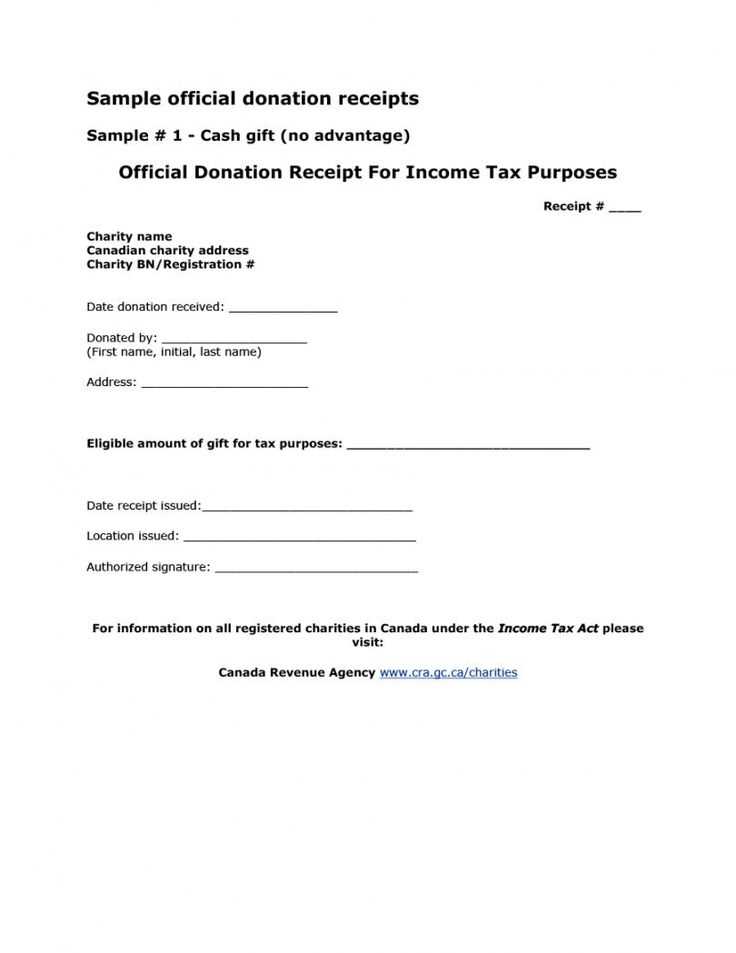

To create a proper Canadian charitable donation receipt, include the donor’s full name, address, and the exact amount donated. The receipt should also state the name of the registered charity and its charitable registration number. This ensures that both the donor and the charity are in compliance with Canadian tax laws.

