Creating a labor receipt template helps streamline transactions and ensure clarity in documenting services rendered. Whether you’re a contractor, freelancer, or small business owner, using a standardized template is an effective way to maintain professionalism and consistency across your transactions.

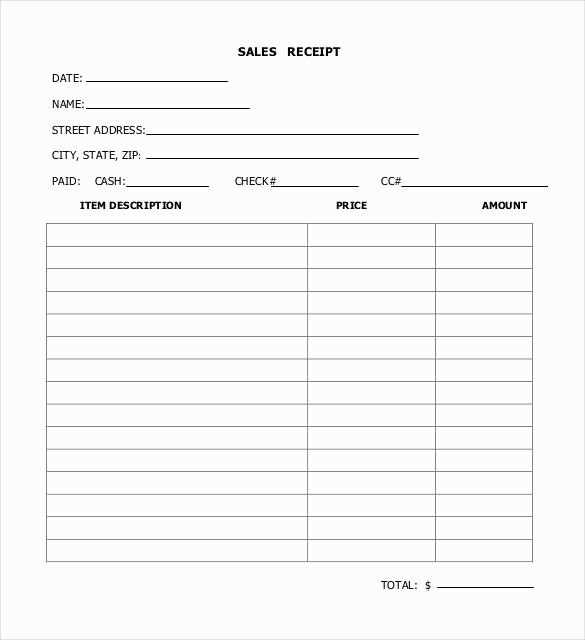

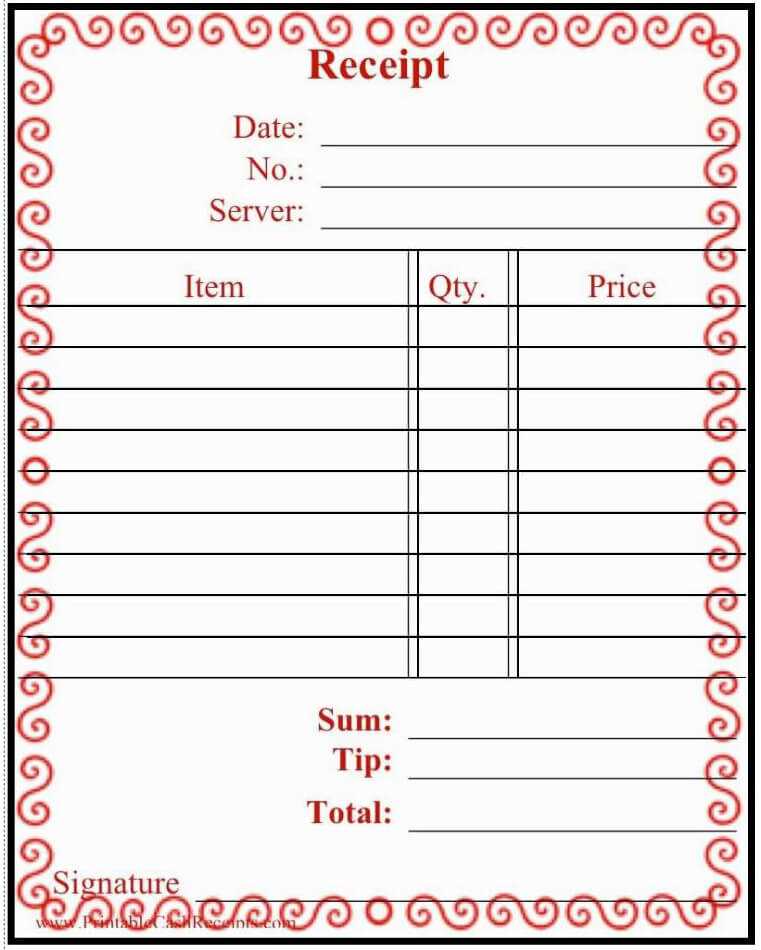

Start by including the basic details such as the service provider’s name, the client’s name, and the date of the transaction. Clearly specify the type of labor provided, including the scope of work completed and the hours worked. This helps both parties understand exactly what was agreed upon.

