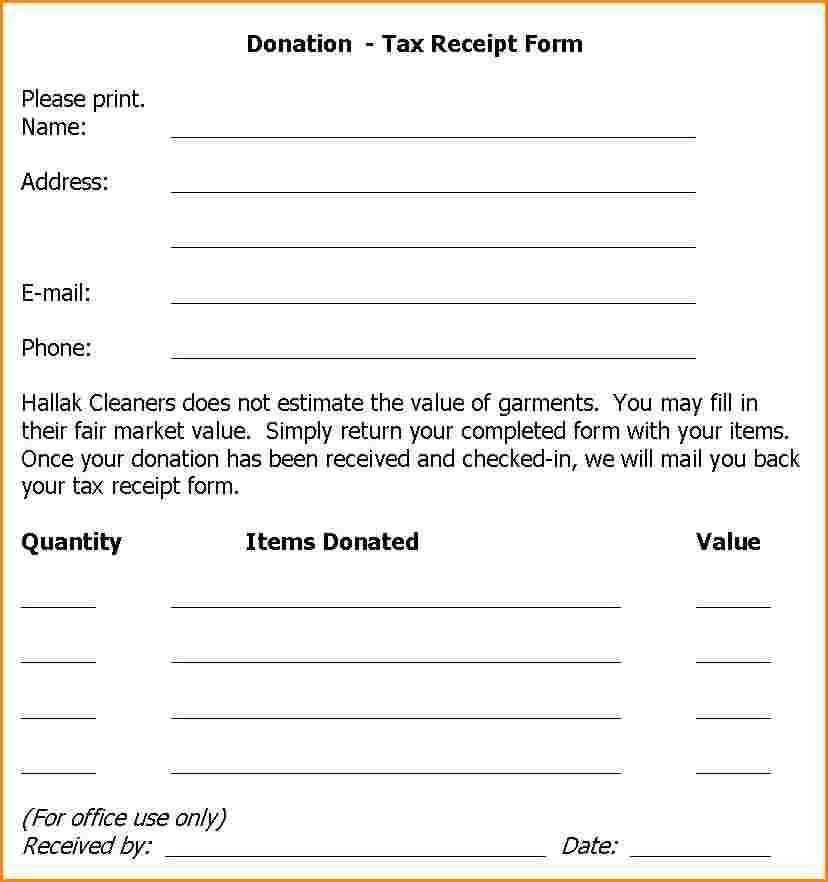

To create a 2018 charitable donation receipt, include the donor’s name, donation amount, and the charity’s details. The template should clearly state that the donation is tax-deductible. This gives the donor the necessary information for tax reporting and ensures your charity complies with regulations. Provide a section that specifies if the donation was cash, goods, or services.

