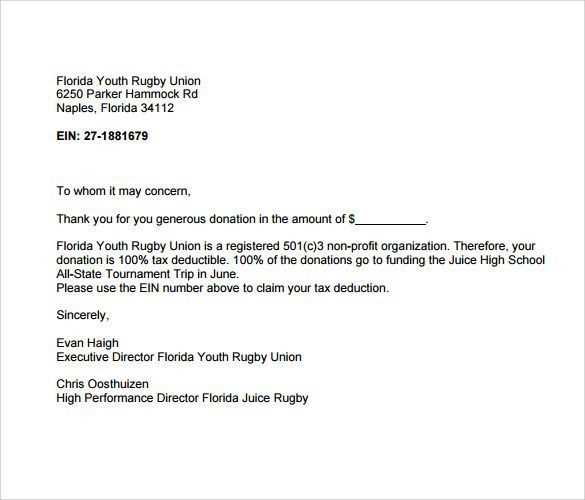

For a 501c3 non-profit organization, providing a clear and accurate donation receipt is crucial for both the donor’s tax purposes and the organization’s record-keeping. The letter should include specific details that confirm the donation and establish its tax-deductible nature. Start by addressing the donor personally and expressing gratitude for their support.

Include the following elements in your receipt letter:

1. Donor’s full name and address.

2. Organization’s name, address, and tax-exempt status (IRS 501c3).

3. The donation date.

4. A description of the donated property or cash, with an estimate of value if applicable.

5. A statement clarifying that no goods or services were exchanged for the donation (or specify the value of any items received, if applicable).

6. A clear statement that the donation is tax-deductible, referring to IRS guidelines.

7. Signature of an authorized representative from the organization.

Be concise but ensure that the letter covers all necessary details. This will give the donor the information they need for their tax records and maintain the legal requirements for your non-profit organization.

