When creating a campaign donation receipt, provide clear details for both the donor and the campaign. Include the donor’s name, the amount donated, the date of the contribution, and the campaign’s name or identification number. This transparency ensures compliance with legal requirements and promotes trust with your supporters.

Make the donation amount easy to read by clearly stating whether the donation is a monetary amount or in-kind contribution. This helps prevent confusion and guarantees that all parties are aligned on the donation’s value. If possible, break down the total amount if it includes multiple donations.

Indicate the donor’s status–for example, whether they are an individual or a business. This helps distinguish between different types of donations and simplifies tax filings. Be sure to include any necessary disclaimers regarding non-tax-deductibility if the campaign does not meet those criteria.

Lastly, provide a contact number or email address in case the donor needs clarification. Ensure the receipt is dated and includes an official signature or electronic validation to finalize the documentation.

Campaign Donation Receipt Template

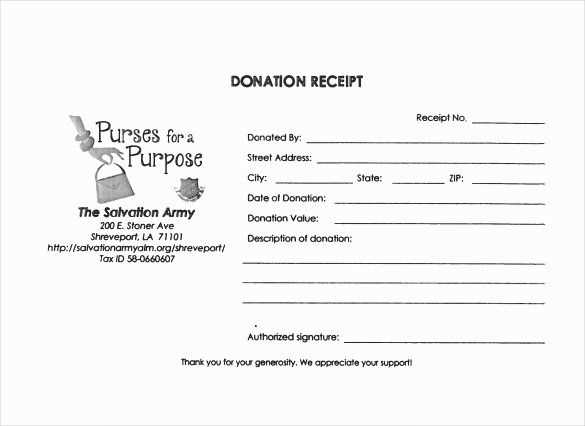

A campaign donation receipt must include specific details to comply with tax regulations and provide transparency to donors. Here’s what to include in your template:

- Campaign Name: Clearly state the name of the campaign receiving the donation.

- Donor Information: Include the donor’s full name and address.

- Donation Amount: Specify the total amount of the donation, along with the currency if applicable.

- Date of Donation: Include the exact date the donation was received.

- Donation Method: Indicate how the donation was made (e.g., cash, check, online transfer).

- Tax-Exempt Status: If applicable, include a statement confirming the campaign’s tax-exempt status, which qualifies the donation for a tax deduction.

- Campaign Representative: Add the signature or name of the campaign representative who issued the receipt.

This template helps to ensure compliance and keeps your donors informed. Personalize it based on your campaign’s specific requirements, but keep all necessary information intact to avoid any confusion or legal issues.

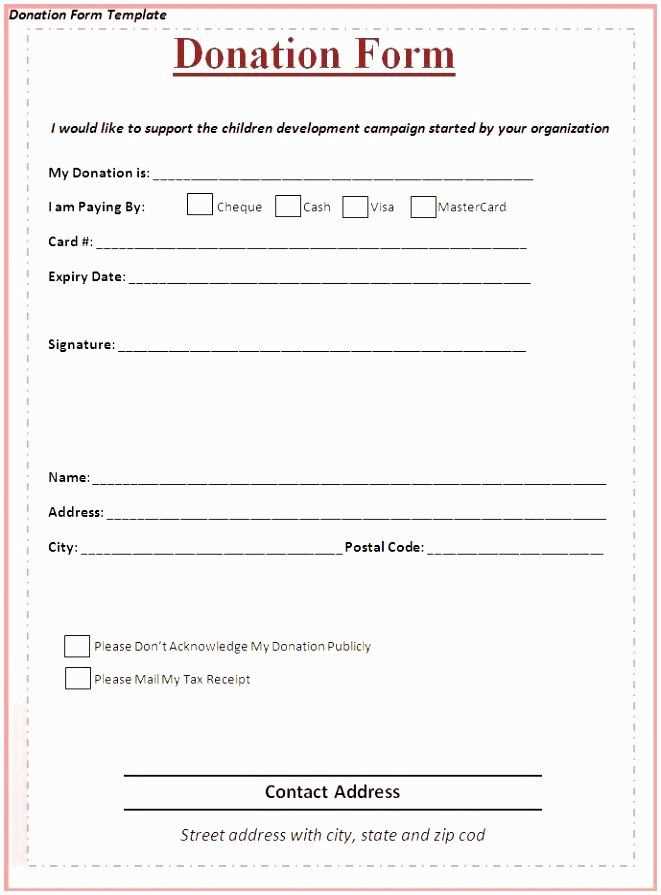

How to Design a Legally Compliant Receipt Template

Ensure your receipt template includes key details such as the donor’s name, the amount donated, and the date of the donation. This provides clear documentation for both the donor and the campaign, helping with transparency and accountability.

