Creating a 501(c)(3) donation receipt is simple and straightforward. Make sure the receipt includes all necessary information to meet IRS requirements for tax-deductible donations. This template can save you time while ensuring compliance with tax laws.

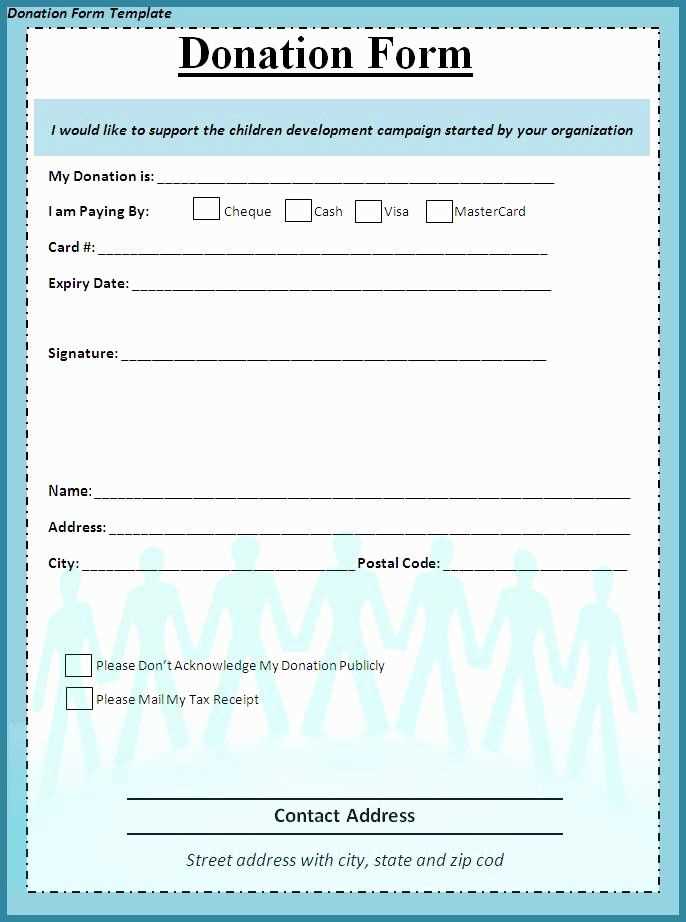

Key elements to include are the donor’s name, the date of the donation, the amount donated, and the organization’s name and address. If the donation includes non-cash items, provide a description of the goods and, if possible, an estimate of their fair market value. It’s also important to specify whether the donation was a cash gift or in-kind contribution.

Make the receipt clear by stating that the organization is a 501(c)(3)) nonprofit, and if the donation exceeds $250, include a statement that no goods or services were exchanged in return. Always keep a copy for your records, as this serves as proof of the donation for both the donor and the organization.

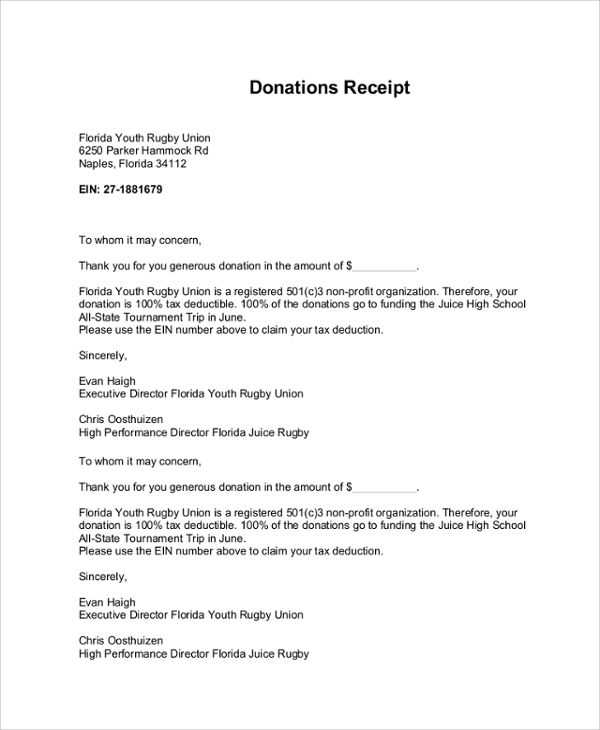

This straightforward format not only fulfills legal requirements but also shows appreciation for the donor’s contribution, strengthening the relationship and encouraging future support.

