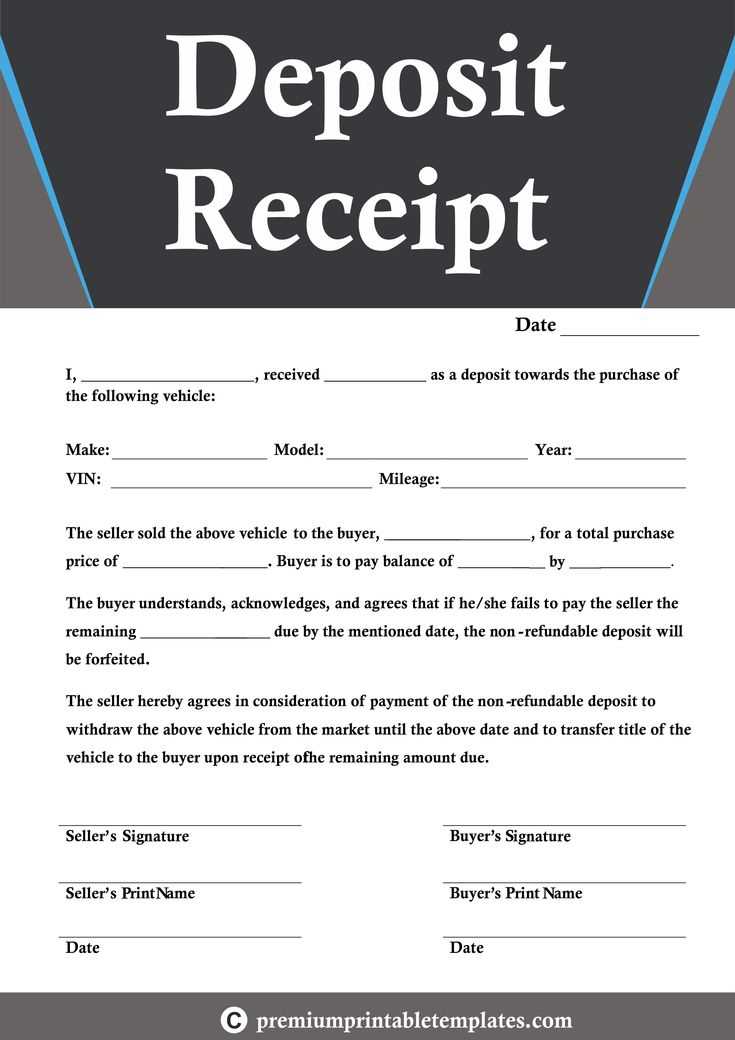

When creating a receipt for a purchase order deposit, clarity and accuracy are key. Begin by clearly stating the date of the deposit and the details of the transaction. Include the buyer’s name, the amount paid, and any reference numbers relevant to the order. These elements should be prominently displayed to ensure both parties have a clear understanding of the payment’s context.

Break down the details in an organized manner. Specify the total deposit amount, as well as the remaining balance, if applicable. If the deposit covers a portion of the overall cost, outline the breakdown to avoid confusion. Always use precise wording to indicate whether the deposit is refundable or non-refundable to set clear expectations from the start.

Next, confirm the purpose of the deposit by including any relevant descriptions or terms related to the specific product or service. This can be particularly useful when dealing with customized orders, pre-sale agreements, or bulk purchases. If applicable, mention the date the remaining balance is due and any penalties for late payments.

Lastly, include contact details for any questions or concerns. Providing a direct way for the buyer to reach out ensures that both parties are aligned in terms of expectations and can handle any disputes efficiently. A transparent, well-organized receipt not only fosters trust but also protects both parties in the event of discrepancies.

Here’s the revised version, where words are repeated no more than two or three times:

Ensure clarity by stating the purpose of the deposit clearly. Specify the amount, due date, and terms. Avoid excessive repetition to keep the message straightforward and professional. A concise approach maintains focus on the transaction without unnecessary details. Confirm receipt promptly to reassure the client of their payment’s processing.

Instead of repeating instructions, use bullet points or numbered lists to enhance readability. For example, you could list the payment methods or deadlines in a structured format. This reduces wordiness while improving comprehension.

