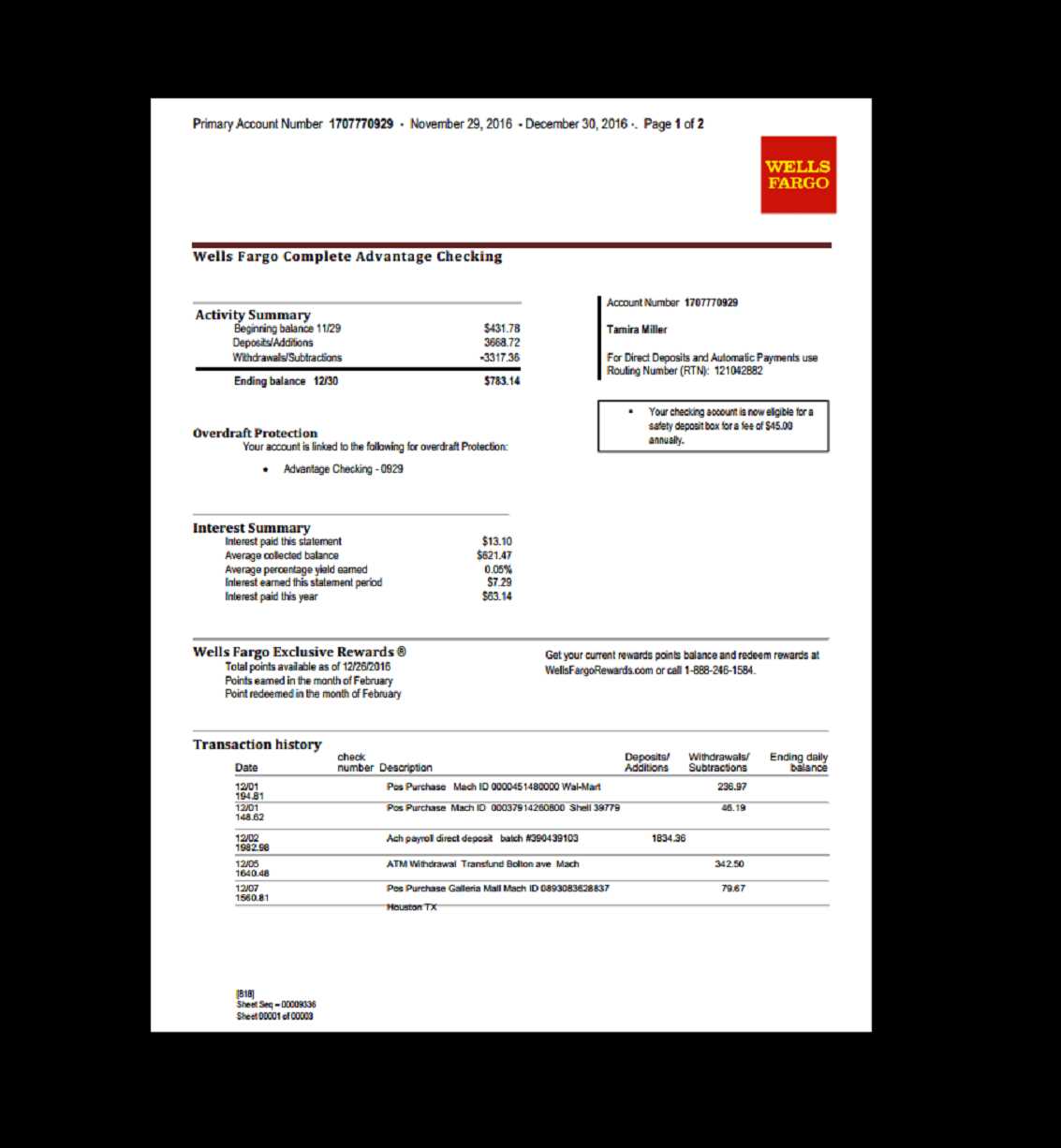

Creating a Wells Fargo deposit receipt template is straightforward. Start with including the transaction details such as the date, amount deposited, and the type of deposit (cash or check). Make sure to list the account number for reference, along with the name of the individual or business making the deposit.

In addition to the basic transaction details, highlighting the Wells Fargo branch code and contact information is helpful for verification. Providing a space for signatures from both the depositor and the bank representative can also help establish legitimacy.

