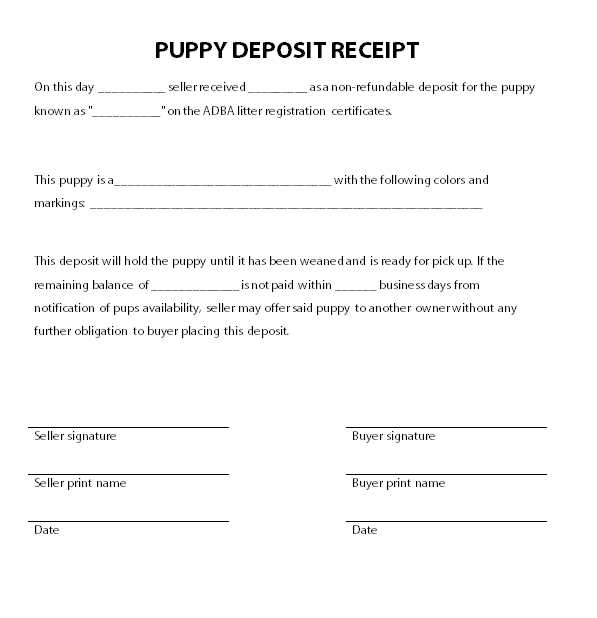

To ensure a smooth transaction when depositing a dog, use a receipt template that clearly outlines the deposit amount, terms, and conditions. This document serves as proof of the agreement between the parties involved and can be customized to meet specific needs. It’s important to include details such as the dog’s identification, the deposit amount, and any relevant dates or deadlines.

Customize the template to specify the responsibilities of both the person depositing the dog and the recipient. Clearly state the conditions under which the deposit will be refunded or forfeited, along with any additional terms, such as veterinary requirements or the expected pickup date. This approach provides transparency and minimizes confusion later.

Make sure to keep a copy of the receipt for your records. This will help maintain clarity in case of disputes and ensure both parties are on the same page regarding the deposit agreement.

Here’s the revised version with repeated words removed, keeping the meaning intact:

To create a dog deposit receipt, include key details clearly. Start with the date and amount of the deposit. Specify the purpose, such as a reservation for dog boarding or services. Mention the pet’s name, breed, and owner’s contact details. State both parties’ names, including the facility or person receiving the deposit. Add terms for deposit refunds, if applicable, and provide payment methods. Always make the receipt simple and straightforward for both parties.

Details to Include

| Detail | Example |

|---|---|

| Date | February 5, 2025 |

| Deposit Amount | $150 |

| Pet’s Name | Max |

| Owner’s Contact | 555-1234 |

| Facility/Person | Happy Paws Pet Boarding |

- Receipt for Dog Deposit Template

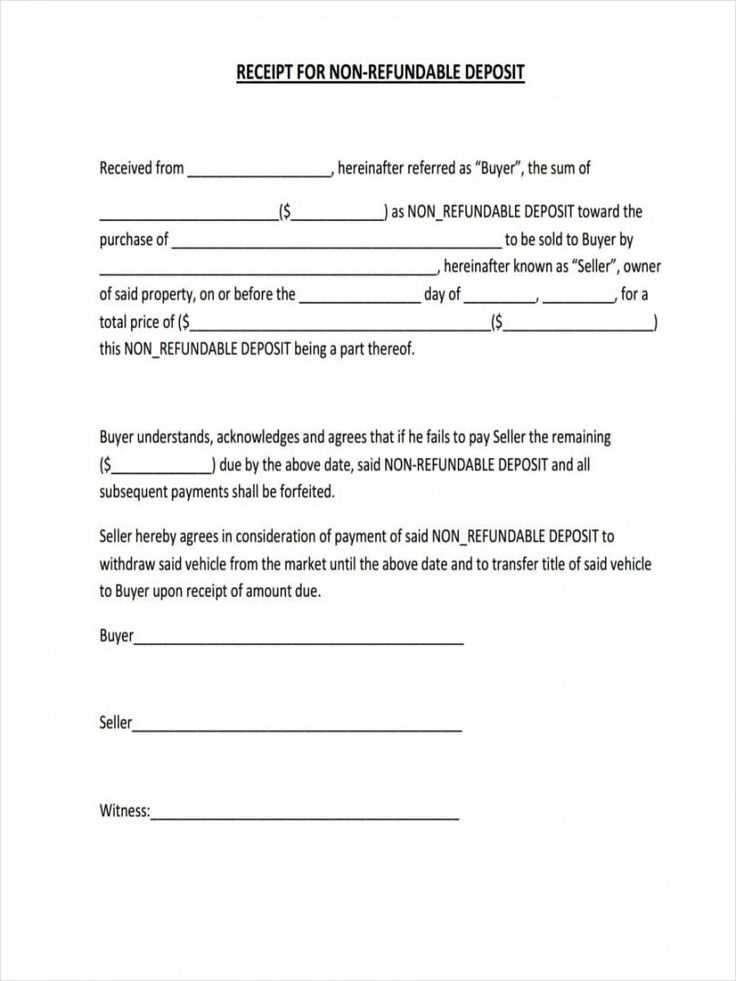

A well-structured dog deposit receipt template is key for creating clear, legally binding agreements between pet owners and caretakers. This template should include key details such as the amount of deposit, date of transaction, and information about the dog being deposited. Make sure to outline any specific conditions attached to the deposit, like refundable or non-refundable status, to avoid confusion.

