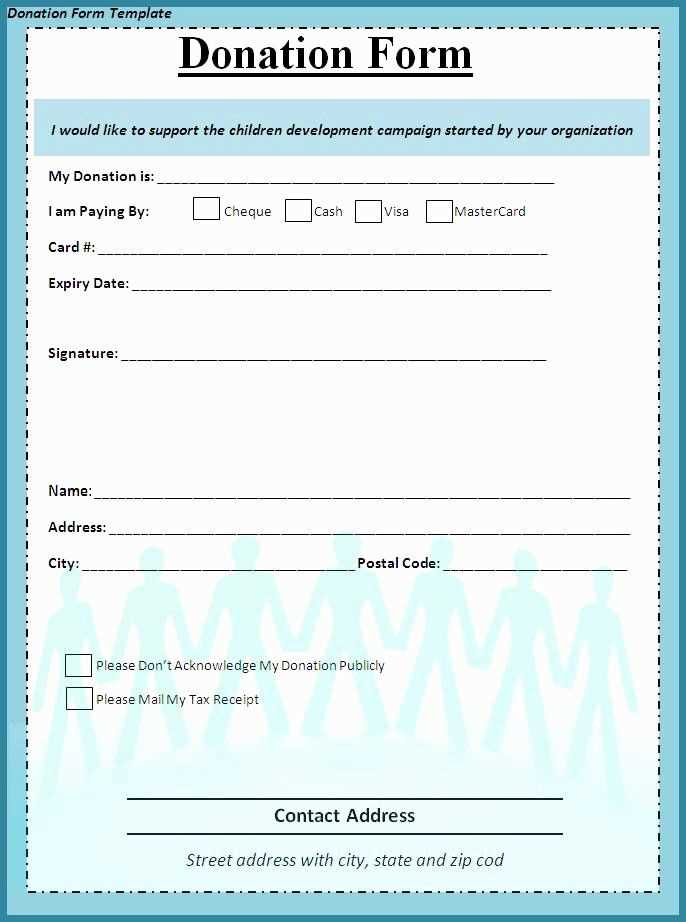

Providing a clear and accurate donation receipt is a key responsibility for 501(c)(3) organizations. This document serves as proof for donors, enabling them to claim tax deductions. The receipt should include specific details to comply with IRS regulations and ensure both parties are protected.

The template should contain the following elements: the organization’s name, address, and tax-exempt status, clearly stated. Include the date of the donation, the amount donated, and whether it was a cash or non-cash contribution. For non-cash donations, a brief description of the item should be provided. If any goods or services were exchanged for the donation, their fair market value must be mentioned.

Always make sure the receipt is issued in a timely manner. Donors need this document to file their taxes, and prompt delivery helps maintain a positive relationship with supporters. Use clear formatting and straightforward language to avoid confusion. This way, you ensure compliance while making the process as simple as possible for donors.

