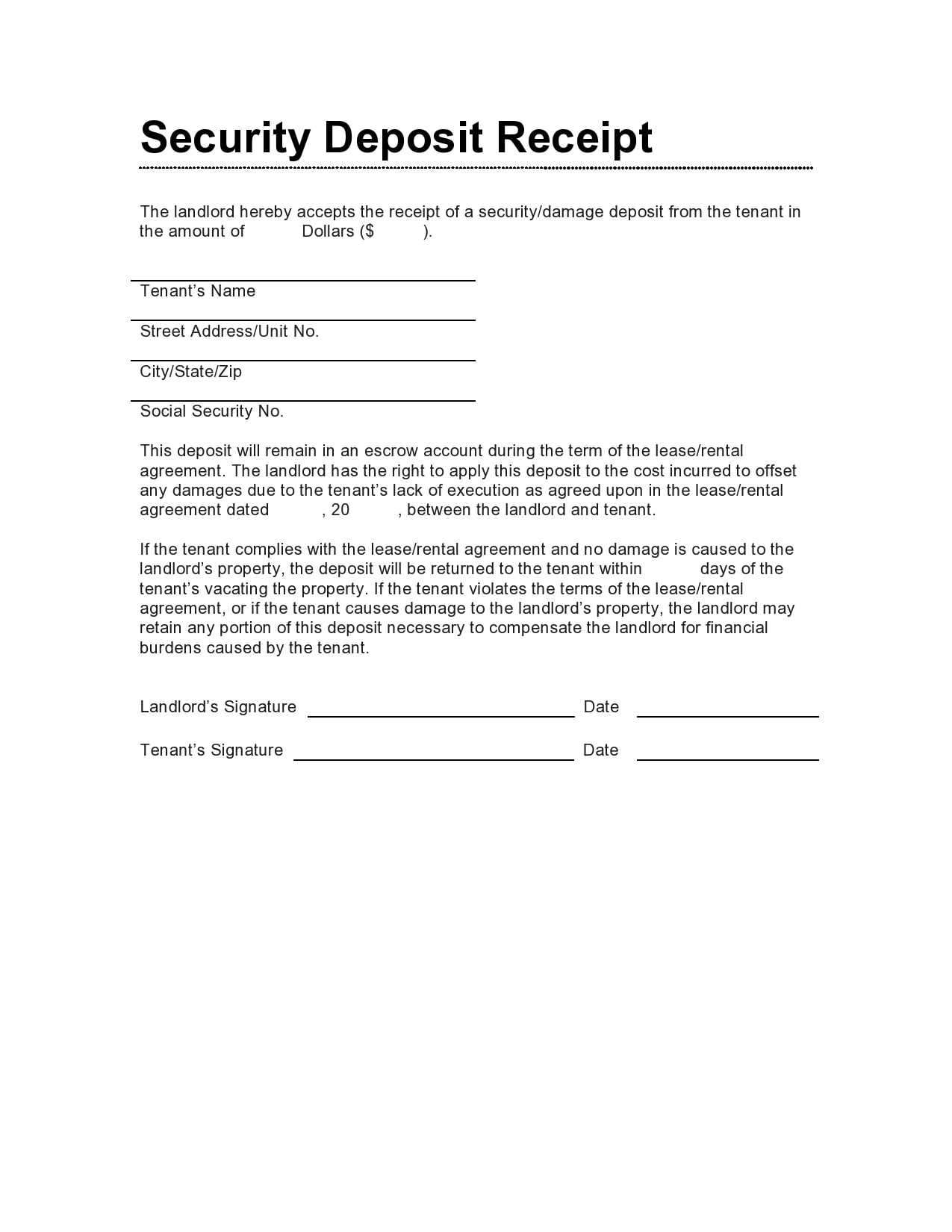

For landlords and tenants alike, a clear and accurate security deposit refund receipt is crucial. This document provides both parties with a transparent record of any deductions and the return of the deposit amount. To simplify the process, use a template that outlines the necessary details in an organized and easy-to-understand format.

