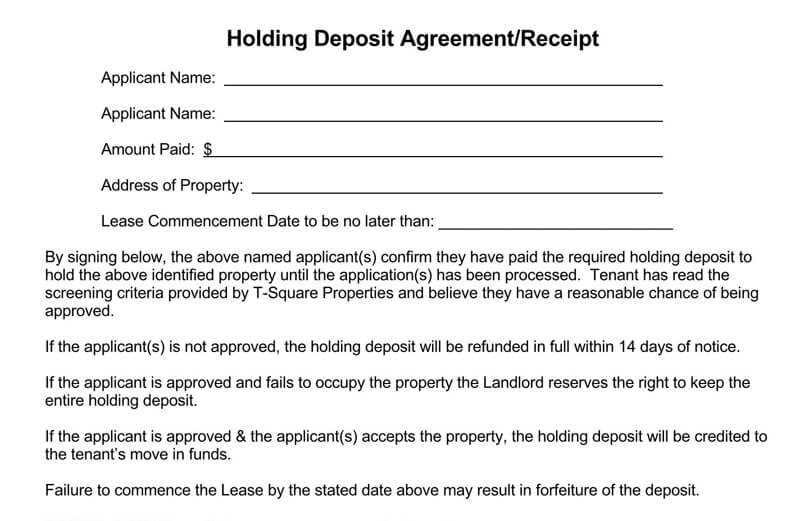

To protect both the landlord and the tenant, it’s important to use a clear and detailed property deposit receipt template. This document serves as an official record, confirming that a deposit has been paid and outlining the terms associated with it. A well-structured receipt helps avoid disputes and provides legal protection for both parties involved.

