Creating a deposit receipt template for orders helps ensure clear communication and transparency between your business and customers. A well-structured receipt provides both parties with a record of the transaction, outlining the details of the deposit amount, payment terms, and other relevant information. This avoids confusion and protects both the customer and the business in case of disputes.

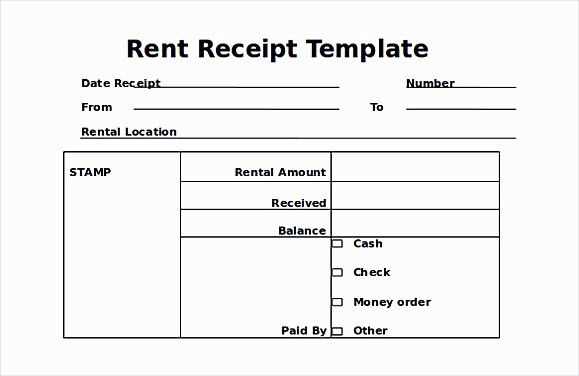

Start by clearly stating the amount of the deposit received, along with the total cost of the order. Include payment methods, such as credit cards, bank transfers, or cash. You should also mention the due date for the remaining balance, as this establishes expectations and provides a clear timeline for the full payment.

In addition, specify any conditions tied to the deposit, such as refunds, cancellations, or changes to the order. This keeps both parties informed about their responsibilities and rights. A simple, easy-to-read format will make it easier for customers to reference the receipt if needed.

Key Information to Include:

- Customer’s name and contact details

- Order description and total price

- Deposit amount and payment method

- Remaining balance and due date

- Refund/cancellation policy (if applicable)

By using this template, you’ll help streamline the order process and provide your customers with the assurance they need about the transaction.

Sure! Here’s the revised version with minimal repetition:

Use clear, concise language in your receipt template to ensure both you and the customer understand the terms of the deposit. Include the date the deposit was received, the amount, and the purpose of the deposit. Add a brief note confirming any payment methods, whether it’s via bank transfer, credit card, or another form. Make sure to specify whether the deposit is refundable and any conditions that apply in case of cancellation. End with a friendly thank you for the business and a reminder of the next steps in the process.

For added clarity, consider including reference numbers or order IDs in the receipt to link the payment directly to the specific order. This helps avoid confusion and makes future communication smoother. Also, always include your business name, contact information, and a disclaimer if necessary to prevent misunderstandings about the deposit terms.

Keep the tone professional yet approachable. If this receipt is being sent electronically, offer the option for the customer to contact you with any questions. Ensure the receipt is easily accessible and neatly formatted, whether it’s printed or emailed.

- Template for Order Deposit Receipt

A well-structured template for an order deposit receipt ensures both parties–vendor and customer–have a clear understanding of the terms. Below is a template you can use, tailored for simplicity and completeness.