501c3 Non-Profit Donation Receipt Letter Template

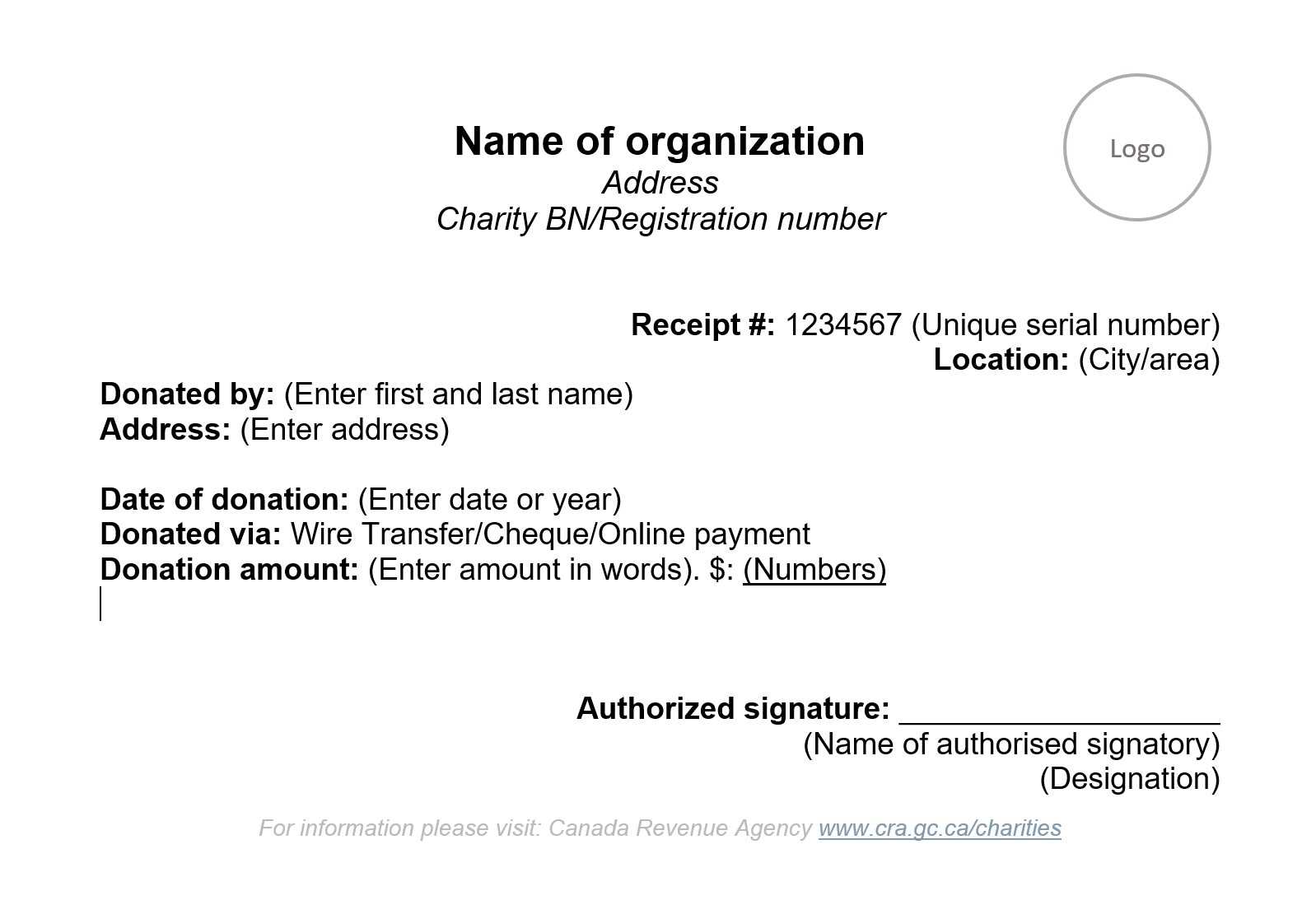

Ensure your donation receipt meets IRS standards by including the following key details:

1. Non-Profit Organization Information

Include the name of your organization, its address, and its 501(c)(3) status. Clearly state that donations are tax-deductible and provide the organization’s EIN (Employer Identification Number).

2. Donor Information

Provide the donor’s full name and address. This allows the donor to claim the deduction on their tax return.

3. Donation Details

Describe the donated items or the amount of the financial contribution. For non-cash donations, include a description of the item(s) donated, but not the value.

4. Acknowledgment of No Goods or Services

State if no goods or services were provided in exchange for the donation. If goods or services were given, provide a description and their estimated value.

5. Date of Donation

Include the date the donation was made. This helps with tracking for tax purposes.

6. Signature and Contact Information

Include a signature line for the person authorized to issue the receipt, along with their title and the organization’s contact details.

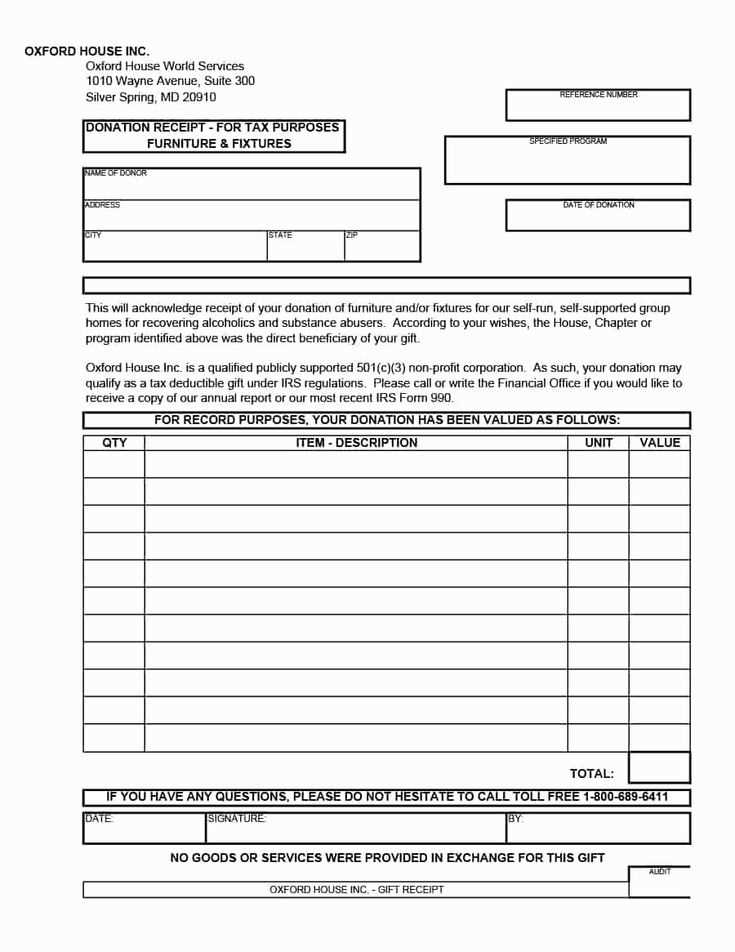

How to Structure a Donation Receipt for Tax Deduction Purposes

Ensure the receipt includes specific details required by the IRS to qualify for tax deductions. Include the following elements:

- Organization Name and Address: Clearly list your non-profit’s name, address, and contact information.

