Ensure your donors receive a clear, well-structured receipt by using a detailed template that includes all essential information. A properly formatted document acknowledges contributions, simplifies tax reporting, and strengthens trust with supporters.

Include the donor’s full name, contact details, and a concise description of the donated item or service. Specify the fair market value if available, or clearly state that the organization does not assign a value to non-cash donations. For cash contributions, list the exact amount received.

Nonprofit organizations should provide their legal name, tax-exempt status, and a statement confirming whether the donor received goods or services in exchange. If the contribution qualifies for a tax deduction, referencing relevant tax codes helps clarify eligibility.

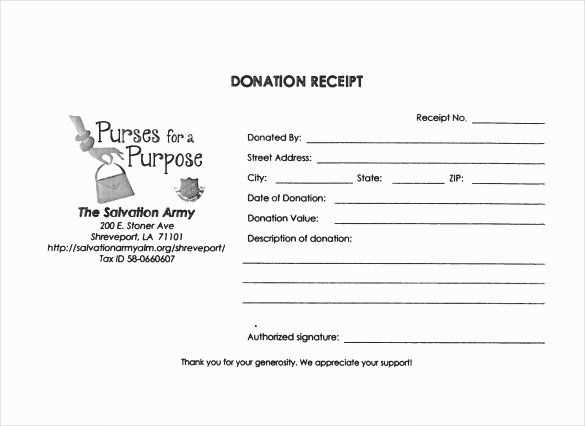

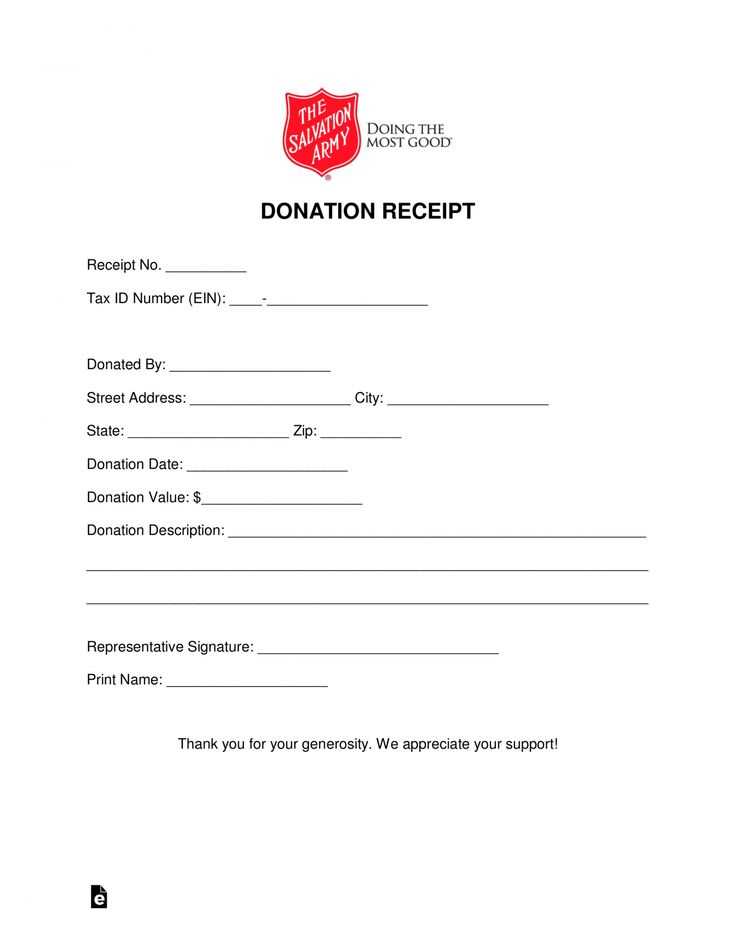

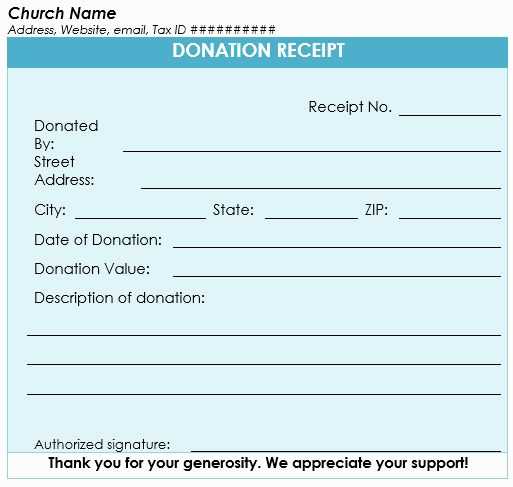

Standardizing your receipt template saves time and ensures compliance with record-keeping requirements. A digital or printed format with a signature from an authorized representative adds credibility and professionalism.