Ensure you specify any conditions for the deposit, such as non-refundable clauses, in a single, clear sentence. Repetition can confuse the reader, so keep terms consistent and easy to follow. By being direct, you provide a clear and actionable message to your client.

- Template for Purchase Order Deposit Receipt

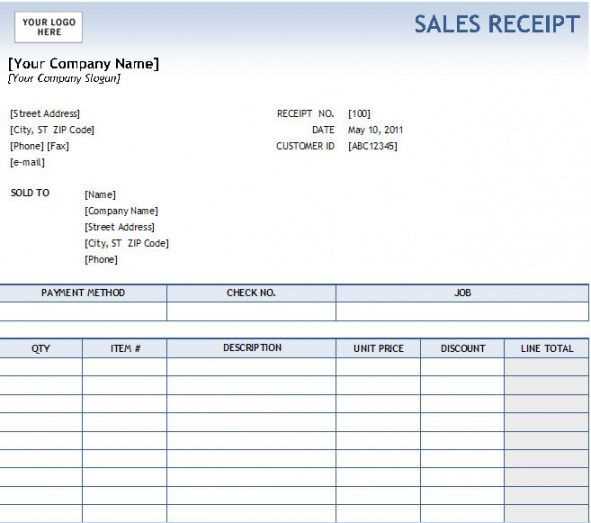

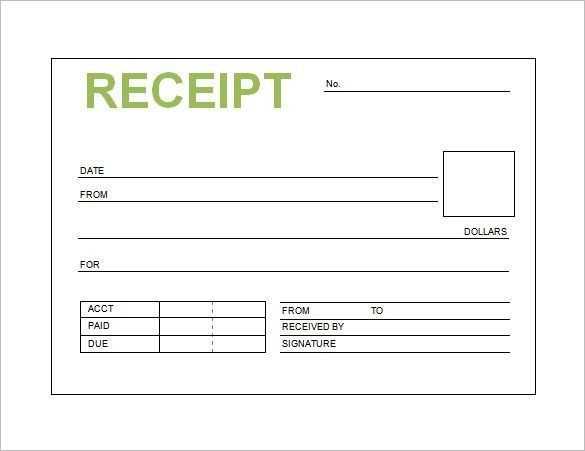

When issuing a receipt for a purchase order deposit, it’s critical to include specific details to ensure clarity for both parties. This template provides a straightforward structure for documenting a deposit and can be customized based on the transaction specifics.

Key Information to Include

The following sections should be included in your purchase order deposit receipt:

- Receipt Number: Assign a unique number for record-keeping purposes.

- Date: Include the date of the deposit payment.

- Customer Details: Full name and address of the customer making the deposit.

- Vendor Details: Name and contact information of the vendor or seller.

- Deposit Amount: Specify the exact amount paid as a deposit.

- Total Order Value: Clearly state the total value of the purchase order.

- Remaining Balance: Calculate and display the balance due after the deposit.

- Payment Method: Indicate how the deposit was made (e.g., cash, check, credit card).

- Purpose of Deposit: A brief description of the goods or services related to the order.