Include a section for the agreed payment rate and the total amount due, making sure to break down any additional charges or taxes. Adding payment terms, such as the due date or preferred payment method, ensures transparency and minimizes confusion.

Lastly, it’s a good idea to incorporate space for both the provider and client’s signatures to confirm the terms of the transaction. This simple addition can prevent future disputes and establish mutual trust.

Here are the corrected lines where the same word repeats no more than 2-3 times:

To maintain clarity and improve readability, limit the repetition of words in the document. This helps avoid redundancy and ensures a smooth flow of information. Here’s a list of corrected lines:

- Make sure to track hours worked accurately to ensure proper compensation.

- Review the list of tasks completed to verify the labor provided.

- The labor cost is calculated based on the agreed hourly rate.

- Submit the completed receipt to confirm the total amount due for services rendered.

- The total number of hours should reflect the actual work performed.

Avoid using the same terms repeatedly in close proximity. This enhances the professional appearance of the document and improves readability for anyone reviewing it.

- Template Labor Receipt Document

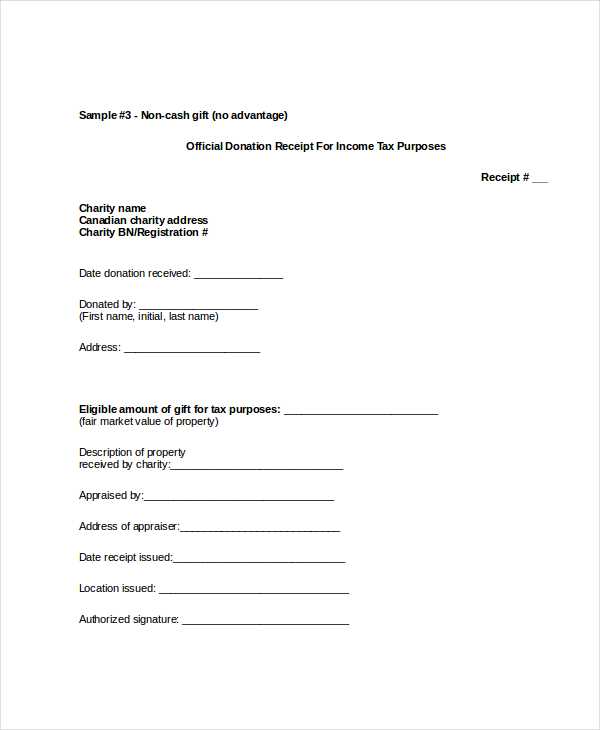

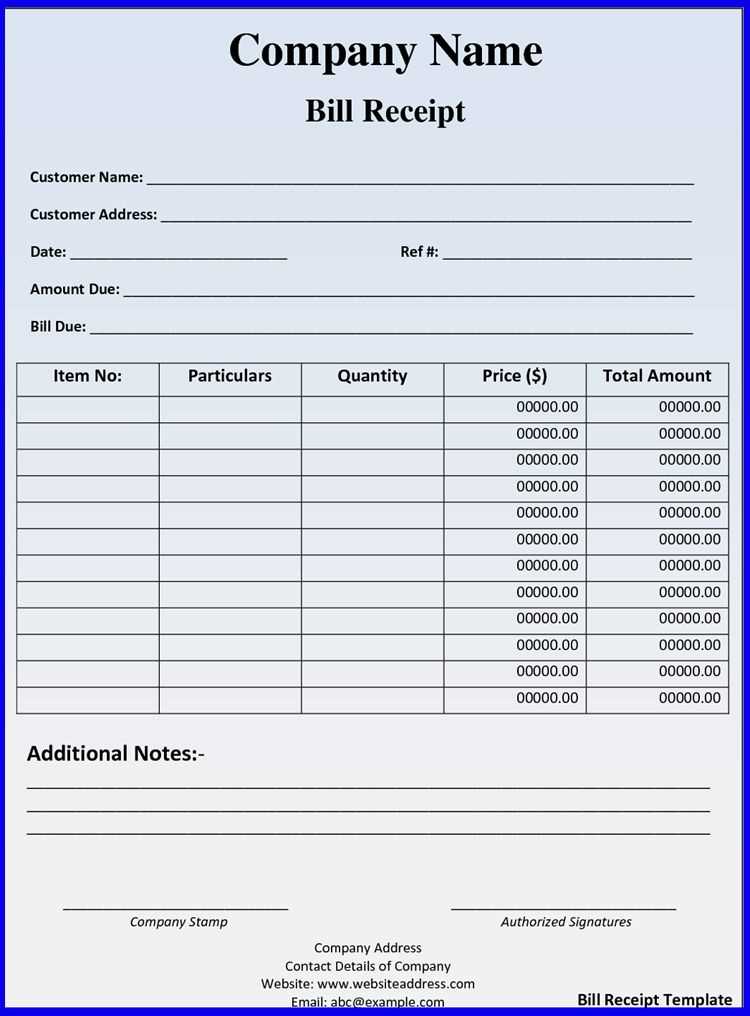

