For nonprofit organizations operating in California, a clear and concise donation receipt is critical for both compliance and donor satisfaction. It ensures that donors have the proper documentation for tax deductions while providing the necessary transparency for your organization. A California donation receipt should include specific information as required by state law to remain valid for tax purposes.

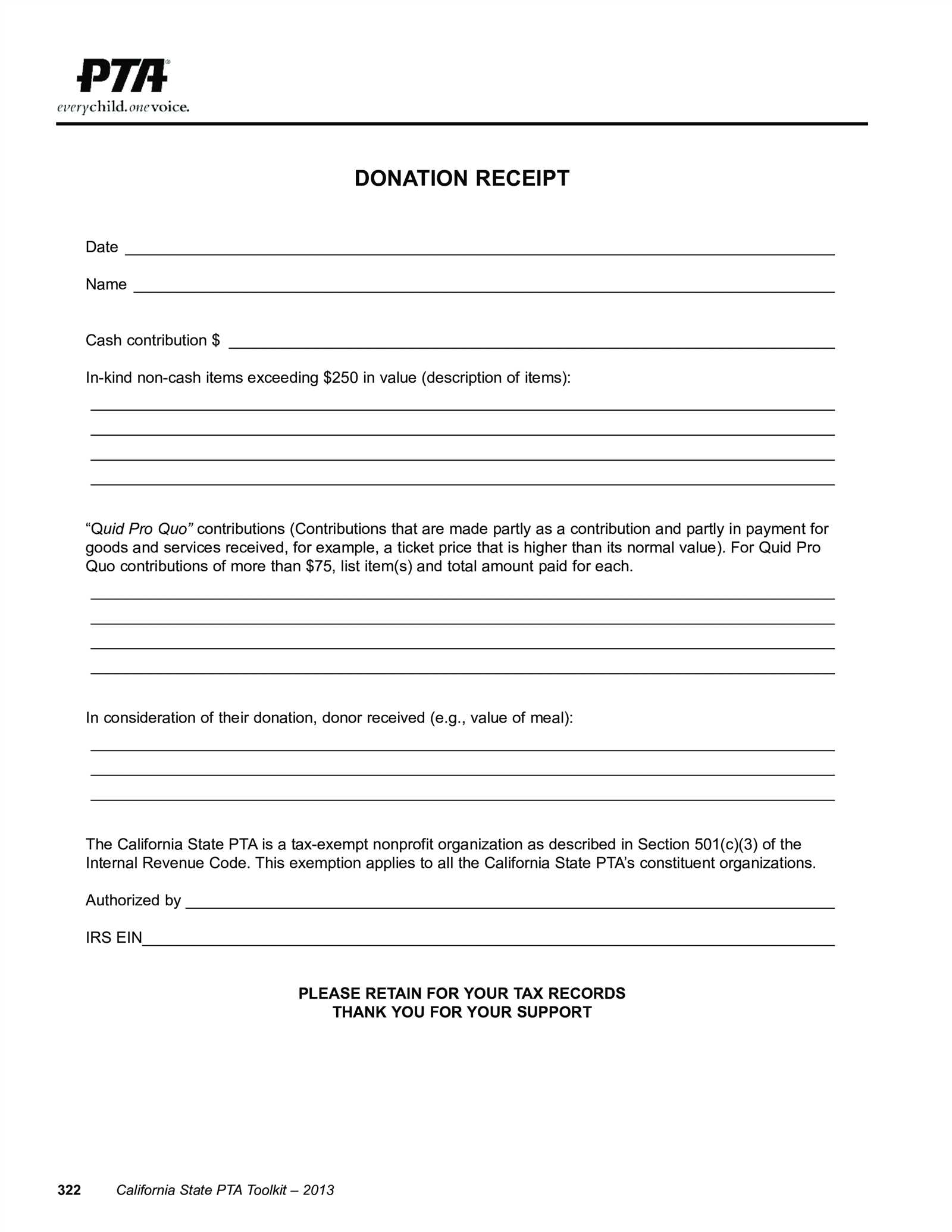

The receipt must clearly identify the name of the organization, its tax-exempt status, and the donor’s information along with a detailed list of items donated (if applicable). It should also specify whether the donation was a cash or non-cash contribution, and if the donor received any goods or services in exchange for their contribution. For non-cash donations over $500, you must also include a description of the property and the date it was received.