Receipt Template Format

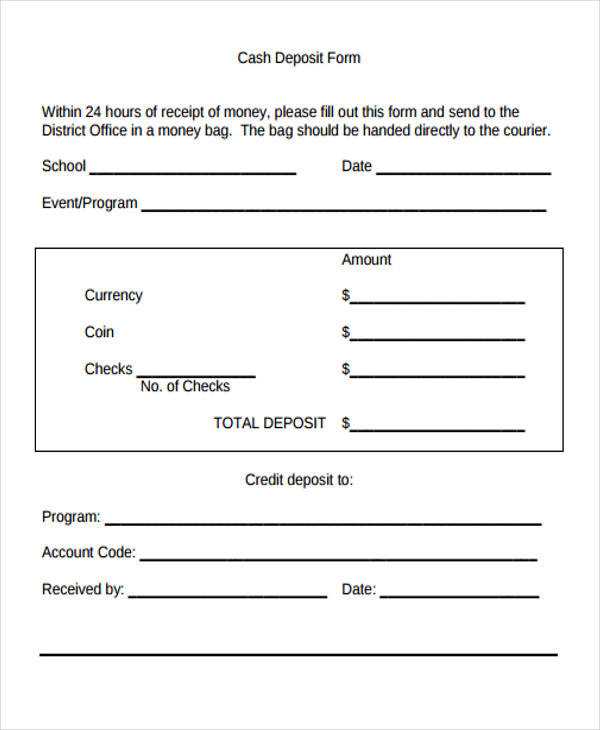

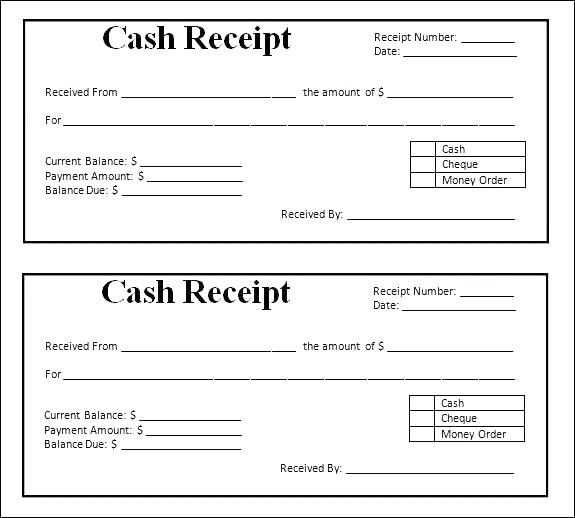

The order deposit receipt should include key information about the transaction, payment, and relevant details for future reference. Here is a breakdown of the fields to include:

| Field | Description |

|---|---|

| Receipt Number | Unique identifier for each receipt issued to ensure easy tracking. |

| Transaction Date | The date when the deposit is received. |

| Customer Information | Name, address, and contact details of the customer making the payment. |

| Order Description | A brief description of the goods or services for which the deposit is being made. |

| Deposit Amount | The exact amount the customer is paying as a deposit. |

| Payment Method | Details of the payment method, such as bank transfer, card payment, or cash. |

| Remaining Balance | The outstanding amount after the deposit, if applicable. |

| Terms and Conditions | Any relevant payment terms, refund policies, or deadlines for the full payment. |

How to Use the Template

Simply replace the placeholder text with the specific details for each transaction. Once completed, both the vendor and the customer should sign the document for acknowledgment and record-keeping. Keep a copy for your records, and provide one to the customer. This template will streamline your deposit receipt process, ensuring that both parties are clear on their obligations.

Ensure the template clearly displays all the key information in a clean, easy-to-read format. Start by including your company’s name, address, and contact details at the top. This establishes a professional appearance and provides transparency.

Order Details

Next, include the customer’s name, order number, and the date of the deposit. Clearly outline the total order amount and specify the deposit amount separately. This prevents any confusion regarding the payment breakdown.

Payment Information

Clearly state the method of payment (e.g., credit card, bank transfer, cash) and include any relevant transaction or reference numbers. If applicable, note the date the deposit was made and provide space for the customer’s signature to confirm receipt.

Conclude with any necessary legal disclaimers or terms of service related to the deposit. Ensure this section is clear to avoid misunderstandings in case of cancellations or refund requests.

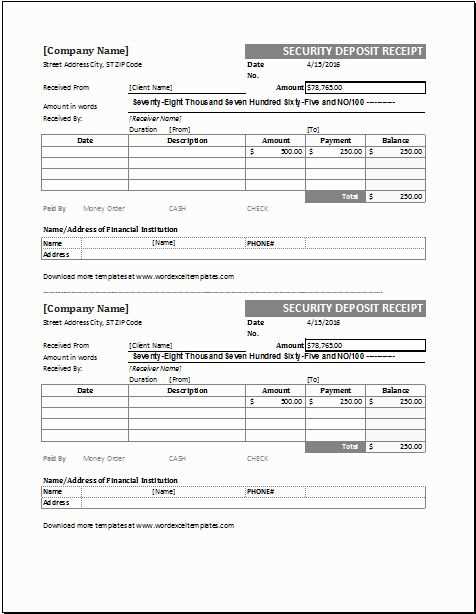

Include the following details to ensure your receipt of order deposit complies with legal standards:

- Buyer and Seller Information: Clearly list the full names, addresses, and contact details of both parties. This establishes clear identification for any legal proceedings.

- Deposit Amount and Terms: Specify the exact amount of the deposit and the terms under which it is refundable or non-refundable. Be specific about conditions that could affect the deposit.