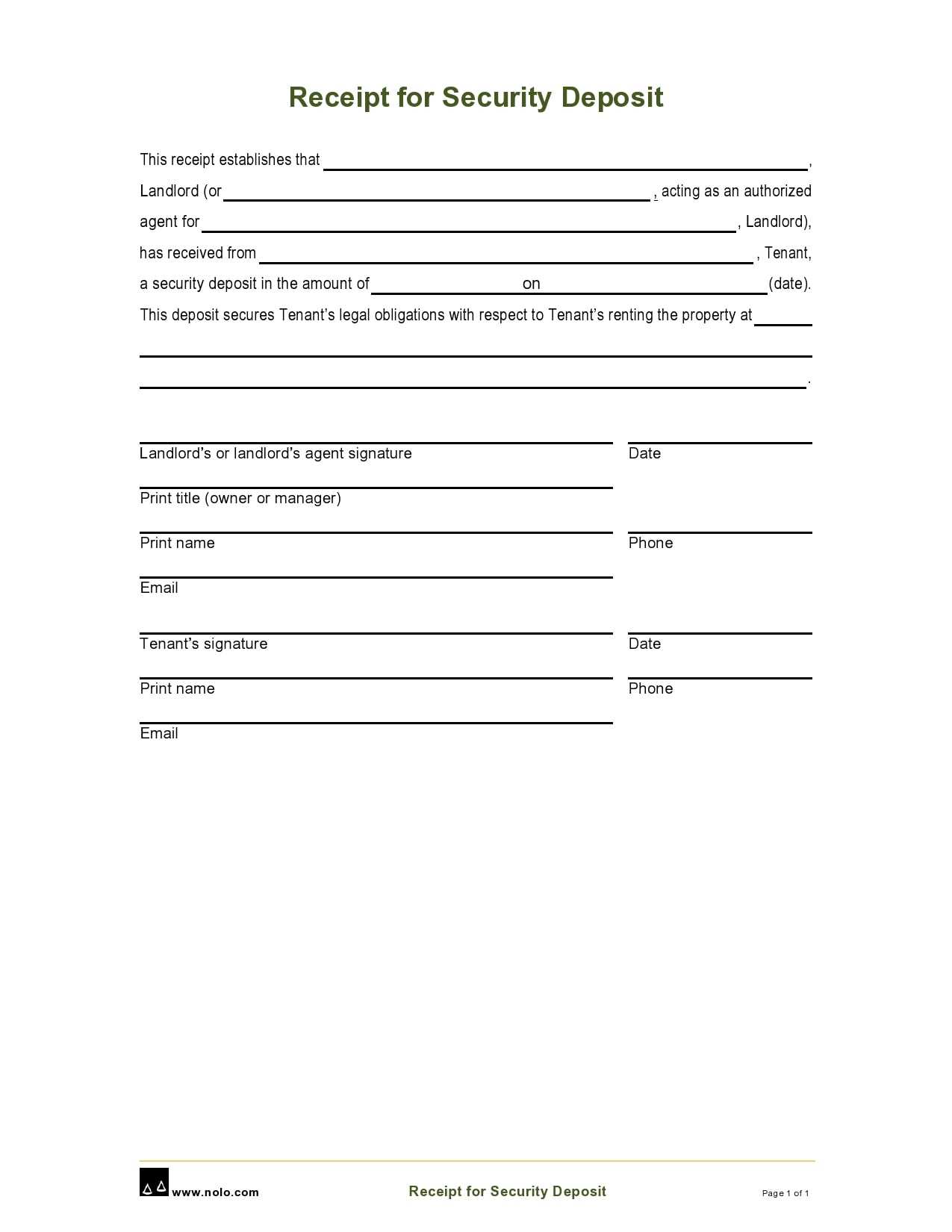

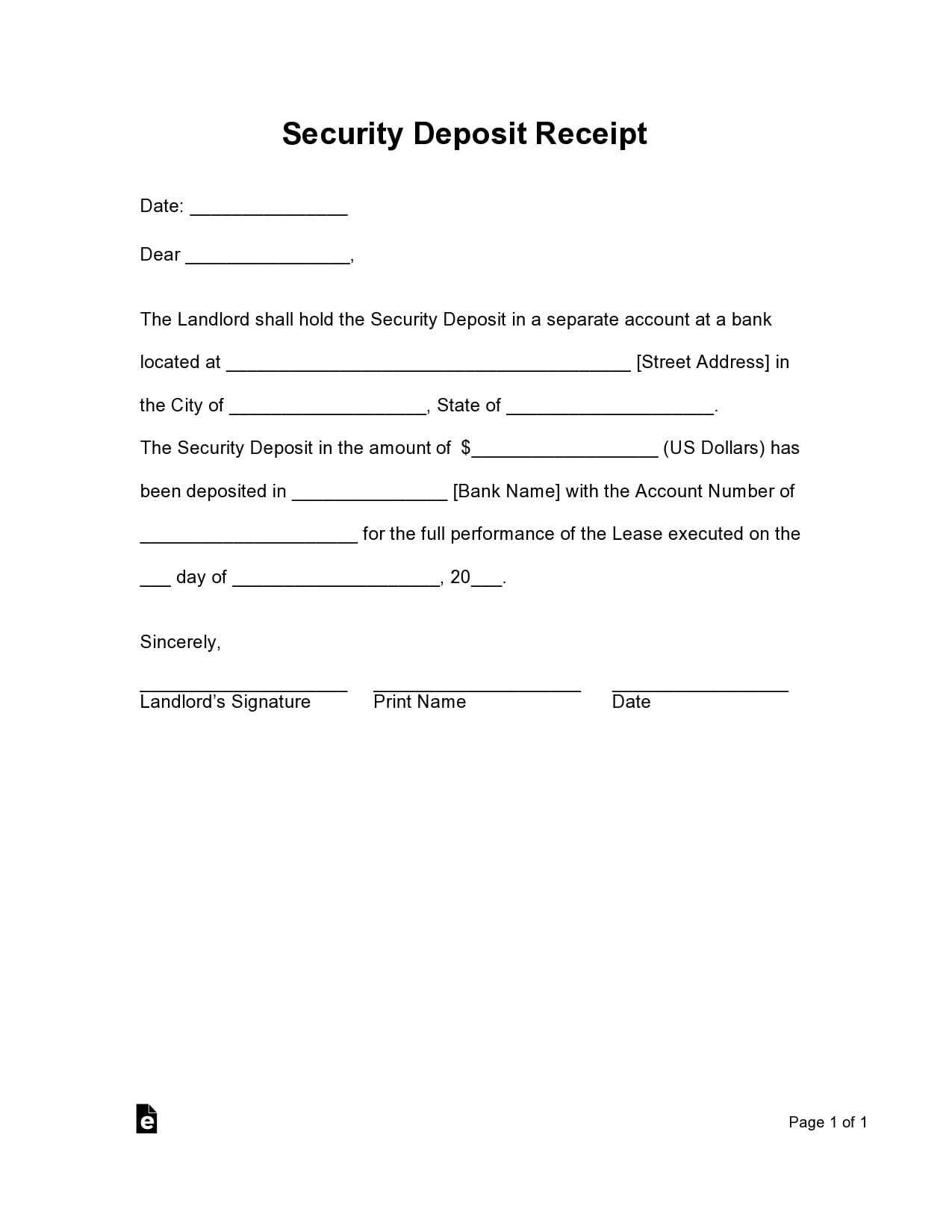

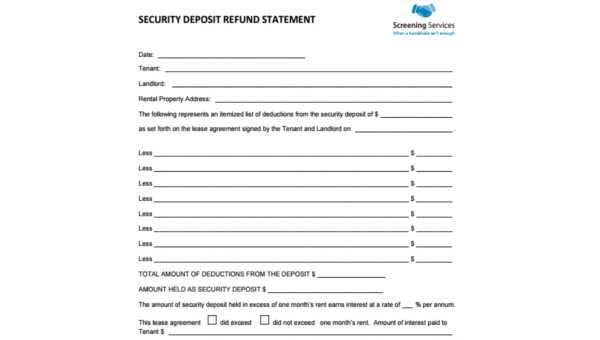

A basic deposit receipt should include specific details like the tenant’s name, the amount of the deposit, the property address, and the date of payment. It’s also helpful to include the purpose of the deposit and any terms regarding its refund or deductions at the end of the tenancy. Ensure that the document is signed by both parties for validation.

