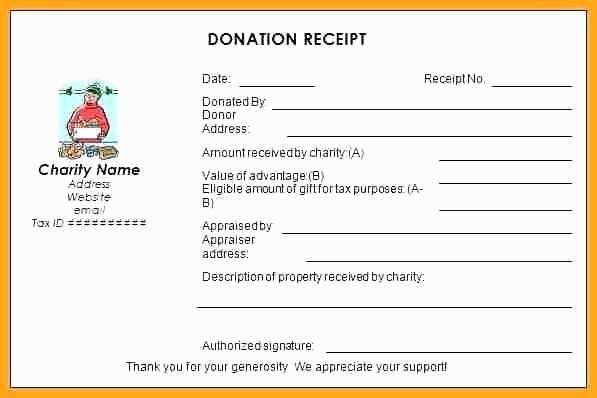

If you need a QuickBooks donation receipt template, choose one that simplifies the tracking and reporting of charitable contributions. A reliable template helps you capture donor information and ensures compliance with tax regulations. Look for a layout that clearly distinguishes between donor details, donation amount, and the non-deductible portion of the gift, if applicable.

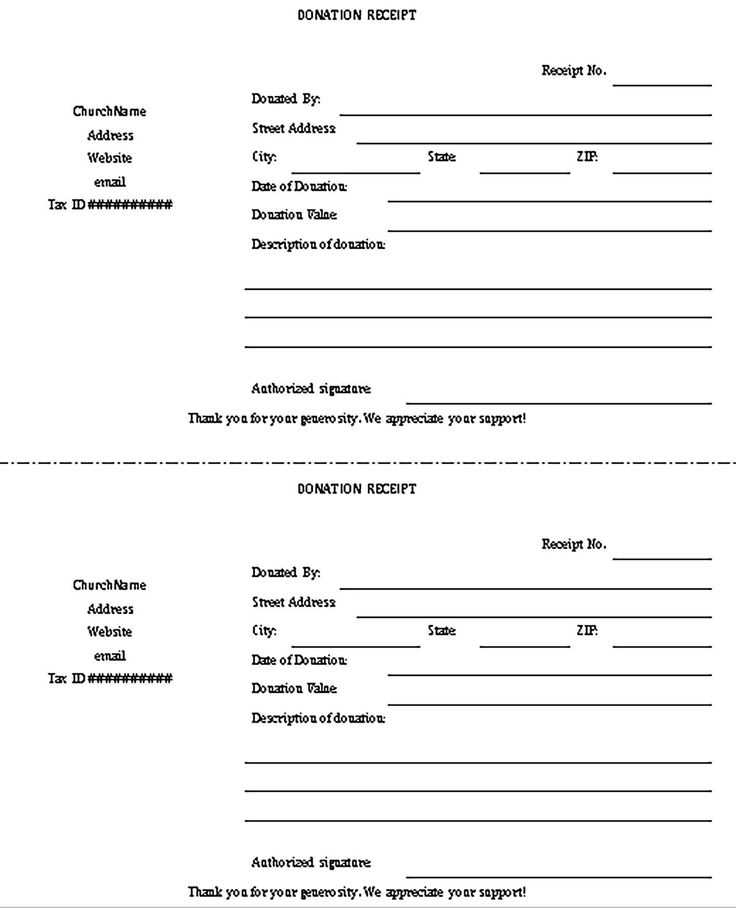

Make sure the template includes all required information such as the donor’s name, donation date, and a description of the items or services donated. It’s helpful to add a section for your organization’s contact details and a statement confirming no goods or services were provided in exchange for the donation.

Choose a template that is easily customizable to match your organization’s style and preferences. A clean, organized design will not only look professional but also make it easier for donors to retain their receipts for tax purposes.

