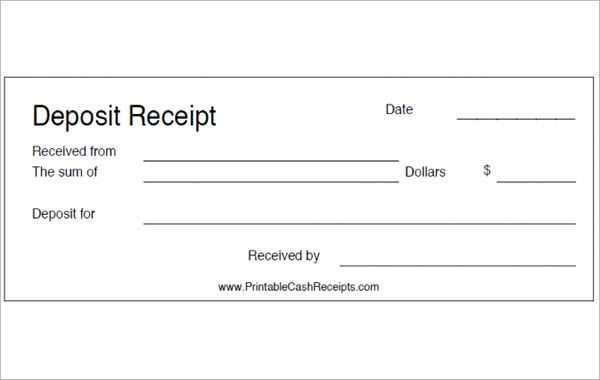

A security deposit receipt is an essential document for both tenants and landlords in Colorado. It provides proof of the deposit amount paid by the tenant, details the conditions under which the deposit was made, and serves as an official acknowledgment for future reference. This receipt also protects both parties in case of disputes regarding the return of the deposit at the end of the lease agreement.

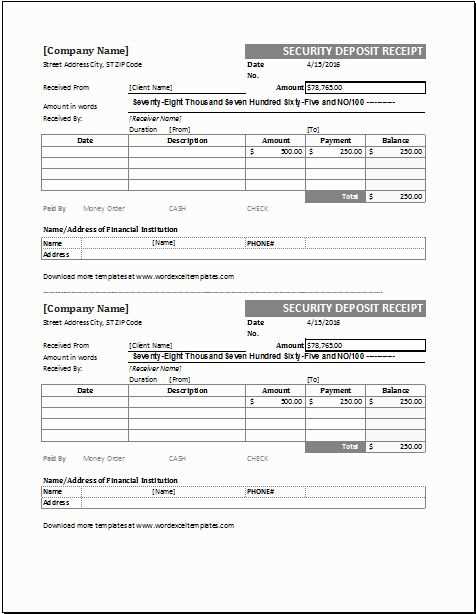

For landlords, using a well-crafted security deposit receipt template can help maintain clarity and transparency with tenants. By including specific details, such as the total deposit amount, the date of payment, and any deductions or terms regarding the return, both parties will have a clear understanding of the financial expectations outlined in the lease agreement. It’s highly recommended to provide a receipt immediately after receiving the deposit payment.

When creating a receipt for Colorado, make sure the document aligns with local state regulations. Include the tenant’s name, property address, deposit amount, and the terms under which the deposit will be refunded. It’s also wise to note any damages or unpaid rent that may affect the refund. This approach ensures that both landlord and tenant are protected in case of disagreements regarding the deposit at the conclusion of the tenancy.

Here’s the revised version where words are not repeated more than two or three times:

