For tax purposes, providing a 501c6 donation receipt is a straightforward yet necessary step in acknowledging contributions made to your organization. A well-structured donation receipt can ensure transparency and help both the donor and the organization maintain accurate records. It should contain all the required details for the donor’s tax deductions and outline the specifics of the donation, including the amount or description of the donation, and whether any goods or services were exchanged in return.

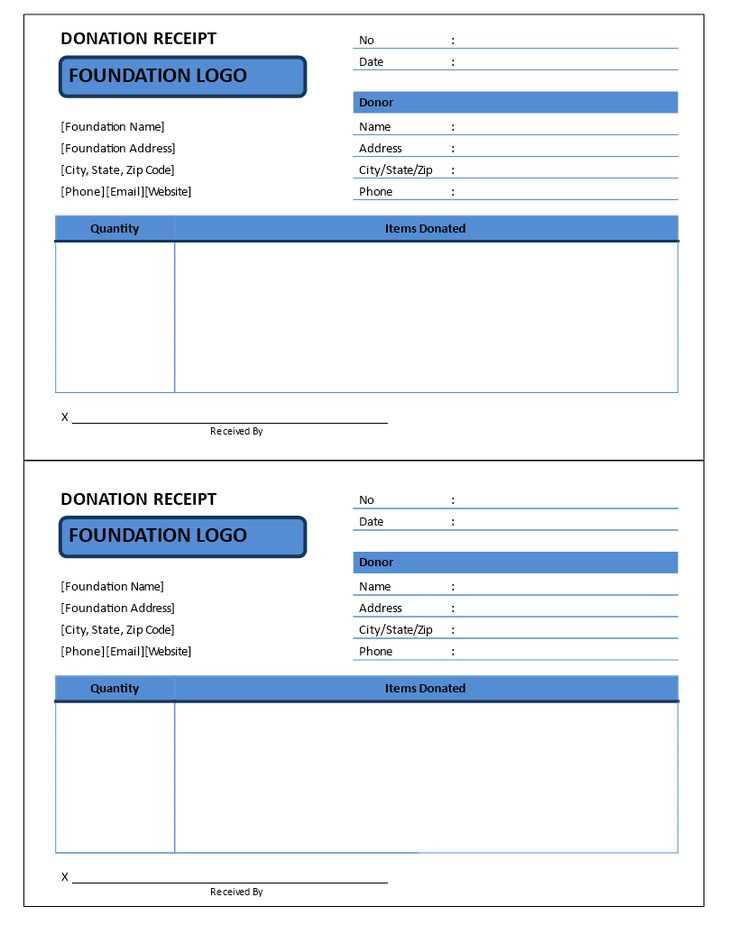

To create an effective 501c6 donation receipt template, include the name and contact information of your organization, the donor’s details, and the date of the contribution. Clearly list the amount donated or a description of non-cash contributions. Additionally, mention whether any benefits were received by the donor, such as tickets or services, and assign a fair market value to those benefits. This helps the donor in determining the exact amount eligible for tax deductions.

Make sure your template complies with IRS guidelines to avoid any issues during an audit. Keep the receipt clear, concise, and easy to understand, ensuring it aligns with the nonprofit’s record-keeping practices. A proper receipt serves as a formal acknowledgment, building trust between the donor and your 501c6 organization.

Here’s the corrected version:

To create a valid 501(c)(6) donation receipt, make sure to include the donor’s name, donation amount, and the date of the contribution. Ensure that the receipt clearly states that no goods or services were exchanged for the donation, unless applicable. For in-kind donations, include a description of the donated items, as well as their estimated value. If the donation exceeds $250, provide a written acknowledgment that meets IRS requirements.

Be specific about the organization’s tax-exempt status. Clearly state that your organization is a 501(c)(6) entity and include your Employer Identification Number (EIN). This ensures the donor can properly claim deductions on their tax return.

For ease of reference, provide a receipt number for organizational tracking. Include contact information for your organization in case the donor has any questions.