Consider using a clean, simple layout to avoid clutter. Organize information in a way that ensures quick readability. A well-structured receipt not only provides a record of the transaction but also serves as an effective reference in case of disputes or questions in the future.

Here are the corrected lines:

Ensure that all required fields are filled in before submitting the deposit receipt. Double-check that the deposit amount matches the one on your bank statement.

If you’re using a template, verify that your account number and routing number are correctly entered. Mistakes in these fields can cause delays in processing your deposit.

Review the date and time on the receipt to confirm accuracy. Errors here can lead to confusion during the reconciliation process.

- Correctly format the deposit amount using two decimal places.

- Ensure that your name and address are legible and properly aligned.

- Use the proper deposit type (e.g., cash, check, or electronic transfer) as indicated in the template.

Lastly, save a digital copy of the deposit receipt for your records. This will help in case of discrepancies or future reference.

- Wells Fargo Deposit Receipt Template Guide

To create a Wells Fargo deposit receipt, follow these steps to ensure accuracy. The deposit receipt serves as proof of deposit for both the bank and the customer.

Start by filling in the required fields. The receipt includes information about the deposit, including the date, account number, and amount deposited. It’s important to provide the correct account details to avoid any confusion.

| Field | Description |

|---|---|

| Date | The exact date the deposit is made. |

| Account Number | The account number associated with the deposit. |

| Deposit Amount | The total amount of money deposited, which should be double-checked for accuracy. |

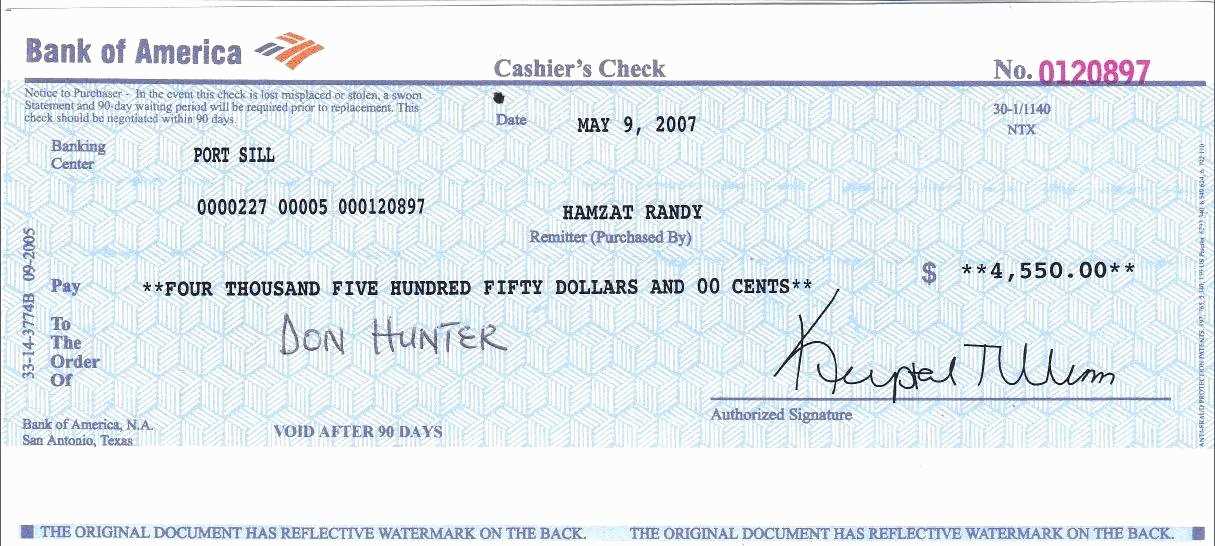

| Deposit Type | Specify whether the deposit is cash, check, or a combination of both. |

| Depositor’s Name | Name of the person making the deposit. |

After filling in the fields, review the information carefully. Ensure the deposit type and amount match what you’ve actually deposited into the account. Double-checking helps prevent errors that could lead to issues later.

Once everything is filled out correctly, print or save a copy of the receipt for your records. This serves as a reference in case any discrepancies arise regarding the deposit.

By following these guidelines, you can easily create a clear and reliable deposit receipt, which is useful for personal financial tracking or business transactions.