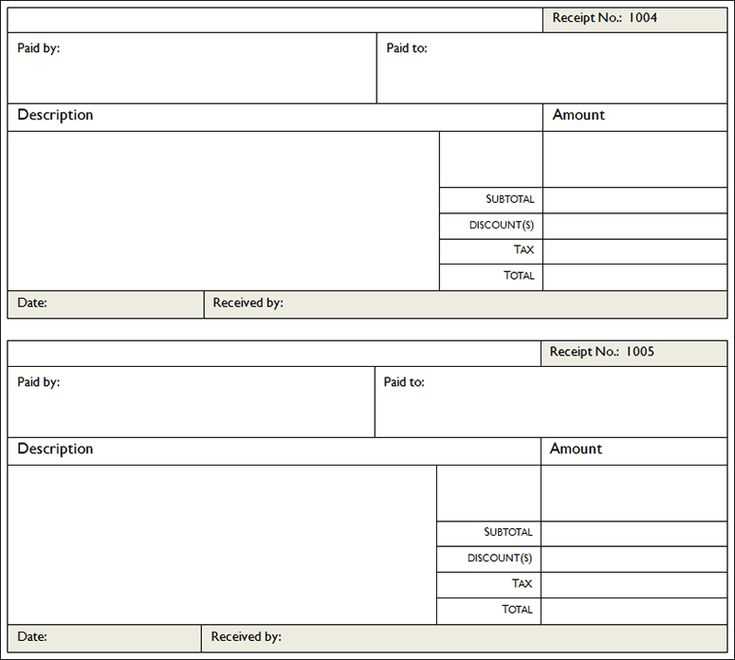

Creating a labor receipt document template involves structuring a clear and concise layout that serves both the provider and the recipient of the labor services. The document should include fields for all relevant information, including labor details, hours worked, hourly rate, and total cost. Below is a simple structure to follow for creating such a template.

1. Header Information: Include the company’s name, logo, address, and contact details at the top of the document. This ensures that the receipt is official and easily identifiable. A date field should also be added to track when the service was provided.

2. Client Details: Include a section for the client’s name, contact information, and address. This allows for easy identification of the recipient of the services and provides a point of contact for any follow-up questions.

3. Labor Description: List the specific services rendered in clear terms. Include the scope of work, materials used (if applicable), and any special tasks performed. This section clarifies the nature of the service provided and prevents confusion later on.

4. Hours Worked: Provide an area to specify the start and end times of the work, as well as a calculation of total hours worked. This allows both parties to verify the accuracy of time billed. If multiple workers are involved, list each worker’s hours separately.

