Need a clear and professional donation receipt template? Whether you manage a nonprofit, run a fundraising campaign, or handle financial records, the right template ensures compliance, transparency, and trust. Below, you’ll find 40 donation receipt templates that cover different needs–from simple cash donations to in-kind contributions and recurring gifts.

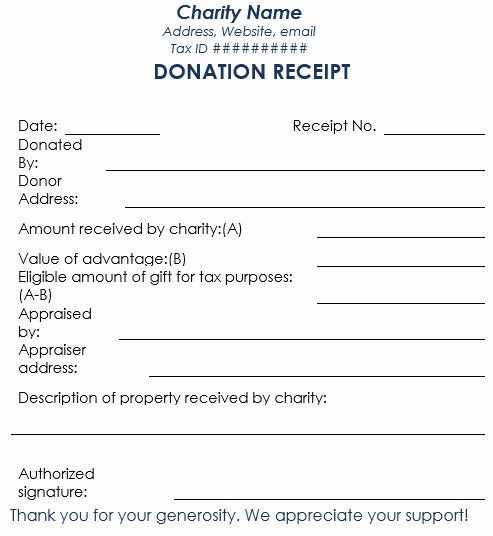

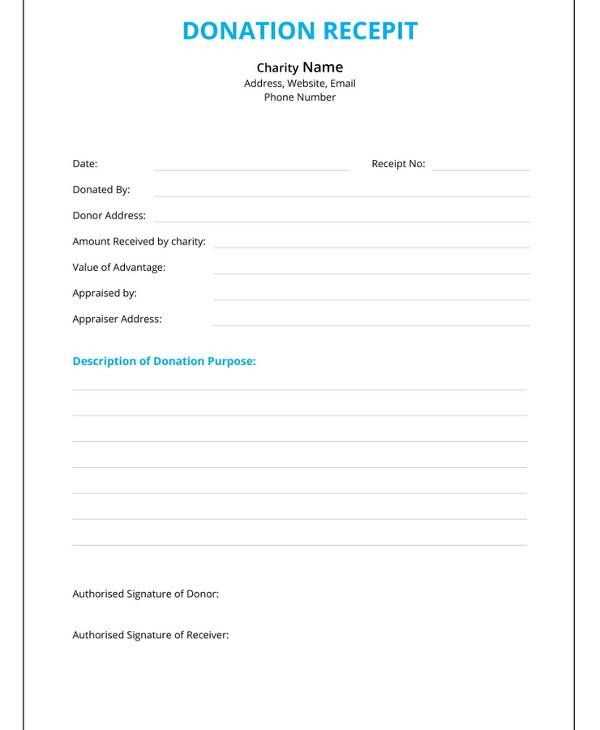

A well-structured donation receipt should include key details: donor’s name, date, amount, organization’s information, and a clear statement of tax deductibility. Some templates also feature sections for special notes, event-based donations, or acknowledgment messages to express gratitude. Selecting a template that fits your purpose saves time and simplifies record-keeping.

Digital and printable formats are available, including Word, Excel, PDF, and Google Docs. Whether you prefer a minimalistic design for quick processing or a detailed layout for legal compliance, there’s an option for every scenario. Explore the templates below and find the one that best fits your organization’s needs.

Here’s the corrected version without unnecessary repetitions:

When designing a 40 donation receipt template, it’s crucial to ensure clarity and simplicity. Avoid using redundant phrases or information that does not add value to the donor’s understanding. The key is to include only the necessary details: donor name, donation amount, date, and the charity’s tax-exempt status. Each of these elements should be presented in a clean, organized layout.

Keep the Information Direct

The donation amount and date should be easy to spot. Instead of repeating the donation total in different places, list it clearly once and emphasize it with bold text or larger font size. This minimizes clutter while maintaining focus on the main information. The donor’s details and donation breakdown, if applicable, should follow logically.

Remove Unnecessary Repetition

Instead of listing multiple thank-you statements, condense this to a single, heartfelt note expressing gratitude for the donor’s contribution. This keeps the message sincere and concise. Redundant language, especially in formal statements, can detract from the overall professionalism of the receipt.