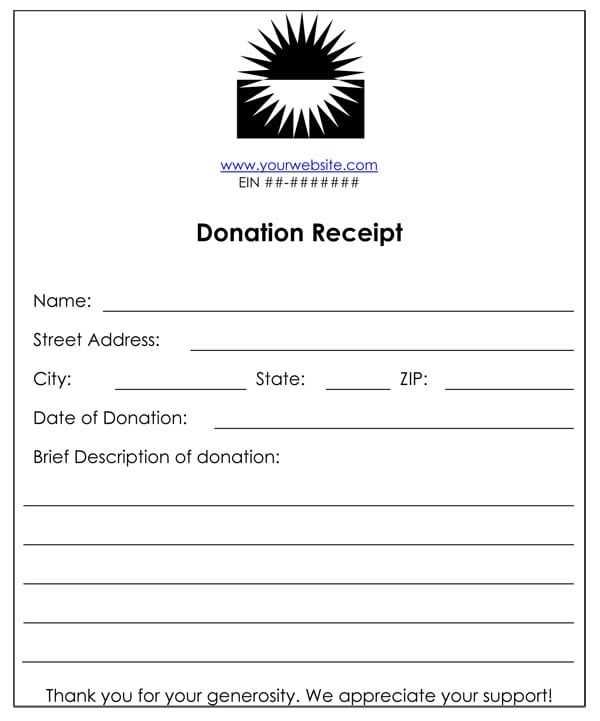

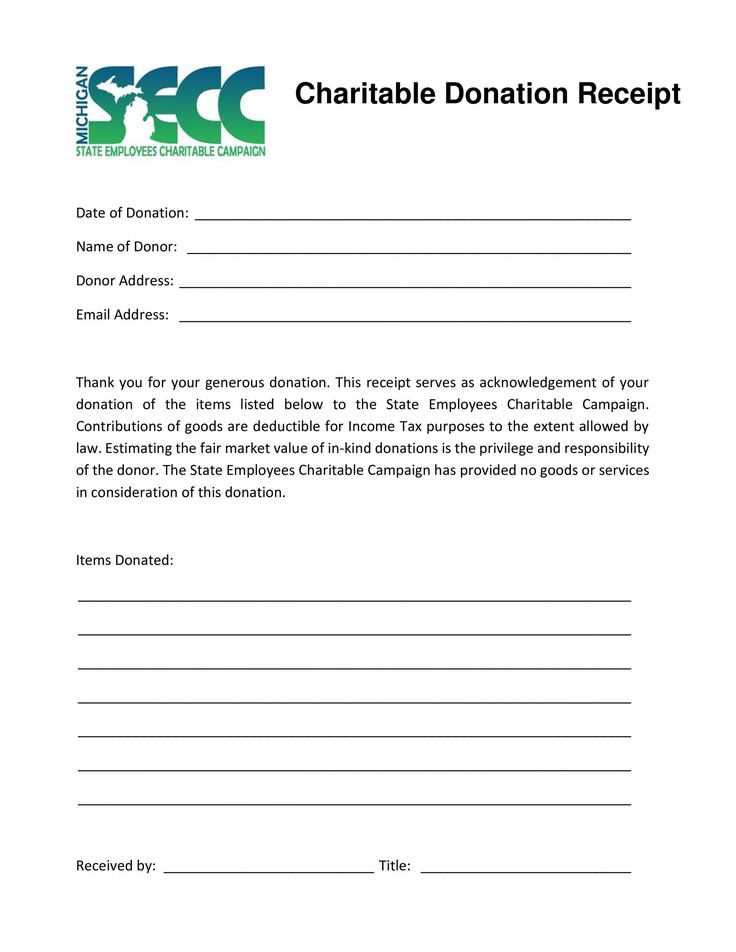

List of Required Information: The receipt must clearly indicate the donation’s value, the date it was received, and whether the donation was monetary or in-kind. For non-cash gifts, provide a description of the donated items. This is necessary to help the donor claim a tax deduction.

Tip: If the donation includes goods or services, make sure to mention the fair market value of any benefits received by the donor. This is especially important for larger donations, as it affects the amount that can be claimed for tax purposes.

Lastly, ensure the receipt is signed by an authorized individual from the charity. This signature verifies the authenticity of the document and provides the donor with the necessary proof for their tax filing. Keeping a digital or physical copy of the receipt is recommended for both the donor’s and the charity’s records.

Here’s the corrected version:

To create a valid Canadian charitable donation receipt, ensure it includes the following key components:

1. Organization Information

Start with the charity’s legal name, address, and registration number. This information must match the details on file with the Canada Revenue Agency (CRA). Missing or incorrect details can cause issues for donors during tax filing.

2. Donor Information

Clearly state the donor’s full name and address. This helps with proper documentation for tax purposes. If the donation is made by an individual or organization, their details must be accurate.

Next, provide a brief description of the donation, including the date and the amount (if it’s a monetary donation) or a detailed description for non-cash gifts. For non-cash donations, include the fair market value (FMV) at the time of the donation.

Ensure that the receipt is signed by a responsible person from the charity, and use a unique receipt number for easy tracking and reference.

Lastly, remember to mention that the donation is eligible for a tax credit and provide any additional instructions on how to claim it on tax returns. These elements help prevent any future complications for the donor or charity.

