Required Information for a Valid Receipt

A proper donation receipt must include specific details to comply with IRS regulations. Ensure the document contains the following:

- Donor’s Name and Address: Clearly list the full name and mailing address of the donor.

- Charity’s Information: Include the organization’s full name, EIN (Employer Identification Number), and mailing address.

- Vehicle Description: Mention the make, model, year, VIN (Vehicle Identification Number), and mileage.

- Date of Donation: Provide the exact date when the donation was completed.

- Statement of Goods and Services: Indicate whether any goods or services were provided in return.

- Donation Value: If the vehicle was sold, state the sale price. Otherwise, note that the donor is responsible for determining fair market value.

IRS Compliance and Documentation

Receipts for Different Donation Scenarios

Depending on the donation amount, different documentation rules apply:

- Under $500: A basic receipt with the above details is sufficient.

- $500 to $5,000: The donor must complete IRS Form 8283 and attach it to their tax return.

- Over $5,000: A qualified appraisal is required in addition to Form 8283.

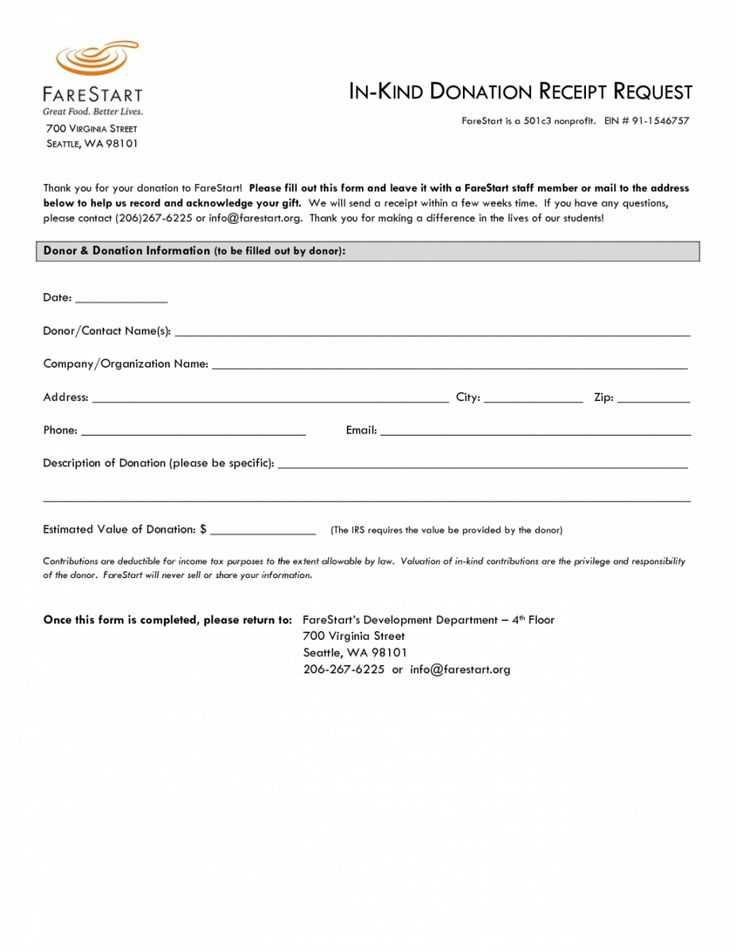

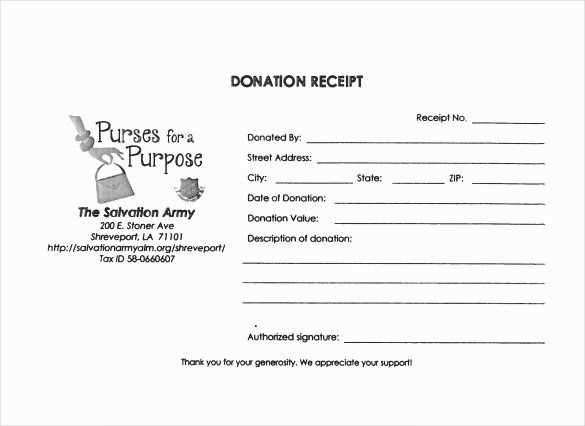

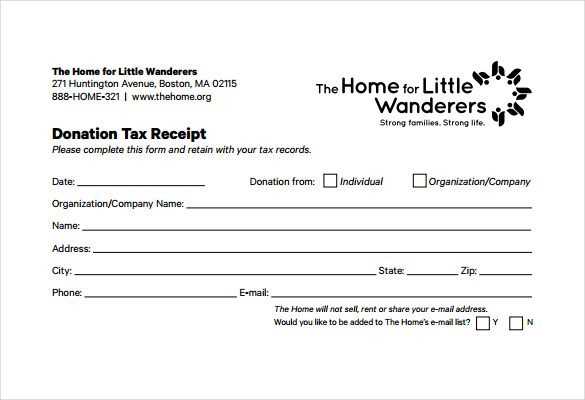

Example Template

Below is a sample format for a donation receipt:

[Organization Name]

[Organization Address]

[EIN: XX-XXXXXXX]

Donor: [Full Name]

Address: [Donor’s Address]

Vehicle: [Year, Make, Model, VIN]

Mileage: [Mileage]

Donation Date: [MM/DD/YYYY]

Goods or Services Provided: [Yes/No]

This receipt serves as a record of your charitable contribution. Retain it for tax purposes.

501c3 Vehicle Donation Receipt Template

Essential Details for a Vehicle Gift Receipt

IRS Rules for 501c3 Contribution Acknowledgments

Determining and Reporting Donated Vehicle Worth

Frequent Errors in Issuing Contribution Receipts

Documentation Standards for Nonprofit Organizations

Printable and Digital Templates for Donor Receipts

A valid 501c3 vehicle donation receipt must include the donor’s name, the organization’s legal name, the vehicle’s identification details (make, model, year, VIN), and the date of donation. The nonprofit must also confirm whether the donor received any goods or services in return. If the vehicle’s claimed value exceeds $500, IRS Form 1098-C should accompany the receipt.

IRS Guidelines for Vehicle Donation Acknowledgment

The IRS requires that the receipt specify how the organization intends to use or dispose of the vehicle. If the vehicle is sold without significant use, the receipt must state the sale price. If retained for program-related use, the organization must describe that use. The receipt should explicitly mention that the donor did not receive substantial benefits in exchange for the gift.

Common Mistakes to Avoid

Omitting key details, such as the vehicle’s VIN or the nonprofit’s tax-exempt status, can lead to IRS rejection. Failing to issue the receipt within 30 days of the vehicle’s sale or significant use also creates compliance risks. Using generic receipts without specifying the donation’s purpose or sale price can result in donor disputes or tax deduction issues.

Nonprofits should maintain accurate records and provide both printed and digital receipt options. Ensuring clarity and IRS compliance protects both the donor and the organization from potential tax complications.