When renting a property in the UK, providing a landlord deposit receipt is a necessary step for both tenants and landlords. This document serves as proof that the tenant has paid a deposit for the rental property and outlines the terms under which the deposit is held. It is vital to clearly state the amount paid, the property address, and any conditions attached to the return of the deposit at the end of the tenancy.

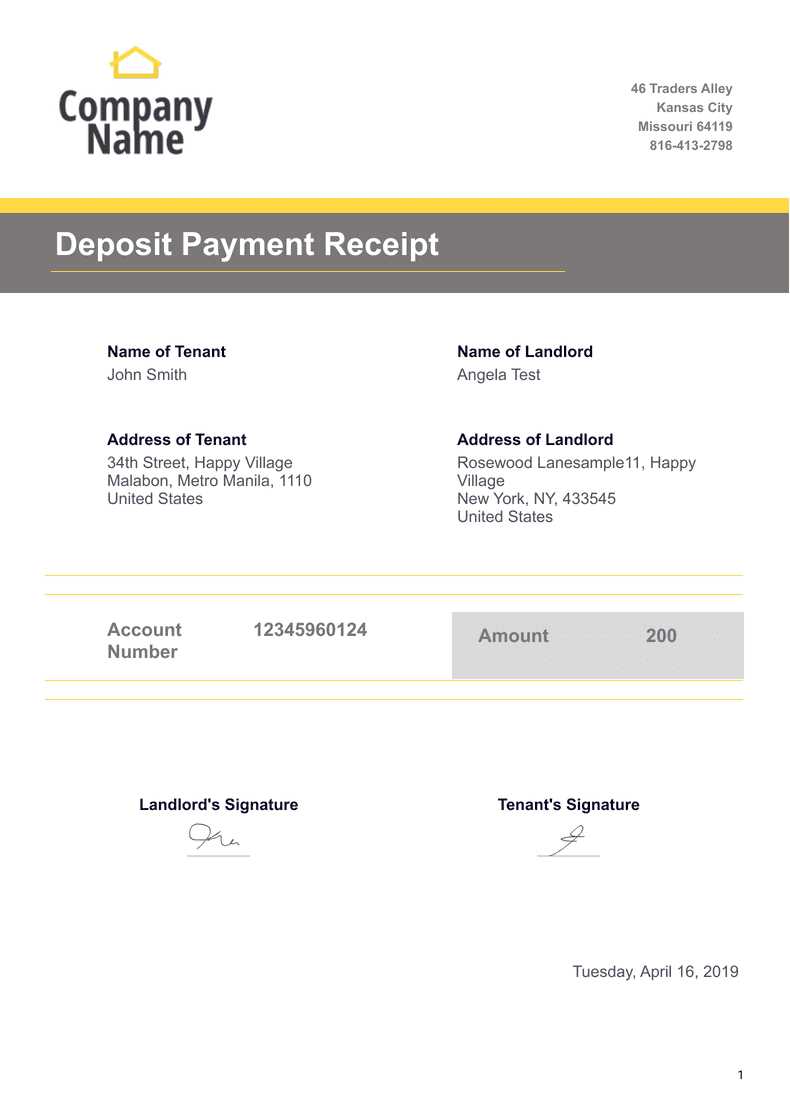

Make sure your deposit receipt template includes all required details, such as the tenant’s name, the date of payment, and the specific amount deposited. Additionally, it should specify whether the deposit is protected under a government-approved scheme, as this is a legal requirement in the UK. By doing so, you can avoid future disputes over the return of the deposit.

Use a clear and simple format to ensure transparency and to keep a record that both parties can refer to. This will safeguard both you and your tenant, making sure that expectations are clear from the outset of the tenancy.

Here’s the revised version:

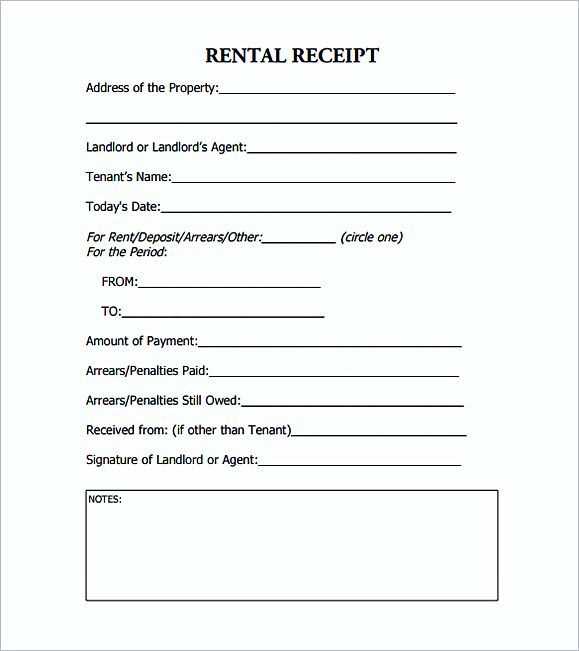

Make sure the landlord deposit receipt clearly specifies the amount received, the date of the transaction, and the property address. The document should also identify the tenant and include their contact details, along with the landlord’s or agent’s information.