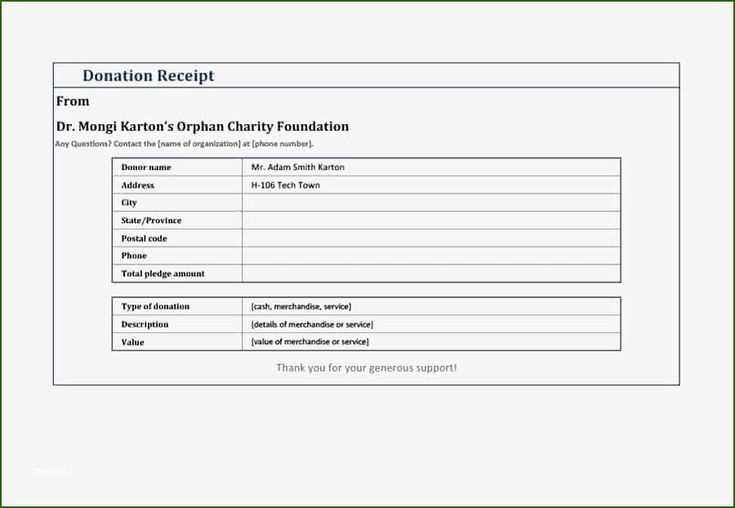

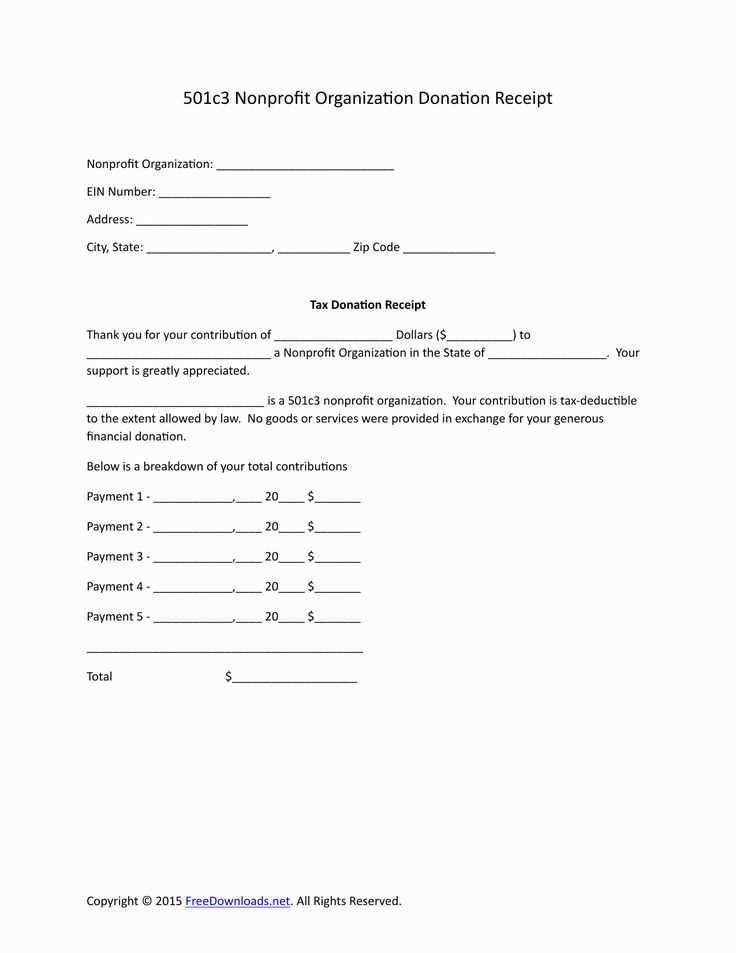

501(c)(3) Donation Receipt Template

A well-structured donation receipt is key to ensuring transparency and compliance with tax regulations for donors to 501(c)(3) organizations. A simple and clear format should include the donor’s name, donation amount, date of the donation, and the organization’s tax-exempt status.

Make sure to specify the value of any goods or services provided in exchange for the donation, if applicable. The IRS requires that this information be included for any donation where the donor receives something in return, like event tickets or merchandise.

Here’s a template to guide you:

Donation Receipt

Organization Name: [Organization Name]

Tax-Exempt Status: 501(c)(3)

Donor Name: [Donor Name]

Donation Amount: $[Amount]

Date of Donation: [Date]

Non-Cash Donation Description (if applicable): [Description of items donated, including their fair market value]

Goods/Services Provided: [Yes/No, and a description of what was provided, if applicable]

Statement: “No goods or services were provided in exchange for this donation” or “The goods/services provided are valued at $[Value].”

This format ensures clarity, covering all IRS requirements. Customize the template to fit the specific details of each donation. Keep a copy of the receipt for your records and provide one to the donor for tax purposes.

Creating a Legally Compliant Donation Receipt for Tax Deduction Purposes

Ensure your donation receipts meet IRS standards by including specific information that confirms both the donor’s contribution and the organization’s status. Follow these guidelines to create compliant receipts that will support tax deductions.

Required Information

A legally valid donation receipt must contain the following details:

- Organization Name: Full legal name of the nonprofit.

- Donor’s Name: Name of the individual or entity making the donation.

- Date of Donation: Exact date when the donation was received.

- Amount or Description of Contribution: The amount of cash or a detailed description of non-cash donations. If applicable, the value of any goods or services provided in exchange for the donation must be disclosed.