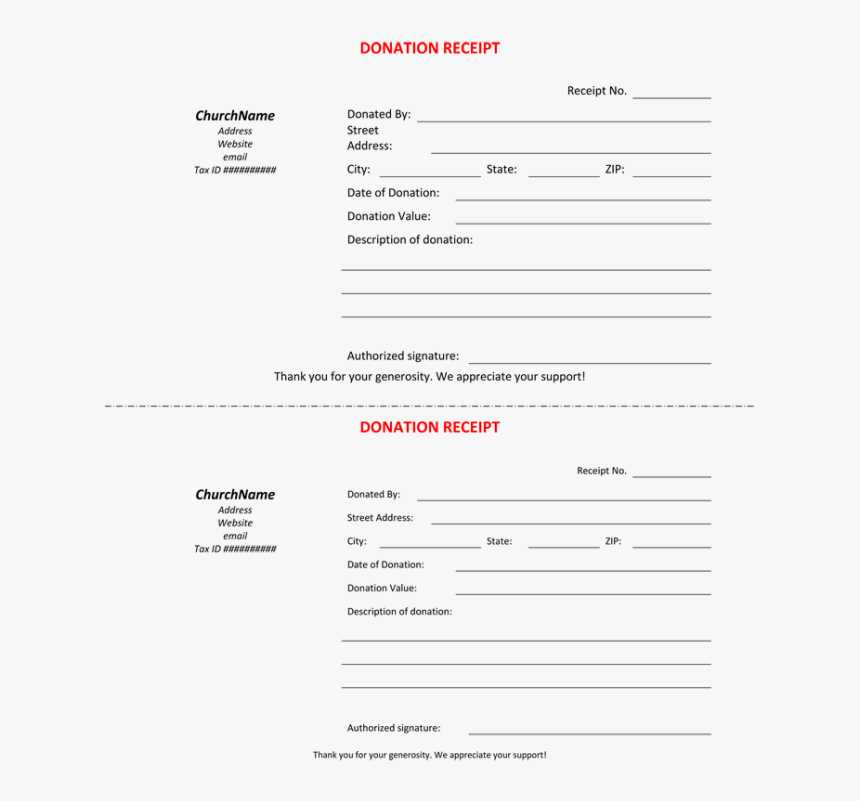

- Canadian Charitable Donation Receipt Template

A well-structured Canadian charitable donation receipt should include all the required details to ensure compliance with Canada Revenue Agency (CRA) guidelines. This receipt serves as proof of donation and is used by donors to claim tax deductions. Below is a list of mandatory elements that must appear on the receipt:

Key Elements of the Receipt

1. Official Name and Address of the Charity: The receipt must clearly display the charity’s name and address. This ensures the donation is linked to a recognized charitable organization.

2. Charity Registration Number: The registration number issued by the CRA is crucial for validation. Without it, the receipt may not be eligible for tax claims.

3. Date of Donation: The receipt must specify the exact date when the donation was made. If the donation was in-kind, the date should reflect when the item was received by the charity.

4. Amount Donated: Whether the donation is in cash, property, or securities, the receipt should clearly state the value of the donation. In-kind donations should be properly appraised for accurate reporting.

5. Official Receipt Number: Each receipt should have a unique identification number for record-keeping and tracking purposes.

6. Signature of an Authorized Person: A charity representative must sign the receipt. This adds legitimacy and confirms that the donation was accepted by the charity.

In-Kind Donations

If the donation includes goods or services, the receipt must reflect the fair market value of the items. The charity is not required to provide a receipt for the donor’s time or services, but any physical goods donated should be acknowledged properly. For example, if a donor gives a used car, the receipt should reflect the fair market value of the vehicle as determined by an independent appraisal.

In addition to the details above, always ensure the language used in the receipt is clear and precise to avoid any misunderstandings with the CRA. Having an accurate, compliant template ensures smooth handling of donations and tax filings for both the charity and its supporters.