- Donor’s Name and Address: The name and address of the donor must be included to verify the donation source.

- Donation Date: Specify the date the donation was made.

- Amount or Description of Donation: For cash donations, list the exact amount. For non-cash donations, describe the items donated and, if applicable, the fair market value.

- Non-Cash Donation Description: If the donation is property, include a brief description of the items, their condition, and their fair market value.

- Statement of No Goods or Services: Confirm that no goods or services were provided in exchange for the donation, or detail what was provided (if applicable).

- Tax-Exempt Status: Include the organization’s 501(c)(3) status and tax identification number (TIN) to verify its eligibility for tax-deductible donations.

Sample Donation Receipt Structure

- Organization Name and Address

- Donor Name and Address

- Donation Amount or Description

- Date of Donation

- Statement of No Goods or Services

- Tax-Exempt Status Details (TIN)

Ensure your receipt is clear, concise, and accurate to meet IRS requirements for tax deductions.

Key Legal and Compliance Elements to Include in Your Letter

Ensure your donation receipt includes the organization’s name and address. This information verifies the entity receiving the donation. Additionally, make sure the donor’s name and address are clearly stated for record-keeping and tax purposes.

Include a statement confirming the nonprofit’s 501(c)(3) status. This statement is necessary for the donor to claim tax deductions. Be specific, including your IRS tax-exempt number if possible.

Clearly mention the date of the donation and the amount donated, whether in cash or property. For non-cash donations, provide an estimate of the donation’s value if possible. If your organization provided any goods or services in return for the donation, include a description and a good faith estimate of their value.

For any non-cash donations, ensure you include a brief description of the donated items or property, noting their condition and how they were valued. This helps clarify the donation for tax reporting.

Conclude the letter with a disclaimer about the donor’s responsibility to determine the value of their donation for tax purposes. This ensures that the organization is not held liable for tax filings or valuations.

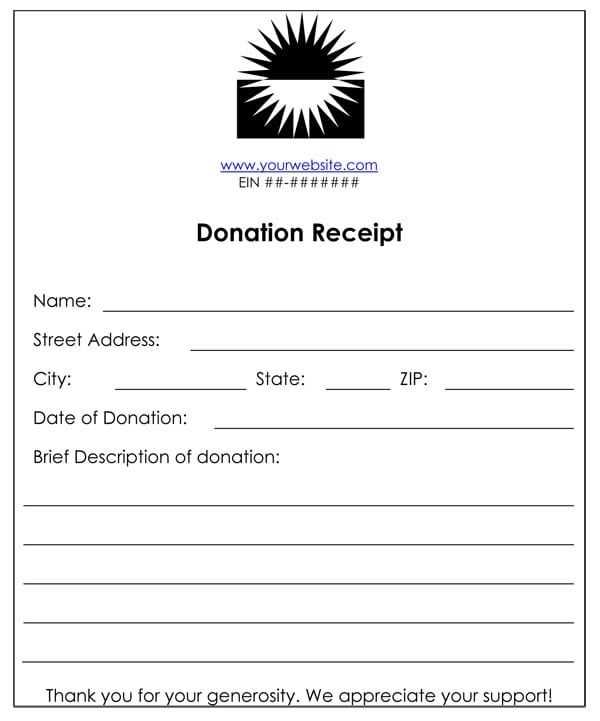

How to Personalize Your Donation Receipt for Donor Engagement

To create a meaningful connection with your donors, personalize each donation receipt with specific details. Include the donor’s name, the exact amount donated, and the date of the contribution. Acknowledge their generosity by adding a thank-you message tailored to the donor’s history with your organization.

Use Donor Data to Customize Messages

Include relevant information such as the donor’s past donations, the specific campaign they supported, or how their contribution will be used. For example, “Your $100 donation helps provide meals for 50 families this month.” This creates a personal connection and reinforces the impact of their gift.

Design Receipts to Reflect Your Organization’s Brand

Incorporate your organization’s logo and colors to make the receipt visually aligned with your brand. A clean, professional design helps donors feel more valued. Consider adding a personal signature from a team member to enhance the human touch.