Template ReceiptAnswer in chat instead

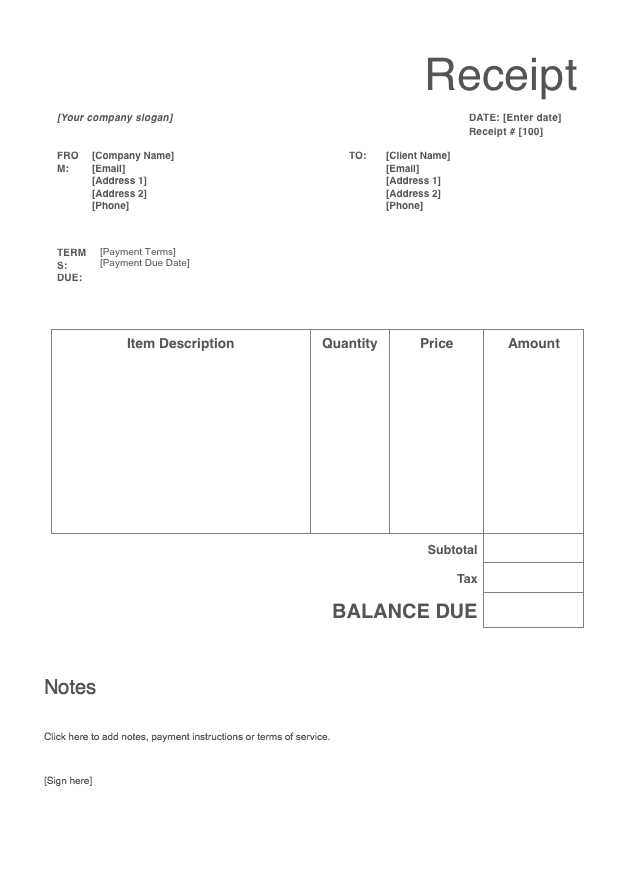

Template Receipt of Documents

Key Elements to Include in a Receipt

Legal and Compliance Considerations for Receipts

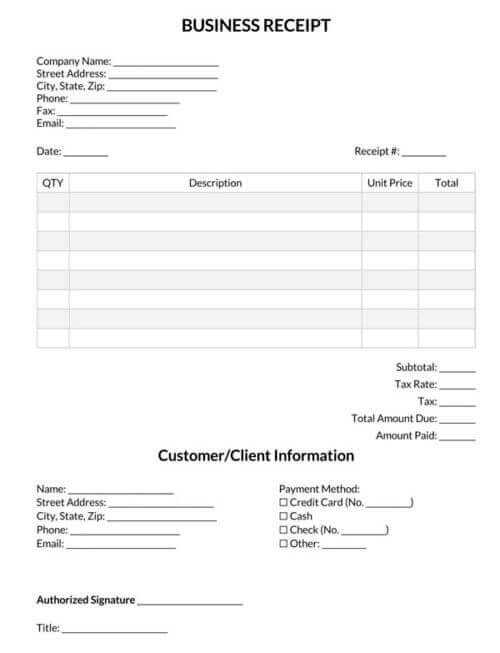

How to Format and Structure a Receipt

Common Mistakes to Avoid When Issuing a Receipt

Digital vs. Paper Receipts: Pros and Cons

How to Verify and Acknowledge Receipt

Key Elements to Include in a Receipt

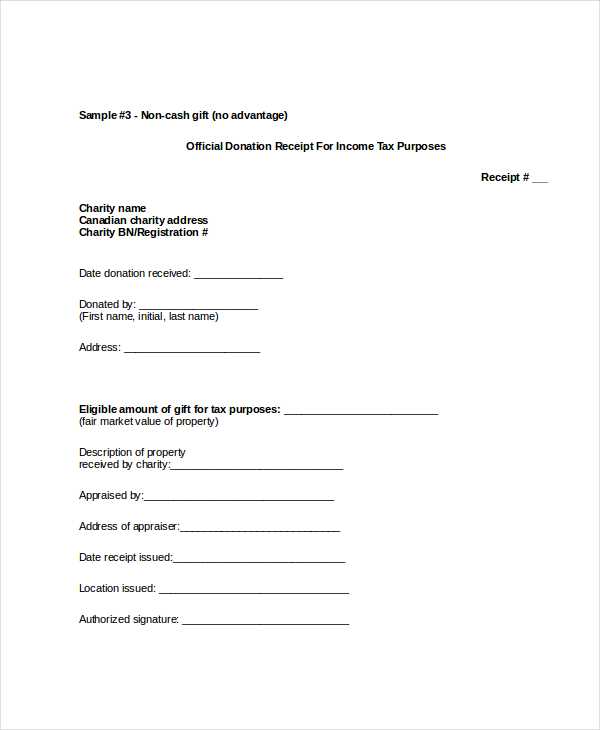

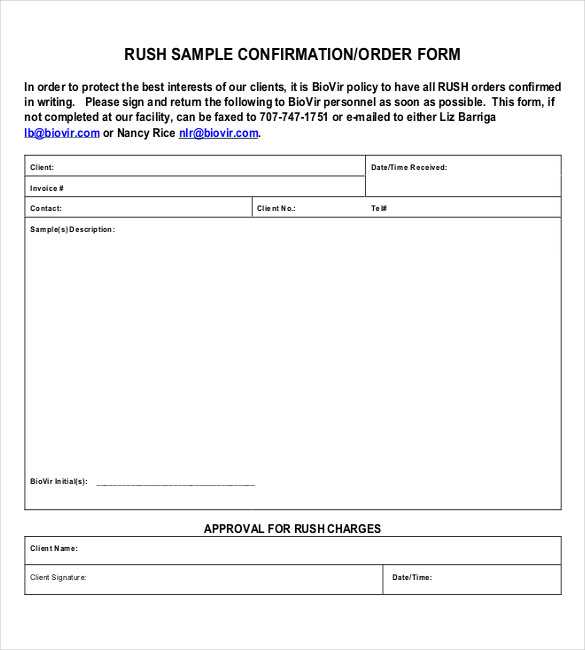

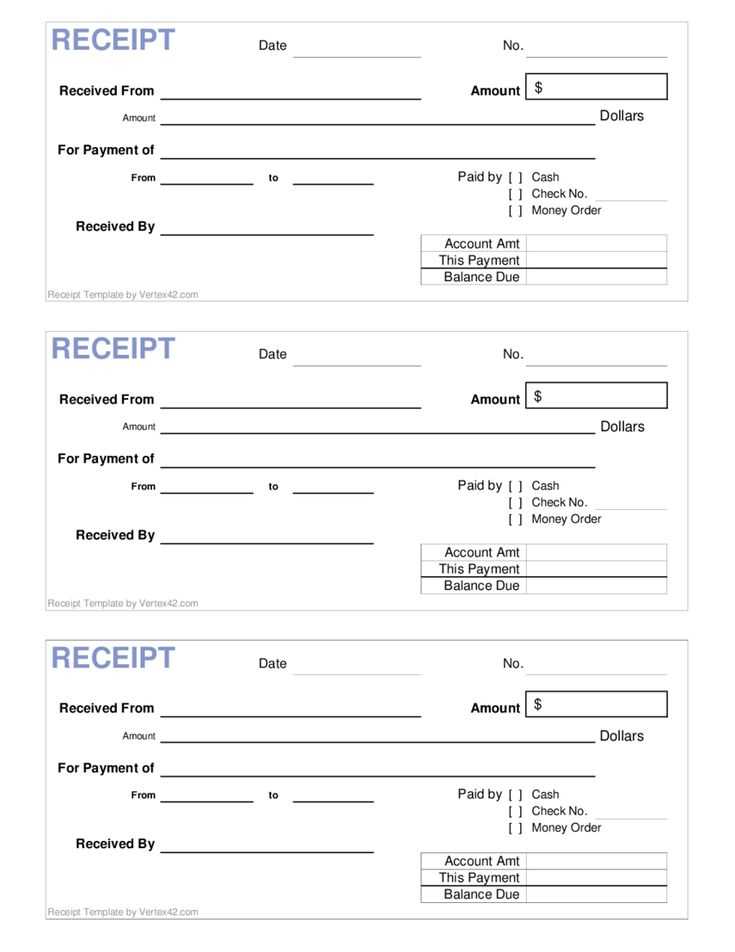

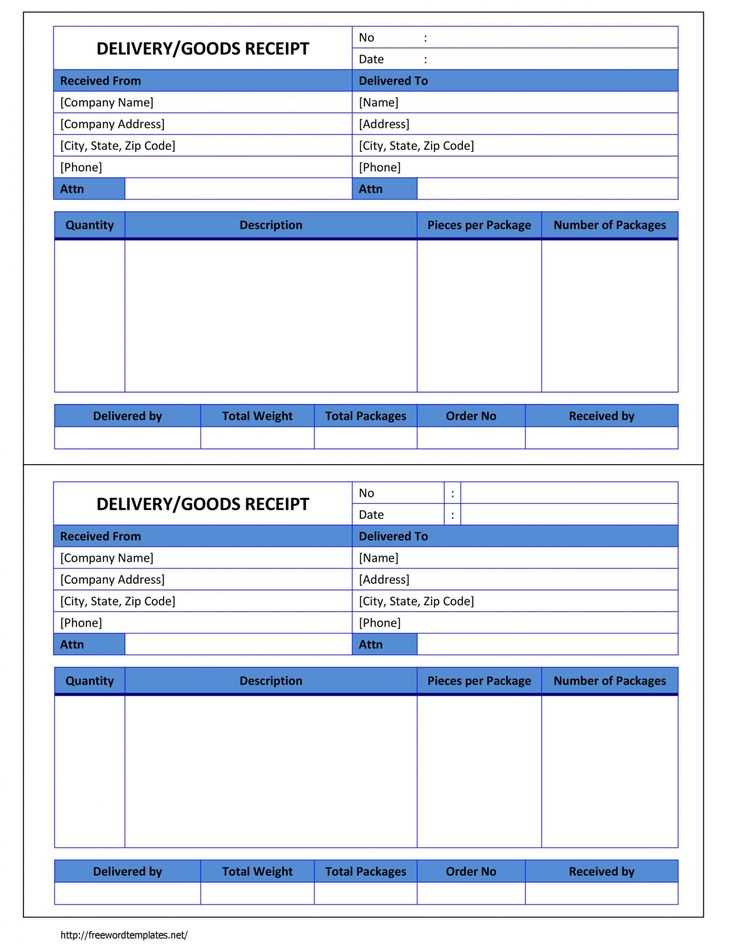