Include the campaign’s legal name, tax identification number, and the official status of the donation (e.g., whether it’s a gift or a contribution subject to limits). This keeps the receipt in line with legal requirements for charitable donations.

Add a disclaimer about whether the donation is tax-deductible, depending on the campaign’s status. If the donation is not deductible, state that clearly on the receipt to avoid confusion.

Make sure the receipt clearly mentions any limits or rules around donation amounts, ensuring donors are aware of contribution caps where applicable. This helps prevent violations of donation limits under election law.

Lastly, include a space for an authorized signature or the campaign treasurer’s name to authenticate the receipt. This provides validation and ensures compliance with regulatory standards.

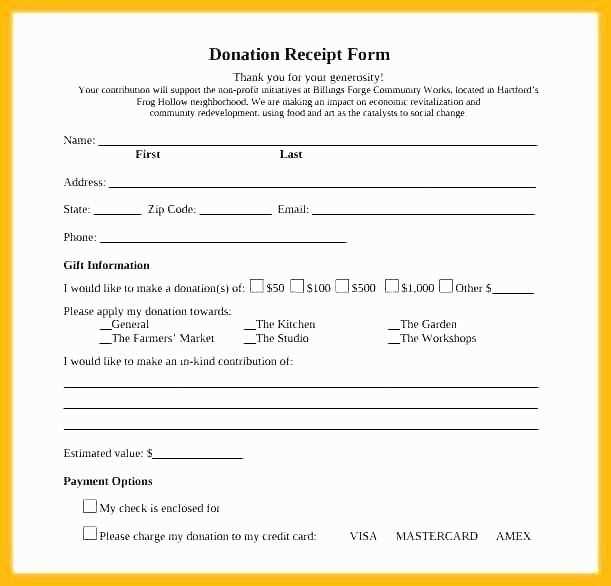

Key Elements to Include in a Donation Receipt

Include the donor’s full name and address at the top of the receipt. This helps verify their identity and ensures proper record-keeping for tax purposes.

Clearly state the donation amount. Specify whether it’s a cash donation, check, or in-kind contribution, and include the exact value of any non-cash donations. If applicable, mention the fair market value of the donated goods.

Note the date of the donation to keep track of when the contribution occurred. This is important for both the donor’s tax records and your organization’s accounting.

Provide the name of your organization along with its tax-exempt status. This assures donors that the contribution is tax-deductible, which is often a key factor in their decision to donate.

Include a statement that no goods or services were provided in exchange for the donation. If something was given in return, such as a thank-you gift, clearly state the value of that gift, so the donor can determine how much of the donation is tax-deductible.

Include your organization’s contact information, including address, phone number, and email. This allows the donor to reach you for any follow-up or inquiries.

End with a thank-you message to show appreciation for the donor’s contribution. A personal touch helps maintain a positive relationship and encourages future support.

Best Practices for Distributing Donation Receipts

Distribute donation receipts as soon as possible after receiving a contribution. This helps ensure donors have the documentation they need for tax purposes while their donation is still fresh in their minds.

Send Receipts via Multiple Channels

Offer receipts through both email and postal mail. Some donors may prefer physical copies, while others may appreciate the speed and convenience of digital receipts. Make sure the format is clear, professional, and easy to print if needed.

Include Clear and Concise Information

Provide all the necessary details in the receipt: the donor’s name, the amount donated, the date of the contribution, and any other information required by tax authorities. Avoid unnecessary jargon, keeping the language simple and transparent.

Ensure the receipt reflects your organization’s name and contact details. This gives donors a way to reach out if they have any questions or need further clarification.

Offer Special Considerations for Large Donations

For significant contributions, follow up with a personal note or additional acknowledgment. This creates a stronger connection and reinforces appreciation. Make sure large donors receive detailed receipts that align with their contribution’s value for proper tax treatment.

Maintain a Record of Receipts Sent

Keep track of every receipt distributed. This will help prevent mistakes and allow you to follow up with donors who may not have received their receipt. Record-keeping also ensures compliance with financial regulations.

Make the Process Seamless

Automate receipt distribution where possible. Many donation platforms allow you to set up automatic receipt generation, streamlining the process for both the donor and your organization. Automation can reduce human error and save time.