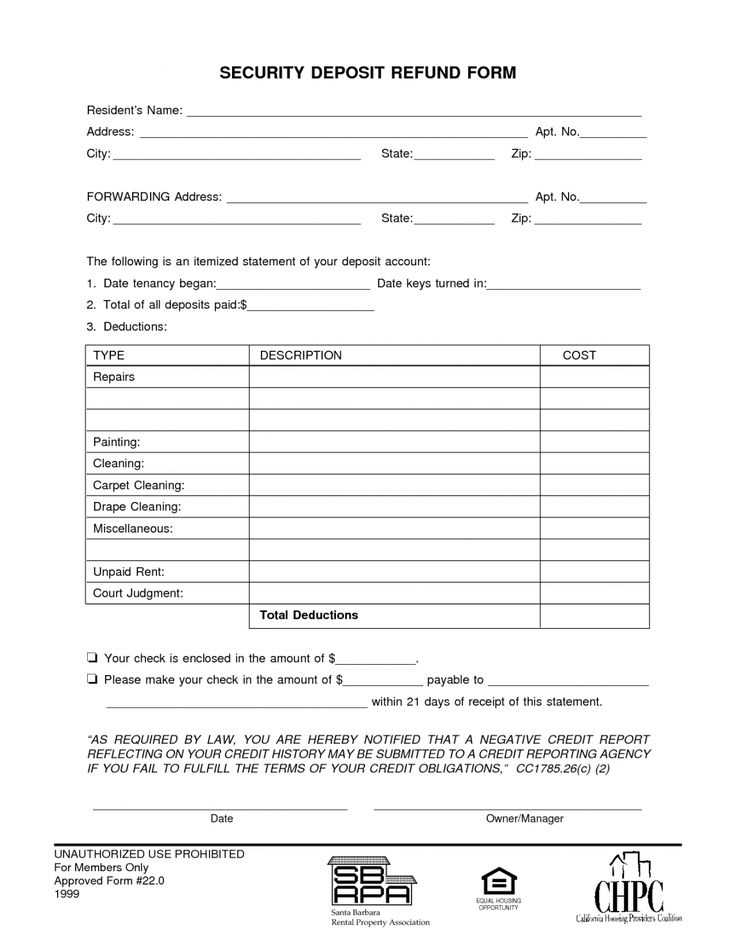

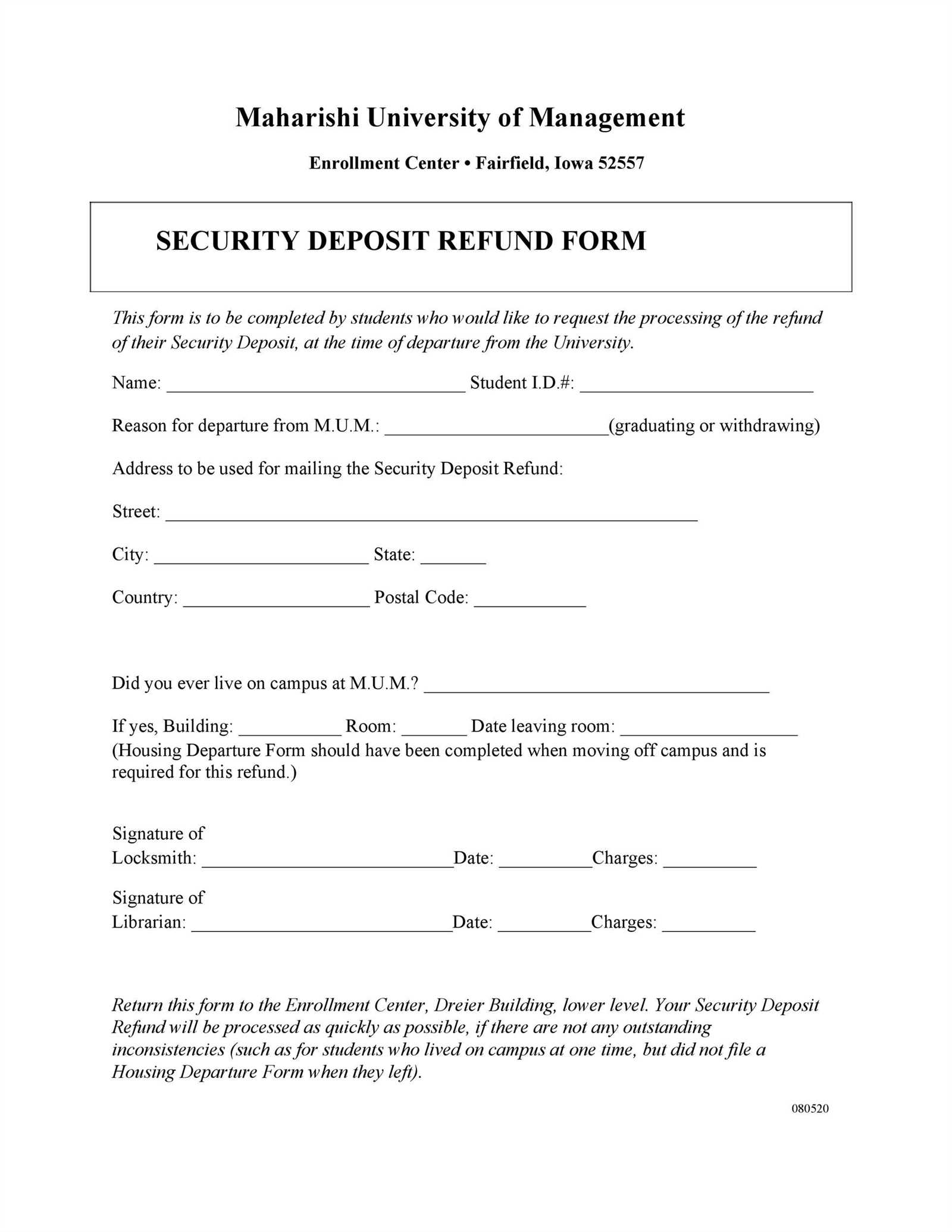

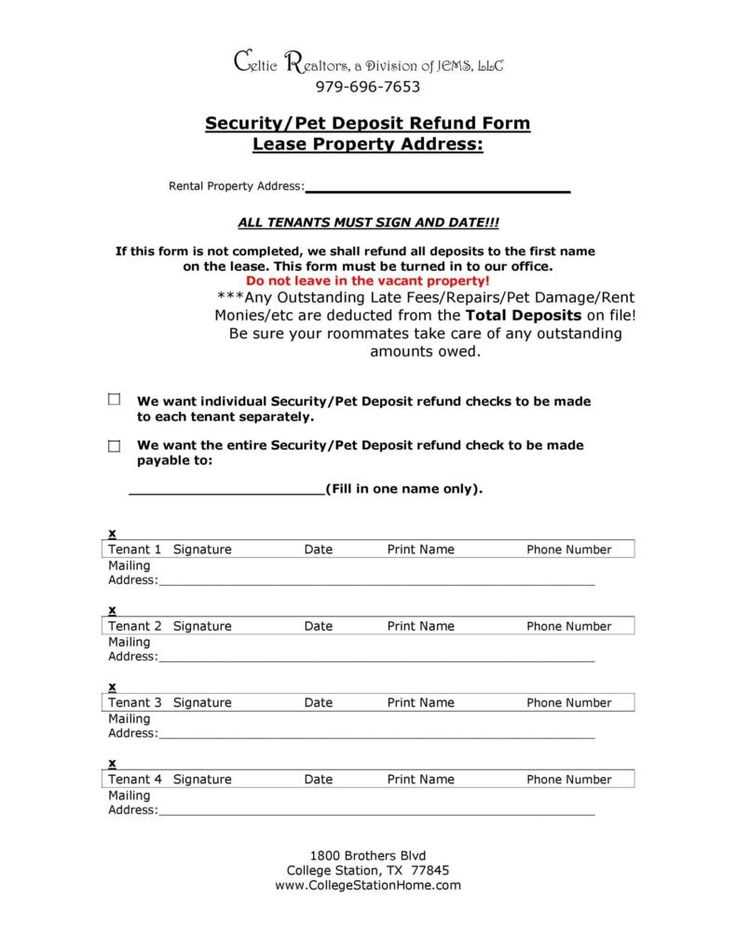

A well-crafted receipt includes key elements such as the tenant’s name, the property’s address, the date of the refund, and the total amount returned. It also lists any deductions for damages or unpaid rent, along with itemized explanations for each deduction. Providing this clarity can help avoid disputes and ensure a smooth transition for both parties.

By using a template, you can save time and ensure consistency across different rental agreements. The receipt serves as both a legal record and a way to maintain professionalism in the handling of security deposits. Whether you are returning the full deposit or part of it, this document protects both the landlord’s and tenant’s rights.

Here is the revised version with reduced repetition:

To create a clear and concise security deposit refund receipt, focus on including the key details without redundancy. Start by stating the refund amount and the reason for the refund. Specify the property or service the deposit pertains to, and indicate the date of refund. Ensure the names of the parties involved are listed accurately. Clearly outline any deductions or adjustments made to the deposit, if applicable.

