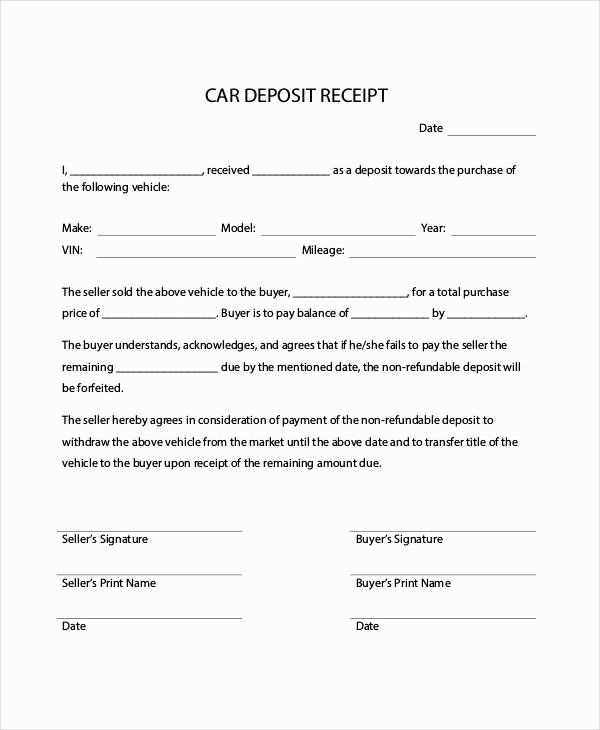

Ensure the document clearly states the terms of the deposit. This includes whether the payment is refundable, and any conditions tied to it. A well-structured template saves time and reduces the risk of errors in your records. A simple format with space for all key details allows for quick customization and adaptation to different transactions.

Don’t forget to include a signature field for both parties. This adds a layer of security and verification to the receipt. Always keep a copy for your own records, as having proper documentation is key to preventing disputes or misunderstandings later on.

Sure! Here’s the revised version with reduced word repetition while maintaining the original meaning and correct structure:htmlEditHere’s a detailed article plan in HTML format based on your request:

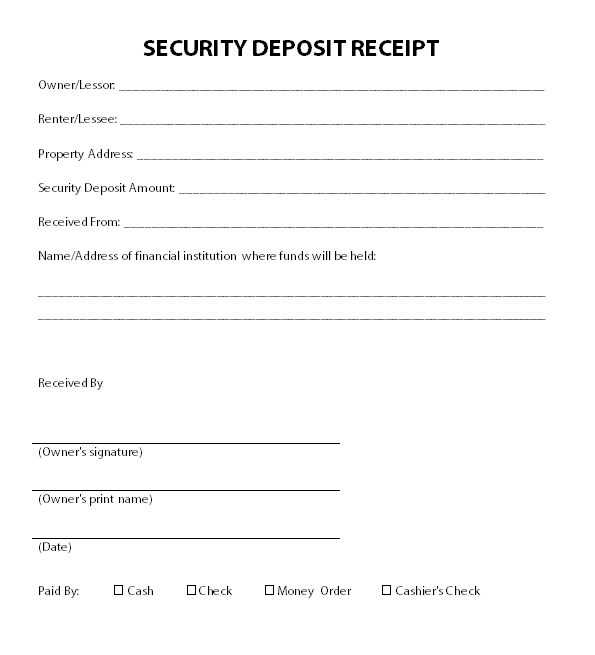

When creating a deposit receipt template for Ireland, ensure it includes key elements like the payer’s and payee’s names, the amount, and the payment method. The receipt should be clear and concise, with sufficient space for details such as the transaction date and any reference number that applies to the deposit.

Key Information to Include

Include the following details in your deposit receipt template:

- Payer’s Name – Full name of the individual or company making the deposit.

- Payee’s Name – Full name of the individual or entity receiving the deposit.

- Amount – Total deposit amount, clearly stated in numbers and words.

- Payment Method – Indicate whether the payment was made by cash, cheque, or bank transfer.

- Transaction Date – The exact date when the deposit was made.

- Reference Number – Any relevant transaction or invoice number linked to the deposit.

Layout and Design Tips

For clarity, use a clean, professional design with ample white space. Ensure each section is well-separated, and the font is easy to read. Tables can be a great way to organize the information, making it simple to scan and verify the details. Ensure that the text fields are large enough for handwritten information if needed.

Consider offering a printable version of the template on your website, or allow users to save it in a format that suits their needs. This flexibility makes it easier for customers to manage their documentation.