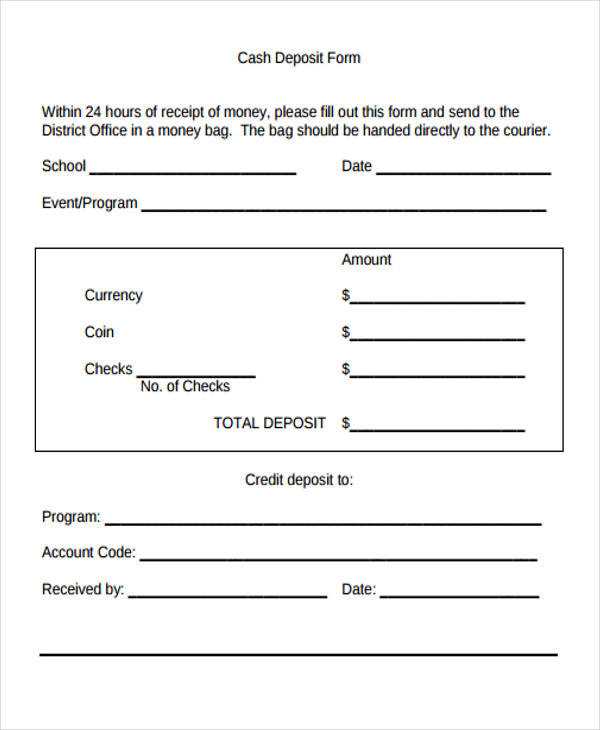

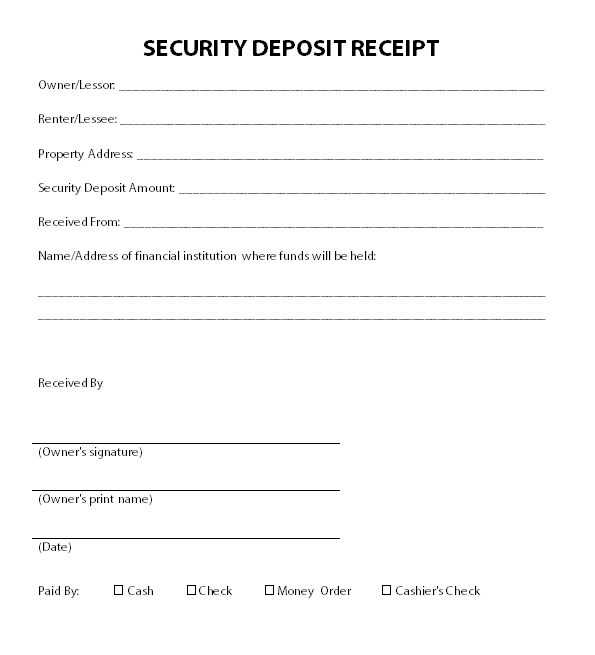

Ensure that the receipt includes all necessary details. Clearly list the amount of the security deposit, the date it was received, and the names of both parties involved. Make sure that the rental address is stated correctly to avoid any confusion later. Use precise language and avoid redundancy, as this helps maintain the document’s clarity.

Key Details to Include

1. Full legal names of tenant and landlord

2. Exact deposit amount and date received

3. Address of the rental property

4. Signature of both parties

Why This is Important

Including accurate and clear information ensures that the document holds up in any legal context. It also helps prevent disputes regarding the return of the deposit at the end of the lease. By avoiding vague terms, both parties understand exactly what has been agreed upon, reducing the chances of misunderstanding.

| Item | Description |

|---|---|

| Deposit Amount | Specify the full amount of the security deposit. |

| Date Received | State the exact date the deposit was paid. |

| Parties Involved | List the names of both tenant and landlord. |

| Rental Address | Provide the full address of the rental property. |

| Signatures | Ensure that both parties sign the document to confirm agreement. |

By following these guidelines, the security deposit receipt remains clear and legally sound. Make sure that all details are included and presented in a simple format to avoid unnecessary complications later on.

- Security Deposit Receipt Template in Colorado

A security deposit receipt in Colorado must include specific details to be legally valid. Make sure the document outlines the amount paid, the date received, and the names of both the landlord and tenant. This receipt serves as proof of payment and must be signed by the landlord or the authorized agent.

The receipt should clearly state the purpose of the deposit, noting that it covers potential damage to the rental property. Include the full address of the rental unit and reference the lease agreement to ensure clarity on the terms related to the deposit.