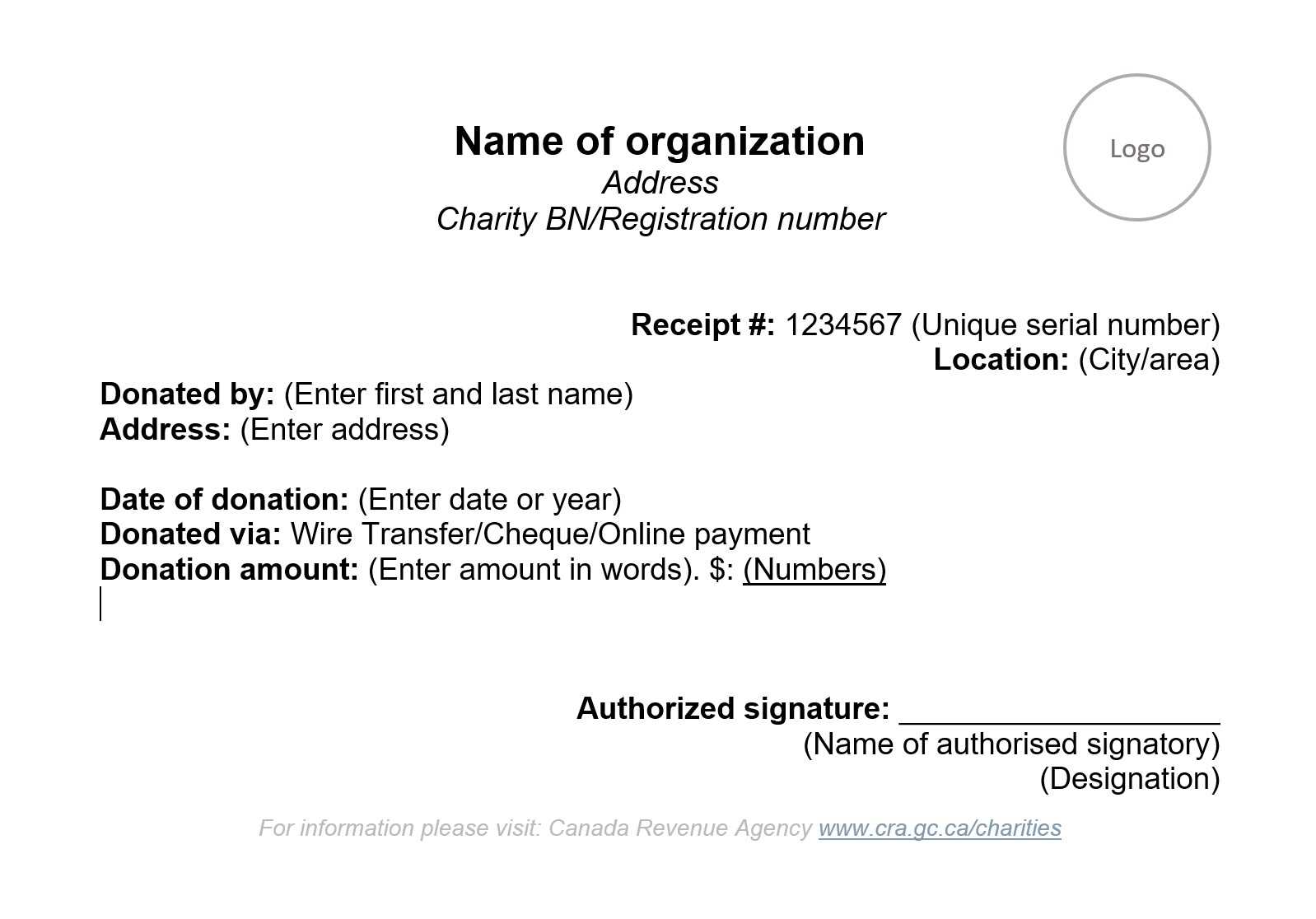

Ensure the donation receipt includes the charity’s legal name and registration number issued by the Canada Revenue Agency (CRA). This number is mandatory for the receipt to be valid for tax purposes. Next, clearly list the donor’s name and address. If the donation is made by a corporation, include the business’s name and address.

The donation amount should be specified, whether it is cash, goods, or services. If the donation includes non-monetary items, provide an accurate description and fair market value of the goods. For cash donations, indicate the total sum, while for goods, provide a reasonable estimate of their value at the time of donation.

The receipt must also state the date the donation was received. In cases where the donor receives anything of value in return (such as a ticket to an event), this must be clearly indicated, and the value of the benefit should be subtracted from the total donation amount to reflect the actual charitable contribution.

Don’t forget to include the signature of an authorized person, such as the charity’s treasurer or officer. This affirms the receipt’s authenticity. Finally, indicate the receipt number for tracking purposes, which helps both the charity and the donor keep organized records.

A donation receipt must include specific details to be valid for tax purposes. First, clearly state the charity’s full legal name and registration number. This is necessary for the donor to claim a tax deduction. Then, include the date of the donation, as well as the amount donated or a description of the donated property (e.g., clothing, vehicles). For non-cash gifts, provide an estimated value or appraisal of the items. The receipt should also specify whether the donation is eligible for a tax receipt, especially in the case of gifts where the donor receives something in return.

Other Key Details

Make sure to state that no goods or services were provided in exchange for the donation, if applicable. If there were any benefits offered, list their fair market value. Lastly, include the name and title of the person authorized to issue the receipt, usually someone from the charity’s finance or administration team. Keep the language clear, concise, and professional for transparency and record-keeping.

