Key Details to Include

A well-structured non-refundable deposit receipt should clearly outline the agreement between parties. Ensure it includes:

- Date of Transaction: Specify when the deposit was made.

- Amount Paid: State the exact sum received.

- Payer and Payee Details: Include names, contact information, and any relevant identifiers.

- Purpose of Payment: Describe what the deposit secures (e.g., rental, service, product).

- Non-Refundable Clause: Clearly indicate that the deposit is not returnable.

- Payment Method: Specify how the payment was made (cash, credit, bank transfer, etc.).

- Signatures: Obtain signatures from both parties for acknowledgment.

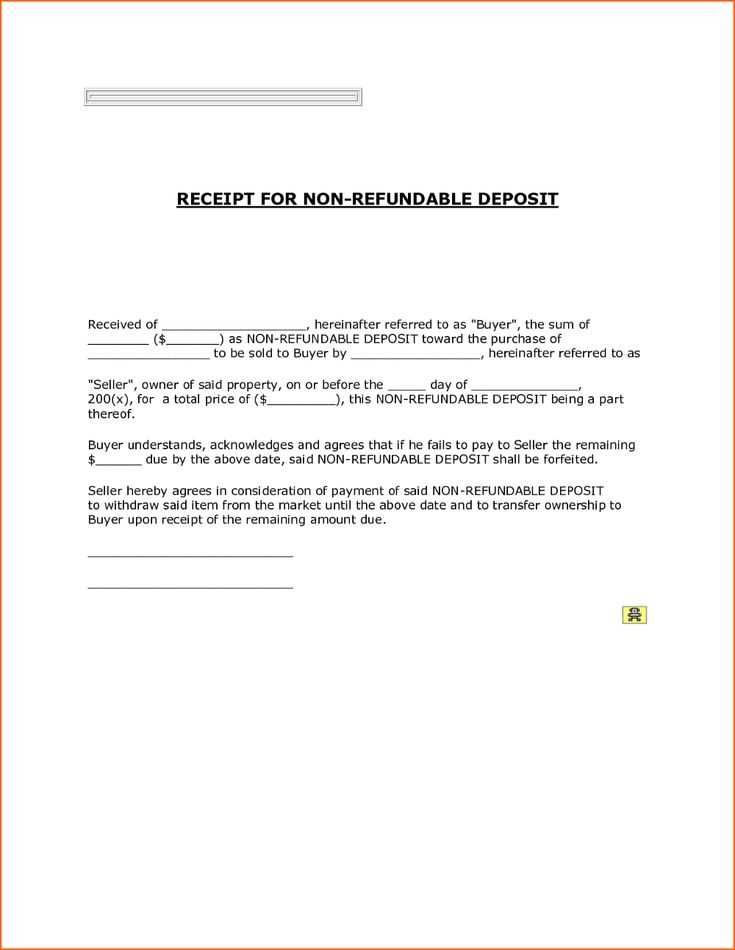

Template Example

Use this structured format to create a clear and professional receipt:

NON-REFUNDABLE DEPOSIT RECEIPT Date: [MM/DD/YYYY] Received From: [Payer's Name] Contact Information: [Payer's Email/Phone] Amount Paid: [$$$] Payment Method: [Cash/Check/Bank Transfer] Purpose of Deposit: [Specify Service or Product] Non-Refundable Agreement: The deposit is non-refundable under any circumstances. Received By: [Payee's Name] Contact Information: [Payee's Email/Phone] Signature of Payer: ________________________ Signature of Payee: ________________________

Final Considerations

Always provide a copy of the receipt to the payer and keep a record for future reference. Digital versions with electronic signatures can enhance security and convenience.

Non-Refundable Deposit Receipt Template

Key Components of a Non-Refundable Deposit Record

Legal Aspects of Irrevocable Deposits

How to Clearly Outline Payment Terms

Adapting a Receipt Template for Various Needs

Frequent Errors in Drafting a Deposit Confirmation

Printable and Digital Receipt Choices

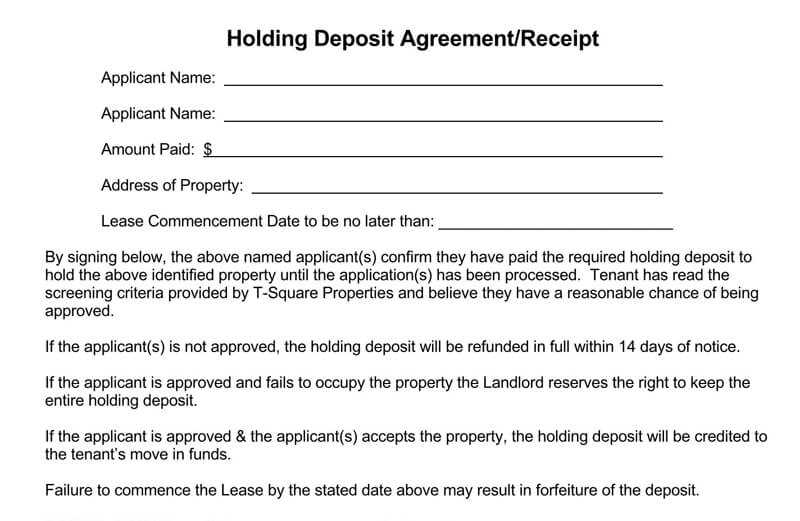

Specify the deposit amount in both numerical and written forms to prevent misinterpretation. Include the payer’s and recipient’s full legal names, ensuring clarity on who is involved in the transaction. Add the date of payment and the purpose of the deposit to establish context.

Define non-refundable terms in straightforward language, avoiding vague phrasing. Explicitly state whether the deposit applies to a final payment or serves as a separate fee. If conditions exist where the deposit might be refunded, outline them precisely.

Ensure compliance with applicable laws by referencing relevant statutes or regulations governing deposits. Specify the jurisdiction to clarify which legal framework applies. If the agreement involves a business, include tax-related details like VAT or sales tax, if applicable.

Outline payment methods accepted and note any restrictions on refunds. If the receipt includes installment payments, describe how they apply to the total balance. Adding a signature section for both parties provides additional confirmation of agreement.

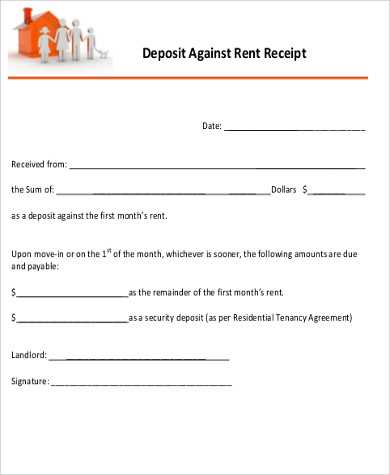

Modify the template based on industry-specific needs. For rental agreements, include lease details. For service-based transactions, describe the scope of work covered by the deposit. If the template is used for event reservations, mention cancellation policies.

Avoid common mistakes such as missing dates, ambiguous refund terms, or incorrect amounts. Double-check calculations and ensure all details match the original agreement. Using standardized wording prevents misunderstandings and legal disputes.

Choose a format that suits record-keeping preferences. Digital receipts allow for easy tracking and integration with accounting software. Printed versions provide a tangible record that can be signed and stored physically. Whichever format is used, ensure a copy is retained for reference.