5. Hourly Rate and Total Charges: Clearly state the hourly rate for each worker involved, followed by the total charges for the service. This section should be calculated automatically where possible, using the hours worked and rate as the basis for the total amount due.

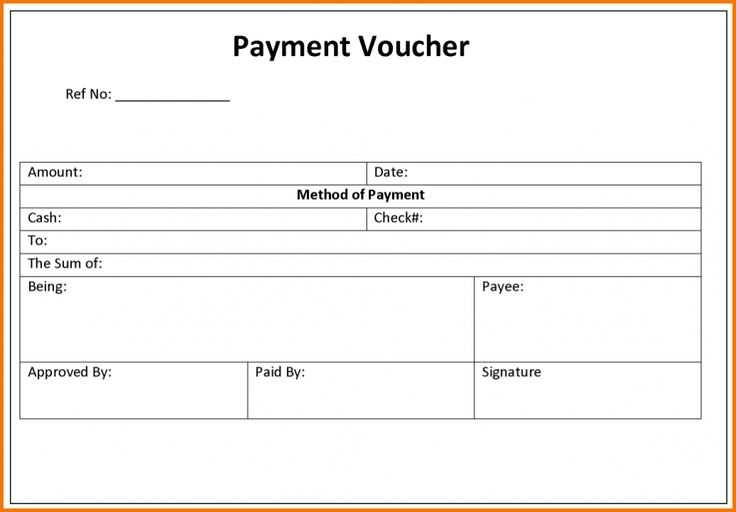

6. Payment Terms: Indicate payment due dates, acceptable payment methods (e.g., cash, credit card, check), and any late fees if applicable. This section clarifies the financial expectations for both parties and helps avoid misunderstandings.

7. Signature Line: Include a place for both the service provider and the client to sign the receipt. This acknowledges that the work has been completed and accepted, and that payment arrangements have been agreed upon.

By following these steps, you create a professional and thorough labor receipt document template that can be adapted to various service industries. Keep the template simple, clear, and customizable to meet the specific needs of different clients and services.

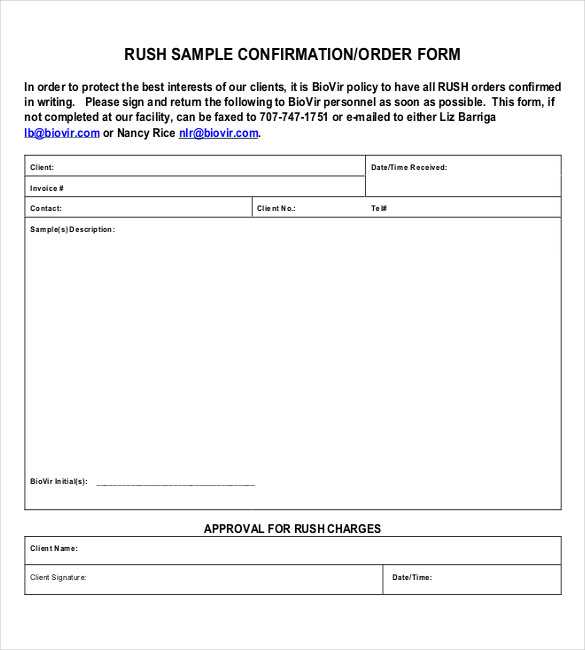

To tailor a labor receipt to your business needs, begin by assessing the type of services you offer. Whether you provide maintenance, consulting, or manual labor, your receipt should reflect the unique nature of these services. For example, if you charge hourly, include the rate and the total hours worked. If it’s project-based, include a breakdown of tasks completed.

1. Add Business Details

Ensure your business name, contact information, and logo are clearly visible. This adds professionalism and makes it easier for clients to reach out for future services. Include the business address, phone number, and email address, as well as any social media links, if applicable.

2. Include Client Information

List the client’s name, address, phone number, and any relevant identification numbers. This ensures you can track and match receipts with customer accounts, especially if you manage multiple clients.