- 40 Donation Receipt Templates: A Practical Guide

Donation receipts are a key part of tracking charitable contributions. Whether you’re running a small nonprofit or managing a large organization, using a structured template ensures consistency and professionalism. Here are the main elements you should look for in a donation receipt template:

1. Basic Information

- Organization’s name and logo

- Donor’s name and contact details

- Date of donation

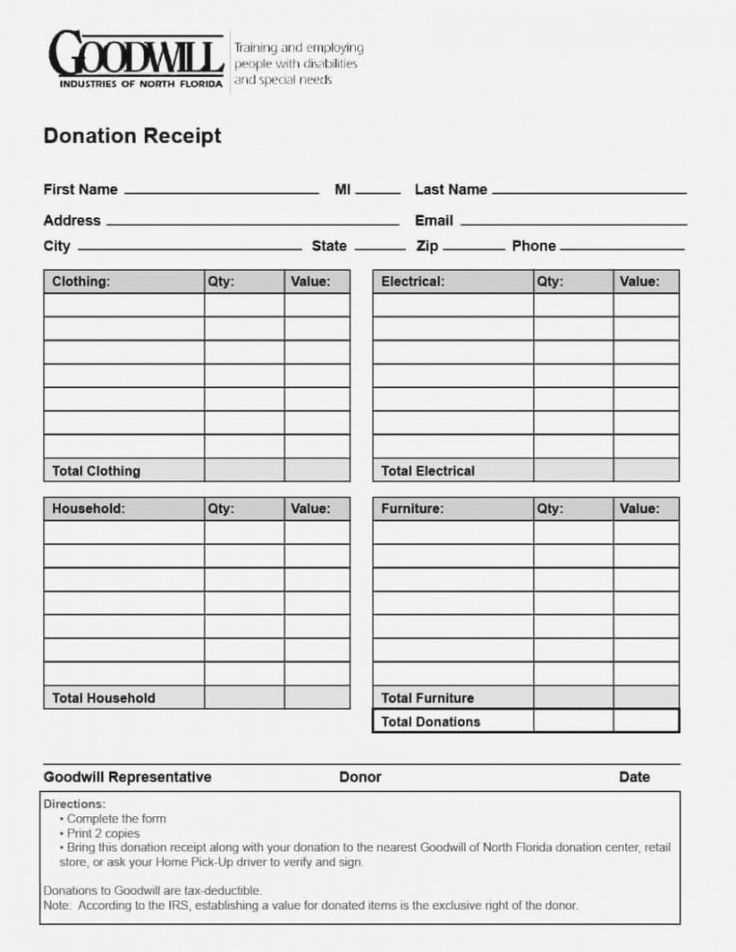

- Description of the donation (e.g., monetary value or itemized list for in-kind donations)

2. Tax Information

- Statement of tax-exempt status (if applicable)

- Tax ID or EIN (Employer Identification Number)

- Note about any goods or services provided in exchange for the donation (to adjust deductible amount)

By using these templates, donors and organizations both ensure clarity in tracking donations and fulfilling tax requirements. Keep it clear, concise, and compliant with legal guidelines for maximum effectiveness.

Include the donor’s full name and contact details. This ensures both recognition and proper record-keeping for tax purposes.

Clearly state the donation amount, specifying the currency. If the donation was non-monetary, provide a detailed description of the item and its estimated value.

List the date of the donation. This helps both the donor and the receiving organization track contributions for tax deductions or reporting purposes.

Include a description of the donation’s purpose. For non-cash donations, this could involve noting any restrictions or intended use of the funds or items.

Provide the organization’s name, address, and contact information. This allows the donor to verify the receipt and ensures transparency in the donation process.

Include a statement acknowledging whether the donation is tax-deductible. This gives the donor clarity on how to treat the contribution in their tax filings.

Offer space for an acknowledgment or thank-you message. Personalizing this section helps maintain a positive relationship with the donor.

For clear and professional donation receipts, tailor the format based on the type of organization issuing them. Whether a non-profit, religious organization, or charity, each has specific details that need to be included.