Key Information to Include

- Date: Always note the exact date the deposit was made.

- Deposit Amount: Clearly state the total deposit received.

- Dog’s Details: Include the dog’s name, breed, age, and any other identifying features.

- Terms of Deposit: Specify the conditions of the deposit, including whether it’s refundable or not and under what circumstances.

- Depositor’s Information: Collect the full name and contact details of the person making the deposit.

- Signature: Both parties should sign the receipt to confirm agreement.

Additional Tips

For accuracy, double-check all details, especially the terms of the deposit. If it’s a large amount, consider using a digital payment platform that provides receipts automatically. Customize the template based on specific agreements made with the pet owner, ensuring transparency throughout the process.

Begin by filling in the date at the top of the deposit slip. This helps keep track of when the deposit was made.

Next, enter the name of the account holder or business making the deposit. Be sure to match it exactly with the account name as listed on the bank’s records.

In the designated section, list the amounts of cash and checks you are depositing. Be precise in separating these amounts to avoid confusion.

If necessary, include any account numbers or information about the checks you are depositing, such as check numbers or the payer’s details.

Double-check the totals for both cash and checks. Accurate calculations ensure a smooth transaction and avoid delays.

Lastly, sign the slip, indicating your approval of the deposit. This step confirms that the deposit details are correct and authorized for processing.