3. Itemize Services and Costs

Be specific about the services provided. Include descriptions, hours worked, rates charged, and any materials used. For example, if you charge for labor and materials separately, make sure to clearly show the cost for each. This helps avoid confusion and ensures transparency.

4. Payment Information

Clearly state the total amount due, including any taxes or additional fees. Specify accepted payment methods and any payment terms, like due dates or late fees. If you offer installment options, mention those as well.

5. Legal and Tax Information

Include your business’s tax identification number (TIN) and any legal disclaimers relevant to your services or industry. This can also include your policy on refunds, warranties, or dispute resolution if needed.

6. Customize for Branding

Use colors, fonts, and layout that align with your brand. A well-designed receipt can reinforce your company’s image and leave a positive impression on clients. Ensure the design is clear and easy to read, with no clutter that distracts from important information.

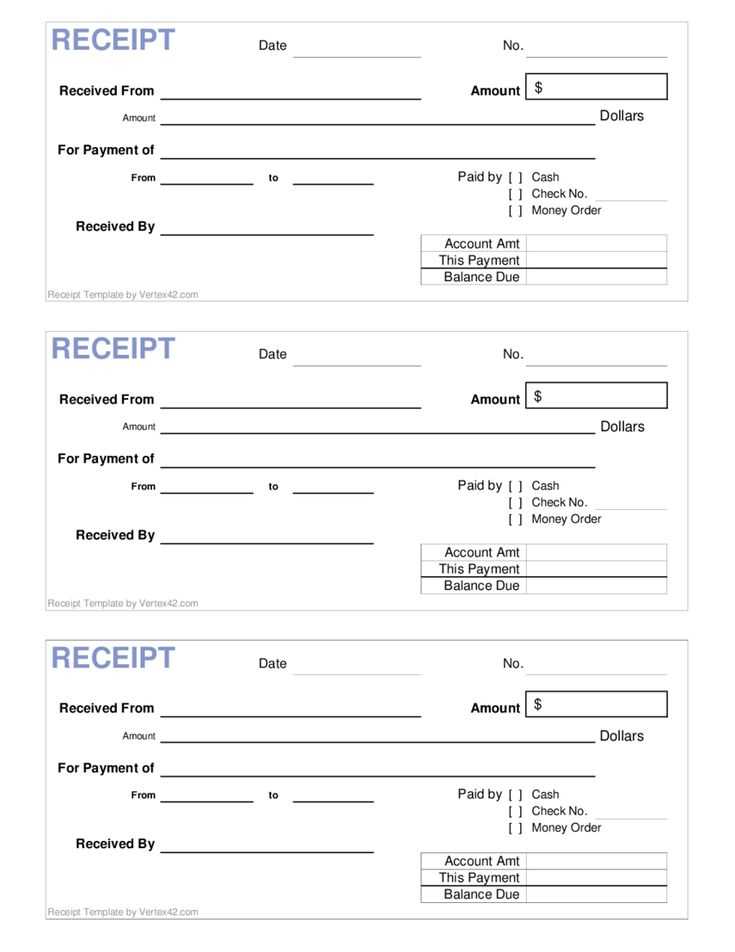

A labor receipt must clearly detail specific information to ensure accuracy and transparency. Below is a list of key elements to include:

| Element | Description |

|---|---|

| Company Information | Include the full name, address, and contact information of the company providing the service. |

| Client Information | Record the client’s name, address, and contact details. |

| Date of Service | List the exact date(s) when the labor was performed. |

| Service Description | Provide a clear breakdown of the work performed, including specific tasks and any materials used. |

| Hourly Rate/Charges | Indicate the labor rate charged per hour, or specify a flat rate if applicable. |

| Time Spent | Document the number of hours or minutes spent on the job, and how the charges are calculated. |

| Subtotal | Sum up the cost of labor before tax, including any materials or extra charges. |

| Tax | Clearly state the tax amount applied to the labor and materials, based on the applicable tax rate. |

| Total | Show the final amount due, including tax and any other additional fees. |

| Payment Terms | Outline when payment is due, acceptable payment methods, and any late fee policy if applicable. |

These elements make the receipt easy to understand and help avoid potential misunderstandings regarding charges and expectations. Always ensure each section is clear and accurate for both parties involved.