Here is the corrected version:

Make sure to include all the required details in the donation receipt. This should include the donor’s name, donation amount, and the date the contribution was made. Specify whether the donation was monetary or non-monetary. If it was a non-cash donation, describe the items donated along with an estimated value, if possible. Mention the organization’s tax-exempt status by noting the 501(c)(3) status and ensure to include the IRS tax-exempt number for reference.

Clearly state that no goods or services were provided in exchange for the donation unless applicable. This ensures transparency and compliance with IRS regulations. Include your organization’s contact information, including an address or email, so the donor can reach out if needed.

For better record-keeping, consider adding a unique receipt number to each donation. This will help the donor track their donations and also assist your organization in maintaining accurate records for tax purposes.

501(c)(3) Donation Receipt Template: A Practical Guide

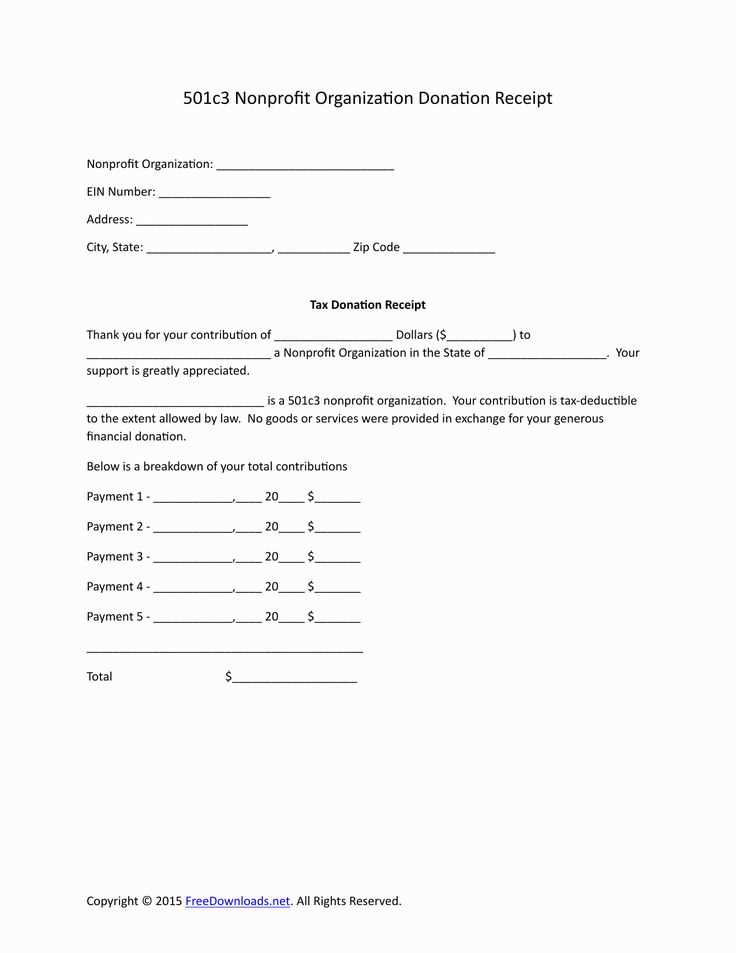

Creating a clear and accurate donation receipt is a key aspect of maintaining compliance for 501(c)(3) organizations. The template you use must meet IRS requirements to ensure that both the donor and the organization are protected during tax filing.

Key Elements of a 501(c)(3) Donation Receipt

Every 501(c)(3) donation receipt must include certain details. This includes:

- The name and address of the charity.

- The donor’s name and address.

- The date of the donation.

- A description of the donated items or services (for non-cash contributions).

- The estimated fair market value of the items (if applicable).

- A statement confirming whether any goods or services were provided in exchange for the donation.

- A statement that no goods or services were provided (if none were given).