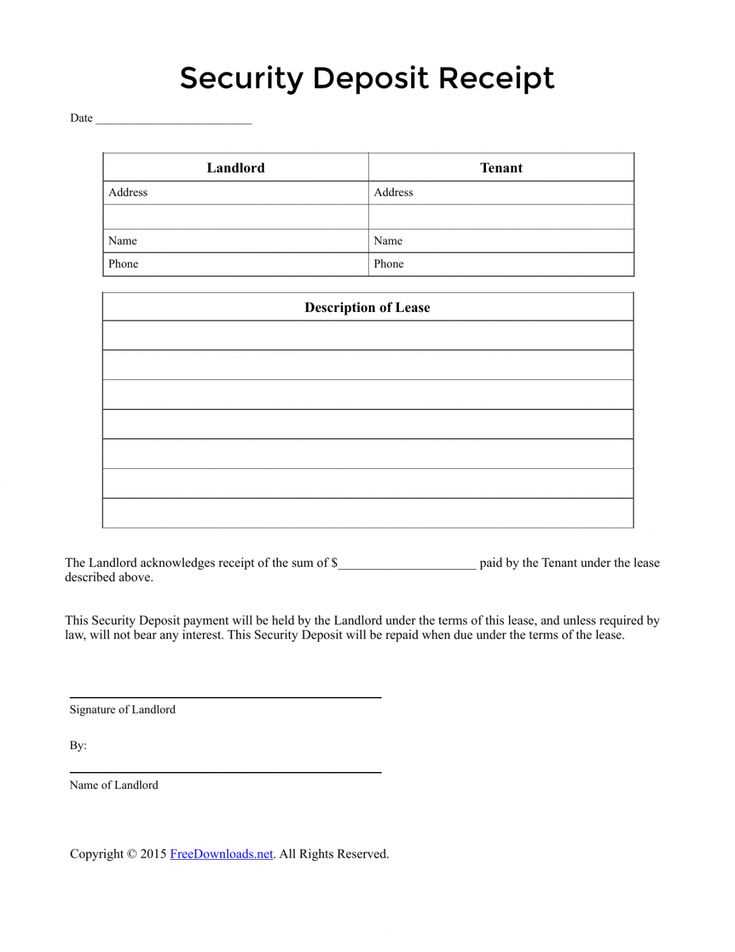

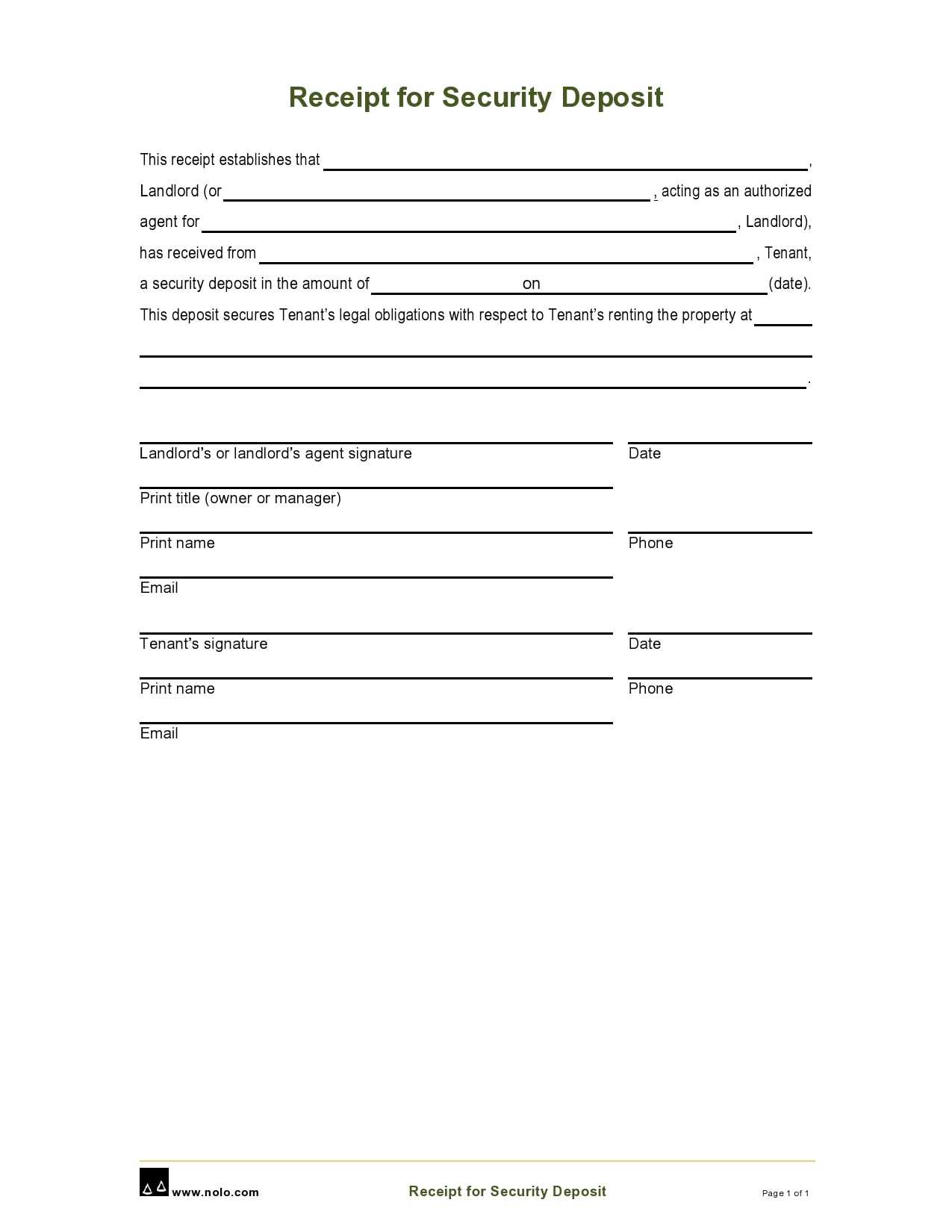

Include the following specifics on your dog deposit receipt to ensure clarity and avoid misunderstandings:

Transaction Information

Record the exact date and time of the transaction. Specify the amount of the deposit, noting the payment method used (cash, check, or card). If applicable, include any reference number or payment ID to link the transaction for future verification.

Parties Involved

Clearly state the names of both the person making the deposit and the recipient organization or individual. This ensures there is no confusion about who is involved in the transaction.

Details of the Dog

Include the dog’s name, breed, and any distinguishing features. If the deposit pertains to a specific dog, make sure the dog’s details are clearly listed to avoid any ambiguity.

Deposit Purpose

Provide a brief description of the purpose for which the deposit was made. This could include services like boarding, training, or a reservation for adoption or purchase.

Agreement Terms

List any key terms or conditions related to the deposit, such as refundable/non-refundable status, deadlines, or policies for changes or cancellations. This protects both parties and clarifies expectations.

| Detail | Information |

|---|---|

| Date & Time | [Insert Date and Time] |

| Amount Deposited | [Insert Amount] |

| Payment Method | [Cash/Credit Card/Check] |

| Parties Involved | [Depositor Name] & [Recipient Name] |

| Dog Details | [Dog Name], [Breed], [Unique Features] |

| Purpose | [Description of Service] |

| Agreement Terms | [Terms and Conditions] |

When selecting a format for your deposit receipt, opt for simplicity and clarity. A clean, easy-to-read layout ensures that the information is quickly accessible. Consider these points:

- File Type: Choose a file type that is widely accepted and easily accessible, such as PDF or DOCX. These formats preserve the layout and are easily shared across devices.

