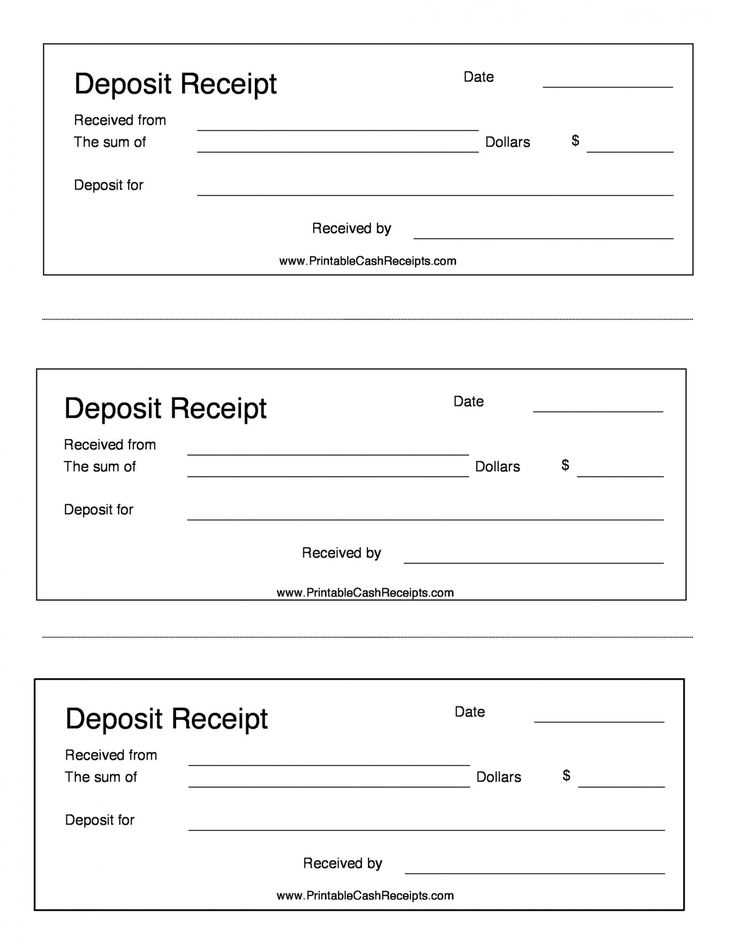

Use clear and concise templates for creating receipts and deposit records to ensure smooth financial documentation. A well-organized template helps track deposits and services rendered, reducing confusion and errors. Choose templates with spaces for all necessary details like the service description, amount, and deposit date.

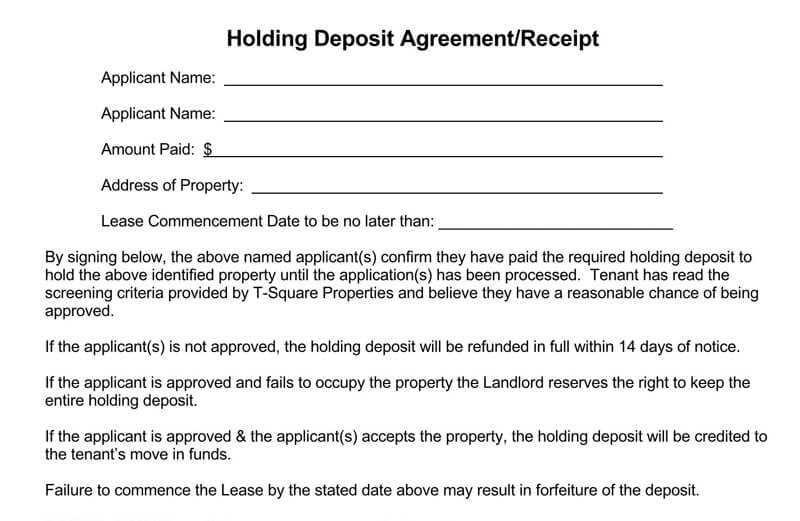

By integrating a service receipt with a deposit template, both clients and businesses can have transparent, organized records for financial transactions. Ensure that your template includes sections for both the service provided and the deposit amount. This clarity aids in future references or potential disputes.

Customizable options allow businesses to add their branding, making the template look professional while also meeting legal requirements for receipts and deposit confirmations. Keep it straightforward–avoid unnecessary sections and focus on key transaction data like the amount, service details, and confirmation of deposit.