It’s important to remember that your donation receipt template should be simple and easy to customize, making it easy for your team to issue receipts promptly. Ensure your template complies with both state and federal regulations, and always double-check the format for consistency with IRS requirements for tax deductions.

Here’s the revised text with minimized repetition:

When preparing a donation receipt in California, ensure it includes the donor’s name, the donation date, and a detailed description of the items or services received. Include a statement confirming whether any goods or services were provided in exchange for the donation. If no benefits were received, specify this clearly to make the receipt compliant with tax laws.

For cash donations, note the exact amount given. For non-cash donations, provide a reasonable estimate of the value. If the donation exceeds $250, include a written acknowledgment from the recipient organization stating that no goods or services were exchanged. This will make it easier for the donor to claim their tax deduction.

It’s also useful to mention the nonprofit’s name and tax-exempt status, including its federal tax ID number. Keep the language clear, concise, and specific to avoid ambiguity. Make sure to issue the receipt promptly after receiving the donation to maintain good recordkeeping practices.

- California Donation Receipt Template: A Practical Guide

A donation receipt in California must meet specific requirements to comply with state tax laws. These receipts are necessary for donors who wish to claim tax deductions. Make sure your template includes the following key details:

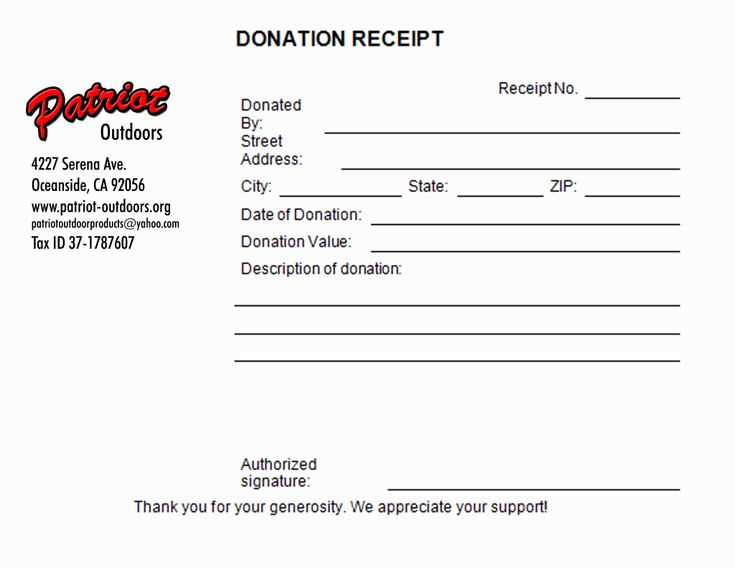

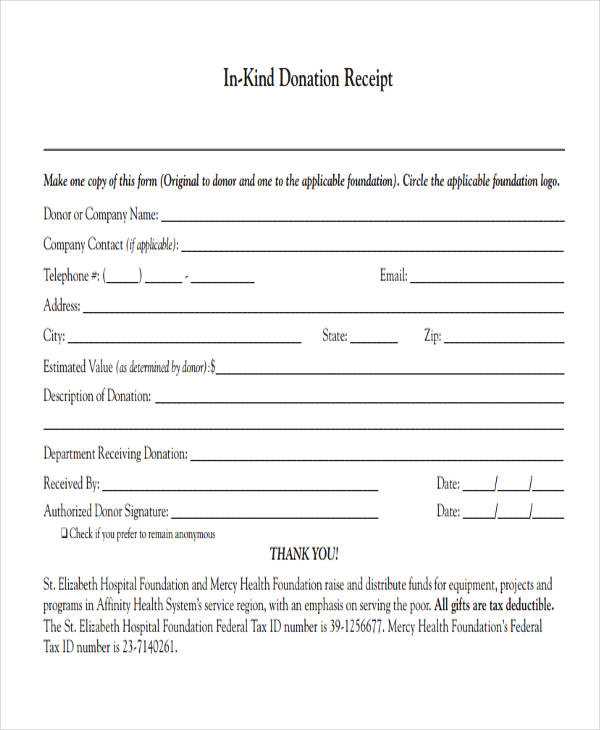

1. Organization Information: Clearly state the name of your nonprofit organization, address, and tax-exempt status (e.g., 501(c)(3) designation). This confirms the donor is contributing to a legitimate entity.

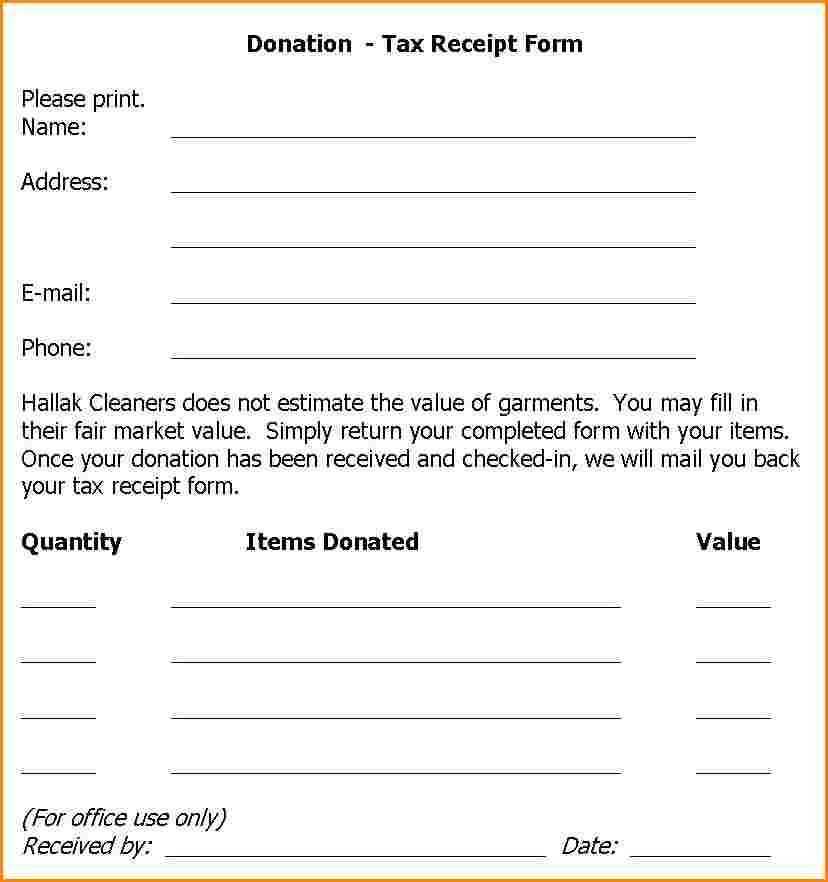

2. Donor Information: Include the full name and address of the donor. This is vital for record-keeping and for the donor to claim tax benefits.

3. Description of the Donation: Describe the donated items or monetary amount. For non-cash donations, a brief description of the items should suffice, though it is important not to assign a value to the donated goods (donors should determine the value themselves).

4. Date of Donation: Clearly indicate the date on which the donation was made. This is important for tracking donations within the correct tax year.

5. Value of Non-Cash Donations: If the donation is non-cash (e.g., items or property), provide a statement that the donor is responsible for determining the fair market value. Include a reminder that the IRS requires a qualified appraisal for any donation over $5,000 in value.