To access your deposit receipt template from Wells Fargo, follow these steps:

1. Log in to your Wells Fargo Online Account

Open your web browser and go to the Wells Fargo website. Enter your username and password to log into your online banking account. If you do not have an account, create one by clicking the “Enroll” button and following the instructions.

2. Navigate to the ‘Deposits’ Section

Once logged in, find the “Accounts” tab in the main menu. Under the “Transactions” section, click on the “Deposits” option. Here you will find a history of your recent deposit transactions.

3. Select the Transaction

Locate the deposit transaction for which you need the receipt. Click on it to open the details of the transaction.

4. Download the Deposit Receipt

In the transaction details view, look for a “Download Receipt” button or link. Click on it to download the deposit receipt template in PDF format. You can now save or print the receipt as needed.

5. Contact Support (if Needed)

If you have trouble accessing the template, Wells Fargo offers customer support via chat or phone. You can reach out to them for assistance in obtaining the deposit receipt.

| Step | Action |

|---|---|

| 1 | Log in to your Wells Fargo online banking account |

| 2 | Navigate to the ‘Deposits’ section |

| 3 | Select the deposit transaction |

| 4 | Download the deposit receipt |

| 5 | Contact Wells Fargo support if needed |

To customize a Wells Fargo deposit receipt for personal use, follow these steps:

1. Access the Wells Fargo Online Platform

Log into your Wells Fargo account using your credentials. Once logged in, navigate to the “Accounts” section and select the account from which the deposit was made. Locate the deposit history section for the relevant transaction.

2. Locate and Select the Deposit Receipt

Find the specific deposit you’re looking for and click on the transaction details. Most deposits will have an option to view or print the receipt. Choose the “View Receipt” option to access it in a downloadable format.

3. Customize the Receipt Details

Once the receipt is displayed, you may be able to edit or add specific details, such as personal notes or references. Use any available fields to modify the document according to your needs. Some online banking platforms may not allow edits directly on the page, so consider printing it to make manual changes if necessary.

4. Save or Print the Customized Receipt

After customization, save the receipt as a PDF file or print it for your records. Ensure the modifications are accurately reflected on the document. If you prefer to store the receipt digitally, keep the file in a well-organized folder for easy retrieval later.

