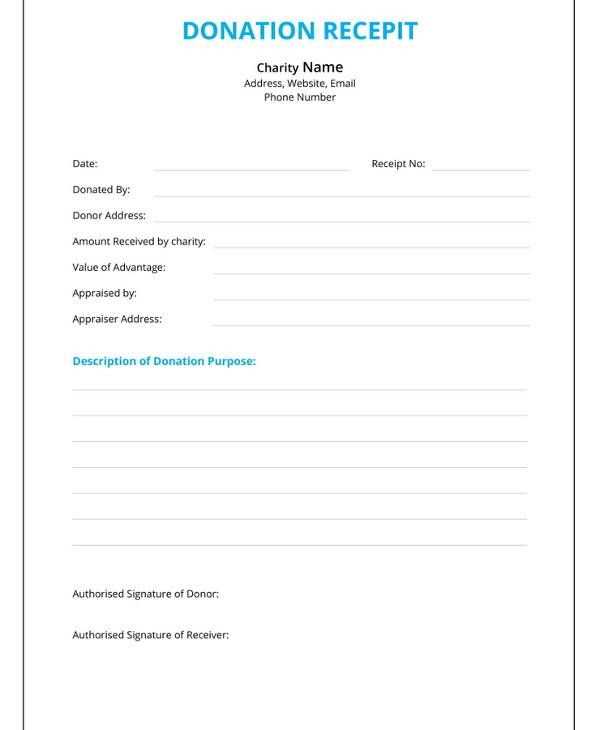

Creating a blank donation receipt template is a simple and practical step for any nonprofit organization. This template serves as a clear and organized way to acknowledge the donations you receive, while ensuring that all necessary details are captured for tax purposes.

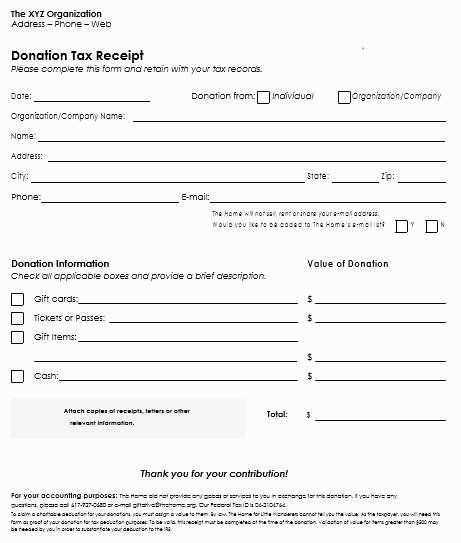

A good template should include key information such as the donor’s name, the donation amount, the date of donation, and a brief description of the item donated. Make sure to include space for your organization’s name and contact information, as well as a statement confirming that the donor did not receive any goods or services in exchange for the donation.

Use a straightforward layout for easy customization. This allows you to quickly generate receipts for each donor without missing any required details. A blank donation receipt template is a time-saver and helps keep your records neat and accurate.

How can I assist with your ongoing articles or any new content you’re working on?