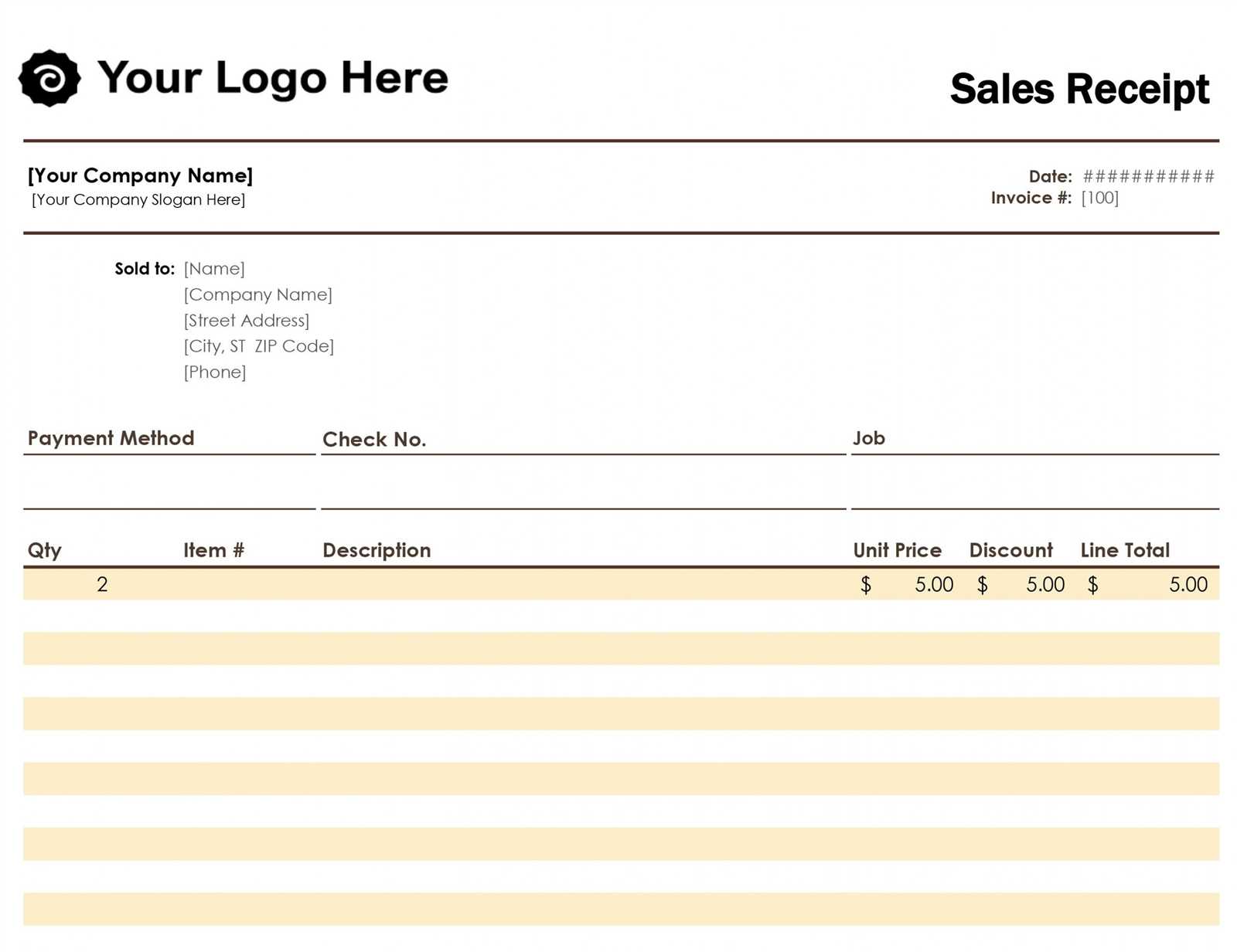

Example Template

| Field | Details |

|---|---|

| Receipt Number | 12345 |

| Date | February 5, 2025 |

| Customer Name | John Doe |

| Customer Address | 123 Main St, Cityville, CA |

| Vendor Name | ABC Supplies Co. |

| Vendor Contact | [email protected] |

| Deposit Amount | $500 |

| Total Order Value | $2,500 |

| Remaining Balance | $2,000 |

| Payment Method | Credit Card |

| Purpose of Deposit | Purchase of Office Furniture |

Ensure that both the vendor and customer retain a copy of the receipt for their records. This document serves as proof of payment and helps avoid any misunderstandings later on in the transaction.