Example of a Donation Receipt Template

Here’s a simple donation receipt template to follow:

[Charity Name] [Charity Address] [Phone Number] [Email Address] Date: [Date]Donor Information:Name: [Donor Name]Address: [Donor Address]Description of Donation:[Description of Items or Services Donated]Estimated Fair Market Value: [Value of Donation]Statement:No goods or services were provided in exchange for this donation, or[If applicable] Goods or services provided: [Description of goods/services].Thank you for your generous contribution![Charity Name] is a 501(c)(3) nonprofit organization.Tax ID: [Tax Identification Number]

Ensure that this template is customized with your charity’s details and tailored to fit the specific nature of each donation. Providing accurate receipts helps maintain the trust and legal compliance necessary for both donors and your organization.

To create a legally compliant 501(c)(3) donation receipt, ensure it includes all the required details as outlined by the IRS. A receipt serves as proof of a donation, and when done right, it can support donors in claiming tax deductions. Follow these steps to create a valid receipt:

1. Include the Organization’s Information

- Name of the nonprofit organization.

- Tax-exempt status statement, such as “501(c)(3) tax-exempt organization” or the specific IRS determination letter number.

- Full address and contact information (phone number, email address, or website).

2. Detail the Donation

- Date of the donation.

- Amount of the cash donation, or a description of the donated property or goods.

- If property was donated, include a statement on whether the organization provided any goods or services in return, and their estimated value.

Be clear on whether the donor received anything in exchange for the contribution. If they did, the receipt must specify the value of those goods or services to ensure compliance. This distinction is vital for both tax reporting and donor transparency.

3. Acknowledge No Goods or Services Were Provided

- If no goods or services were exchanged, make sure the receipt explicitly states that, such as “No goods or services were provided in exchange for this donation.”

4. Include the Organization’s Tax-Exempt Number

- The IRS-issued tax-exempt number can be included to ensure that the nonprofit is recognized as a 501(c)(3) entity.

By providing all of these details, the receipt not only becomes compliant with IRS regulations but also ensures transparency for both the donor and the organization. Ensure your nonprofit organization keeps detailed records of all donations for both internal use and donor reference.

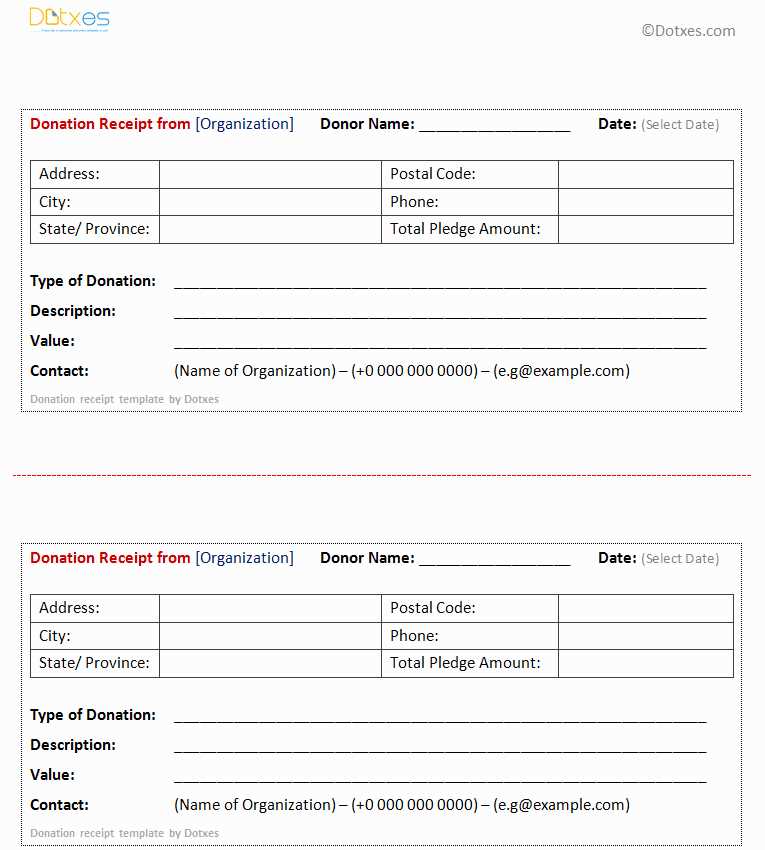

Each 501(c)(3) donation receipt must include specific details to comply with IRS requirements and provide donors with proper documentation for tax purposes. The following elements are crucial to ensure that your receipt meets legal standards:

| Element | Description |

|---|---|

| Organization Name | Clearly list the full name of the 501(c)(3) organization as registered with the IRS. |

| Tax-Exempt Status | Include the phrase “Tax-exempt organization” and the 501(c)(3) designation, verifying the nonprofit’s status. |

| Donor Information | Provide the donor’s name and address to identify the contributor. |

| Date of Donation | State the exact date of the donation or the date it was received. |

| Donation Description | Describe the donated items or cash. For non-cash donations, give a brief description, but avoid estimating the value. |

| Donation Value | If the donation is in cash, list the exact dollar amount. For non-cash donations, provide a description but not the value unless appraised. |

| Statement of No Goods or Services | Include a statement that no goods or services were provided in exchange for the donation, or specify what was provided, if any. |

| Signature | Sign the receipt with an authorized representative’s name and title within the organization. |

Including these components ensures transparency and helps both the donor and the organization stay compliant with IRS regulations. Double-check that all information is accurate to avoid complications during tax season.

Ensure your donation receipts meet IRS standards to avoid unnecessary complications. Below are some common mistakes to avoid:

1. Failing to Include Required Information

Donations must be properly acknowledged with key details. Always include the donor’s name, the organization’s name, the date of the contribution, and the amount or description of the donated property. Missing this information could lead to disqualification of tax deductions.

2. Not Providing a Value for Non-Cash Donations

If the donation is non-cash, such as goods or services, you must provide a description of the item. However, do not assign a value to it–this responsibility lies with the donor. The IRS expects you to describe the item without estimating its worth.

3. Incorrectly Listing the Organization’s Tax Status

It’s vital to state that your organization is a 501(c)(3) entity. If your tax-exempt status is not clearly stated, donors might not be able to claim their deductions. This statement should be visible and explicit on all receipts.

4. Overlooking Donor Acknowledgment for Smaller Donations

For donations of $250 or more, a formal receipt is required. For gifts under this amount, a simple acknowledgment letter is often sufficient. However, ensure your records align with IRS rules even for smaller donations to maintain consistency.

5. Ignoring the “No Goods or Services” Statement

If the donor receives no goods or services in return for their gift, clearly state “no goods or services were provided in exchange for this donation.” Failure to provide this information could jeopardize the donor’s ability to claim a deduction.

6. Not Issuing Receipts in a Timely Manner

Issuing receipts after a long delay can create confusion and problems for donors when filing taxes. Make sure to send receipts promptly after receiving a donation to ensure the process is smooth for both your organization and your donors.

Avoiding these common mistakes will help your organization stay compliant and provide donors with the necessary information to claim their tax deductions without issues. Double-check each donation receipt for accuracy before sending them out to ensure that everything aligns with IRS requirements.

501(c)(3) Donation Receipt Template

Use a simple and clear template to ensure your 501(c)(3) donation receipts meet IRS requirements. Make sure to include the following details:

- Organization’s Name and Address: Clearly state the nonprofit’s legal name and full address. Include your tax-exempt status (501(c)(3)) to help the donor understand the validity of the receipt.

- Donor’s Name: Include the name of the individual or organization who made the donation. This should match the information provided in the donor’s tax records.

- Donation Date: List the exact date the donation was received. This is critical for accurate tax reporting.

- Donation Description: Provide a description of the donated property or cash amount. For non-cash donations, specify the nature and condition of the item(s) donated.

- Amount of Cash Donated: If the donation is cash, the exact amount must be included. Do not provide a value for non-cash gifts unless an appraisal has been made.

- Statement of No Goods or Services Provided: Include a statement such as: “No goods or services were provided in exchange for this donation,” or list the value of goods or services provided if any were given in return for the donation.

- Signature: End the receipt with a signature of an authorized representative of the nonprofit, including their title and contact information.

For each donation, ensure accuracy and clarity in your receipts to avoid issues during tax filing. Providing a proper template not only helps maintain transparency but also supports your donors’ tax filings. Be consistent with these details, and your receipts will be IRS-compliant.