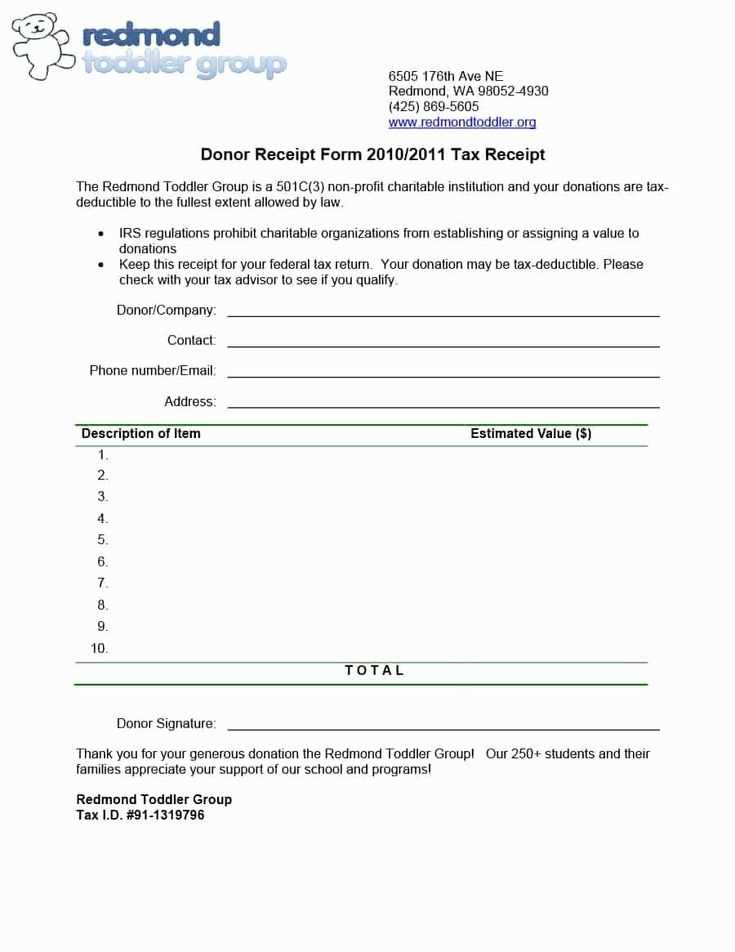

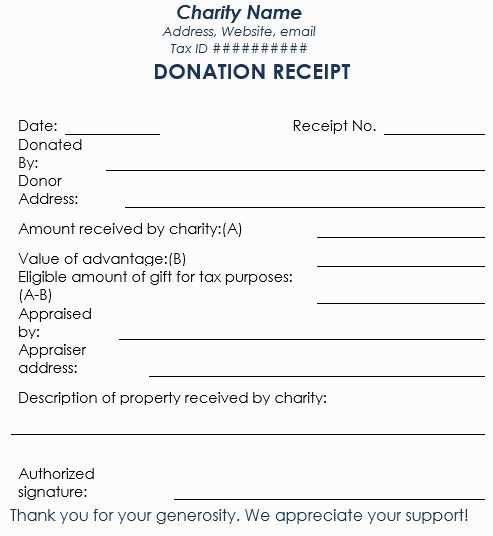

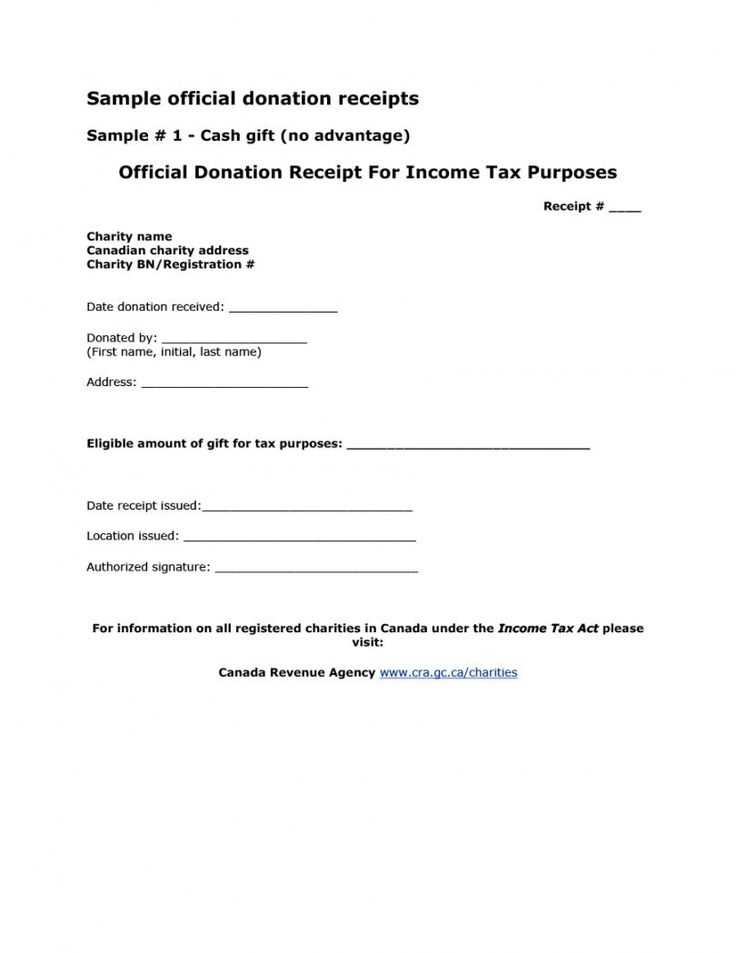

Ensure the receipt includes the charity’s legal name, address, and tax identification number (TIN). If your charity is registered, mention the registration details. Additionally, add a date of donation and the value of goods or services provided, if applicable. For non-cash donations, include a description of the items without assigning a value unless an appraisal was performed.