Key Elements to Include

Include the following sections for clarity:

- Refund amount

- Reason for refund

- Property or service related to the deposit

- Refund date

- Adjustments or deductions

Formatting Tips

Use bullet points or short paragraphs to avoid clutter. Ensure the receipt is easy to read, with bold headings for each section. This helps the reader find important information quickly. Keep the language simple and direct to avoid confusion.

- Security Deposit Refund Receipt Template

Use a security deposit refund receipt template to provide clear documentation of the refund process. The receipt should include specific details such as the amount refunded, the date of refund, and any deductions made. This helps protect both parties involved–tenant and landlord–and ensures transparency.

The key sections of a security deposit refund receipt are as follows:

| Section | Description |

|---|---|

| Tenant Information | Include the tenant’s full name and address. |

| Property Details | List the property address and unit number (if applicable). |

| Refund Amount | Clearly state the total refund amount. |

| Deductions | Itemize any deductions (e.g., cleaning fees, repairs) and provide the amounts. |

| Refund Date | State the date when the refund was processed. |

| Landlord Information | Include the landlord’s name, business name (if applicable), and contact details. |

| Signature | Provide a space for both the landlord and tenant to sign, acknowledging the refund. |

Ensure the receipt is clear and concise, and that both parties retain a copy for their records. A well-structured template prevents confusion and simplifies the process of handling security deposits. Make sure to update the receipt with the correct details each time a refund occurs. This document provides accountability for all transactions and minimizes potential disputes.