By using a straightforward property deposit receipt template, you can streamline the process of managing deposits and ensure transparency. This not only provides a sense of security to the tenant but also gives the landlord a legal reference in case of any future issues regarding the deposit.

Here’s the revised version with minimized word repetition:

To create a concise and clear property deposit receipt, ensure that the language is straightforward and the essential details are covered without unnecessary repetition. First, include the property address and the name of the landlord and tenant. Clearly state the amount of the deposit, its purpose, and any conditions tied to its return. Avoid repeating the same terms, such as ‘deposit’ and ‘payment’, throughout the document. Instead, use synonyms or rephrase sentences to reduce redundancy.

For example, instead of repeatedly stating “property deposit”, you can alternate with “security amount” or simply refer to “the payment”. Always prioritize clarity and precision in every section, keeping each point direct and to the point.

Additionally, confirm the receipt date and specify the method of payment (e.g., cash, check, bank transfer). Avoid lengthy explanations or terms that could make the receipt look overly complex. Finally, include a signature line for both the landlord and tenant to acknowledge the receipt and agreement terms.

- Property Deposit Receipt Template

A property deposit receipt is a legal document confirming the payment of a deposit for a property transaction. Use this template to ensure all necessary details are included and both parties are clear about the agreement. It should contain information such as the date of payment, the amount, the names of the parties involved, and the property address.

Key Elements to Include:

- Receipt Number: Assign a unique reference number to keep track of payments.

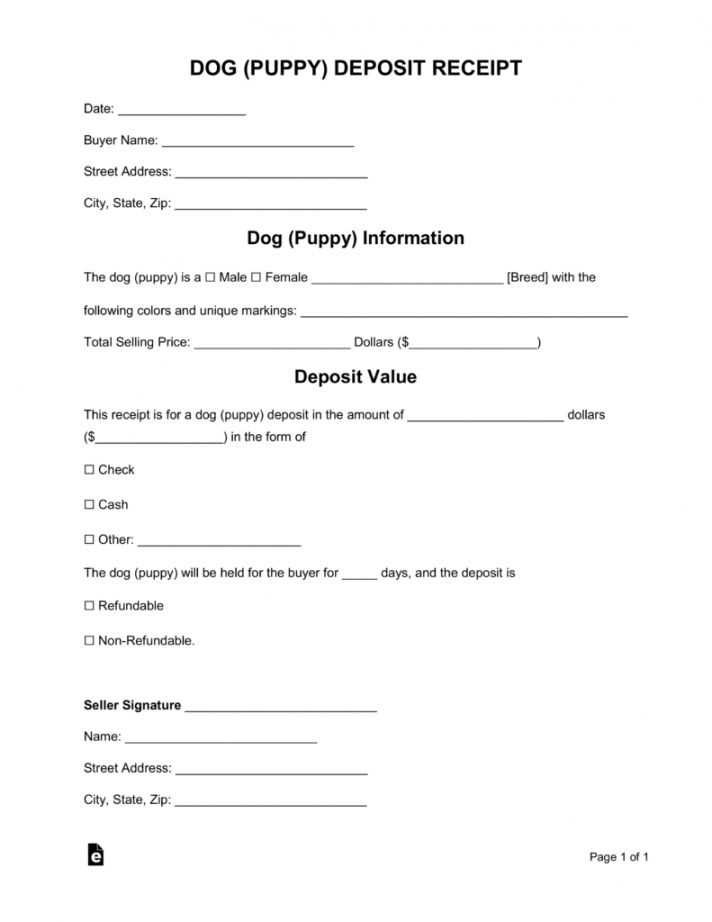

- Parties Involved: Clearly state the names and contact information of the landlord or seller and the tenant or buyer.

- Payment Details: Specify the amount of the deposit and the method of payment (e.g., bank transfer, cash).

- Property Information: Provide the address and description of the property related to the deposit.

- Date of Payment: Record the exact date the deposit was made.

- Purpose of the Deposit: State whether the deposit is for rent, purchase, or another purpose.

- Refund Conditions: Outline any terms for refunding the deposit, including conditions under which the deposit is refundable or non-refundable.