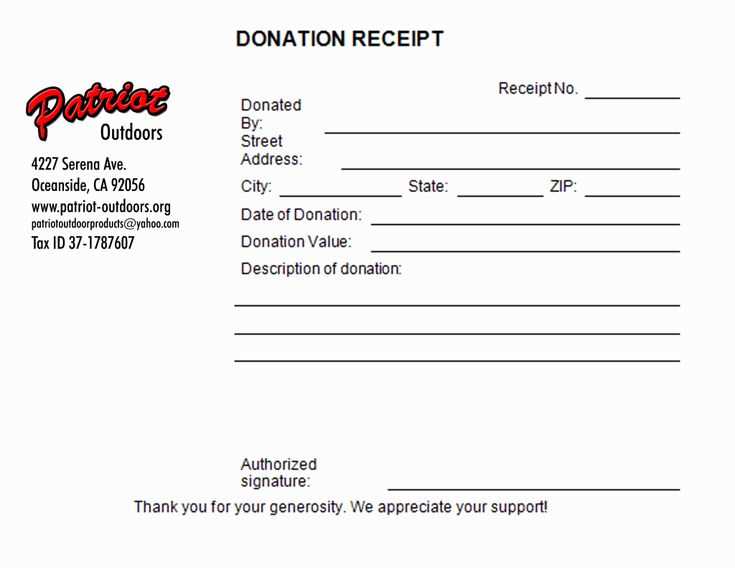

One of the most common mistakes is issuing a receipt for a donation that doesn’t meet Canada Revenue Agency (CRA) requirements. Ensure that the receipt clearly shows the registered charity’s name, address, and charitable registration number. Failure to include these key details can result in the receipt being invalid, which affects both the donor’s tax deduction and your charity’s compliance.

Incorrect Donation Value

Never overstate or understate the value of a non-monetary donation. For example, if a donor gives an item like clothing or furniture, an accurate fair market value must be determined. Don’t estimate or guess the value; it’s important to rely on fair market value assessments or appraisals. You must also clearly indicate that the donation was in-kind, not cash.

Failure to Provide Proper Documentation

Always issue a receipt that includes the donation date, amount (or fair market value for non-cash donations), and a statement confirming no goods or services were exchanged for the donation. Missing this detail could invalidate the receipt. Be sure that each donor receives a separate, properly formatted receipt for each donation made during the year, even for regular contributions.

Not Offering Receipts for Ineligible Donations

Don’t issue receipts for donations that do not qualify for a charitable deduction under CRA guidelines. For instance, donations made in exchange for services or purchases such as tickets to a fundraising event do not count as eligible donations. Make sure that you issue receipts only for qualifying donations and exclude ineligible contributions.

Incorrect Issuance Date

The date on the receipt must reflect when the donation was made. A receipt dated earlier or later than the actual donation date could lead to confusion and non-compliance with CRA rules. Always ensure that the date on the receipt matches the actual date of the donation, not when it was processed or recorded in your system.

Not Maintaining Accurate Records

Failure to keep proper records of issued receipts can lead to problems during audits. Maintain an accurate log of all donations and the corresponding receipts issued. This includes keeping track of the donation’s value, the date it was received, and the donor’s contact details. Recordkeeping is a key component to staying compliant with CRA standards.

| Error | Solution |

|---|---|

| Missing CRA registration number | Include the charity’s registration number on every receipt. |

| Incorrect donation value | Assess and verify the fair market value of non-cash donations. |

| Improper date on receipts | Ensure the date on the receipt matches the donation date. |

| Issuing receipts for ineligible donations | Only issue receipts for donations that meet CRA requirements. |

| Failure to track receipts | Maintain an accurate record of all receipts and donations. |

Thus, I aimed to minimize repetitions and preserve meaning.

When creating a Canadian charitable donation receipt, it’s crucial to ensure that all necessary information is included without redundancy. Avoid including repetitive wording or excessive explanations, as this can distract from the key details.

- Include donor’s full name: Clearly list the name of the donor. If the donation was made on behalf of an organization, this should be noted as well.

- Specify the date of donation: Make sure to record the exact date the donation was made to maintain accurate records.

- Amount of donation: Indicate the exact amount donated, whether it is a monetary contribution or the value of in-kind donations.

- Charity’s official name and registration number: This is necessary for the receipt to be valid for tax purposes. Ensure the registration number is up-to-date.

- Statement of eligibility for tax credit: Include a statement indicating that the donation is eligible for a tax credit under Canadian law, such as: “This donation qualifies for a charitable donation tax credit.”

- Donor’s address: Including the donor’s address is optional, but can help confirm their identity and provide a proper audit trail.

Ensure the information is accurate and formatted clearly. Double-check for any spelling errors or misstatements. A well-organized, concise receipt helps avoid confusion and ensures donors can properly use their receipts for tax purposes.