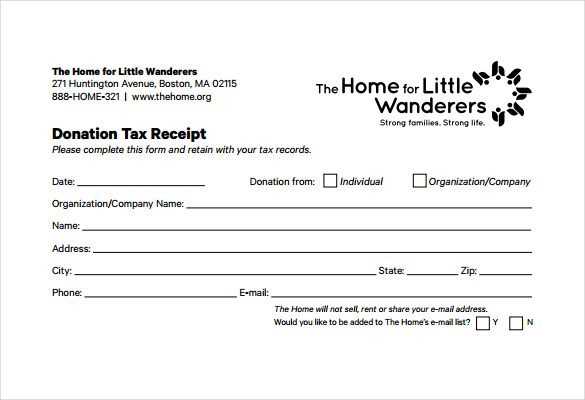

Customizing a Blank Donation Receipt for Different Types of Donations

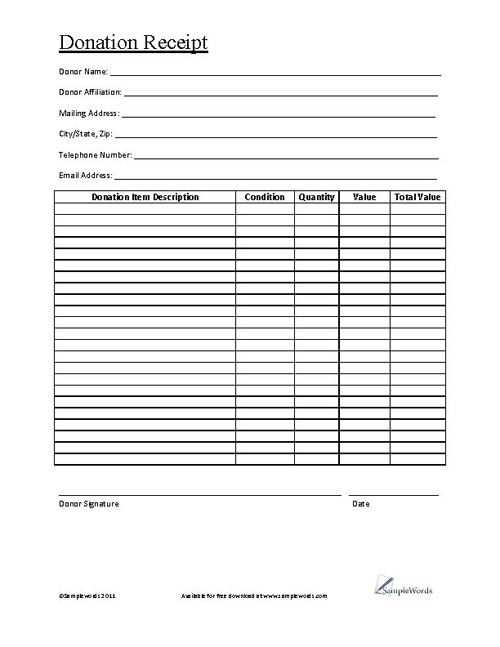

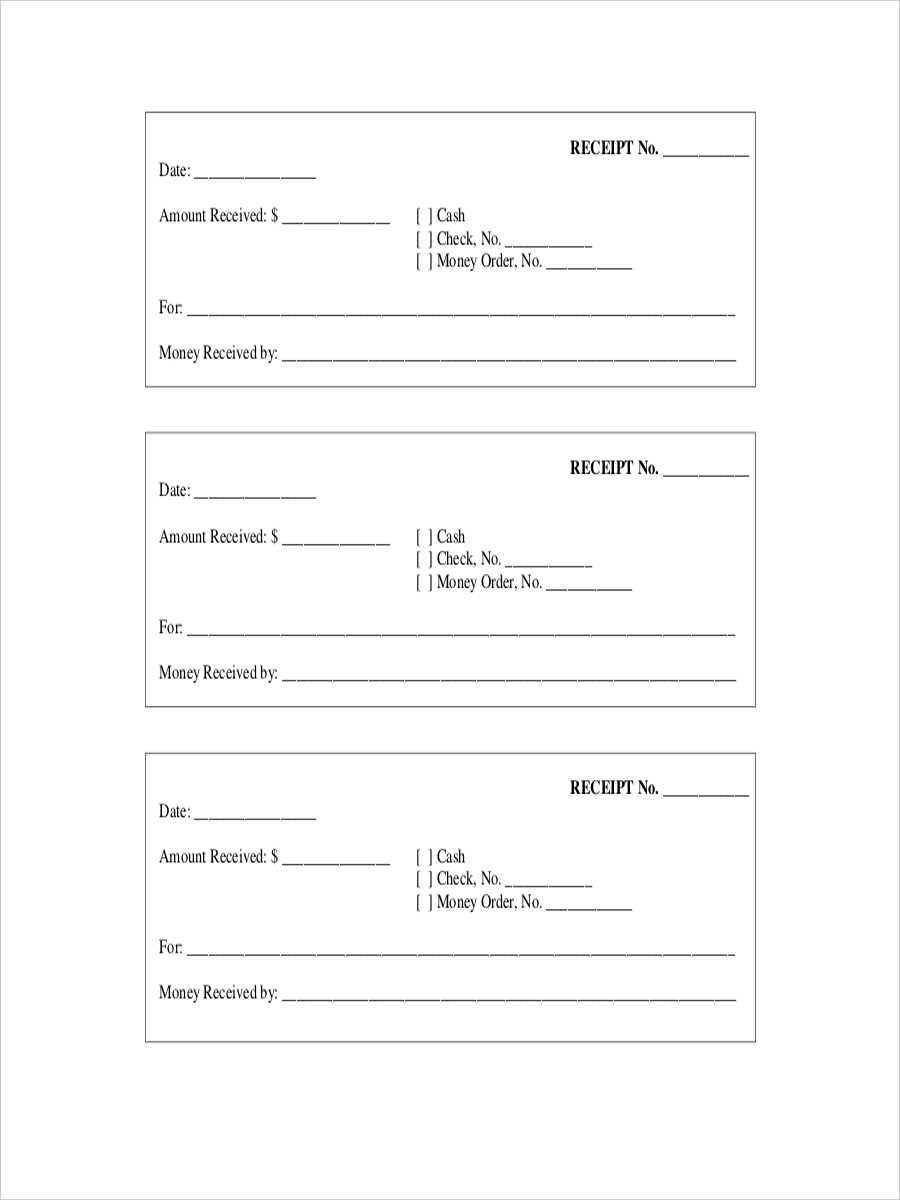

Tailor the receipt based on the type of donation to ensure accuracy. For monetary donations, include the donation amount in both figures and words. Add a note about whether the donation is tax-deductible. For in-kind donations, describe the donated item, its condition, and estimated value. If donations are for specific programs or events, reference those purposes directly on the receipt.

When handling recurring donations, specify the frequency of donations, such as monthly or annually. This is important for both tracking and tax purposes. For memorial or tribute donations, include the name of the person or cause the donation honors.

For non-monetary gifts, such as volunteer hours, include the number of hours volunteered, and make clear whether the organization assigns a monetary value to those hours. Always ensure that the receipt contains a clear statement about the nonprofit’s tax-exempt status and the IRS requirements for documentation.

Legal Requirements and Key Information to Include in a Donation Receipt

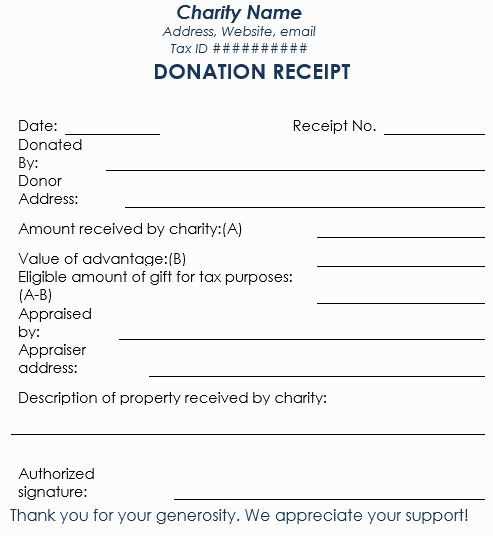

A donation receipt must include specific details to comply with legal standards and ensure the donor can claim deductions on taxes. Here are the key elements to include:

- Donor Information: Full name and address of the donor.

- Charity Information: The charity’s legal name, address, and tax-exempt status, including its EIN (Employer Identification Number).

- Donation Date: The exact date the donation was made.

- Donation Amount: Clearly state the amount donated, or a description of non-monetary donations, including their estimated value.