6. Tax Status Confirmation: Explicitly state that the organization is a tax-exempt entity under IRS regulations. Include a statement that no goods or services were provided in exchange for the donation, unless applicable (e.g., if the donor received something like event tickets or gifts).

7. Signature (Optional): While not required by law, some donors appreciate a signature or an authorized person’s title to validate the receipt. This adds professionalism to the receipt.

By ensuring these details are included, your California donation receipt template will meet legal requirements and help donors claim their deductions without issues.

For tax purposes in California, a donation receipt must contain specific details to be valid for deductions. Here’s what should be included:

- Organization’s Name and Address: Ensure the full legal name and address of the charitable organization are clearly listed.

- Date of Donation: Include the exact date the donation was made. This is important for taxpayers to claim deductions in the correct tax year.

- Amount of Cash Donation: Clearly state the amount of money donated. For monetary gifts, this should be the exact dollar amount.

- Description of Non-Cash Donations: For item donations, provide a brief description of the goods. Do not assign a value–donors are responsible for determining the value of non-cash contributions.

- Statement of No Goods or Services Received: If the donation was purely a gift with no exchange of goods or services, include a statement such as, “No goods or services were provided in exchange for this donation.” If there were goods or services received, specify their value.

- Tax-Exempt Status of the Organization: Include the organization’s IRS 501(c)(3) status, which confirms its eligibility to receive tax-deductible donations.

- Signature of an Authorized Person: The receipt should be signed by an authorized representative of the charity to validate the donation.

Including these details ensures the receipt is compliant with California tax laws and supports the donor’s ability to claim deductions on their state and federal tax returns.

In California, nonprofits must comply with specific rules when issuing donation receipts. These requirements ensure transparency and help donors with tax deductions. To stay in compliance, a donation receipt should include the following key details:

| Required Information | Description |

|---|---|

| Nonprofit Name and Tax ID | The receipt must clearly display the nonprofit’s legal name and IRS Employer Identification Number (EIN) or California tax-exempt number. |

| Donor’s Name | The receipt must include the full name of the donor for accurate records and verification. |

| Date of Donation | The specific date the donation was made should be noted to determine the applicable tax year. |

| Donation Amount or Description | If the donation is a cash gift, the exact amount should be listed. For non-cash donations, a description of the items donated, including their condition, is necessary. |

| Non-cash Donations Valuation | If a donor contributes non-cash items, the organization should not appraise the value but may offer a statement that the donor is responsible for valuation for tax purposes. |

| Statement of Goods or Services Provided | If the donor receives anything of value in return (like tickets to an event), the receipt must state that the donor’s contribution is tax-deductible only for the amount exceeding the value of those goods or services. |

For donations over $250, the IRS requires more detailed information. A specific acknowledgment letter must be sent, detailing whether goods or services were provided, and if so, their fair market value. Donors should retain a copy for their tax filings.

California law mandates these details to ensure accuracy in reporting donations and to support both the donor’s and nonprofit’s tax filing processes. Noncompliance can lead to issues with tax deductions for donors and potential legal trouble for nonprofits.

Use clear and concise language. Start with the name of your organization and its address, followed by the donor’s name and address. Include the date of the donation and the donation amount, making sure to specify whether it was cash or an in-kind gift. Clearly state that no goods or services were provided in exchange for the donation, unless something was given, in which case, you must specify the fair market value of the item(s) provided.

Organize the receipt with distinct sections for each piece of information. For example, list the donor’s name and address in one section, donation details in another, and your organization’s information in a third. This separation keeps the document easy to read. Make sure the receipt is formatted neatly and is easy to follow, avoiding long paragraphs or overly dense information.

Always include your organization’s tax identification number (TIN) to ensure compliance with IRS requirements. If the donation involves goods or services, you need to give a detailed description of the items, along with their estimated fair market value. If you offer any acknowledgment for the donation, make sure this is clearly stated as well.

End with a brief statement confirming that the donation is tax-deductible, as long as the donor does not receive anything of significant value in return. Keep the receipt simple, but make sure all required information is present. Lastly, sign or have someone from your organization sign the receipt to validate it.