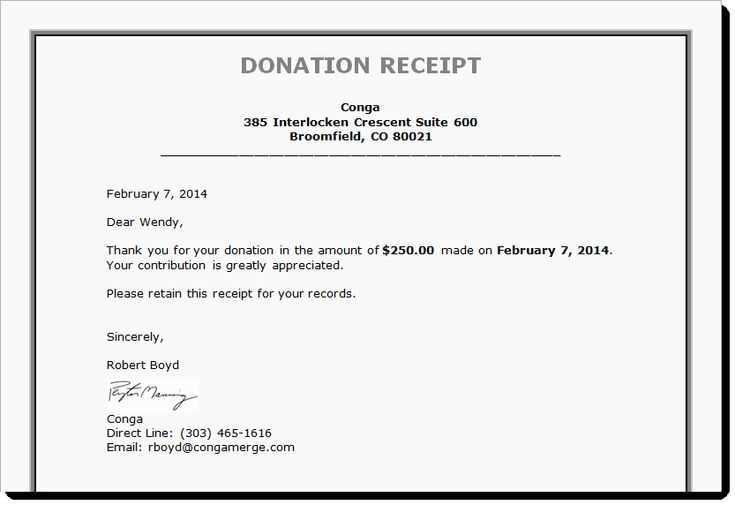

Here’s an example of what the receipt could look like:

Donation Receipt

Thank you for your donation to [Organization Name], a 501(c)(6) nonprofit organization. No goods or services were provided in exchange for this donation.

Donor Information:

Name: [Donor’s Name]

Address: [Donor’s Address]

Donation Amount: $[Amount]

Date of Donation: [Date]

Organization Information:

[Organization Name]

[Organization’s EIN]

Contact: [Phone Number / Email]

- 501c6 Donation Receipt Template: A Practical Guide

A 501c6 donation receipt serves as a formal acknowledgment of a charitable contribution to a nonprofit organization. Here’s how to structure an effective donation receipt for 501c6 organizations.

- Organization Name and Details: Include the full name of the organization, its address, and its tax-exempt status. Clearly state the IRS tax-exempt number, as this proves that the donation is eligible for tax benefits.

- Donor Information: Include the donor’s full name and contact details. This helps both parties maintain a record of the contribution.

- Donation Date: Indicate the exact date when the donation was made. This ensures that the receipt corresponds to the correct tax year.

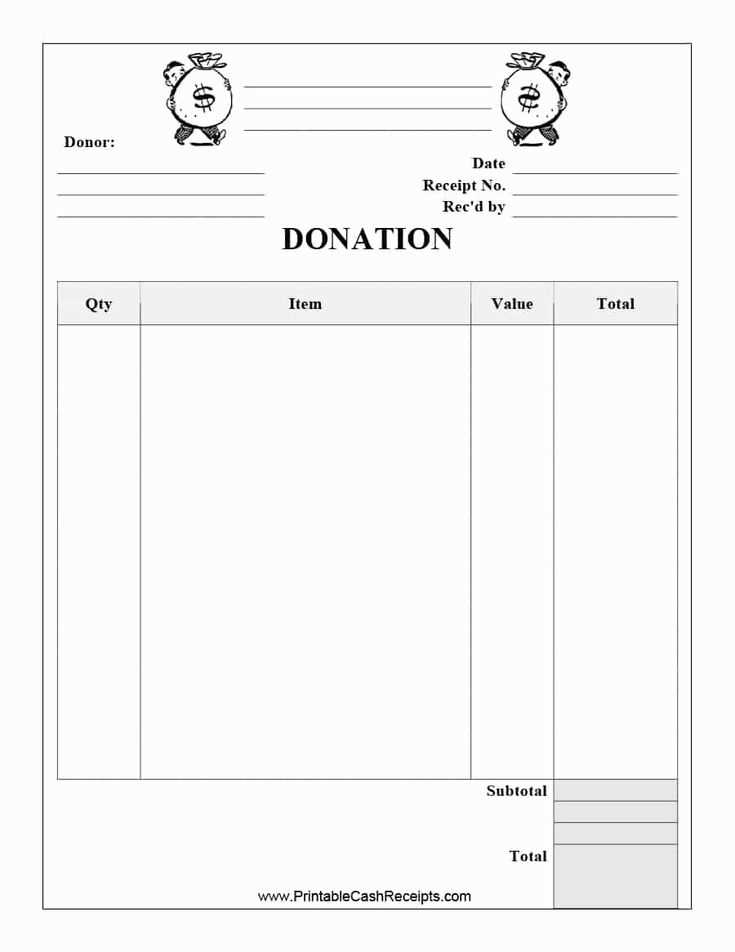

- Description of Donation: Provide a description of the donation, whether it is monetary, goods, or services. If the donation is property, include a description and, if available, an estimate of the value.

- Amount of Monetary Donation: Clearly state the dollar amount of the donation for monetary gifts. For non-cash gifts, estimate the fair market value.

- No Goods or Services Provided: State if no goods or services were provided in exchange for the donation. If goods or services were provided, include a description and their value. This is necessary for compliance with IRS regulations.