Here’s the Corrected Version:

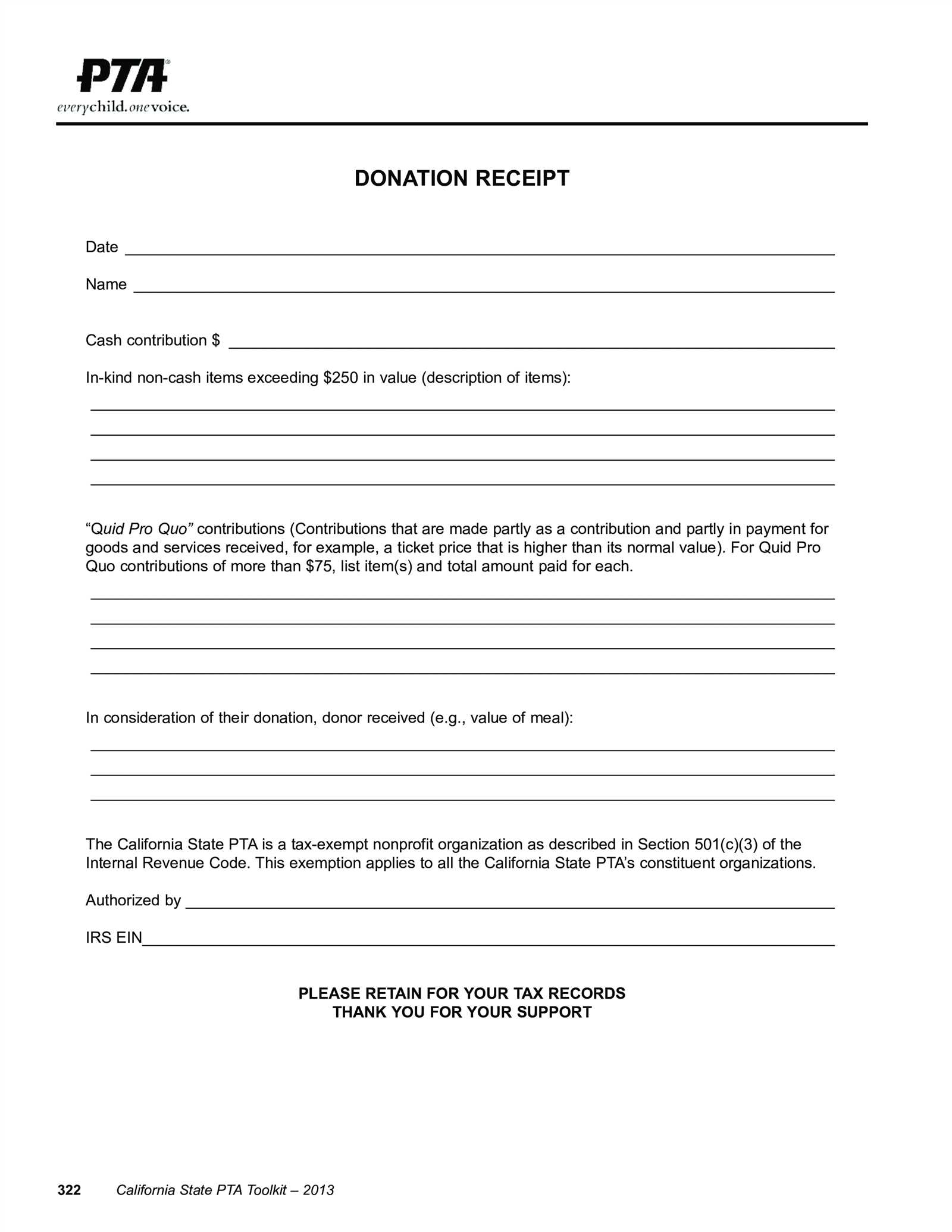

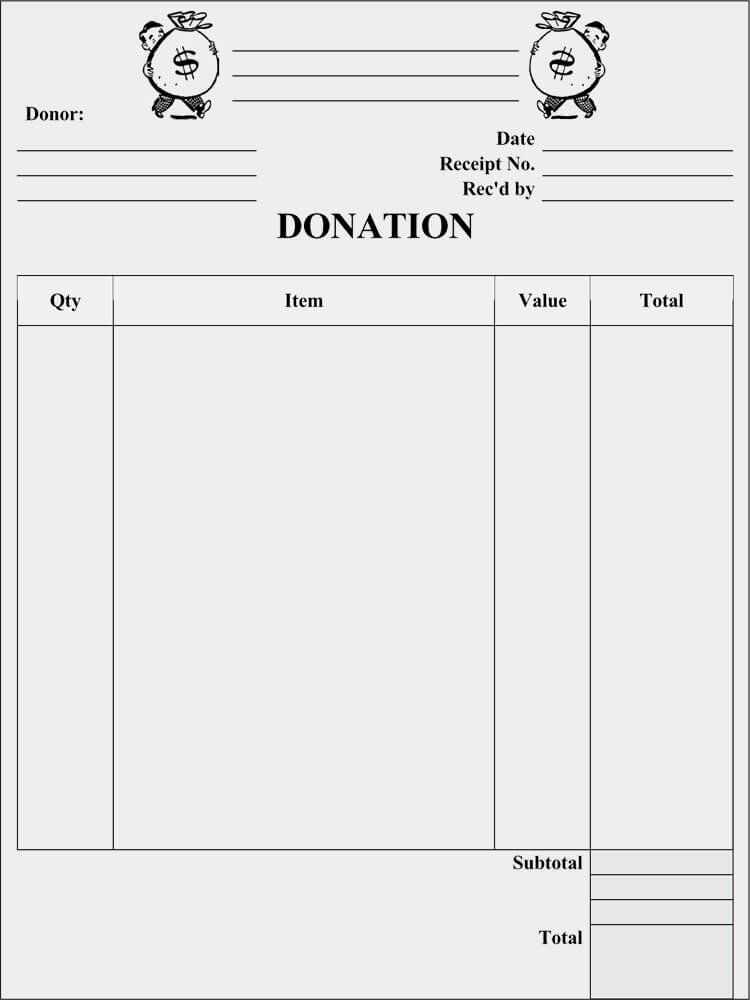

When creating a donation receipt in QuickBooks, it’s crucial to ensure the template includes all the required information for tax purposes. Focus on clarity and accuracy to avoid errors. Start with the donor’s name and contact details at the top. Next, include the donation amount and specify whether the donation was cash or an in-kind contribution. For in-kind donations, list the items donated along with their estimated value. Don’t forget to mention if any goods or services were provided in exchange for the donation, as this affects the tax-deductible amount.

Donation Receipt Date

Be sure to include the date of the donation. This is necessary for record-keeping and can be useful for year-end tax filings. A clear, visible date will help you stay organized and avoid any confusion later.

Tax-Exempt Status Information

If your organization is tax-exempt, add your exemption status and any relevant IRS identification numbers. This assures the donor that their contribution is eligible for tax deductions.

Best QuickBooks Donation Receipt Template

How to Personalize a Donation Receipt in QuickBooks

Essential Details to Include in a Donation Receipt

Common Errors to Avoid When Using QuickBooks Receipts

QuickBooks offers customizable donation receipt templates designed to meet the needs of nonprofits. Start by selecting a basic template from the software and adjust it to match your organization’s branding. You can add your logo, adjust fonts, and choose a layout that fits your style. Customizing these details makes your receipts look more professional and ensures they align with your nonprofit’s image.