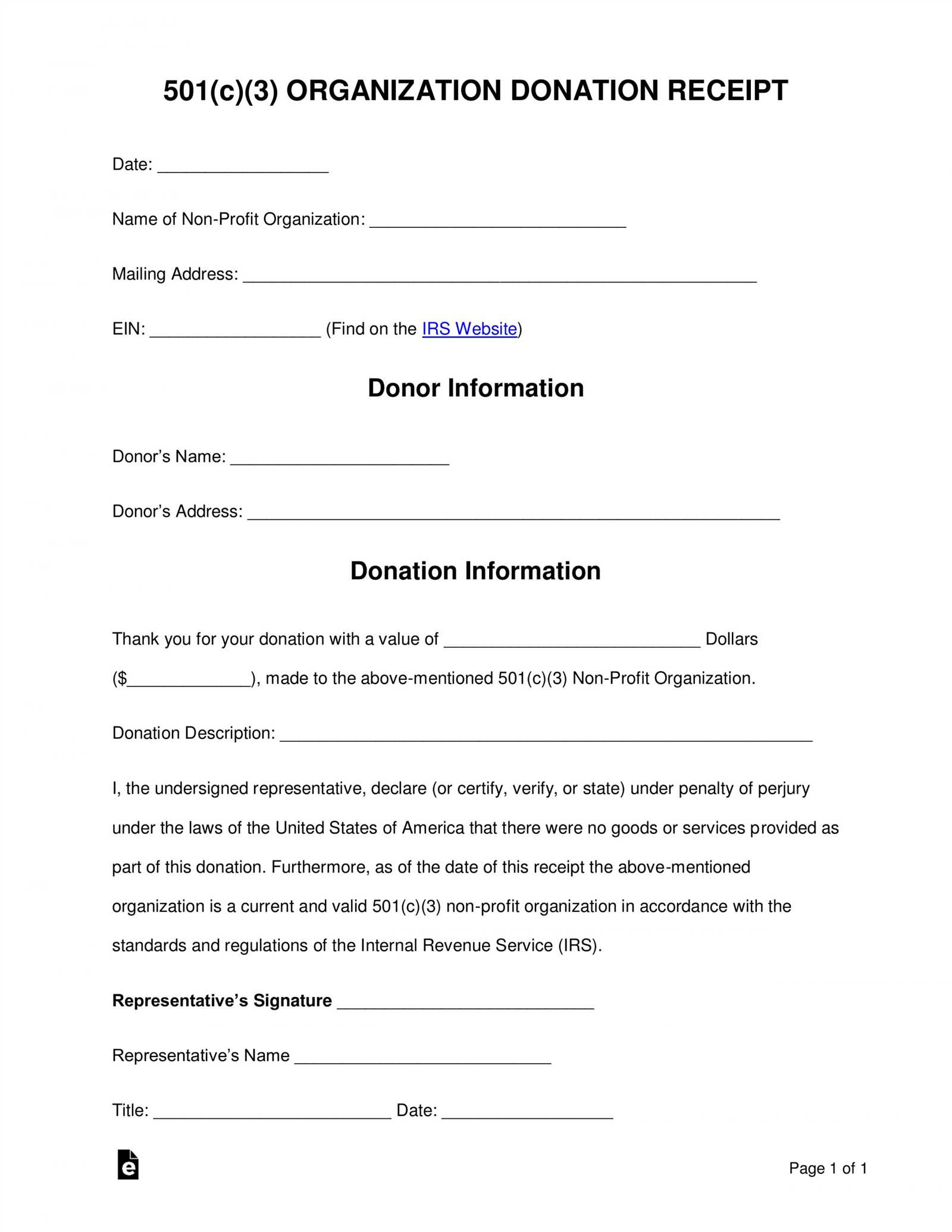

Non-Profit Organizations

- Include the organization’s legal name and address at the top.

- State the amount donated, specifying whether it was in cash, goods, or services.

- Provide a clear statement indicating no goods or services were received in exchange for the donation, if applicable.

- Ensure that the receipt contains the organization’s EIN (Employer Identification Number) for tax purposes.

- Include the date and a unique receipt number for easy tracking.

Religious Organizations

- Start with the church or religious entity’s name and contact information.

- Describe the donation and specify whether it’s for general funding, specific projects, or designated funds.

- If the donation was cash, note it as “cash donation” and include the date.

- Clarify if any tangible benefits, such as event tickets or merchandise, were given in return for the donation.

Charities and Foundations

- Clearly display the name and address of the charity or foundation.

- List the donation amount and specify whether it was made in-kind or as cash.

- Provide a description of the items donated if it was an in-kind gift, including estimated value if applicable.

- State whether any goods or services were provided in return and, if so, their value.

- Ensure the receipt includes a thank-you message and reminds the donor of their tax benefits.

Donation receipts must include specific details to comply with tax laws. In the U.S., the IRS mandates that charitable organizations provide a written acknowledgment for donations over $250. This acknowledgment must contain the organization’s name, donation date, and amount or description of donated property.

For non-cash donations, the receipt should describe the item donated but does not need to assign a value. Donors must keep a copy of this receipt for their tax filings. For gifts above $500 in value, the donor should attach IRS Form 8283 to their tax return, and for donations over $5,000, a qualified appraisal may be required.

