Provide clear documentation with a tenant deposit receipt to avoid misunderstandings. Use a simple and organized template to record all necessary details about the deposit transaction. This ensures both you and the tenant have a written agreement about the deposit amount, conditions, and handling process.

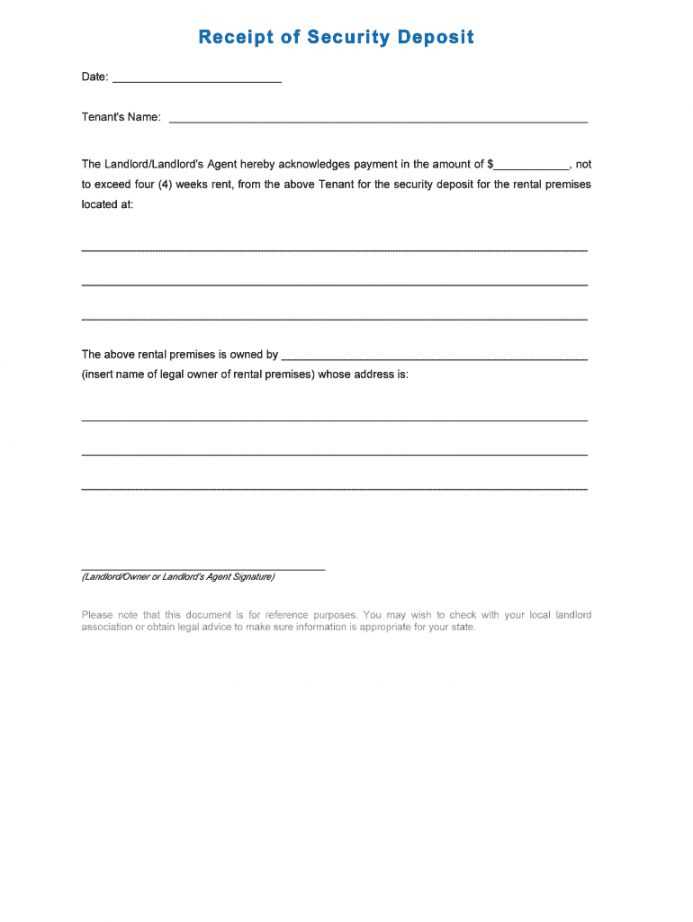

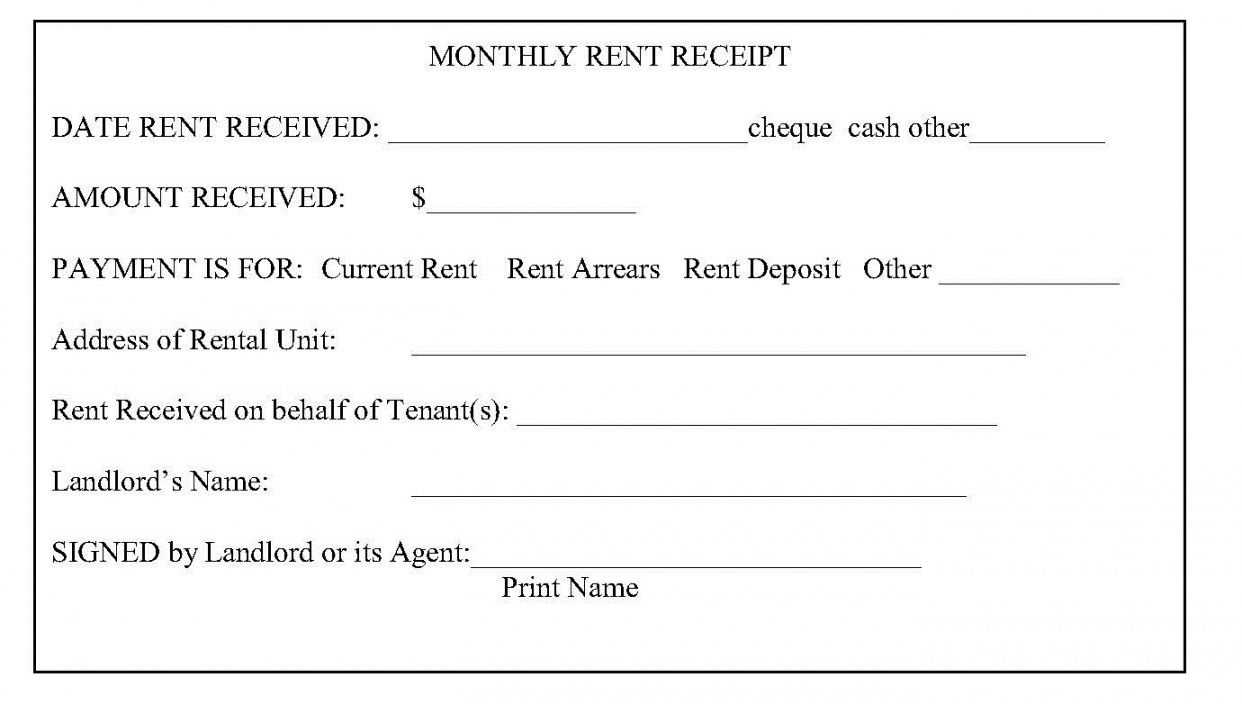

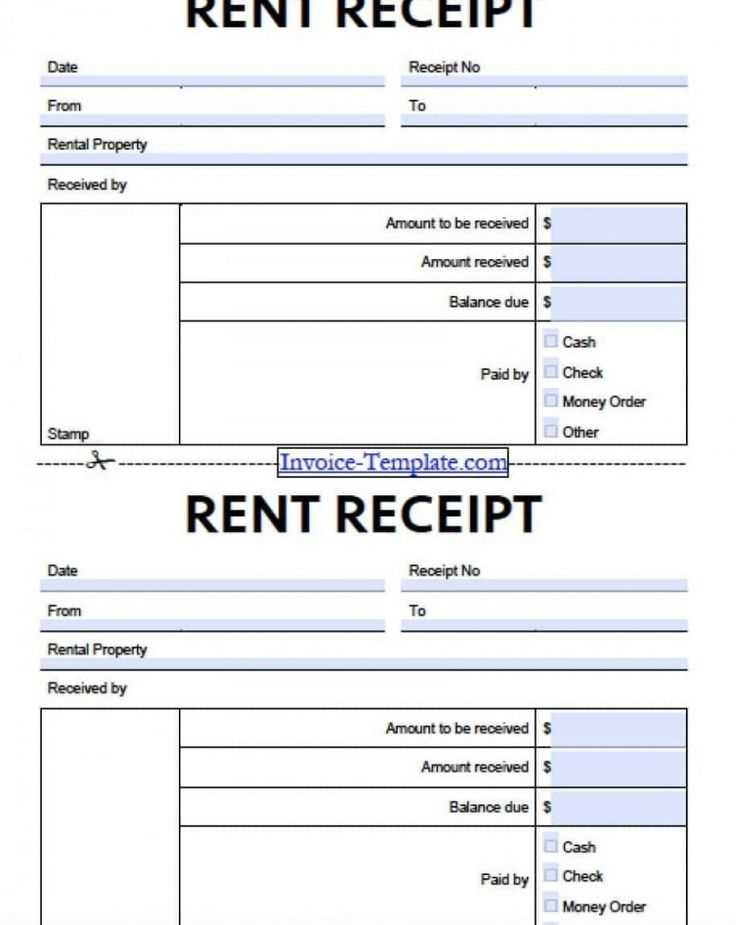

A good tenant deposit receipt should include the tenant’s name, the rental property’s address, the deposit amount, and the date the payment was