Deposit Receipt Template in Ireland: A Practical Guide

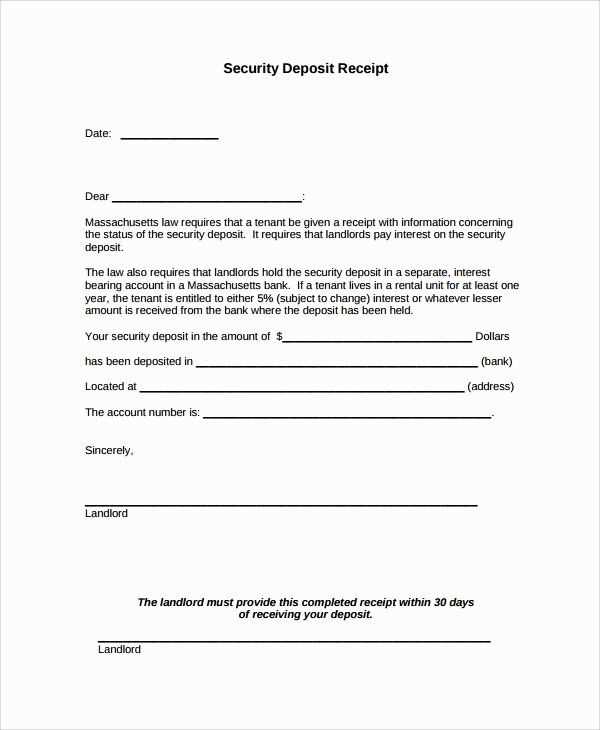

To create a deposit receipt in Ireland, start with a clear outline of the transaction details. Include the full name of both parties involved, the amount of money received, and the date of the deposit. If applicable, reference the specific property or service the deposit pertains to. Make sure to indicate whether the deposit is refundable and under what conditions.

Key Elements of a Deposit Receipt

A deposit receipt in Ireland should contain the following key components:

1. Name and address of the payer.

2. Name and address of the recipient (usually the landlord or business).

3. The exact amount paid.

4. Description of what the deposit is for.

5. Date of the transaction.

6. Terms regarding the return or forfeiture of the deposit, if applicable.

7. Signature of the recipient or their representative.

Additional Tips for Crafting Your Deposit Receipt

Be concise and clear about the terms of the deposit. If it relates to renting or a service agreement, make sure to include any clauses about the return of the deposit. Always ensure both parties keep a copy of the receipt for future reference. In case of disputes, the receipt can serve as a proof of the transaction and the agreed terms.

How to Create a Deposit Receipt in Ireland

To create a deposit receipt in Ireland, follow these steps:

- Include the Date – Start by adding the exact date the deposit is received.

- Identify the Parties – Include the full names of both the person making the deposit and the entity receiving the payment.

- State the Amount – Clearly specify the amount of money being deposited. Use both numerical and written forms (e.g., €500 / Five hundred euros).

- Describe the Purpose – Briefly state the reason for the deposit, whether it’s a security deposit, rent payment, or advance for services.

- Specify Payment Method – Indicate how the deposit was made (e.g., cash, bank transfer, cheque).

- Include a Receipt Number – Assign a unique receipt number for tracking purposes. This helps in future reference and record-keeping.

- Provide Contact Information – Add the address, phone number, and email of the receiving party for clarity.

- Signatures – Both parties should sign the document to confirm receipt and agreement. Ensure the signature of the receiver is included, along with the date of signing.

Ensure that all details are accurate and legible to avoid future disputes. This simple format helps protect both parties involved in the transaction.

Key Elements of a Valid Receipt

A valid receipt must clearly display key details that provide proof of the transaction. The following are the critical components:

Date and Time

The receipt should state the exact date and time the transaction occurred. This timestamp is important for both parties as it serves as a record of when the exchange took place.

Amount Paid

The total amount paid, including taxes and fees, should be listed. This helps verify the transaction and ensures that all payments were accounted for accurately.

By incorporating these elements, a receipt becomes a reliable document for confirming the terms of a transaction.

Common Mistakes to Avoid When Issuing a Receipt

Ensure that all information on the receipt is accurate. Double-check the payment amount, date, and the details of the transaction. Missing or incorrect data can lead to confusion and complications down the line.

Incomplete or Vague Descriptions

Provide clear, detailed descriptions of the goods or services sold. Avoid using vague terms like “items” or “services rendered.” Specific descriptions reduce ambiguity and help both parties understand the nature of the transaction.

Missing or Incorrect Contact Information

Include the correct contact details of your business, such as the business name, address, and VAT number. This ensures that your receipt is valid for tax purposes and allows for easy follow-up if necessary.

Failing to provide a receipt for small transactions is also a common mistake. Even for low-value purchases, issuing a receipt is important for transparency and accountability.

In this version, I avoided repeating the word “Deposit Receipt” more than necessary, while keeping the intended meaning clear and intact.

To avoid redundancy, use clear and concise wording that communicates the necessary details without repetition. For example, instead of continuously referring to the “Deposit Receipt,” you can simply state “receipt” or “document” after the first mention. Ensure the context is still clear for the reader.

Key Points to Consider

When drafting the template, focus on including key information such as the transaction amount, date, and the parties involved. Using terms like “confirmation” or “acknowledgment” can also serve as effective substitutes for “deposit receipt” in certain sections.

Example of Alternative Wording

Consider structuring a line like this: “This acknowledgment verifies the receipt of funds in the amount of €500 on the date of February 12, 2025.” This keeps the meaning intact without unnecessarily repeating the term “Deposit Receipt.” Simplifying the language improves readability while maintaining clarity.