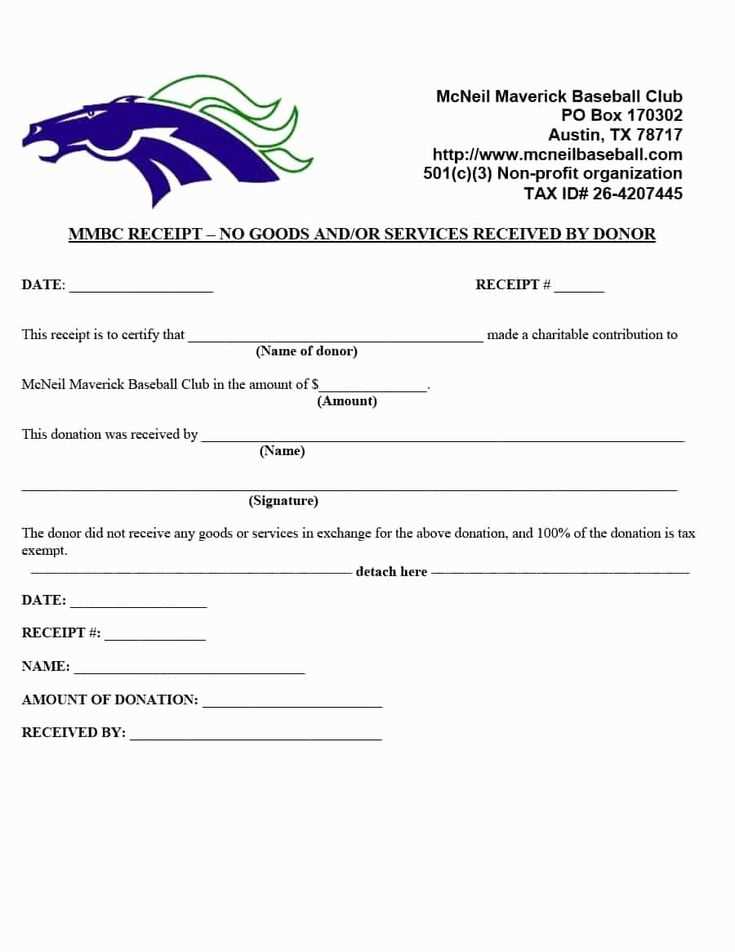

- Statement of No Goods or Services Provided: If no goods or services were provided in exchange for the donation, include a statement to that effect.

- Tax-Exempt Status: Statement confirming the organization’s 501(c)(3) status (e.g., “Your donation is tax-deductible as permitted by IRS regulations.”)

Template Example

Here’s a sample layout for a donation receipt:

| Donation Receipt |

|---|

| Organization Name: [Nonprofit Name] |

| Donor Name: [Donor Name] |

| Date of Donation: [MM/DD/YYYY] |

| Donation Amount: $[Amount] or Description: [Item/Service] |

| No Goods or Services Provided in Exchange for This Donation |

| Tax-Exempt Status: 501(c)(3) Organization |

| Signature of Authorized Representative: [Name] |

Always keep records of all issued receipts for compliance with IRS reporting requirements. These receipts help ensure transparency and avoid complications during tax filings.

Key Elements to Include in Your 501(c)(3) Donation Receipt Template

Include the organization’s name, address, and federal tax identification number (EIN) to ensure donors can easily verify its legitimacy. Clearly state that the organization is a 501(c)(3) tax-exempt entity to provide proper recognition of the status.

Donation Details

Specify the date of the donation and the amount or description of the items donated. For monetary donations, state the exact amount given. If goods were donated, list them with sufficient detail to describe the nature of the contribution.

Donor Acknowledgment

Provide a statement that no goods or services were exchanged for the donation (if applicable), or describe what goods or services were provided. This will clarify the donor’s eligibility for a tax deduction.

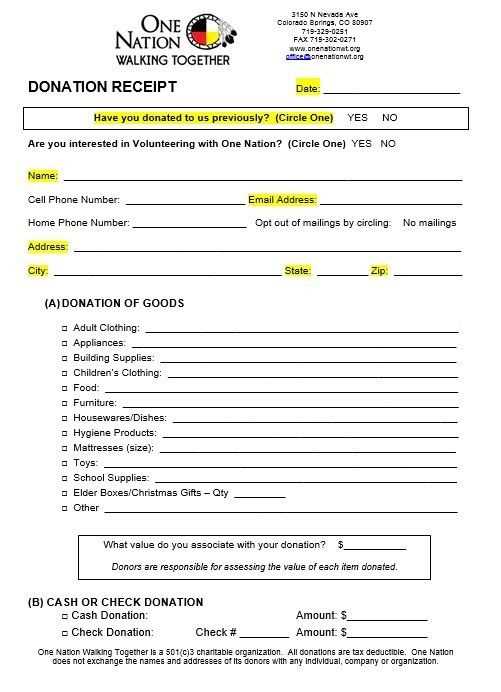

Ensuring Proper Acknowledgment of Non-Cash Donations in Your Template

Include a clear description of the donated items. Specify their general nature, quantity, and condition. For example, “5 boxes of assorted books in good condition” or “1 used bicycle, fair condition.” Avoid assigning a monetary value to the items as it is the donor’s responsibility to determine that value. If applicable, include a note that the organization does not appraise donations.

Include a Statement About Non-Cash Donations

Clearly state that the donor has received no goods or services in exchange for the non-cash donation. This confirms the tax-deductible nature of the contribution. An example statement might read: “No goods or services were provided in exchange for this donation.” This language is necessary for IRS compliance.

Donor’s Signature and Date

Ensure the template includes space for both the donor’s signature and the date of donation. This confirms the donor’s intent and the specific date on which the donation was made, providing legal protection for both parties.

- Describe the condition of the donation, but avoid overvaluing it.

- Incorporate a statement that no goods or services were provided in return.

- Ensure the donor signs and dates the document.