made. Include a brief description of any conditions tied to the deposit, such as non-refundable fees or deductions for damages. It is also important to clarify whether the deposit is refundable under specific terms, helping to prevent future disputes.

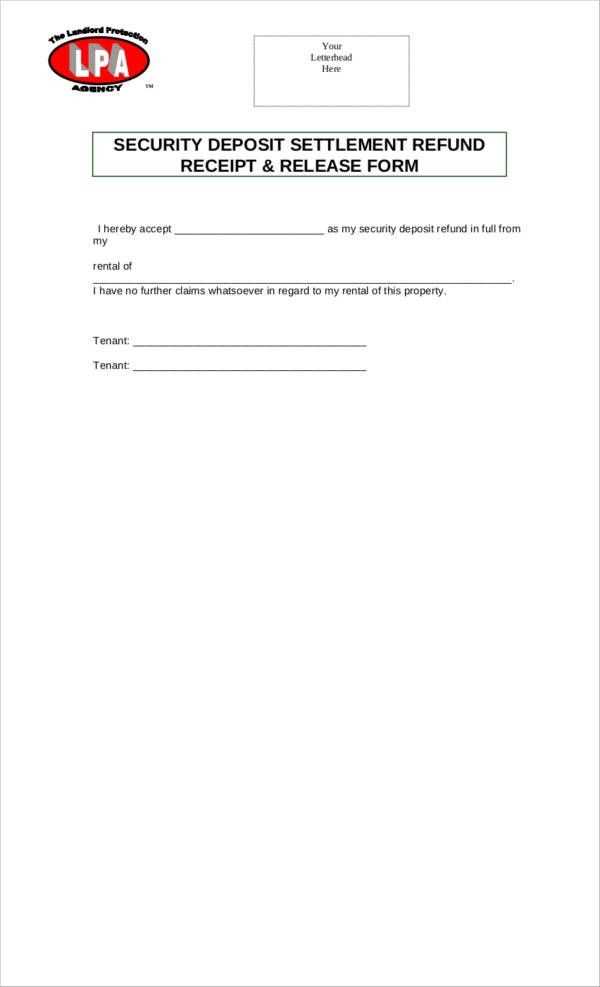

By utilizing a clear template, you ensure all parties are on the same page regarding the handling of the deposit, whether it is for a lease renewal, move-out inspection, or potential refund. This receipt also provides legal protection, offering transparency in the landlord-tenant relationship.