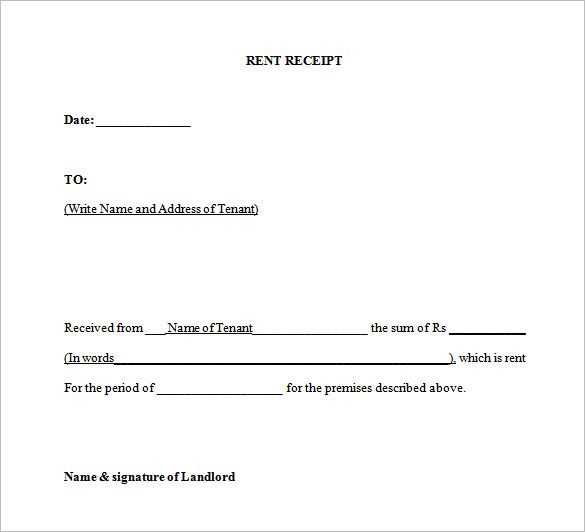

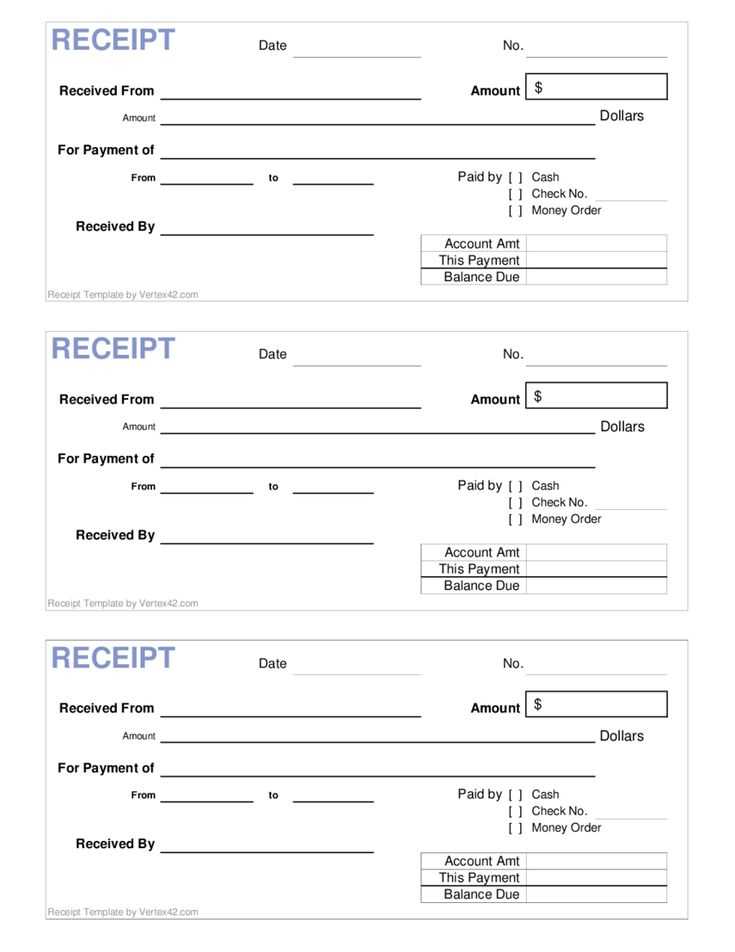

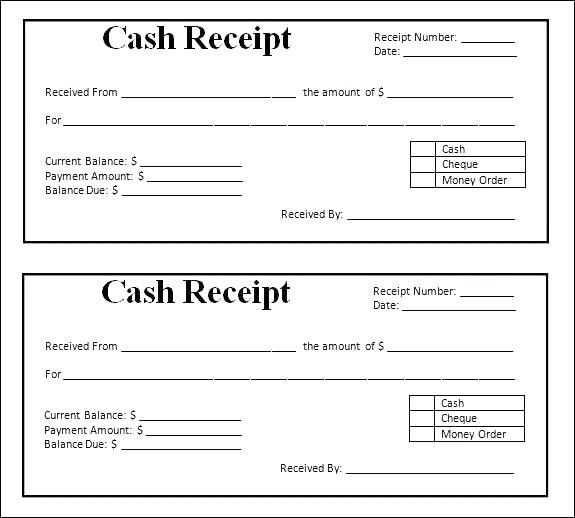

Ensure every receipt includes date of issuance, names of involved parties, and a detailed list of received documents. Specify each document’s title, reference number, and number of pages. Clearly state the purpose of the receipt and provide signatures or digital acknowledgments.

Legal and Compliance Considerations for Receipts

Verify compliance with local regulations, including data protection laws and record-keeping requirements. Use standardized language to prevent disputes. Maintain receipts for the legally required period and ensure access for audits or legal inquiries.

For digital receipts, implement secure encryption and verifiable timestamps. If using electronic signatures, comply with e-signature regulations to ensure legal validity.

Common Mistakes to Avoid When Issuing a Receipt

Omitting essential details, using vague descriptions, and failing to verify document accuracy can lead to disputes. Avoid unclear language–each document must be identifiable without assumptions. Always confirm recipient details and obtain a clear acknowledgment of receipt.

Digital vs. Paper Receipts: Pros and Cons

Digital receipts offer efficient storage, faster retrieval, and improved security but require proper encryption. Paper receipts provide tangible proof but risk loss or damage. Choose based on accessibility, security needs, and compliance requirements.

How to Verify and Acknowledge Receipt

Use unique identifiers like reference numbers or QR codes for verification. Require the recipient to sign manually or via a digital signature platform. If acknowledgment is remote, use a confirmation email or an automated tracking system.