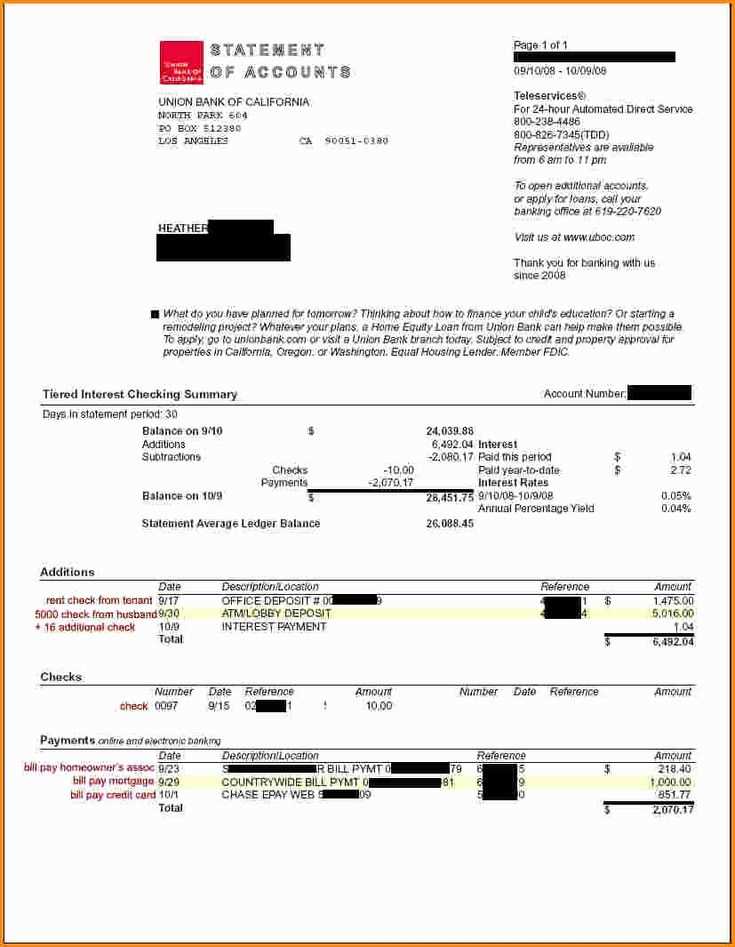

A Wells Fargo deposit receipt template typically contains key details of the transaction. You’ll find the date and time of the deposit, along with the branch location and the name of the employee handling the transaction. The receipt will also display the deposit amount and whether it’s cash, check, or another form of deposit. For checks, the check number and any relevant reference number may be included. Additionally, your account number, or a portion of it, is often listed for verification purposes. Lastly, the receipt will feature a unique transaction ID, which serves as a reference for tracking the deposit in the future.

To print and save your deposit receipt template from Wells Fargo, follow these steps:

- Log in to your Wells Fargo online account.

- Navigate to the “Accounts” section and select “View Account Activity.”

- Find the deposit transaction in your transaction history.

- Click on the deposit to open the details. You should see an option to view or download the deposit receipt.

- Click on the “Download” or “Print” button, depending on your preference.

Once you have the receipt open, you can either save it as a PDF on your computer or print it directly using your printer. If you choose to save it, make sure to select the correct location on your device for easy retrieval later.

By following these steps, you can efficiently keep a digital or physical copy of your deposit receipt for your records.

Double-check the date before finalizing your deposit receipt. Many users forget to update the deposit date, which can lead to confusion or errors in tracking the transaction. Ensure that the date entered matches the actual deposit day.

Always verify the account number. Misprinting the account number or selecting the wrong one from a dropdown list can cause deposits to be routed incorrectly, potentially leading to delays or mismanagement of funds.

Not Including All Deposit Details

It’s easy to overlook adding all necessary deposit details, such as check numbers or deposit amounts. These details are essential for record-keeping and should be filled in accurately to avoid discrepancies when reviewing the deposit later.

Ignoring the Receipt Formatting

The Wells Fargo template is designed for clarity, but skipping the correct format may result in missing or illegible information. Always ensure that you use the template’s predefined sections for each data point, so your receipt is clear and professional-looking.

Lastly, don’t skip saving or printing a copy of the receipt after completing the form. Always store a digital or hard copy of your completed receipt for your records. This helps avoid issues in case of future inquiries or discrepancies with the deposit.

Check the receipt’s transaction date and time to confirm that it matches your deposit attempt. Any discrepancy between the date or time might indicate that the transaction was recorded incorrectly. Always verify this detail to ensure the deposit was processed within the expected timeframe.

Review Deposit Amounts

Double-check the amount of money listed on the receipt against what you deposited. Ensure no missing or extra digits and verify that the numbers match your records. Small errors can occur, especially in high-volume deposit areas, so always confirm this information before leaving.

Verify Account Number and Deposit Type

Ensure the account number listed on the receipt is correct. If you made a deposit to a specific account, cross-reference the account number on the receipt with your records. Also, confirm the deposit type, whether it’s a cash deposit, check deposit, or transfer, to avoid any misunderstandings.

If anything seems out of place, contact Wells Fargo immediately for clarification. Keeping a copy of the receipt for your records can help resolve any future discrepancies quickly.

When creating a Wells Fargo deposit receipt template, ensure it includes the following key elements for clarity and accuracy.

- Account Number: Clearly display the account number for which the deposit is being made. This ensures that the funds are properly credited to the right account.

- Deposit Amount: List the total amount deposited. If it includes multiple checks or cash, specify the breakdown of each component.

- Date of Deposit: Include the exact date of the deposit to ensure proper record-keeping and consistency.

- Deposit Method: Indicate whether the deposit was made via check, cash, or electronic transfer. This helps in tracking different deposit types.

- Branch Information: Include the branch where the deposit was made, including the branch code or address. This provides location-specific details for reference.

- Receipt Number: Assign a unique number to each deposit receipt for easy tracking and retrieval.

- Customer Name: Add the name of the person or business making the deposit for identification purposes.

Incorporating these elements ensures the receipt template is both professional and informative. Make sure to format the information clearly and in an easy-to-read layout, providing all necessary details for both the customer and bank personnel.