Services Receipt Deposit Templates: A Detailed Guide

Choose a template that clearly separates service details and deposit information. Keep the structure simple and easy to read. At the top, include your business name, address, and contact information for quick reference. Below this, list the client’s name, service provided, and date of service.

Highlight the Deposit Amount: Clearly state the deposit amount paid by the client. Specify whether it’s a percentage of the total fee or a fixed amount. This ensures both parties have clarity on what has been paid upfront and what remains due.

Provide Payment Terms: Define the payment schedule, including the remaining balance and due date. This helps clients stay informed about upcoming payments and keeps the transaction transparent.

Include Service Details: Briefly describe the service rendered to avoid any confusion. Be specific with the type of service provided, the hours worked (if applicable), and any other relevant details like additional fees or taxes.

Signatures: Make room for both the client’s and service provider’s signatures. This serves as formal acknowledgment of the terms outlined in the receipt and helps prevent disputes later on.

Additional Notes: Leave space for any additional information or specific conditions agreed upon, like refunds, adjustments, or special requests related to the deposit or service provided.

By structuring your template with these key elements, you’ll ensure clarity and professionalism in all service deposit transactions. Keep it straightforward and to the point, and always review the terms with your clients before finalizing the document.

Creating a Clear Template for Service Payment Confirmations

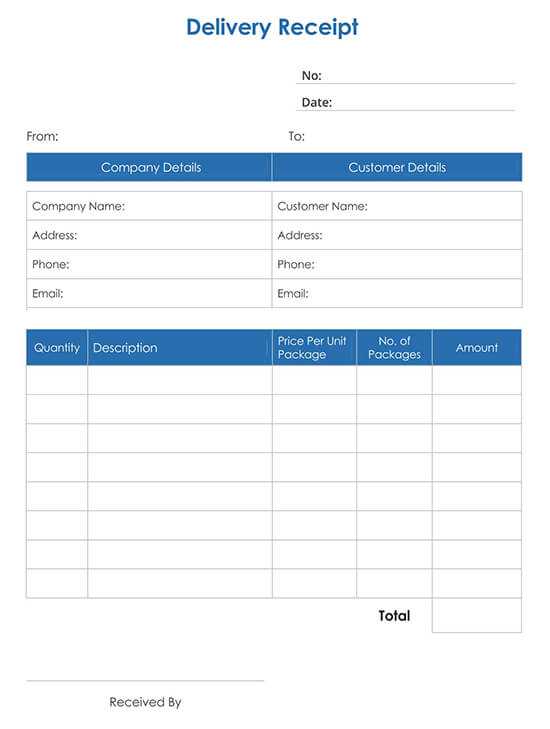

To build a simple and clear payment confirmation template, begin by outlining the key components. This ensures both clarity and professionalism in communicating payment status. Here’s how you can structure it:

- Service Details: Include the name of the service, date of provision, and description. Clear identification of what has been paid for avoids confusion.

- Payment Information: Clearly state the total amount paid, payment method, and transaction reference number. This provides a quick reference for both parties.

- Client Information: Include the client’s name, address, and contact details. This confirms the payment is linked to the correct individual or company.

- Provider Information: Ensure your contact details (company name, address, and contact number) are listed. This allows the client to reach out if needed.

- Date of Payment: Include the exact date payment was received. This helps track payments and resolve any disputes over timing.

- Confirmation Statement: Clearly state that the payment has been received. A simple sentence like “Payment has been successfully received” ensures there is no ambiguity.

- Signature or Stamp: Include a signature or company seal, if relevant, to add formality and authenticity to the document.

Ensure the format is simple and easy to read. Avoid cluttering the document with unnecessary information. Each section should be distinct and easy to reference. Clear labeling and consistent layout reduce errors and confusion.