Ensure that the receipt is signed by both parties, confirming the agreement and transaction. This will help avoid misunderstandings or disputes in the future.

To structure a property deposit receipt correctly, ensure that it includes the key components required by law to make the document legally binding and clear for both parties involved. Start by specifying the date of the transaction and the parties’ full names, along with their contact information. This ensures that the deposit receipt is easily traceable and identifies the individuals or entities responsible.

Key Elements to Include

| Element | Description |

|---|---|

| Deposit Amount | Clearly state the exact sum deposited, using both numerical and written forms to avoid any confusion. |

| Property Details | Include a brief description of the property, including its address, unit number (if applicable), and any other identifiers like property type or reference number. |

| Payment Method | Specify how the deposit was made–cash, cheque, bank transfer, etc.–and include any relevant transaction details, such as cheque number or bank reference number. |

| Purpose of Deposit | Clarify the reason for the deposit (e.g., security deposit, booking fee) and any specific terms related to its return or non-return. |

| Terms of Agreement | State any conditions that apply to the deposit, such as the duration it covers, when the full payment is due, or conditions under which the deposit may be forfeited. |

| Signatures | Ensure that both the payer and the recipient sign and date the receipt, confirming the agreement. |

Additional Recommendations

Consider including a clause specifying the deposit’s return timeline and conditions for full or partial refund. This clause helps set expectations and provides clarity regarding the return process. Be sure to outline the responsibilities for any property damage or maintenance that may be covered by the deposit. Lastly, keep a copy of the receipt for both parties and ensure that it’s stored in a secure place, should any future disputes arise.

A deposit receipt should contain specific details to ensure clarity and protect both parties. Include the following key elements:

1. Date of Payment

Clearly state the date when the deposit was made. This helps track the timing of the transaction and is essential for both parties to reference in the future.

2. Name of the Payor and Payee

Include full names of both the person making the payment and the person receiving it. This ensures there is no ambiguity about who is involved in the transaction.

3. Amount of the Deposit

Specify the exact amount of the deposit. It is crucial to ensure that both parties agree on the figure and that it matches any agreed-upon terms.

4. Purpose of the Deposit

State the purpose for which the deposit is being made, whether it is for renting property, securing a service, or any other reason. This helps avoid confusion in the future.

5. Terms of Refund or Non-Refund

Clarify whether the deposit is refundable and under what conditions. If the deposit is non-refundable, state this explicitly to prevent any misunderstandings.

6. Property or Service Details

If the deposit is for renting property, include details such as the property address, rental period, and any relevant identifiers to ensure there is no ambiguity.

7. Signature of Both Parties

Both the payor and the payee should sign the receipt to confirm that the deposit details are correct and mutually agreed upon. This adds a layer of legal protection.

8. Additional Information

Include any other relevant details such as payment method (cash, check, credit card), reference numbers, or notes regarding specific conditions tied to the deposit.

One of the most frequent mistakes is failing to include the correct payment details. Always state the exact amount paid, including any applicable taxes or fees. This eliminates any confusion regarding the deposit amount and ensures clarity for both parties.

Another common mistake is not specifying the payment method. Whether it’s cash, bank transfer, or another form of payment, this should be clearly outlined to avoid disputes later on. Include transaction references or check numbers if applicable.

Omitting the date of the transaction can lead to confusion about when the deposit was made. Make sure to add the date to prevent misunderstandings, especially if the deposit is related to a lease or rental agreement with a specific timeline.

It’s also crucial not to overlook the inclusion of both parties’ contact details. Missing this information can complicate communication if further issues arise. Ensure that both the payer’s and the recipient’s full names, addresses, and phone numbers are listed.

Sometimes, receipts fail to clearly state the purpose of the deposit. Be specific about what the payment is for, whether it’s for property rental, a damage deposit, or something else. This helps prevent potential conflicts and clarifies the nature of the transaction.

Lastly, neglecting to sign the receipt is a frequent oversight. Both parties should sign to confirm the receipt of the payment. Without signatures, the document lacks validation, which can cause problems if a dispute occurs later on.

Property Deposit Receipt Template

The template for a property deposit receipt should include all necessary details to ensure clarity and avoid misunderstandings. Here’s what should be included:

- Deposit Amount: Clearly state the total amount paid as a deposit.

- Property Address: Include the full address of the property involved in the transaction.

- Payee and Payer Information: List the names and contact information of both the individual or company receiving the deposit and the one making the payment.

- Date of Payment: Specify the exact date when the deposit was received.

- Terms of Deposit: Outline whether the deposit is refundable, and under what conditions.

- Payment Method: Note how the payment was made (e.g., check, bank transfer, cash).

- Signature: Include a space for the signatures of both parties involved in the transaction to confirm the receipt.

Including these key elements will provide clear documentation for both the payer and payee, reducing the likelihood of disputes.