Ensure clarity in your donation process with a detailed and professional acknowledgment receipt. A well-crafted template reflects gratitude and confirms the donation, providing both the donor and the recipient with a clear record of the transaction.

Start with basic information: donor’s name, donation date, amount, and description of the gift. This allows both parties to have accurate details for their records. Also, include your organization’s tax-exempt status and a statement about how the funds or items will be used. This reassures the donor about the impact of their contribution.

For convenience, keep the template simple and concise. Avoid unnecessary jargon, and ensure the receipt is easy to read. Personalize the message to show appreciation, and leave space for any additional comments or details the donor may need. A well-organized and thoughtful acknowledgment strengthens the relationship with your supporters.

Detailed Guide on Acknowledgement Receipt of Donation Template

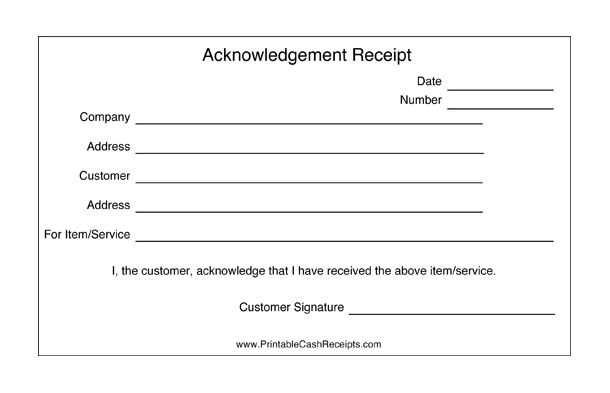

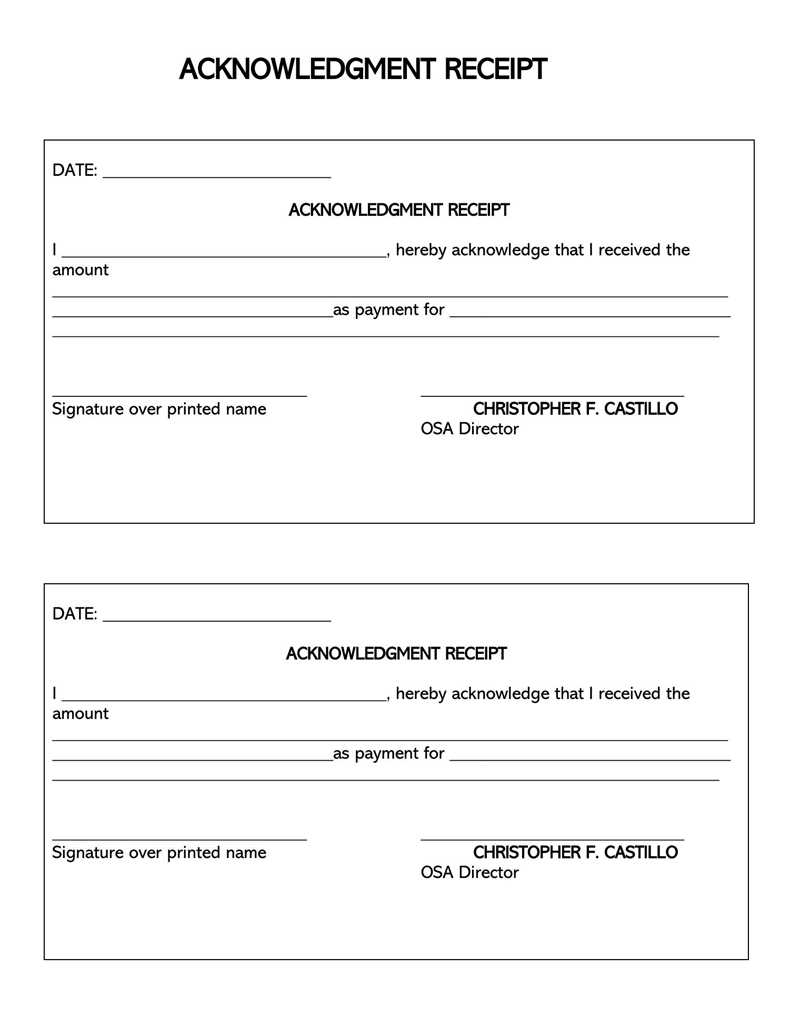

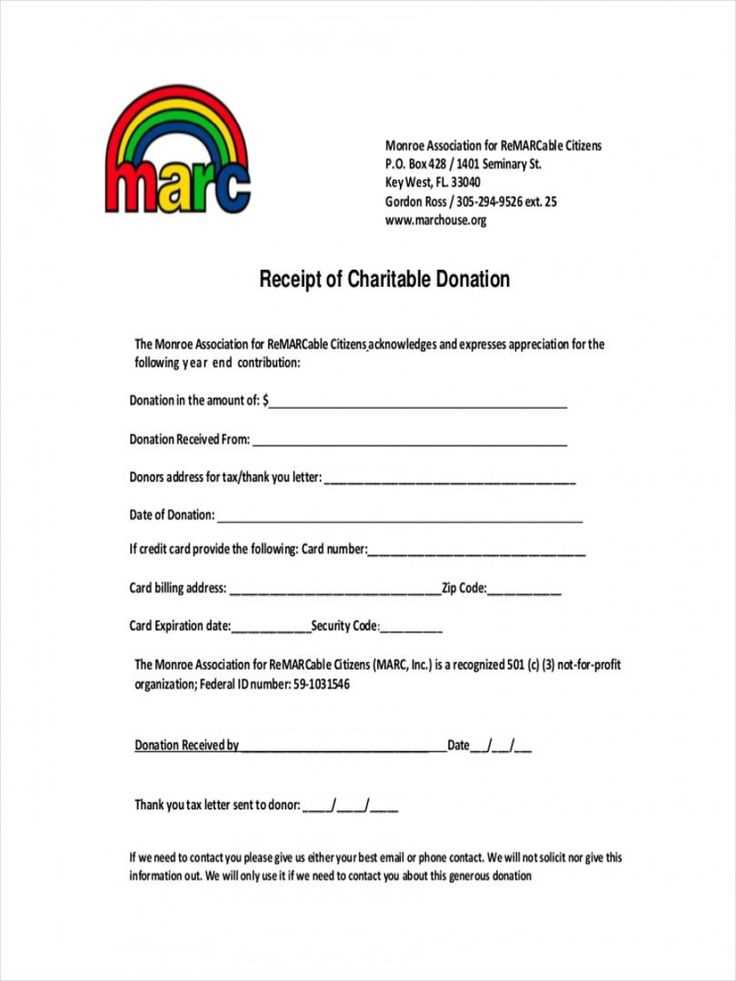

When creating an acknowledgement receipt for a donation, make sure to include key details such as the donor’s name, the amount or value of the donation, the date of the donation, and a clear statement confirming receipt. The document should also mention whether the donation is tax-deductible, if applicable.

Begin with a header that includes the organization’s name and contact information. Below this, include a section where you can clearly specify the donor’s name and their donation details. This should be followed by a statement such as, “Received with gratitude,” to express appreciation for the contribution.

Make the donation amount or description of goods clearly visible, with a line item or breakdown if necessary. If the donation was in the form of goods, provide a brief description of each item received.

To ensure clarity, include a statement on the document about whether the donation is eligible for tax deduction. This can be a simple sentence, like: “This donation may be tax-deductible in accordance with IRS regulations.” Avoid unnecessary legal jargon but ensure compliance with local tax laws.

End the receipt with a formal thank you note to reinforce gratitude and the significance of the donation. A line such as, “Thank you for your generous support,” will complete the document.

Lastly, include the signature of an authorized person from the organization and a date to validate the document.

Understanding the Key Components of a Donation Receipt

Include the name and address of the organization receiving the donation. This establishes the recipient’s identity clearly. Specify the donor’s full name and address to confirm the transaction’s legitimacy. Detail the donation amount, or describe the donated items, along with their value. This ensures both parties are aware of the exact nature of the contribution.

Donation Date and Transaction Description