Ensure that the receipt clearly shows the full transaction amount, including taxes, fees, or any additional charges. Failing to include these can lead to confusion and disputes. Double-check the totals before finalizing the document.

Be precise with the date and time of the transaction. Missing or incorrect timestamps can complicate record-keeping or even invalidate the receipt in some cases. Always confirm that the information is accurate before issuing.

Do not forget to include a clear description of the purchased items or services. A vague or generalized description may cause problems if the receipt is used for warranty claims or returns. List each item or service separately with a corresponding price.

Make sure the receipt includes the correct payment method. If the transaction was completed with a credit card, include the last four digits of the card number. If paid by cash, note the amount tendered and the change given. This helps in case of future inquiries or discrepancies.

It’s crucial to avoid abbreviations that may confuse the recipient. Clear and concise descriptions will make the receipt easy to understand for both the customer and your own accounting department.

Don’t forget to include your business details. Missing contact information, such as the business name, address, and phone number, can make it difficult for a customer to reach out for inquiries or future transactions.

Lastly, never issue a receipt without verifying the customer’s request. Some customers may not require a receipt, and issuing one unnecessarily can lead to wasted resources and added confusion.

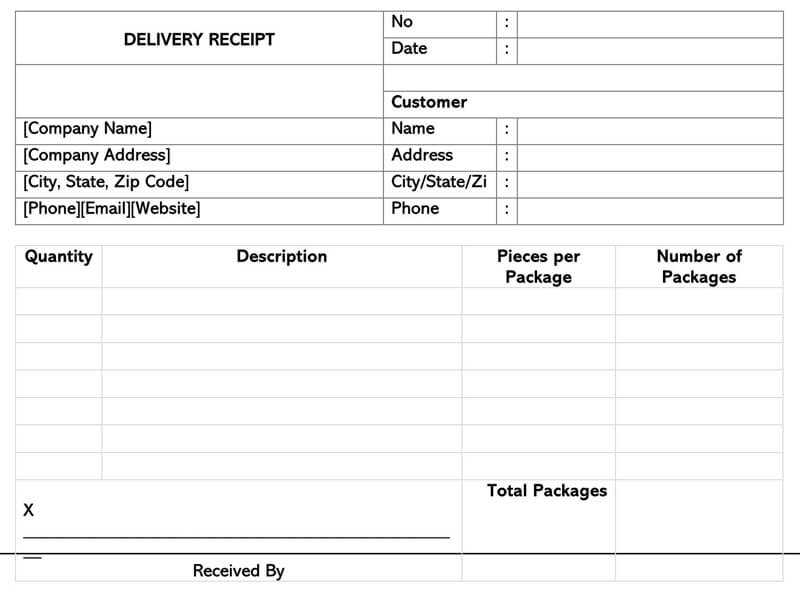

Ensure the header clearly states the labor details being documented. Include a concise description of the job or service provided.

For clarity, break down labor costs in distinct sections, listing each task or service separately with the corresponding time spent and hourly rate. Provide a detailed, line-by-line account of the work done to avoid confusion.

Accurate dates are important for any labor receipt document. Be sure to specify the exact date the work was performed, as this is critical for both invoicing and record-keeping purposes.

It’s helpful to include the name and contact information of the person performing the work. This ensures transparency and allows the recipient to easily reach out if necessary.

Don’t forget to indicate payment terms. Clearly state whether the payment is due immediately, within a specific period, or on a specific date to avoid misunderstandings later on.

Lastly, include any applicable taxes. Ensure the tax amount is calculated based on the labor charges and presented separately for easy reference. This can prevent any confusion and provide a clear view of the total cost.