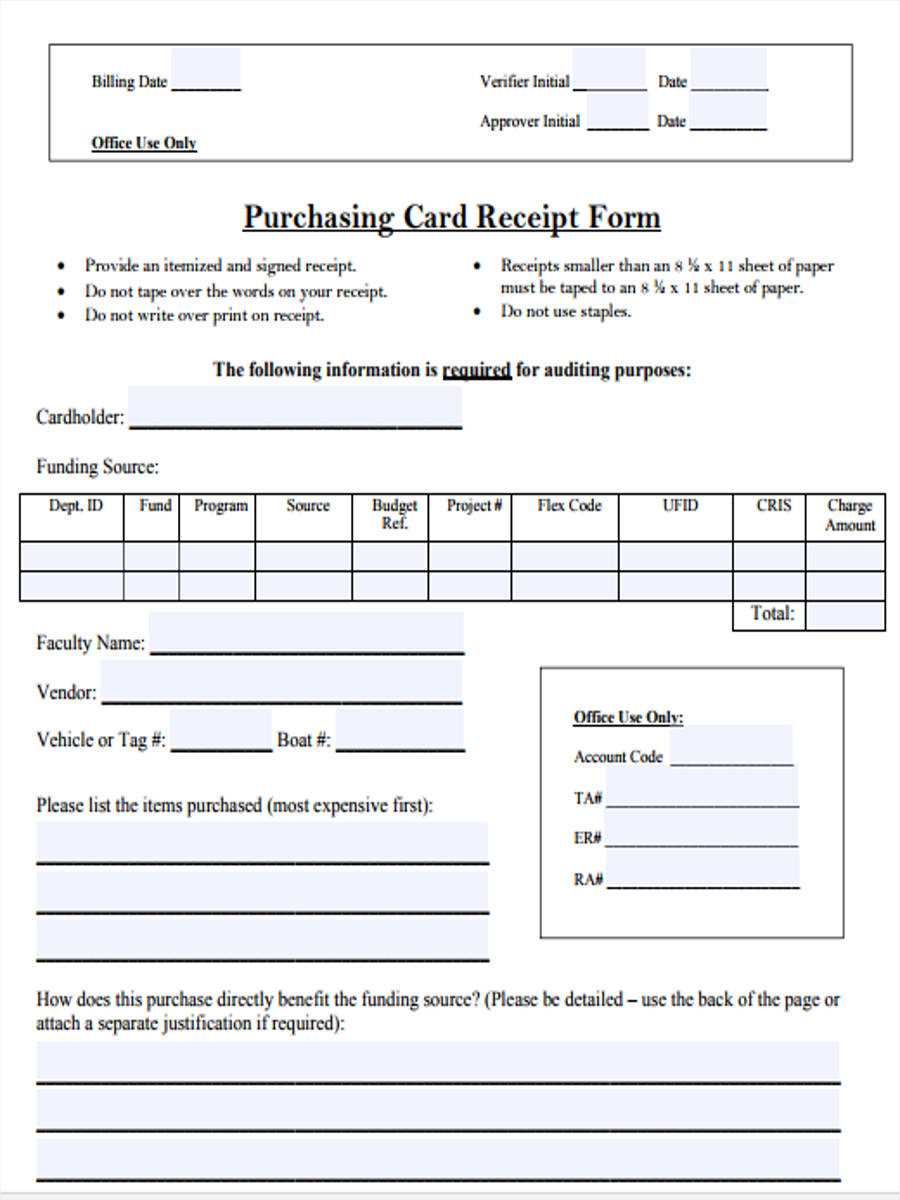

To create a precise receipt for a purchase order payment, include the following key details: the receipt number, date of payment, and payment method. Always start by identifying the purchaser and the supplier with their names, addresses, and contact information. This ensures clear identification of both parties involved in the transaction.

Key Payment Information

Specify the amount paid, including any deposit or advance, and outline the currency used. If applicable, break down the payment into separate charges for easy understanding, such as product cost, shipping, or taxes. This breakdown reduces confusion and adds clarity to the transaction record.

Transaction Confirmation

Include a section confirming the details of the purchase order, such as the order number and the list of items or services purchased. Also, note any remaining balance, and mention payment terms, like the final due date. This provides a clear timeline and ensures the customer understands when to expect the remaining charges.

Ensure that the receipt is signed by an authorized person from your company, adding legitimacy to the document. A detailed, clear receipt not only serves as proof of payment but also strengthens trust between the buyer and seller.

Ensure that the deposit confirmation contains the full details of the transaction. Include the customer’s name, the date the deposit was made, and the agreed-upon deposit amount. Specify the total purchase order value and the deposit percentage, showing clearly how the deposit fits into the total cost.

Detail the payment method used and provide any necessary transaction or reference numbers for easy tracking. If applicable, include bank account information or payment gateway reference codes.

Outline any deadlines for the remaining balance, as well as the terms under which the deposit may be refunded or forfeited. Specify the goods or services covered by the deposit and clarify any conditions tied to the payment, such as shipment dates or specific terms of delivery.