- Signature: The signature of an authorized representative of the 501c6 organization should be included, confirming the authenticity of the receipt.

Using this template helps ensure that your 501c6 donation receipts are compliant and easy to understand. Keep records of all receipts to maintain transparency and support future tax filings.

501c6 organizations, such as business leagues and trade associations, must meet specific legal requirements when issuing donation receipts. Donations to these groups are tax-deductible under certain conditions, and the receipt plays a critical role in documenting this deduction.

Key Information to Include on Donation Receipts

The IRS requires certain details on all donation receipts. These include the name of the organization, the date of the donation, and the amount given. If the donation includes non-cash items, a description of the donated property must be provided. The receipt should also include a statement confirming that no goods or services were provided in exchange for the donation, unless such items were given, in which case, their fair market value must be disclosed.

IRS Guidelines for 501c6 Receipts

The IRS does not mandate specific forms for donation receipts, but it provides clear guidelines on what information must be included. It’s important to remember that receipts for donations over $250 require a written acknowledgment from the organization. This acknowledgment must contain the total amount donated, any goods or services received, and a description of those items. For donations of property, the IRS expects a detailed description to substantiate the claimed deduction.

To create a custom donation receipt template for your 501c6 organization, begin by including all necessary legal and tax-related details. Ensure the template contains your organization’s full name, address, and tax identification number (EIN). These details verify your nonprofit status and are required for donors’ records. Without these, donors might face difficulties claiming tax deductions.

Next, provide clear instructions on how the donation is categorized. If the donation is a monetary gift, specify the amount and date. If it’s an in-kind donation, describe the goods or services donated. Remember that 501c6 organizations can only issue receipts for non-deductible donations, so make sure your wording reflects that, explaining any benefits or privileges donors may receive in exchange for their contributions.

Don’t forget a statement confirming that no goods or services were provided in exchange for the donation, if that’s the case. This simple note ensures compliance with IRS requirements. If there were goods or services provided, include an estimate of their fair market value to allow donors to calculate their deduction.

The template should also include a disclaimer or acknowledgment of the donor’s understanding of the donation terms. This can be a brief sentence noting that the donor agrees to the receipt’s contents. Keep the design clean and professional, focusing on functionality. The receipt should be easy to read, with clear sections for the donor’s details, contribution amount, and acknowledgment.

Finally, test your template. Make sure it prints properly and that all information is accurate. You can automate this process by integrating it with your donation tracking system to streamline the receipt generation for each donor. Keep updating the template as needed to reflect any changes in legal requirements or organizational procedures.

First, make sure to include all required information on the donation receipt. Failing to list the donor’s name, donation date, and the amount or description of the contribution can lead to confusion or legal issues. Without this, the receipt may not be valid for tax purposes.

Another mistake is not distinguishing between donations that are tax-deductible and those that are not. For instance, if a donor receives any goods or services in exchange for their contribution, this must be clearly stated. The value of the goods or services should be deducted from the total donation amount.

It’s crucial to accurately describe the organization’s 501c6 status. If you omit this information, it could cause confusion about the donor’s eligibility for tax deductions. Be sure to mention that your organization is a tax-exempt entity under section 501(c)(6) of the IRS code.

Neglecting to issue the receipt in a timely manner is another common mistake. Donors expect to receive acknowledgment soon after making a donation. Delay in issuing receipts can result in lost tax benefits or frustrated supporters.

Lastly, avoid vague language. Provide a detailed description of the donation, especially if it involves intangible goods or services. This reduces the risk of misunderstanding between the donor and your organization regarding the nature of their gift.

Optimizing the Donation Receipt Template for 501(c)(6) Organizations

Ensure clarity and accuracy by including the necessary elements in your 501(c)(6) donation receipt template. First, specify the donor’s name and address, as well as the organization’s full legal name, address, and tax-exempt status. It’s essential to include the exact date of the donation and describe the donated goods or services, if applicable. Clearly state whether the donation was in cash or in-kind, and provide a fair market value estimate for any non-cash contributions.

Be transparent by confirming whether the donor received any goods or services in exchange for the donation. If so, mention the value of those goods or services. Include a statement affirming that no goods or services were provided if the donation was entirely charitable. The template should also state that the organization is a qualified 501(c)(6), ensuring tax-exempt status under IRS guidelines.

To maintain compliance, use concise and precise language. Avoid unnecessary repetition, and keep the focus on key details, such as the donation amount and tax-exempt information. A well-structured receipt will help the donor with tax deductions and demonstrate your organization’s professionalism.