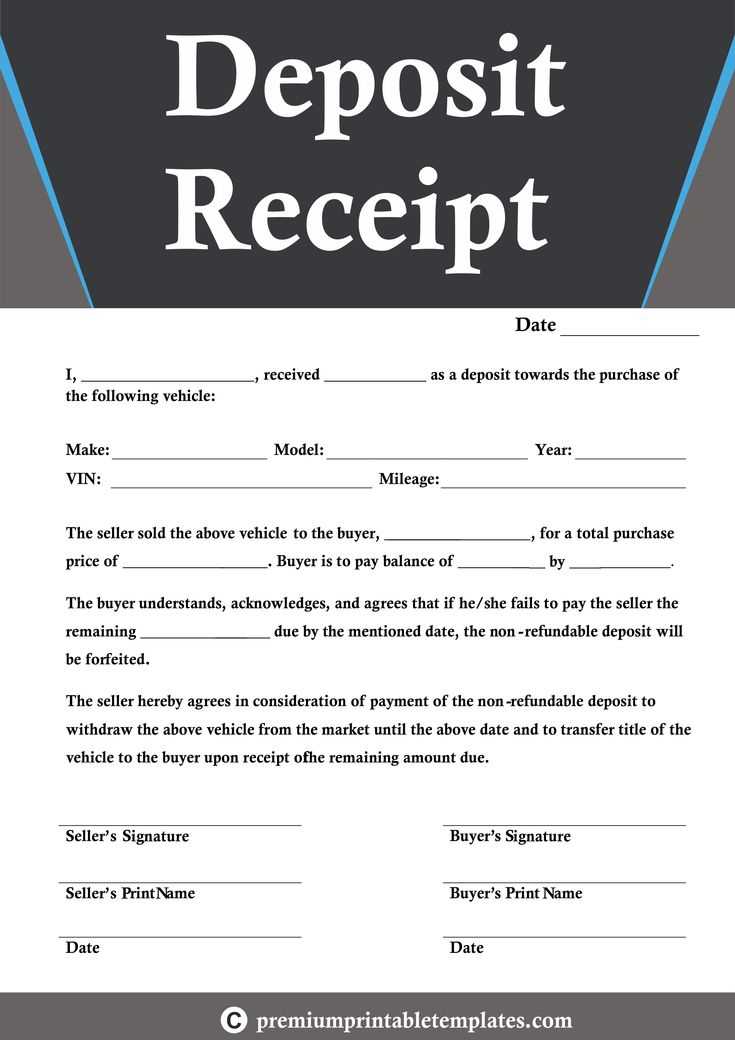

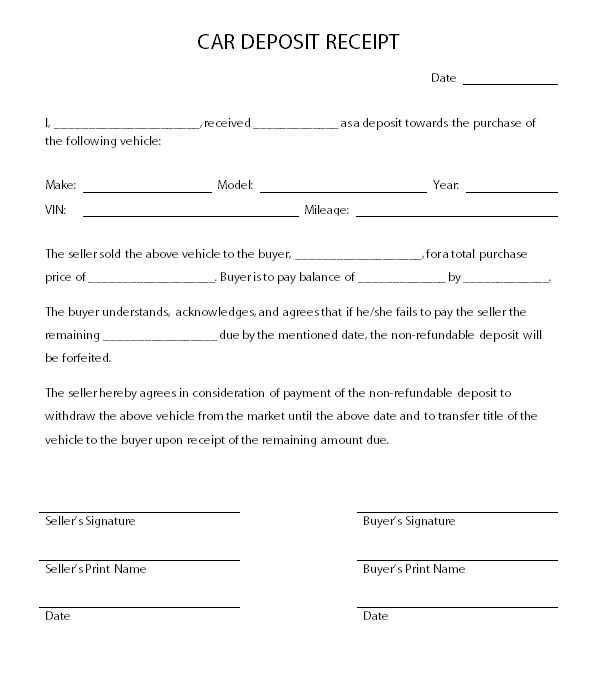

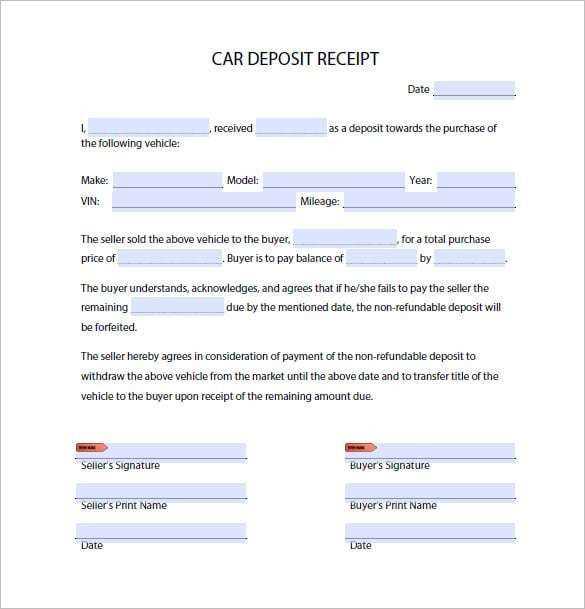

A well-structured deposit receipt protects both the buyer and seller in a vehicle transaction. It serves as proof of payment, outlining key details such as the amount paid, payment method, and terms of agreement. Without this document, disputes over deposits can become complicated.

Include essential details to make the receipt legally valid. Specify the full names of both parties, the vehicle’s make, model, VIN, and agreed-upon total price. Clearly state whether the deposit is refundable or non-refundable to prevent misunderstandings.

Use a straightforward format that is easy to read and understand. A structured template should feature sections for payment confirmation, seller contact information, and any conditions tied to the deposit. Providing a signed copy to both parties ensures transparency.

Choosing a printable or digital template simplifies the process. Editable formats allow quick adjustments to fit different sales agreements. Whether handling a private sale or dealership transaction, a reliable receipt template keeps records clear and enforceable.

Vehicle Deposit Receipt Template

Use a structured format to document the deposit transaction clearly. Include the payer’s and recipient’s full names, contact details, and the date of payment. Specify the vehicle’s make, model, year, and VIN to prevent misunderstandings.

Key Details to Include

State the deposit amount in both numerical and written form. Indicate whether it is refundable or non-refundable and under what conditions. Clearly outline the payment method and attach a signature section for both parties to confirm agreement.

Key Elements to Include in the Receipt

Ensure the receipt contains all necessary details to avoid disputes and misunderstandings. Each section should be clear, concise, and legally sound.

Buyer and Seller Information

- Full Names: Include the complete legal names of both parties.

- Contact Details: Provide phone numbers, email addresses, and physical addresses.

- Identification: Mention driver’s license numbers or other valid IDs if applicable.