How to Personalize a Donation Receipt in QuickBooks

Personalizing a receipt in QuickBooks is simple. Go to the ‘Sales Receipt’ section, then choose ‘Customize’ to adjust the template. Add relevant details such as your nonprofit’s name, contact information, and any legal disclaimers. It’s also a good idea to include a thank-you message or note of appreciation to make the donor feel valued. Make sure the receipt looks neat and professional, reflecting the care your organization puts into its work.

Essential Details to Include in a Donation Receipt

Every donation receipt should include the donor’s name, the donation amount, and the date. Additionally, clarify whether the donation is a cash or non-cash contribution, as required by the IRS. If the donation is non-cash, provide a description of the item donated. For donations over $250, include a statement confirming whether anything of value was provided in return. These are key details to ensure the receipt is both accurate and legally compliant.

Lastly, add your nonprofit’s tax-exempt status number. This confirms to the donor that the contribution is tax-deductible and provides them with necessary information for filing their tax return.

Common Errors to Avoid When Using QuickBooks Receipts

One common mistake is failing to accurately categorize the donation type. Always ensure the donation is correctly classified as either a cash or non-cash contribution. Another error is not providing enough detail for non-cash donations, which could lead to confusion during tax filing. Lastly, avoid generic or vague wording in your receipts. Being clear and specific about donation amounts, dates, and items helps both you and your donors maintain accurate records.