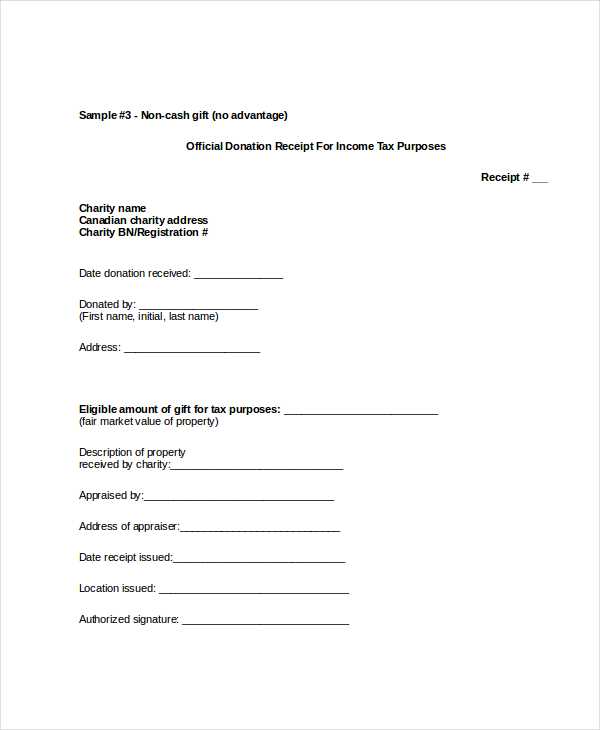

Key Elements to Include

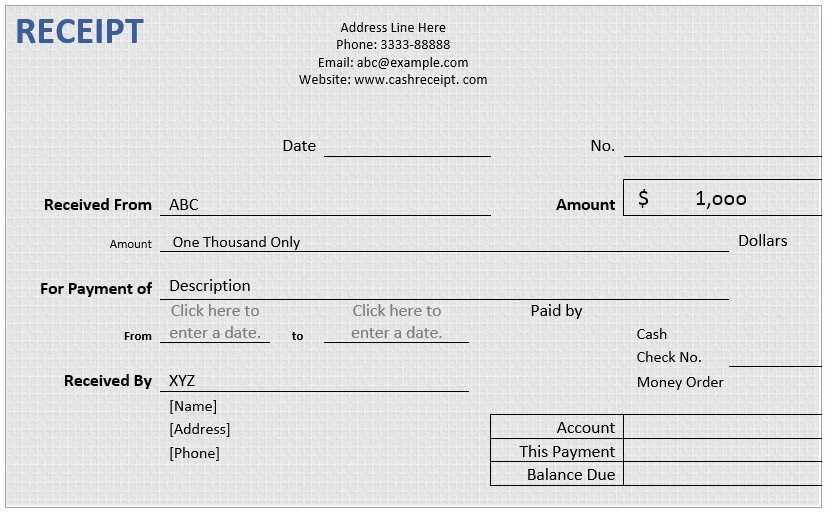

A well-structured receipt should contain clear details to ensure accuracy and compliance. Use the following elements:

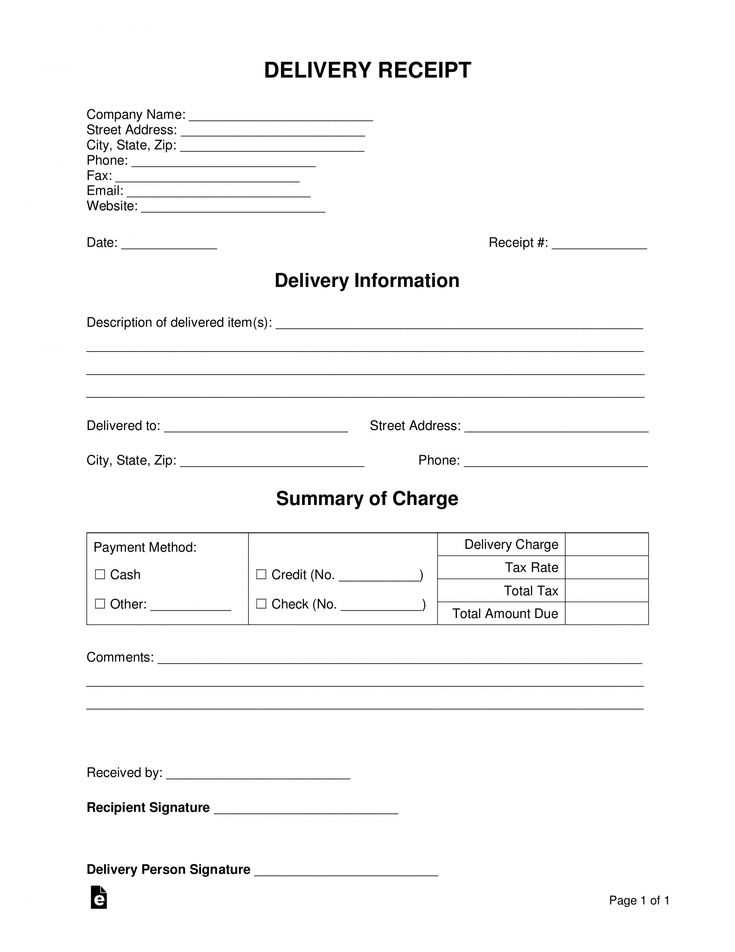

- Business Information: Name, address, contact details, and tax identification number.