Auction Donation Receipt Template

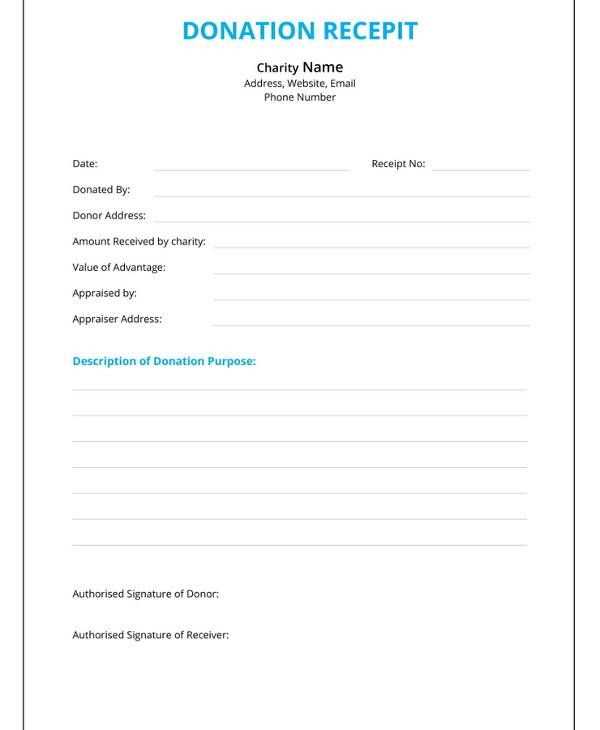

Provide a structured receipt to ensure tax compliance and transparency for donors. The document should clearly outline key details and maintain a professional format.

Essential Information to Include

- Donor Details: Full name or organization name and contact information.

- Receiving Organization: Charity name, address, and tax identification number.

- Description of Donation: Item or service donated, with a brief description.

- Fair Market Value: Estimated value of the donation, if applicable.

- Date of Contribution: The date the donation was received.

- Statement of No Goods or Services: Confirm if the donor received anything in return.

- Authorized Signature: A representative’s signature for validation.

Formatting Tips for Clarity

- Use a clean, easy-to-read layout with section headings.

- Ensure all financial details are accurate to comply with tax regulations.

- Include the organization’s contact details for any follow-up inquiries.

- Provide a digital or printed version for donor records.

A well-prepared receipt builds trust with contributors and simplifies record-keeping for tax purposes. Keep the format consistent to streamline the process for future events.

Key Elements to Include in a Receipt

List the donor’s name and contact details to ensure accurate record-keeping. Include the organization’s full name, address, and tax identification number for legitimacy.

Specify the donation date and a clear description of the item or service contributed. If it’s a tangible item, mention its condition and estimated value. For monetary gifts, state the exact amount.

Confirm whether the donor received anything in return, such as event tickets or goods. If applicable, note the fair market value of these benefits.

Add a statement verifying the organization’s tax-exempt status. Conclude with a signature or official contact to validate authenticity.

Legal Considerations for Donation Receipts

Include the donor’s full details. The receipt must clearly state the donor’s name and address to ensure proper documentation for tax purposes.

Specify the donation amount or item description. For monetary gifts, list the exact amount. For non-cash donations, describe the item and avoid assigning a value–this is the donor’s responsibility.

Confirm tax-exempt status. Clearly state that the organization is a registered nonprofit and eligible to receive tax-deductible contributions under applicable laws.

Include the donation date. This is essential for tax reporting. The receipt should reflect when the contribution was made, not when it was processed.

Acknowledge non-compensation. If the donor did not receive goods or services in exchange, include a statement confirming that no benefits were provided. If something was given in return, describe it and specify its fair market value.

Follow jurisdictional requirements. Regulations vary, so ensure compliance with local and national tax laws. When in doubt, consult a tax professional.

How to Format and Customize a Receipt

Ensure your receipt is clear and professional by organizing it logically. Begin with the title at the top, such as “Donation Receipt” or “Auction Receipt.” This helps the recipient immediately recognize the purpose of the document. Below the title, include the name and contact details of your organization for easy reference.

Include Donor and Donation Information

List the donor’s full name, address, and contact information. Clearly state the date and the amount of the donation. If the donation consists of multiple items, break them down with a brief description, including the value of each item, if applicable.

Specify Donation Details

Clearly mention whether the donation was monetary or a non-cash item. If non-cash, describe the items in detail. If the donation is non-monetary, include the appraised value for tax purposes. Avoid vague descriptions; provide specifics to avoid confusion later.

Conclude the receipt by including a thank-you note for the donor’s contribution. This adds a personal touch and reinforces the importance of their support.