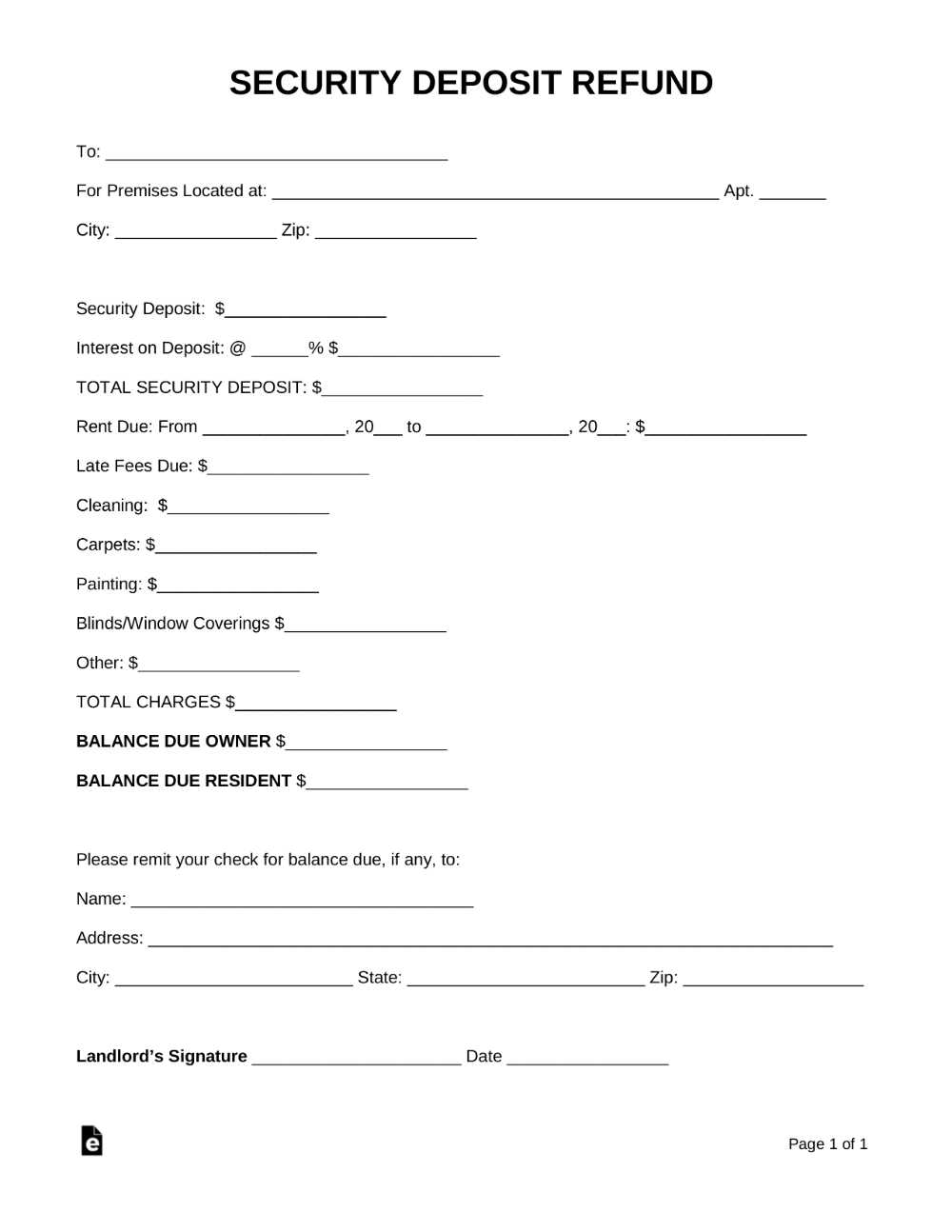

If the deposit is refunded, the receipt should reflect the refund amount, any deductions made (with explanations), and the final balance. The landlord must also mention the date when the refund was issued, if applicable.

It’s important for both parties to keep a copy of the receipt for their records. Failure to provide a proper receipt could lead to disputes over the security deposit, so ensure the template you use aligns with Colorado state requirements and provides all necessary information for future reference.

In Colorado, landlords must provide a written receipt for any security deposit received from a tenant. This receipt should include specific details about the deposit, such as the amount, the date it was received, and the names of the parties involved (landlord and tenant). Additionally, if the security deposit is held in an interest-bearing account, the receipt must indicate this, along with any interest earned. Failure to comply with these requirements can lead to legal consequences for landlords, including the forfeiture of the right to withhold any part of the deposit at the end of the lease.

The law also requires that the receipt be signed by the landlord or an authorized agent to make it legally binding. Tenants should always ensure they receive this documentation at the time of deposit and keep it for their records throughout the tenancy. It’s also advisable for tenants to request a copy of the lease agreement, which will outline the conditions under which the security deposit may be withheld, including damages or unpaid rent.

If the landlord fails to provide a receipt or does not comply with the legal requirements for security deposits, they may face penalties, including the potential loss of the deposit in disputes over its return. Tenants have the right to pursue legal action if they do not receive proper documentation or if the security deposit is not returned within the legal timeframe after the lease ends.

When preparing a security deposit acknowledgment in Colorado, make sure it contains these key elements:

- Tenant and Landlord Information: Clearly list the full names of both parties involved. Include their contact details to ensure transparency and traceability.

- Amount of Deposit: Specify the exact amount of the deposit. This amount must match the one paid by the tenant.

- Purpose of Deposit: Describe the purpose of the security deposit, which typically covers damages or unpaid rent. This clarifies its intended use.

- Condition of the Property: Detail the property’s condition at the time of move-in, ideally supported by an inspection checklist or photos. This protects both parties by offering a reference point.

- Deposit Return Terms: Include a clear statement about the timeline for returning the deposit. Colorado law mandates that the deposit be returned within one month unless specified otherwise in the lease.

- Potential Deductions: Outline any conditions under which the landlord may withhold part or all of the deposit, such as damage to the property beyond normal wear and tear.

- Signatures and Dates: Both the tenant and landlord should sign and date the acknowledgment, confirming their agreement to the terms outlined in the document.