- Statement of No Goods or Services: Include a statement confirming whether any goods or services were provided in exchange for the donation. If applicable, describe the goods or services and their fair market value.

- Tax-Exempt Status: A note that the organization is a tax-exempt entity under IRS section 501(c)(3), or relevant local tax codes, which is necessary for donors to claim deductions.

Ensure that these components are included in every receipt issued. This will help donors meet their tax obligations and also guarantee compliance with relevant laws and regulations.

How to Provide Donors with Proper Acknowledgment and Records

Provide donors with clear, accurate receipts immediately after they contribute. This allows them to keep track of their donation for tax purposes. Include the donor’s name, donation date, amount, and a statement that no goods or services were exchanged for the contribution, if applicable.

Offer an easy-to-understand receipt template that includes all the required details. For example, a typical format should include the donation amount, donor information, and the purpose of the donation. If the donation was made in kind, specify the item’s value or a description of the goods received.

Follow up with a thank-you note that acknowledges the donation and reaffirms the receipt’s information. Be sure the note is personal and shows appreciation for the donor’s generosity. A well-crafted acknowledgment can enhance donor relationships and encourage future giving.

Keep accurate records of all donations. A database or donor management system helps ensure details are tracked properly and in compliance with tax laws. It also allows for quick access to donor history if needed.

Ensure the acknowledgment process complies with tax laws in your area. Donors should receive a receipt for any donation exceeding a specified threshold, typically set by the IRS for U.S. donations or local tax regulations elsewhere.