Vehicle Details

- Make, Model, and Year: Clearly specify the vehicle’s specifications.

- VIN (Vehicle Identification Number): This unique code ensures accurate identification.

- Mileage: Document the odometer reading at the time of deposit.

Payment Information

- Deposit Amount: State the exact sum received.

- Payment Method: Specify whether it was paid in cash, via check, or another method.

- Balance Due: If applicable, mention the remaining amount and due date.

Terms and Conditions

- Refund Policy: Indicate whether the deposit is refundable or non-refundable.

- Deadline for Full Payment: Set a clear timeframe for completing the transaction.

- Signatures: Both parties should sign to confirm agreement.

Legal Considerations for a Secure Transaction

Always use a written agreement to outline the terms of the deposit. Specify the amount, payment method, refund conditions, and deadlines. Both parties should review and sign the document to confirm their acceptance.

Verify the identity of the buyer and seller by checking official identification documents. If dealing with a business, confirm its legal status through official records. This step prevents fraud and ensures accountability.

Define the conditions under which the deposit is refundable or non-refundable. A clear refund policy eliminates misunderstandings and protects both parties in case the transaction does not proceed.

Include a clause specifying the dispute resolution process. State whether disputes will be handled through mediation, arbitration, or legal action. This helps avoid costly and lengthy legal battles.

| Key Clause | Purpose |

|---|---|

| Deposit Amount | Specifies the exact sum and currency |

| Payment Method | Details whether cash, check, or bank transfer is used |

| Refund Policy | Defines conditions for a refund or forfeiture |

| Buyer & Seller Identity | Ensures both parties are legally recognized |

| Dispute Resolution | Establishes legal options in case of disagreements |

Ensure the document complies with local laws. Some jurisdictions require specific disclosures or formalities. Consulting a legal professional can help tailor the agreement to meet all necessary legal requirements.