Details to Include:

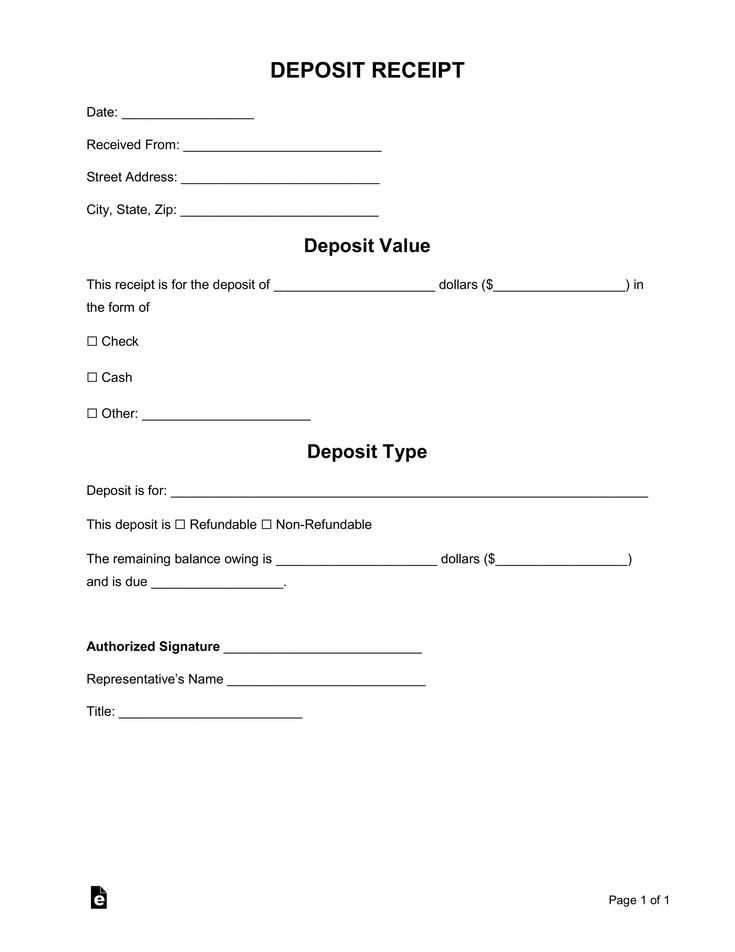

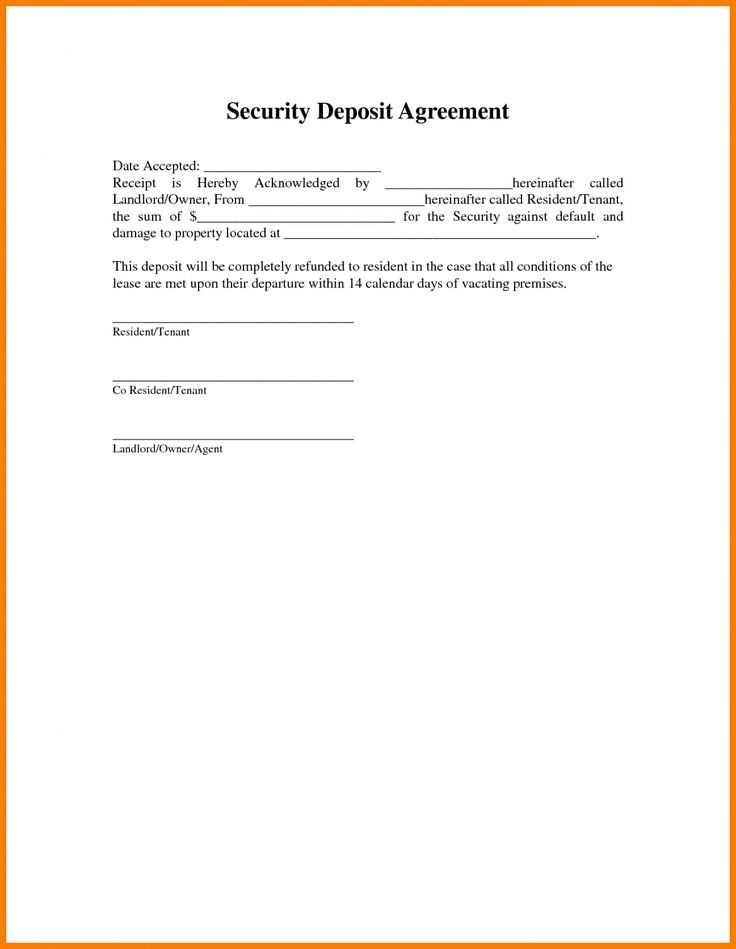

Include a clear statement that this deposit is for the rental property. Specify the terms under which the deposit is refundable, including conditions for deductions like damages or unpaid rent. Both parties should sign the document to validate the transaction.