Ensure you include the correct donation amount. A common mistake is omitting the total value of the contribution or listing it incorrectly. This can lead to confusion for both the donor and the IRS during tax filing. Always double-check the figures before issuing a receipt.

Avoid vague descriptions of the donation. Specific details about the items donated, such as the condition and quantity, should be clear. For cash donations, note the exact amount given. If the donation includes goods, list each item separately to comply with IRS guidelines.

Don’t forget to include the organization’s official name and address. Without this, the receipt may not be valid for tax purposes. The IRS requires this information for documentation of charitable contributions. Additionally, provide the organization’s EIN (Employer Identification Number) to ensure legitimacy.

Issue the receipt at the time of the donation, not later. Delaying receipts can cause confusion for both the donor and your organization. The receipt should reflect the donation date accurately to align with the donor’s tax filing period.

Double-check that the receipt includes a statement that no goods or services were provided in exchange for the donation, especially for donations above a certain value. If something was received in return, such as a raffle ticket or event entry, clearly indicate this on the receipt and reduce the deductible amount accordingly.

Finally, always provide receipts for all donations. Even small amounts should be documented. Donors need a proper record for tax deductions, and failing to issue receipts for even minor donations can create complications for both your organization and the donor.

Non-cash contributions must be clearly documented in your receipt. Follow these steps to ensure accurate reporting:

- Describe the donated item(s): List each item or category of items donated. For example, if someone donates clothing, specify the type and quantity, such as “10 shirts, 5 jackets.”

- Assign a reasonable value: The IRS does not require you to assign a dollar value to non-cash donations, but you must provide a reasonable estimate. If possible, refer to fair market value guidelines or consult with an appraiser for high-value items.

- Include a disclaimer for non-cash donations: Add a statement clarifying that the donor is responsible for determining the fair market value of the items. For instance, “The charity does not provide an appraisal of the donated items.”

- State the condition of the items: Mention the condition of the donated items, whether new, gently used, or well-worn. This helps establish the credibility of the reported value.

- Provide a receipt number: Include a unique identifier for tracking donations, especially if you handle large volumes of contributions.

- Ask for a description from the donor: It’s useful to have the donor provide a list of donated items or a value estimate in writing. This helps you verify the donation if necessary.

By following these steps, your receipt will accurately reflect non-cash donations, which helps both the donor and the organization stay compliant with IRS guidelines.

Issue a receipt immediately after receiving a donation, especially for cash or check transactions. If the donation is made online, provide the receipt as soon as the payment is processed. Timeliness is key to maintaining accurate records for both your organization and the donor.

For Single Donations

For one-time donations, send a receipt within 24-48 hours. This ensures donors have a clear record for tax purposes and shows prompt acknowledgment of their support.

For Ongoing Donations

In the case of recurring donations, issue receipts either annually or immediately after each donation, depending on the donor’s preference. If issuing annual receipts, ensure they reflect the total contributions made over the year, including the date and amount of each donation.

Keeping these timelines helps maintain transparency and strengthens donor trust, ensuring compliance with legal standards while providing a positive donor experience.

Donation Receipt Template for California

To ensure your donation receipts comply with California laws, include the following key elements:

- Donor Information: Include the donor’s full name and address. This allows the donor to claim tax deductions.

- Organization Details: Clearly state your nonprofit’s legal name, address, and tax ID number (EIN). This ensures transparency.

- Donation Information: Specify the donation date, the amount (for cash donations), or a description of donated property. For non-cash donations, include an estimated value.

- No Goods or Services Provided: If the donation was fully tax-deductible, include a statement confirming that no goods or services were provided in exchange for the donation.

- Fair Market Value: For donations of goods, state the fair market value if the donor has received goods or services, such as tickets or a meal.

- Signature: Include the signature of an authorized representative to validate the receipt.

Ensure all sections are accurate and clearly presented. Double-check for any necessary disclosures to meet California’s legal requirements.