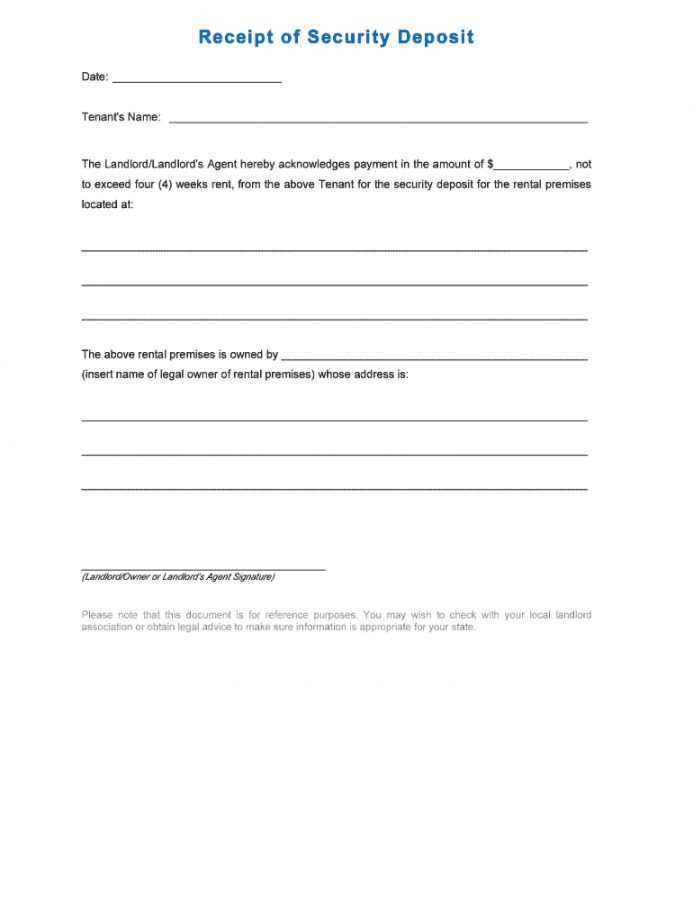

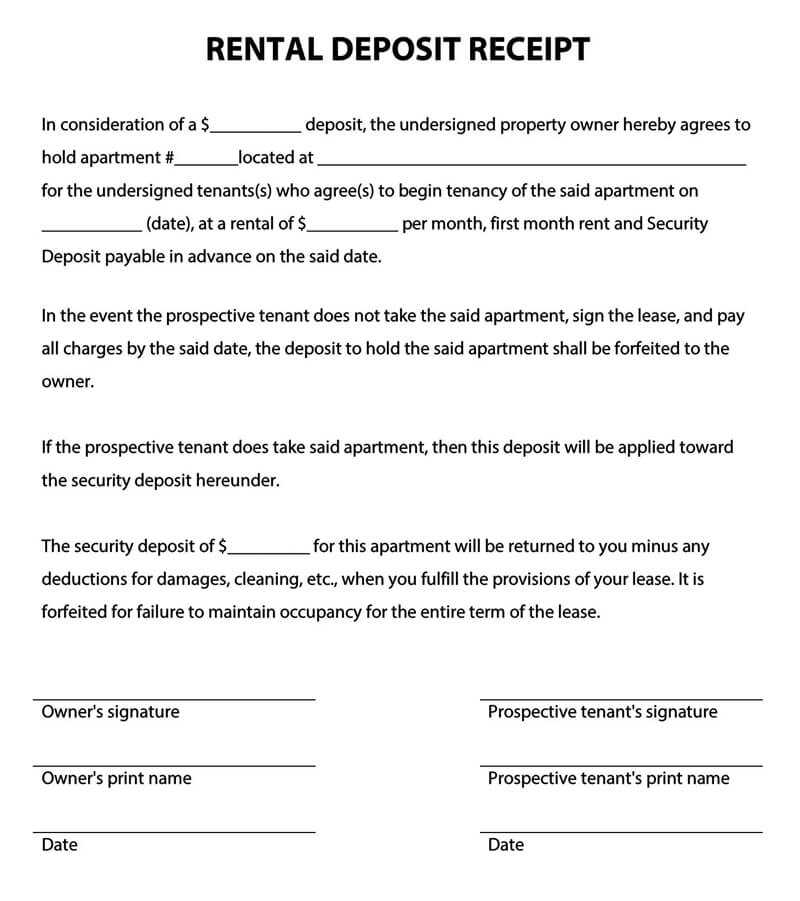

Begin by creating a header with the title “Security Deposit Refund Receipt” for clarity. Below the title, include the date the receipt is issued, followed by the tenant’s name and address. Next, state the amount of the security deposit returned. Specify any deductions, such as for damages, if applicable, and provide a breakdown for transparency. Add a section with a brief description of the property, including its address, to ensure the refund is associated with the correct rental unit.

Include a clear statement confirming that the refund is issued for the security deposit, and if any amounts were withheld, mention the reason. Ensure to add a line for the signature of the landlord or property manager to authenticate the document. Lastly, include space for the tenant’s signature to acknowledge receipt of the refund. This step ensures both parties are on record regarding the transaction.

Make sure the template is easy to understand and avoids any unnecessary complexity. A clean and straightforward format helps prevent confusion and ensures all necessary details are captured.

A security deposit refund receipt should provide clear, accurate details to avoid any confusion. Here are the key elements to include:

- Receipt Number: Assign a unique number for tracking purposes.

- Tenant’s Name: Include the full name of the tenant who made the deposit.

- Landlord’s or Property Manager’s Name: Clearly state the name and contact details of the party issuing the refund.

- Property Address: List the address of the rented property for which the deposit was refunded.

- Amount Refunded: Specify the exact amount being refunded, breaking down any deductions.

- Refund Date: The exact date when the refund was issued.

- Deposit Amount: State the original deposit amount and any deductions made.

- Reason for Deductions: If applicable, provide a clear breakdown of any deductions (e.g., damages, unpaid rent).

- Payment Method: Indicate how the refund was made (e.g., check, bank transfer).

- Signature: Include signatures from both the landlord or manager and the tenant to confirm agreement.

Each section must be clear and concise to avoid any future disputes or misunderstandings.

Always double-check the refund amount. Failing to accurately calculate the refund can create confusion or disputes later. Verify any deductions and ensure they align with the agreed terms.

Incorrect or Missing Signatures

Both parties should sign the receipt. A lack of signatures can result in a document that lacks legal validity. Ensure both the issuer and recipient confirm the transaction by signing the receipt.

Inaccurate Date or Transaction Details

Ensure the refund date is clearly mentioned. Errors in dates or missing transaction details may lead to misunderstandings about when the refund was processed. Always cross-check the information provided to avoid discrepancies.

Failing to provide a clear breakdown of the refund, including any deductions for damages or unpaid rent, can lead to confusion. Be specific about the amounts and the reasons for any reductions.

Be clear about the payment method used for the refund. Stating a refund was made in cash when it was via bank transfer can lead to confusion and unnecessary follow-ups.

A security deposit refund receipt should clearly detail the refund amount, the date of the refund, and the conditions under which it is issued. Ensure that all necessary information is included for both parties to have a clear record of the transaction.

Key Elements

Include the tenant’s full name, the property address, and the reason for the refund. Specify the amount refunded, and mention any deductions if applicable. Be sure to note if the full deposit was refunded or if part of it was retained for repairs or cleaning.

Formatting Tips

Maintain a professional tone throughout the document. Use clear language and avoid unnecessary jargon. Keep the receipt concise, with accurate details that can easily be referenced later by either party.