Here’s the revised version without word repetitions:

Begin by clearly stating the deposit amount and the date it was received. Make sure to specify if the deposit is refundable or non-refundable. Include details about any potential deductions, such as damages or unpaid rent, and the conditions under which these may be applied. Specify the deadline for returning the deposit after the lease ends. It’s also helpful to add the tenant’s contact details for any necessary communication. Clarify any rules for disputes related to the deposit, including how to handle disagreements.

- Deposit Amount: List the exact amount received.

- Refundable or Non-Refundable: Clearly define this aspect.

- Conditions for Deductions: Outline scenarios where the deposit may be reduced.

- Return Timeline: Indicate how long the landlord has to return the deposit after lease termination.

- Tenant’s Contact Info: Include the tenant’s phone number and email.

- Dispute Resolution: Mention the process to resolve deposit-related disagreements.

Make sure to date the document and include both parties’ signatures. This ensures transparency and prevents misunderstandings.

- Tenant Deposit Receipt Template

Creating a tenant deposit receipt is a key step in documenting the security deposit transaction. This receipt serves as proof of payment and ensures transparency between landlords and tenants. It is important to include all necessary details for clarity and future reference.

Key Information to Include

Include the following details in the receipt:

- Tenant Name: Clearly state the name of the tenant who paid the deposit.

- Property Address: Specify the address of the rental property.

- Amount Paid: Indicate the exact amount of the deposit.

- Deposit Purpose: Mention the purpose, such as “Security Deposit” or “Damage Deposit.”

- Date of Payment: Note the exact date the deposit was paid.

- Landlord or Agent’s Name: Include the name of the person receiving the deposit.

- Signature: Have both the landlord and tenant sign the receipt to acknowledge the transaction.

Why This Template Matters

A properly structured tenant deposit receipt minimizes disputes over deposit return and ensures both parties are on the same page regarding terms. Clear documentation is beneficial should disagreements arise about deposit refunds or property conditions.

A deposit receipt serves as an official record of the tenant’s payment, ensuring transparency and protection for both parties. It provides clear documentation that a tenant has made a deposit, specifying the amount, date, and purpose. This can prevent misunderstandings in the future, especially during move-out inspections when refunding the deposit is discussed.

Clarity and Transparency

By issuing a deposit receipt, landlords offer clear proof that the tenant has met their financial obligation. This helps avoid confusion if there is a dispute regarding the deposit or the conditions under which it may be withheld. It also creates a sense of accountability for both the tenant and the landlord.

Legal Protection

A receipt can be crucial in legal proceedings. In the event of a dispute, it acts as evidence that the tenant has fulfilled their financial responsibilities. It can help settle issues concerning the return of the deposit or any deductions made for property damages.

Always ensure that the deposit receipt is properly filled out with the correct details. It should include the amount paid, date of payment, and a description of the deposit’s purpose. Keeping a copy of this receipt is advisable for both parties to guarantee protection in the future.

The deposit receipt must include clear details to ensure both the landlord and tenant are aligned on the terms. Include the full name of the tenant and landlord, as well as their contact information, to avoid any confusion. Record the exact amount of the deposit, specifying the currency and any other related charges, if applicable.

Describe the purpose of the deposit in a straightforward way, such as “security deposit” or “advance rent,” and include any reference to the rental property, such as its address or unit number. List the date the deposit was received to establish a timeline.

If there are any specific terms associated with the deposit, such as conditions for return or deductions, include these details to prevent misunderstandings. Finally, have a clear signature section for both parties to confirm the transaction.

Adjusting the tenant deposit receipt template for different property types ensures the document reflects specific circumstances and requirements. Each property type has its unique needs, and the deposit receipt should account for them.

Residential Properties

For residential properties, include specific sections to address household items, furniture, and appliances that may be provided. Clearly list the condition of these items to avoid disputes later. The template should also reflect local rent laws regarding deposit amounts and return timelines.