Ensure that your receipts are clear and accurate to avoid issues with tax deductions. Below is a basic checklist for ensuring tax compliance in donation receipts:

| Requirement | Description |

|---|---|

| Organization’s Name | Include the full legal name of your organization. |

| Donation Date | State the date when the donation was made. |

| Donation Amount | For cash donations, the exact amount must be listed. |

| Non-Cash Donations | Describe the donated property but do not assign a value. |

| Donor’s Acknowledgment | State whether the donor received any goods or services in return. |

Keeping accurate records of donations helps maintain tax compliance. If your organization receives large donations, consulting a tax professional for detailed guidance is advisable.

Adapt your donation receipt template for both digital and print formats by focusing on key design elements. For digital use, ensure your template is optimized for mobile and desktop views. Use high-resolution images and scalable vector graphics (SVGs) to maintain clarity on different screen sizes. Incorporate clickable elements like donation links, buttons, or social media icons where applicable. For print, prioritize high-quality typography and sufficient white space to enhance readability. Choose colors that print well and ensure your layout is suitable for various paper sizes, especially if you plan to use standard or custom dimensions.

For digital formats, consider offering downloadable PDFs or email-friendly designs, which can be easily shared or printed by the donor. Adjust the file size to avoid slow loading times, while ensuring it remains clear and professional. In contrast, print receipts should feature bleed areas and proper margins to ensure all content fits neatly on the page after printing. If you’re using a template with logos or branding, ensure they are high resolution for print, while lighter file sizes are preferable for online versions.

Whether you’re designing for digital or print, consistency across both mediums strengthens your brand’s identity. Keep the same fonts, color scheme, and layout structure across all versions. Customize the footer for digital receipts to include clickable links to your website or donation page, while print receipts may benefit from more direct contact details, such as phone numbers or physical addresses.

Always double-check the accuracy of the donor’s name. A small mistake in spelling can cause confusion and reflect poorly on your organization. Ensure that every detail, including the donor’s contact information, is correct before issuing the receipt.

Missing or Incorrect Donation Amounts

Double-check the donation amount. Confirm that the numbers on the receipt match the donation made. If the receipt includes an incorrect amount, it can lead to serious issues for both the donor and the nonprofit. Ensure that both the written and numerical amounts are accurate.

Failure to Include Tax Information

Tax deduction details are crucial. Failing to mention whether the donation is tax-deductible can cause confusion for the donor. Ensure you clearly state if the donation qualifies for tax exemption and include any relevant tax identification numbers for transparency.

Do not overlook the date of the donation. It’s critical for both record-keeping and tax purposes. If the receipt does not include the correct date, the donor might face difficulties in claiming deductions.

Be clear about what the donation was for. Include a brief description of the campaign or program funded by the donation. This helps the donor keep track of their contributions and gives clarity about how the money will be used.

Lastly, remember to include your organization’s contact information. The receipt should have your organization’s name, address, phone number, and email. This ensures that the donor can reach out for any clarifications or if they need further documentation for tax purposes.

Check online platforms such as Canva, which offers a variety of customizable receipt templates. You can easily access them, select your preferred design, and download them in different formats.

Another reliable source is Microsoft Office Templates. They offer free receipt templates in Word and Excel formats. You can find several styles to match your needs, and the templates are ready to use once downloaded.

If you prefer working with Google Docs, try Google Docs Template Gallery, where you can find receipt templates that can be edited directly in the cloud and accessed from any device.

Template.net also provides a collection of free and paid receipt templates that are easy to customize. This site offers templates for various types of receipts, including donation receipts, sales receipts, and more.

For those seeking more specialized options, Lucidpress provides highly professional templates that are customizable and downloadable for free with a basic account. It’s a great option for businesses looking for polished designs.

Don’t forget to explore Freepik, which has both free and premium receipt templates. You can download them in various formats, from PSD to AI, depending on your design skills and software preferences.

Enhancing the Quality of Your Donation Receipts

To create a donation receipt that meets all necessary requirements, focus on clarity and accuracy. Include the donor’s details, donation amount, and the date. Additionally, mention your organization’s tax-exempt status and include a statement clarifying whether any goods or services were provided in exchange for the donation. This ensures transparency and compliance with regulations.

Keep the layout simple, with clear headings for each section. Clearly state the purpose of the donation and reference the tax laws that apply to charitable contributions. This provides both the donor and the recipient with the necessary documentation for tax purposes.

For better readability, use bullet points or numbered lists for important details. If you’re offering receipts for large donations, consider offering a personalized thank you message in the receipt itself to build goodwill. Adding this personal touch can create a stronger connection with your donors.

By following these steps, you ensure the receipt is both functional and appreciated by the donor.