- Consistency: Use the same format for all receipts to avoid confusion. This maintains a professional appearance and ensures uniformity in your records.

- Information Organization: Keep the receipt sections organized. Include key details such as the date, amount, payment method, and payer information. This makes it easier to reference and track transactions.

- Design: A straightforward design without excessive graphics keeps the focus on the information. Clear headings, bullet points, and ample white space improve readability.

Stick to a format that best suits your needs and is simple for both parties to access and understand. Avoid complicated structures that might delay or confuse future reference or audits.

In dog deposit agreements, certain terms help define the responsibilities and expectations between both parties. These key terms can ensure clear communication and reduce misunderstandings.

Deposit Amount refers to the specific sum of money paid to secure the dog before finalizing the sale or adoption. This amount is typically non-refundable if the agreement is breached by the buyer.

Balance Due is the remaining amount that must be paid once the deposit has been made, often due by a set deadline before the dog is transferred to the buyer’s care.

Terms of Refund outline the conditions under which the deposit may be refunded. This could include circumstances such as the seller being unable to provide the dog or the dog not being available for delivery within a specified time frame.

Transfer of Ownership describes the moment when the dog legally becomes the buyer’s property, typically after full payment and completion of all necessary documentation.

Health Guarantee refers to the assurance that the dog is in good health at the time of sale or transfer. It often specifies the seller’s responsibility if the dog is found to be ill or defective within a certain period after the transfer.

Delivery Terms cover the logistics involved in the dog’s transfer, including transportation arrangements, costs, and the timeline for when the dog will be delivered to the buyer.

Begin by focusing on your business’s core needs. Adjust the template’s layout to reflect the essential services you offer, ensuring clear navigation for clients. Organize sections that display your contact details, pricing, and service descriptions in a simple, straightforward manner. Avoid clutter to keep the document clear and easy to understand.

- Modify fields to match your business terminology, such as renaming “deposit” to something more relevant like “reservation fee” or “booking deposit” if needed.

- Incorporate your company’s branding by adding your logo and adjusting colors to match your business theme. This helps reinforce your identity and professionalism.

- Use customer-friendly language in the template’s instructions and descriptions. Ensure that all terms are easy to read, avoiding any technical jargon that may confuse your clients.

Update any automated sections that include payment details or terms. Make sure these match your current policies, such as payment methods and refund terms, keeping them aligned with your business standards.

- For example, change payment terms to specify the time frame for the deposit, such as “due within 7 days of booking” instead of just “due upon booking.”

- Adjust any tax or service fee sections to reflect the actual rates you apply.

After customizing, ensure the template is tested by sending it to a colleague or a trusted client for feedback. Make necessary tweaks based on their input to enhance clarity and functionality.

When arranging a deposit for dog services, ensure the terms are clear and enforceable. Specify the amount, refund conditions, and timeline for returning the deposit in the service agreement. Clearly state whether the deposit is refundable if the client cancels or if services are not rendered as expected. This prevents potential misunderstandings.

Include a clear cancellation policy in your contract. Define what constitutes a valid cancellation and the penalty, if any. For example, some businesses retain the deposit if the client cancels within a specific time frame, such as 24 or 48 hours before the service begins. Always comply with local regulations regarding refunds to avoid legal disputes.

Outline the services covered by the deposit. Make sure the client understands which services the deposit applies to, whether it’s for boarding, grooming, or walking services. This will protect both parties if there is any disagreement about the scope of services provided.

Finally, keep records of all deposit transactions. A written agreement with the client, including all deposit-related terms, serves as a legal safeguard in case of a dispute. Make sure the receipt or confirmation includes details like the amount paid, service dates, and any refund conditions.

Receipt for Deposit of Dog Template

Ensure that the template clearly outlines the necessary details to confirm the deposit of a dog. A well-structured receipt should include the following elements:

- Depositor’s Name: Include the full name of the individual who is making the deposit.

- Receiver’s Information: Provide the name and contact details of the person or organization receiving the dog.

- Dog’s Details: Clearly state the dog’s breed, age, and any identifying marks or features.

- Deposit Amount: Specify the exact amount being deposited and any agreed-upon terms related to the deposit.

- Date of Deposit: Record the date the deposit was made.

- Purpose of Deposit: Note the reason for the deposit, whether it’s for boarding, adoption, or other services.

Additional Information

Consider adding a section for any special instructions or terms related to the care of the dog during the deposit period.

Confirmation Section

Ensure the receipt has a clear section for both parties to sign, confirming that the details are accurate and agreed upon.