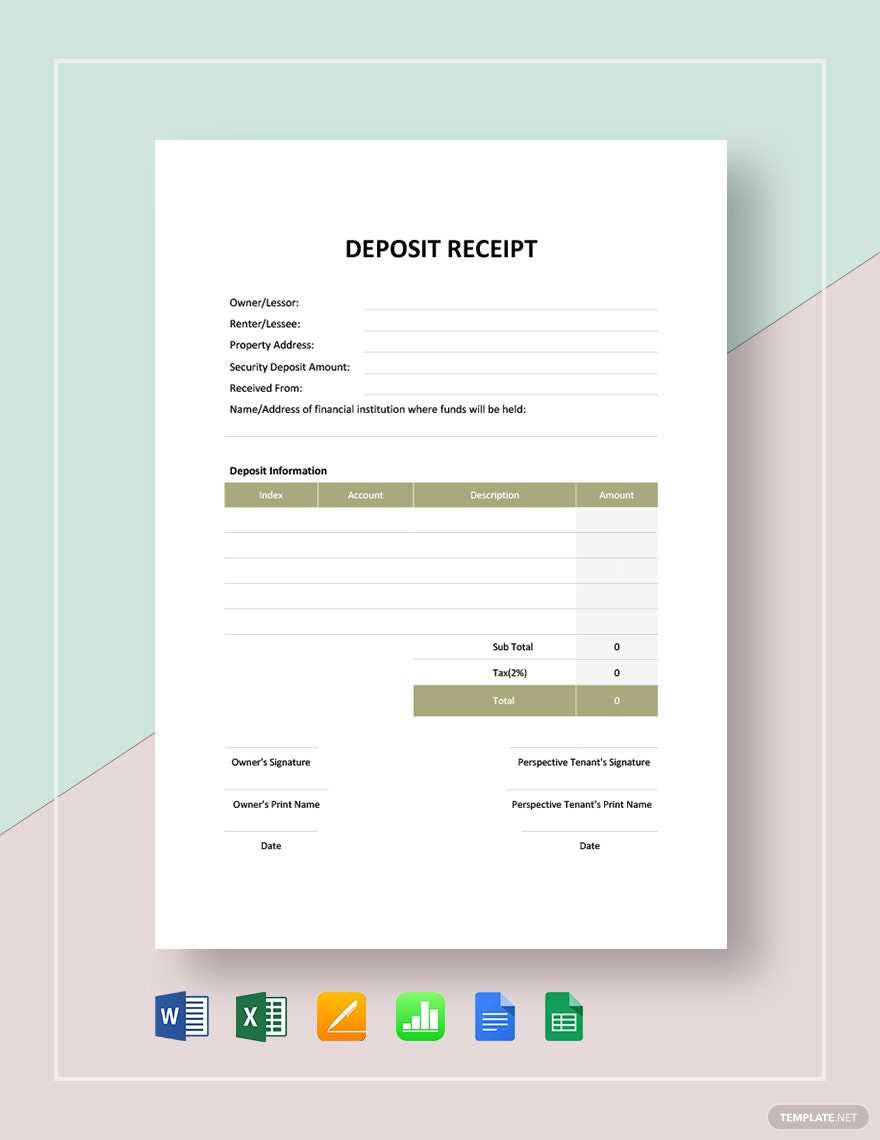

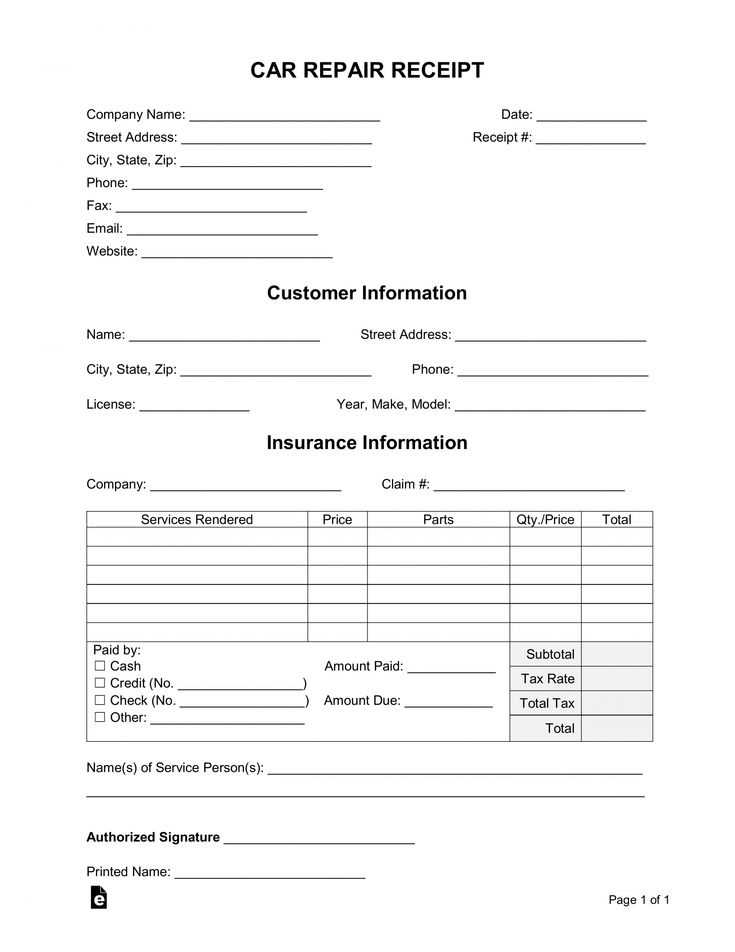

How to Structure Payment Details Clearly

List each payment component separately to avoid confusion. Include the deposit amount, total vehicle price, remaining balance, and due dates. Use bold text for key figures to make them easy to spot.

Specify the payment method and reference number to simplify tracking. Indicate whether the deposit is refundable and under what conditions. If applicable, mention any late fees or penalties to prevent misunderstandings.

Break down taxes and additional fees so buyers understand the full cost. Keep descriptions concise but precise. A well-structured section prevents disputes and ensures transparency.

Customizing the Template for Different Agreements

Adjust the template by modifying key sections to align with specific transaction types. Begin by specifying whether the deposit applies to a purchase, lease, or rental. Each type requires different conditions regarding refunds, payment deadlines, and contract finalization.

Key Adjustments for Various Agreements

- Purchases: Include clauses about the deposit’s role in the final price, refund conditions, and the timeframe for completing the sale.

- Leases: Outline security deposit terms, conditions for refund deductions, and responsibilities for potential damages.

- Rentals: Define payment schedules, cancellation policies, and terms for deposit application toward future payments.

Additional Customization Options

- Payment Methods: Specify accepted options, including bank transfers, checks, or digital payments.

- Refund Conditions: Detail scenarios where the deposit is refundable, partially refundable, or non-refundable.

- Signatures and Acknowledgments: Ensure all involved parties sign to confirm their understanding and agreement.

Customize each section based on the agreement type to prevent misunderstandings and establish clear expectations for both parties.