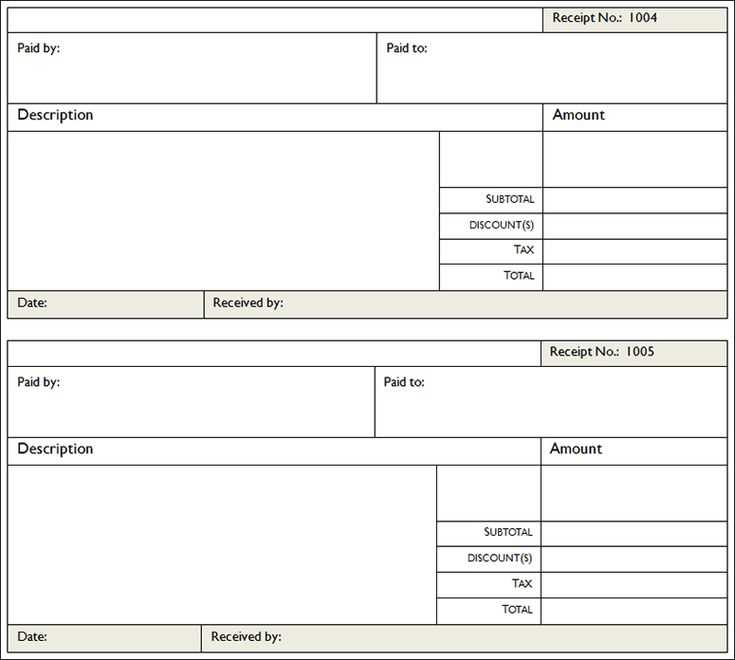

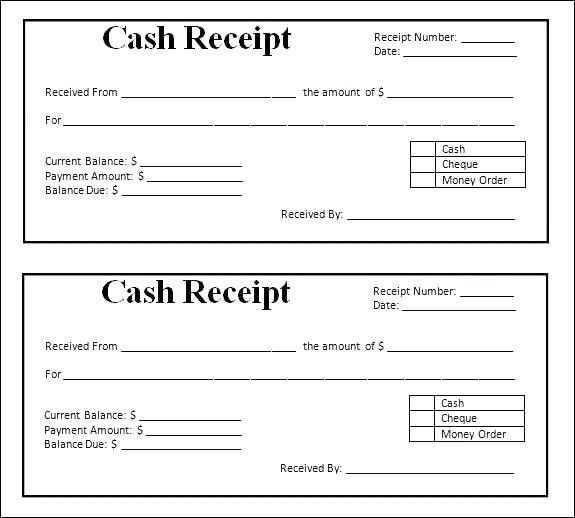

- Receipt Number: A unique identifier for tracking and record-keeping.

- Date of Transaction: Clearly state the purchase or service date.

- Buyer Details: Name and contact information, if applicable.

- Itemized List: Each product or service, quantity, unit price, and total cost.

- Subtotal, Taxes, and Total: Breakdown of charges, including applicable taxes.

- Payment Method: Cash, credit, bank transfer, or any other form of payment.

- Terms and Conditions: Return policies, warranties, or any other relevant notes.