- Payment Method: State the method of payment used for the deposit (e.g., bank transfer, credit card, etc.). This adds transparency to the transaction.

- Agreement Date and Signature: Include the date the deposit was received and ensure both parties sign the receipt. A signature confirms agreement to the terms laid out.

- Refund Conditions: Outline the specific circumstances under which a refund may be issued. Ensure these conditions comply with consumer protection laws in your jurisdiction.

- Product or Service Details: Provide a clear description of the product or service being ordered, including any relevant specifications, quantities, or delivery expectations.

- Legal Jurisdiction: Specify the legal jurisdiction that will govern the agreement in case of disputes. This clarifies where legal matters will be handled.

Clarity and Precision

Ensure all terms are clearly outlined to prevent misunderstandings. Avoid vague language and ensure both parties have a mutual understanding of the deposit’s role within the agreement.

Compliance with Consumer Protection Laws

Ensure your receipt complies with local consumer protection regulations. This includes giving buyers the right to a refund or cancellation under specific conditions, as well as transparency about fees or charges.

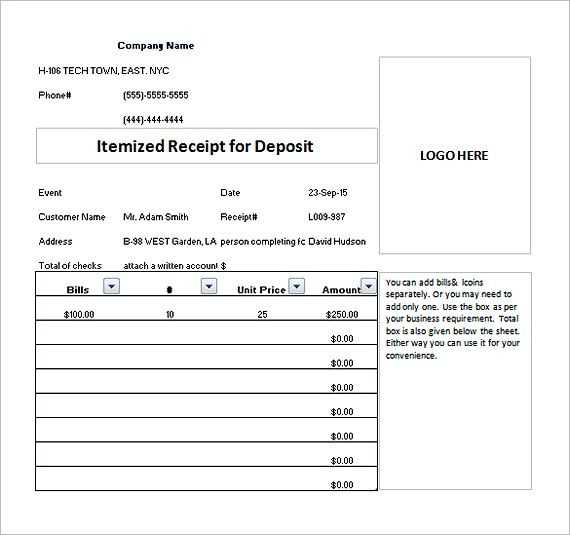

Identify the specific information your business needs to include on a deposit receipt. Include details like customer name, date of deposit, amount, and a brief description of the product or service. Customize the format based on your branding–logo, colors, and fonts should align with your business identity.

Set up a unique receipt number system. This makes it easier to track each deposit and maintain organized records. You can either manually generate numbers or automate them using your accounting or invoicing software.

Integrate payment method details. Specify whether the deposit was made through cash, check, credit card, or bank transfer. This transparency helps both parties keep accurate financial records.

Add a section for terms and conditions. Outline any policies related to deposits, such as refund and cancellation policies. This reduces confusion and protects both parties in case of disputes.

Use clear and concise language. Keep the receipt easy to read, and avoid unnecessary jargon. Make sure every field is self-explanatory, so customers understand the receipt without further explanation.

Include a payment breakdown if necessary. If the deposit is part of a larger payment, break down the amounts to show what the deposit is covering (e.g., deposit for service, remaining balance due).

Test the final version before use. Ensure the formatting and information are correct, and that it prints well if you’re issuing physical receipts. Double-check that all fields are editable if using a template, so you can update it as your business needs change.

Ensure the order deposit receipt template includes a clear breakdown of the payment terms. Start with the customer’s name, date of the order, and the agreed amount. Specify the deposit percentage or fixed amount, indicating the total order value to avoid confusion.

Include a statement of purpose–explain that the deposit secures the order and is non-refundable unless otherwise stated in the terms. This ensures both parties are on the same page regarding the deposit’s role in the transaction.

Provide clear payment instructions, such as the preferred method of payment and due date. If the deposit is made online, mention the transaction details and provide a reference number for tracking. If paid by bank transfer, include bank account details and any additional charges for wire transfers.

Specify the balance due date and outline any conditions for the remainder of the payment. Clearly state if the balance is expected upon delivery, upon completion of services, or after an inspection period.

Lastly, include a section for signatures or electronic confirmation. This step ensures both parties acknowledge and agree to the terms outlined in the deposit receipt.