Commercial Properties

In commercial leases, the template should focus more on the state of the property, including any alterations or tenant improvements. Specify whether the deposit covers common areas, parking spaces, or equipment provided by the landlord. Be detailed about the timeline for deposit return, especially if the space is being renovated after occupancy.

In both cases, customize the template to ensure compliance with local rental laws and to reflect the specific needs of your property type.

The requirements for tenant deposit receipts vary across different jurisdictions, with specific laws dictating how and when landlords must issue these receipts. In most cases, a landlord is required to provide a written receipt for any deposit received from a tenant. This helps to protect both parties and ensures clarity in financial transactions.

United States

In many U.S. states, the law mandates that landlords issue a receipt for any security deposit paid. These receipts should include details like the amount, the date the payment was made, and the property for which the deposit was paid. In some states, the landlord must provide an itemized list of the conditions of the property at the time of the deposit. States like California and New York also require that security deposits be held in a separate, interest-bearing account.

United Kingdom

In the UK, landlords are required to protect tenant deposits in a government-approved tenancy deposit scheme. A receipt must be provided to the tenant within a set period, typically 30 days from the receipt of the deposit. The receipt must confirm the amount, the name of the scheme, and provide a reference number. This system ensures transparency and protects the tenant’s rights.

Other countries and regions have similar requirements that aim to create a transparent and fair environment for both landlords and tenants. It’s critical to check local laws before drafting a deposit receipt to ensure compliance with regional rules.

Always include clear details about the amount of the deposit. Leaving out the deposit figure can lead to confusion and disputes. Specify the exact sum, the date received, and the name of the payer.

1. Missing Key Information

- Make sure to list the full name and contact details of both the tenant and the landlord.

- Note the property address where the deposit applies.

- Document the purpose of the deposit, whether it’s for damages, cleaning, or any other agreed-upon purpose.

2. Vague Language

Be precise with the wording to avoid ambiguity. Phrases like “deposit amount” should be followed by the exact number, not just “a sum of money.” If there are conditions on refunding the deposit, outline them clearly to prevent misunderstandings later on.

3. Incomplete Signatures

Ensure both parties sign the receipt, confirming they agree to the terms. Without signatures, the document may be seen as invalid in case of a dispute.

4. Forgetting to Provide a Copy

- Always give a copy of the signed receipt to the tenant. This will be useful for record-keeping and reference.

- Keep a copy for yourself in case you need it later.

How to Use the Receipt to Resolve Disputes

Refer to the receipt immediately when a disagreement arises over the tenant’s deposit. The document serves as an official record of the transaction and details the amount paid, the payment date, and any conditions tied to the deposit.

If the dispute involves damage claims or discrepancies over the return of the deposit, the receipt can be used to verify the terms agreed upon at the time of the payment. Compare any charges against the conditions outlined in the receipt. If no damage was noted at move-in, but a deduction is made for repairs, the receipt can help confirm whether the charges are justified.

In cases of partial refund requests, show the receipt to prove the original amount paid and any applicable deductions. This helps clarify misunderstandings and provides a foundation for negotiation. If legal action is needed, the receipt can be presented as evidence in court or arbitration to support your position.

The clarity provided by a well-organized receipt also prevents miscommunication. Include a detailed description of any specific terms or expectations for the deposit, such as maintenance responsibilities or the condition of the property, to avoid ambiguity during dispute resolution.

| Key Information in the Receipt | How It Helps in Disputes |

|---|---|

| Deposit Amount | Clarifies the total sum paid by the tenant, which can be compared to any refund or deductions made. |

| Payment Date | Establishes a timeline, helping to verify when the deposit was made and if the timing aligns with any disputes. |

| Condition Notes | Documents the state of the property at the time of payment, providing evidence for any damage claims. |

| Terms of Agreement | Clarifies expectations around the deposit, such as maintenance or return conditions, which help resolve misunderstandings. |

Ensure clarity in the tenant deposit receipt by including the following critical elements:

- Date of receipt: Specify the exact date when the deposit was received. This will help establish a clear timeline for both parties.

- Tenant and landlord details: Include full names and contact information of both the tenant and landlord. This makes it easier to address any concerns related to the deposit.

- Amount received: Clearly state the exact amount of the deposit, as well as the currency. Any discrepancies can be avoided by listing the amount precisely.

- Deposit purpose: Specify that the deposit is held as security for potential damages or unpaid rent. This should align with the terms mentioned in the lease agreement.

- Deposit conditions: Outline the specific conditions under which the deposit may be retained or refunded. This adds transparency and protects both parties in case of disputes.

- Signature section: Provide spaces for both the tenant and landlord to sign. This confirms both parties agree to the receipt and its terms.

Ensure the tenant receives a copy of the signed receipt for their records. This documentation serves as proof of the transaction and avoids misunderstandings down the road.