Why It Matters:

A well-drafted receipt protects both the landlord and tenant in case of disputes. The receipt serves as proof that the tenant has paid the deposit and ensures transparency in how the money will be handled.

- Landlord Deposit Receipt Template Overview

A landlord deposit receipt is a key document in tenancy agreements. It provides a written acknowledgment of the deposit amount received from the tenant. This document serves as proof of payment and is useful in resolving any future disputes regarding the deposit.

- The template should include the full name and address of both the landlord and tenant.

- Clearly state the deposit amount and the property address for which it was paid.

- Specify the date the deposit was received and the method of payment (cash, cheque, bank transfer, etc.).

- Include details about any conditions regarding the return of the deposit at the end of the tenancy.

- If applicable, mention if the deposit is protected by a tenancy deposit scheme, and provide relevant scheme details.

The receipt helps clarify the responsibilities of both parties and ensures transparency, reducing potential disagreements over the deposit during the tenancy or at its conclusion.

Clearly state the tenant’s name, property address, and the amount of the deposit. Make sure this information is accurate to avoid any confusion later. Include the date of the receipt, as it serves as proof of the transaction.

Describe the condition of the property at the time of deposit. You can reference a separate inventory or inspection report, but provide a brief summary on the receipt itself to confirm both parties agree on the property’s status.

List the payment method used for the deposit (e.g., cash, bank transfer, cheque). This can be helpful in case of disputes over the payment process.

Note the terms of the deposit return. Specify the conditions under which the deposit will be returned, such as upon the tenant’s vacating the property and after an inspection. Mention the timeline for the return, if applicable.

Provide a space for signatures from both the landlord and tenant. This confirms mutual agreement on the terms listed in the receipt. Both parties should sign the document in the presence of one another for validation.

If the deposit is held in a third-party scheme, include the relevant details about the scheme, such as the provider’s name and contact information. This is important for transparency and legal requirements.

Clearly outline the tenant’s name, the property address, and the date the payment is made. This gives a clear record of the transaction and ensures both parties know the details. Include the exact amount paid, whether it’s a full deposit or partial payment. Specify the method of payment (bank transfer, cheque, etc.) to avoid confusion.

Deposit Breakdown

List any deductions, if applicable, such as cleaning or repairs. This provides transparency and sets expectations for the return of the deposit. If no deductions are made, state that the deposit is refundable in full, with any conditions that may apply.

Landlord’s and Tenant’s Signatures

Ensure both parties sign the receipt. The tenant’s signature acknowledges that the receipt is correct, while the landlord’s signature affirms the terms of the transaction. This prevents any disputes down the line and provides proof that both parties agreed to the receipt’s details.

Issuing a deposit receipt is a legal obligation for landlords in the UK when taking a tenant’s deposit. This receipt serves as proof of payment and outlines the terms under which the deposit is held, ensuring transparency and protecting both parties.

According to the Tenancy Deposit Scheme (TDS), landlords must issue a written receipt for any deposit received. This should include details like the amount, the date, and the conditions for returning the deposit. Failing to provide this receipt could lead to legal disputes and, in some cases, penalties.

It’s important for the landlord to include the specific terms for deposit protection. The deposit must be held in a government-backed scheme, and the receipt should confirm this. This protects the tenant’s deposit and ensures the landlord complies with the legal requirements set by the Housing Act 2004.

| Key Information to Include in a Deposit Receipt | Description |

|---|---|

| Deposit Amount | The exact amount paid by the tenant. |

| Date Received | The date when the deposit was paid. |

| Deposit Protection Scheme | The name of the scheme where the deposit is held, along with relevant registration details. |

| Conditions for Return | Conditions under which the deposit will be returned, including any deductions for damage or unpaid rent. |

For tenants, receiving this receipt confirms that their deposit is protected. For landlords, it provides legal evidence that the deposit has been received and is being held in compliance with UK law.

Always provide a clear breakdown of the deposit amount in the receipt, including the total paid and the purpose of each payment. Specify whether the deposit covers damages, unpaid rent, or any other expenses. It’s important to list the deposit date, tenant name, and property address to ensure clarity. Include both the landlord’s and tenant’s details, as well as a section for both parties to sign, confirming receipt and agreement.

If the deposit is returned, include the return amount and any deductions, along with a breakdown of the reasons for those deductions. This shows transparency and avoids misunderstandings. Ensure that all amounts are accurately calculated to avoid disputes later on.

Finally, ensure the tenant receives a copy of the signed receipt immediately after payment, either in print or electronically, to confirm all terms are agreed upon.