How to Customize Deposit Templates for Specific Service Types

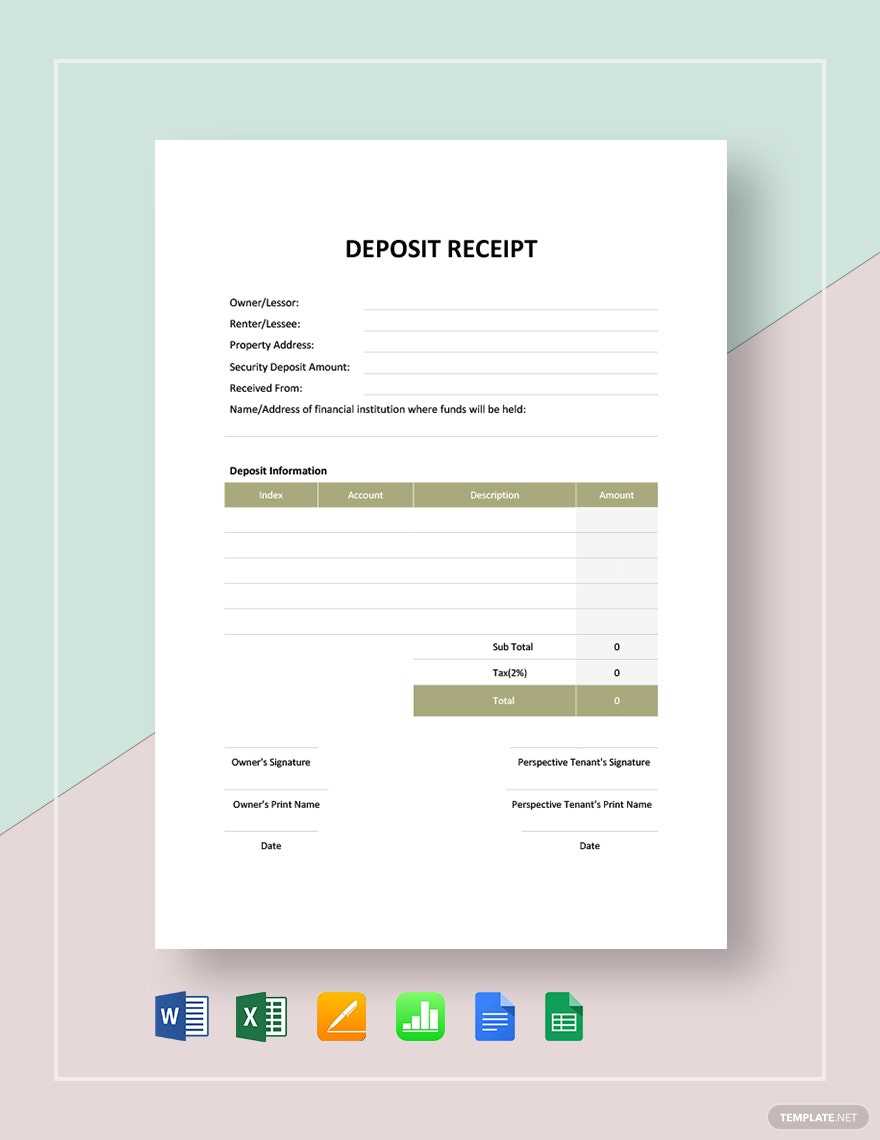

To tailor deposit templates to specific services, begin by identifying the key elements that distinguish each service. For example, service-based businesses often require fields like service name, service date, and a detailed breakdown of costs. Modify the template to capture these unique data points, ensuring that each service type has the necessary sections for accuracy and clarity.

Adjusting Template Fields for Different Services

For each service type, create a custom field set that reflects the specific data needed. For consulting services, focus on hours worked and hourly rate. For product-based services, include fields for product name, quantity, and unit price. This customization eliminates irrelevant fields and simplifies the template for users. Use drop-down menus or checkboxes where applicable to enhance usability and reduce errors.

Incorporating Dynamic Calculations

Integrate automated calculations based on the type of service. For instance, if the deposit is related to a service project with variable pricing, set up formulas that calculate the deposit based on the project cost or time spent. This reduces manual input and ensures accuracy. Make sure to test these formulas to confirm they work correctly with each service type.

Ensuring Legal Compliance in Service Receipt Documents

Ensure your service receipt templates include key information to avoid legal issues. Start by providing clear identification details, such as the full names of both the service provider and the recipient, along with their addresses and contact information. Include a precise description of the service provided, including the scope, dates, and location if applicable.

Specify the total amount paid for the service and note the method of payment. Always indicate any applicable taxes and fees to maintain transparency. The document should be signed by both parties, either digitally or physically, to validate the transaction.

Comply with local regulations by including disclaimers or terms of service, especially if your jurisdiction requires it. This can cover any warranties, liabilities, or limitations on the service provided. Be sure to use proper language that aligns with your region’s legal standards to avoid confusion or disputes.

Regularly review and update your templates to reflect any changes in tax laws or business regulations. This helps prevent future legal complications and keeps your receipts up-to-date with compliance standards.