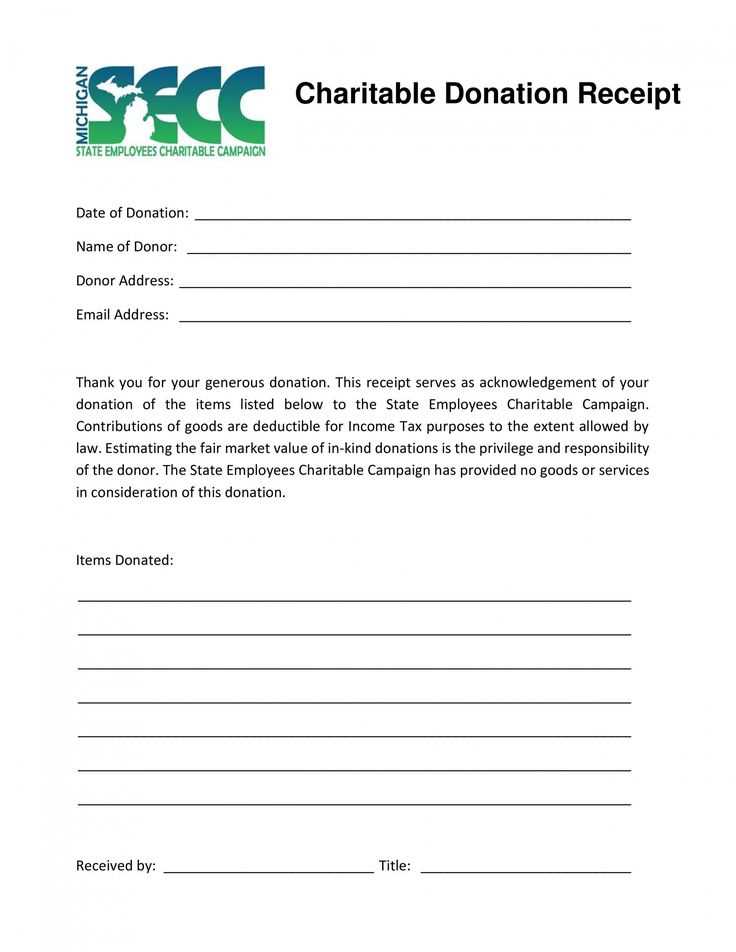

Keep the language clear and direct. Avoid unnecessary jargon, focusing on details that the donor will need for their tax filing. This includes a statement confirming that no goods or services were exchanged in return for the donation, or if they were, the value of those services should be noted.

Here is the corrected version without word repetition:

When creating a charitable donation receipt, accuracy is key. Ensure the donor’s name, donation amount, and the date of the gift are clearly stated. Include your organization’s name and address, along with a statement confirming that no goods or services were provided in exchange for the donation. If there were any goods or services provided, specify their fair market value to avoid any confusion.

For tax purposes, mention whether the donation is cash or non-cash. For non-cash donations, it’s necessary to include a description and estimated value. Ensure the receipt is signed and dated by an authorized individual within your organization. Additionally, include any relevant tax-exempt status details to help the donor claim tax deductions.

2018 Charitable Donation Receipt Template

To properly format a charitable donation receipt for tax purposes in 2018, ensure it meets IRS guidelines. Include the name of the charitable organization, the donor’s name, the date of donation, and a description of the donated property. If the donation is in cash, state the amount; for property, provide a brief description without valuing it. For donations over $250, you must also include a statement indicating whether the donor received any goods or services in return for the gift. If so, a good faith estimate of the value of those goods or services must be included.

Key Information to Include in a 2018 Donation Receipt

First, include the organization’s name and address. Follow that with the donor’s name and address for verification. Date the receipt as close to the donation as possible. If applicable, detail the donation’s value, either in cash or description of items. If the donor received any goods or services, note this along with an estimate of their value. Lastly, provide a statement verifying the nonprofit’s tax-exempt status, confirming that no goods or services were exchanged, or if they were, specifying their fair market value.

Common Mistakes to Avoid When Creating a Charitable Donation Receipt in 2018

Avoid omitting key details like the date of the donation and the donor’s information. Do not include vague descriptions of donated items or values–clarity is key. Be cautious not to overestimate or underestimate the value of any goods or services received in exchange. Ensure the receipt reflects the correct tax-exempt status of the charity. Mistakes in these areas could cause complications for both the donor’s tax filings and the charity’s records.