Common Mistakes to Avoid in the Document

Missing Key Details

Always include the vehicle’s make, model, year, VIN, and odometer reading. Without these, the receipt lacks legal clarity and may cause disputes. Double-check that the buyer’s and seller’s names, contact information, and deposit amount are correctly entered.

Unclear Deposit Terms

Specify whether the deposit is refundable or non-refundable. Ambiguous wording can lead to disagreements. If the deposit applies toward the final purchase, state this explicitly. Avoid vague phrases and ensure both parties understand the conditions before signing.

Proofread the document for typos or missing information. Any errors can lead to misinterpretations. A well-structured, precise receipt protects both buyer and seller from potential misunderstandings.

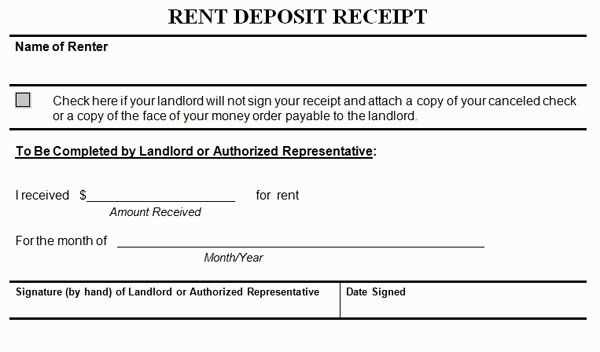

Printable and Digital Format Options

When creating a vehicle deposit receipt, you have two main options for format: printable or digital. Both offer convenience, but each suits different needs.

Printable Option

For a physical copy, choose a printable format. This provides a tangible document that can be handed over immediately. Use standard paper sizes like A4 or letter, ensuring the text is clear and legible. A printed receipt gives an official feel and can be stored for future reference, making it ideal for in-person transactions or when physical records are preferred.

Digital Option

A digital format offers quick sharing via email or cloud storage, reducing paper usage. Choose a file type like PDF to ensure compatibility across devices. A digital receipt is easily accessible on smartphones and computers, making it convenient for both parties. It can also be stored securely, minimizing the risk of physical damage or loss.ABCHow to create a printable receipt?Best practices for storing digital receipts?Key differences between formats for vehicle receipts