To properly calculate and itemize deductions on a deposit receipt, begin by identifying the specific costs that need to be deducted from the original deposit amount. These costs can include cleaning fees, repairs, or unpaid rent. It’s critical to be transparent about the deductions and provide supporting documentation, such as receipts or invoices, for each item.

- List the Deduction Categories: Begin by categorizing each deduction. Common categories include cleaning, repairs, unpaid rent, and damage beyond normal wear and tear. Include an item description and the total cost for each deduction.

- Provide Supporting Documentation: Attach receipts, photos, or repair invoices that justify the costs of the deductions. This builds trust and ensures both parties understand the reasons for the deductions.

- Calculate Total Deductions: Add up the cost of each deduction to determine the total amount that will be subtracted from the deposit. Ensure all amounts are accurate and reasonable.

- Itemize the Final Amount: Subtract the total deductions from the original deposit amount to calculate the remaining balance. Itemize this final amount on the receipt and provide a clear breakdown for the tenant.

- Provide a Timeline for Returning the Balance: Ensure that the remaining balance, if applicable, is returned to the tenant within the timeframe required by state law, typically within 30 days in Colorado.

Clear communication and detailed documentation are essential for a fair and transparent process. This helps both the landlord and tenant understand the deductions and avoid disputes.

Always provide a clear, written receipt to tenants when receiving a security deposit. The receipt should include the amount paid, the date of payment, and the property address. This confirms the transaction and serves as proof of payment for both parties.

Make sure to include specific details, such as the method of payment (cash, check, bank transfer), and note if any portion of the deposit is being held for a specific purpose. For example, if part of the deposit covers damages or cleaning, list those details on the receipt.

Provide the receipt as soon as possible after receiving the deposit, preferably immediately or within a couple of days. This ensures transparency and avoids misunderstandings. A quick acknowledgment of the deposit payment strengthens trust with the tenant.

Consider including both the landlord’s and tenant’s names on the receipt, as well as a clear statement that this is a receipt for the security deposit. For easy reference, you can add a unique identifier or reference number for the transaction.

Finally, keep a copy of the receipt for your records. This is necessary for proper documentation in case of disputes or future financial dealings related to the property.

Be clear about the total amount of the security deposit. Leaving this vague or incorrectly stated may lead to confusion and disputes later. Ensure that the document explicitly lists the amount the tenant is paying and confirm that it matches the rental agreement.

Missing Tenant and Landlord Information

Provide full contact information for both the tenant and the landlord. Failing to include accurate details for both parties can result in issues during communication, especially if disputes arise regarding the deposit.

Incorrect Handling of Deductions

Clearly specify the conditions under which the deposit may be deducted. Outline potential reasons for deductions such as damage or unpaid rent. Avoid vague language like “minor damages,” as this can lead to disputes. Include a list of what constitutes acceptable deductions and how the tenant can contest them.

Ensure that the receipt includes the date it was issued. Omitting this detail can create confusion over deadlines for returning the deposit. The tenant should know when the document was signed and when the refund (or deductions) is expected.

Addressing disputes over deposit receipts requires clear communication and adherence to Colorado laws. If a disagreement arises, the first step is to review the terms outlined in the rental agreement, especially those concerning the security deposit. Check the receipt for any discrepancies in the amount documented versus the landlord’s claims. It is also important to verify if the landlord has provided a written explanation for any deductions.

Initiating Communication

Contact the landlord directly to discuss the issue. State the facts calmly and request documentation that justifies any deductions. If the landlord is unresponsive or unwilling to provide clarity, keep records of all communications, including emails, letters, and phone calls.

Filing a Claim

If informal communication does not resolve the issue, tenants may file a claim in small claims court. Ensure all evidence, including the original deposit receipt, rental agreement, and communication records, are presented. Colorado law mandates that landlords return security deposits within one month after the tenant vacates, unless the landlord has documented damage or unpaid rent. If the landlord fails to comply, the court may award additional compensation for damages.

When drafting a security deposit receipt in Colorado, include the amount of the deposit, the date it was received, and the name of the person or entity receiving it. Be clear about the purpose of the deposit, such as securing the rental agreement or covering potential damages. Specify the rental property address and tenant’s details for accurate identification.

Ensure the receipt is signed by the landlord or authorized representative, acknowledging receipt of the funds. If applicable, include information on the conditions for refunding the deposit, along with any deductions that could apply. It’s also helpful to note the legal timeframe for returning the deposit under Colorado law, typically within 30 days after the tenant vacates the property.

Double-check for accuracy before issuing the receipt to avoid disputes. Properly documenting this transaction will protect both the tenant and landlord in case of future disagreements.