Formats and Best Practices

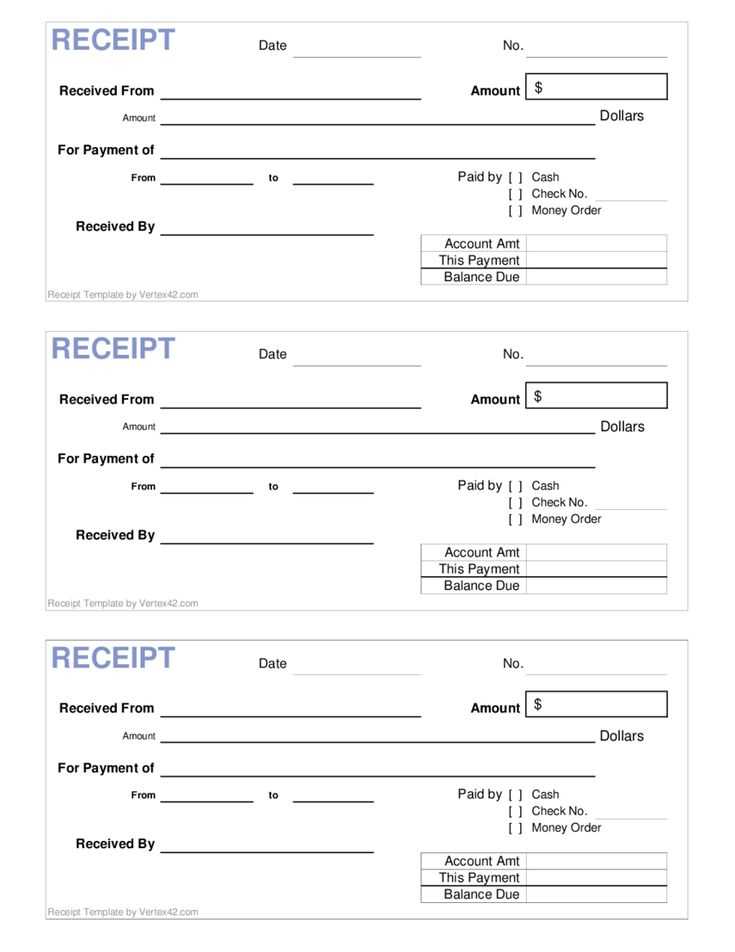

Paper vs. Digital Receipts

Paper receipts are common for in-person transactions, but digital formats offer benefits such as easy storage and retrieval. Many businesses use PDF or email-based receipts to improve efficiency.

Customization and Branding

A receipt is not just a document but also a reflection of a business. Adding a logo, brand colors, and a professional layout enhances credibility.

Automation and Integration

Automated receipt generation through accounting software or point-of-sale systems ensures accuracy. Integration with financial tools simplifies bookkeeping and tax reporting.

Using a structured receipt template minimizes errors and improves transparency. Whether for personal or business use, a detailed format enhances clarity and compliance.

Receipt Template Document: Key Aspects and Application

Mandatory Elements in a Receipt Form

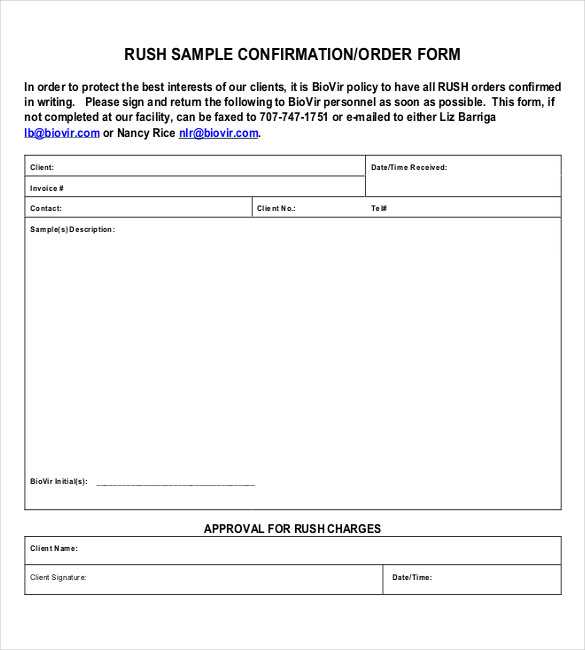

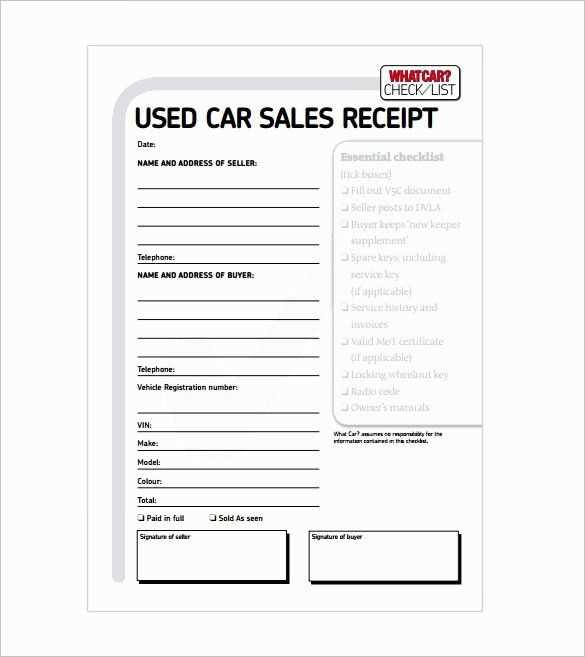

Ensure every receipt includes a unique transaction ID, date, seller details, buyer information, itemized list of goods or services, total amount, and payment method. Omitting any of these can lead to compliance issues or disputes.

Legal Standards for Documentation

Verify that receipts meet tax regulations, including VAT details where required. Some jurisdictions mandate digital copies, electronic signatures, or specific formatting for legal validity. Always align templates with local laws to prevent regulatory penalties.

Adapting templates for different industries improves efficiency. Retail businesses benefit from barcodes and return policies, while service providers should highlight terms of service. Digital formats offer automation options, reducing errors and improving record-keeping.

Choosing between digital and paper formats depends on business needs. Digital receipts enhance tracking, reduce costs, and integrate with accounting software, whereas printed versions remain useful for traditional transactions or customers who prefer physical copies.

Common mistakes include missing essential details, unclear breakdowns, or incorrect tax calculations. Using reliable receipt-generation tools minimizes these risks. Popular options include QuickBooks, Wave, and Zoho Invoice, all offering customization, automation, and secure storage.