State the exact date of the donation. This is crucial for record-keeping and tax purposes. If applicable, note the method of donation–whether it was cash, check, or in-kind contributions. Including this ensures transparency for both the donor and organization.

Tax-Exempt Status and Acknowledgment

Clearly mention the organization’s tax-exempt status, such as 501(c)(3) if relevant. This allows the donor to know their eligibility for tax deductions. Include a brief statement that no goods or services were exchanged for the donation, confirming that it is fully tax-deductible.

Steps to Customize and Personalize Your Acknowledgement Template

Begin by including the donor’s full name and the exact amount of the donation. Make sure to mention how their contribution supports your cause specifically.

Customize the greeting to reflect the tone of your organization. Use a warm, appreciative message that suits the occasion, whether it’s a formal event or a more casual donation drive.

Update the template with your organization’s branding, such as logos or color schemes. This makes the receipt feel more personal and connected to your mission.

Adjust the date format to suit your needs and be clear about when the donation was received. This is particularly important for accounting and tax purposes.

Provide a short description of how the funds will be used. Donors appreciate knowing exactly where their money is going.

Make sure to include a contact number or email for any questions. Personalize this section with a specific person or department to build trust with the donor.

Review and test the final version. Ensure all fields are correctly filled out and that the formatting is consistent across different devices and formats.

Best Practices for Delivering Donation Receipts to Donors

Send receipts promptly after receiving a donation. A quick response helps maintain transparency and assures donors that their contribution is recognized.

Include Necessary Information

Ensure that the receipt includes the following details:

- Donor’s name and contact information

- Donation amount or description of goods/services

- Date of the donation

- Organization’s name and contact details

- Statement confirming no goods or services were exchanged for the donation (if applicable)

- Tax identification number of the organization (for tax deduction purposes)

Offer Multiple Delivery Methods

Provide donors with options for how they receive their receipts, whether by email, physical mail, or through an online portal. Make sure each method is secure and efficient.

- Email is the fastest method and can be automated for immediate delivery.

- Printed receipts are ideal for larger donations or donors who prefer hard copies.

- Online platforms can allow donors to access and download their receipts at any time.

Ensure the receipt format is clear, professional, and easy to understand. Use a straightforward layout with all key information clearly visible. This will enhance the donor’s experience and make the receipt useful for tax purposes.