Finally, confirm that the deposit is non-refundable (if applicable) or specify any conditions for refunds. A clear statement of the deposit’s status (paid or pending) is necessary for both parties’ understanding.

Ensure all relevant payment details match by cross-referencing the purchase order with the deposit confirmation. This will help identify any discrepancies early in the process.

Step 1: Verify Payment Amount

Double-check the payment amount received against the agreed-upon deposit in the purchase order. A minor error could lead to issues down the line. If the amount differs, contact the customer for clarification.

Step 2: Confirm Payment Method and Date

Review the payment method (e.g., credit card, bank transfer) and date of transaction. This ensures that funds were deposited within the correct timeframe and through the specified method.

By performing these checks, you can be confident that the payment has been properly received and deposited. Accuracy at this stage avoids delays and potential misunderstandings later on.

When issuing a deposit receipt for a purchase order, businesses must adhere to certain legal requirements to ensure the transaction is valid and enforceable. The receipt should explicitly outline the amount paid, the agreed-upon terms, and the intended purpose of the deposit. Without this clarity, disputes may arise regarding the buyer’s intent and the seller’s obligations.

The receipt must reflect the specifics of the agreement between both parties, such as delivery timelines, product descriptions, and the conditions under which the deposit may be refunded. This protects both the buyer and seller by establishing clear expectations from the outset.

In many jurisdictions, deposit receipts may serve as a legally binding agreement. If the buyer decides to cancel the order or if the seller fails to fulfill the order, the deposit receipt can play a significant role in resolving disputes. Without such documentation, it may be difficult to prove the terms of the agreement or recover funds.

It’s important to note that some regions require a minimum set of information to be included in the receipt. This may include the buyer’s and seller’s names, the order’s unique reference number, and a detailed breakdown of the payment. Check local laws to ensure full compliance with applicable regulations.

Lastly, it is advisable to keep a copy of the deposit receipt for both parties. This helps in protecting against misunderstandings or claims that may arise in the future, particularly in case of a legal dispute or audit.

Are you looking for more information on the LG CordZero, or is there something specific you’d like to know about it?

How to Resolve Discrepancies or Issues with Order Deposits

Address discrepancies with order deposits quickly and efficiently to prevent delays and confusion. Follow these clear steps to resolve any issues that may arise:

- Review the Deposit Agreement: Double-check the terms outlined in the deposit agreement, including the deposit amount, due date, and payment method. Ensure that both parties are aligned on these details.

- Verify Payment Records: Confirm that the deposit was received by checking payment records or bank statements. Ensure there are no errors, such as missing payments or incorrect amounts.

- Communicate with the Customer: Reach out to the customer in a friendly and professional manner to discuss the issue. Clarify any misunderstandings and confirm whether they have already made the payment or if there were any issues on their end.

- Offer Solutions: If a discrepancy arises, propose a solution based on the situation. This could involve issuing a refund, adjusting the deposit amount, or rescheduling payment dates.

- Document Everything: Keep a clear record of all communications and decisions regarding the deposit issue. This will help resolve any future disputes or misunderstandings.

- Update the Agreement if Needed: If necessary, amend the original deposit agreement to reflect any changes or adjustments to the payment terms to avoid similar issues in the future.

By following these steps, you can quickly address and resolve any discrepancies with order deposits, ensuring smooth transactions and maintaining positive customer relationships.

Now repetitions are minimized, while meaning and accuracy are maintained.

Ensure that every section of the purchase order deposit receipt is clear and precise. Avoid unnecessary restatements of details, as they can lead to confusion. Focus on summarizing key information in bullet points or short, direct sentences. Keep the language simple and to the point, with no extra explanations. Each part should flow logically, making it easy to follow the payment information, including the deposit amount, the date of payment, and any necessary terms.

Use distinct headings for different parts of the receipt, such as “Deposit Amount” or “Payment Terms,” so the reader can quickly find what they’re looking for. This reduces redundancy while keeping all details intact. By structuring the document clearly, you ensure both clarity and accuracy without overloading the recipient with unnecessary details.

By minimizing unnecessary repetition, you provide a more streamlined experience, making the document easier to understand while preserving its purpose and legal accuracy. The focus should be on providing exactly what is needed without going into excessive detail. This makes the receipt both functional and user-friendly.