A well-structured charitable donation receipt can help both donors and charities keep clear records for tax purposes. It’s not just a formality–this document acts as proof of the donation and ensures that the giver can claim deductions on their taxes, if applicable. Create a donation receipt that includes all required details like the donor’s name, the donation amount, and the date of the transaction to stay compliant with tax regulations.

Include the charity’s official information, such as its name, address, and tax-exempt status number. This shows the legitimacy of the organization and provides important details for the donor’s tax filing. A clear mention of whether the donation was monetary or a physical item is essential, along with a description of the items donated, if any.

Don’t forget to include the date of donation and an acknowledgment that no goods or services were provided in exchange for the donation, especially if it’s a cash gift. This ensures that the donor can maximize their tax benefits. The tone should be professional but friendly, ensuring clarity and building trust.

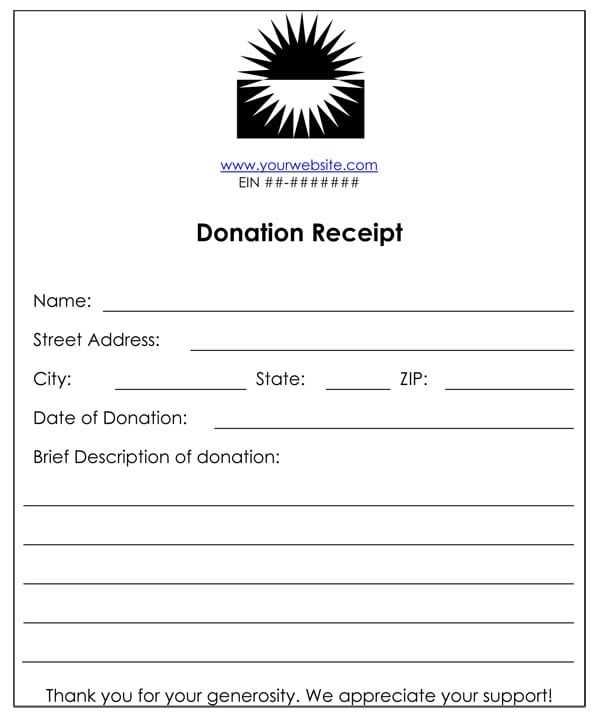

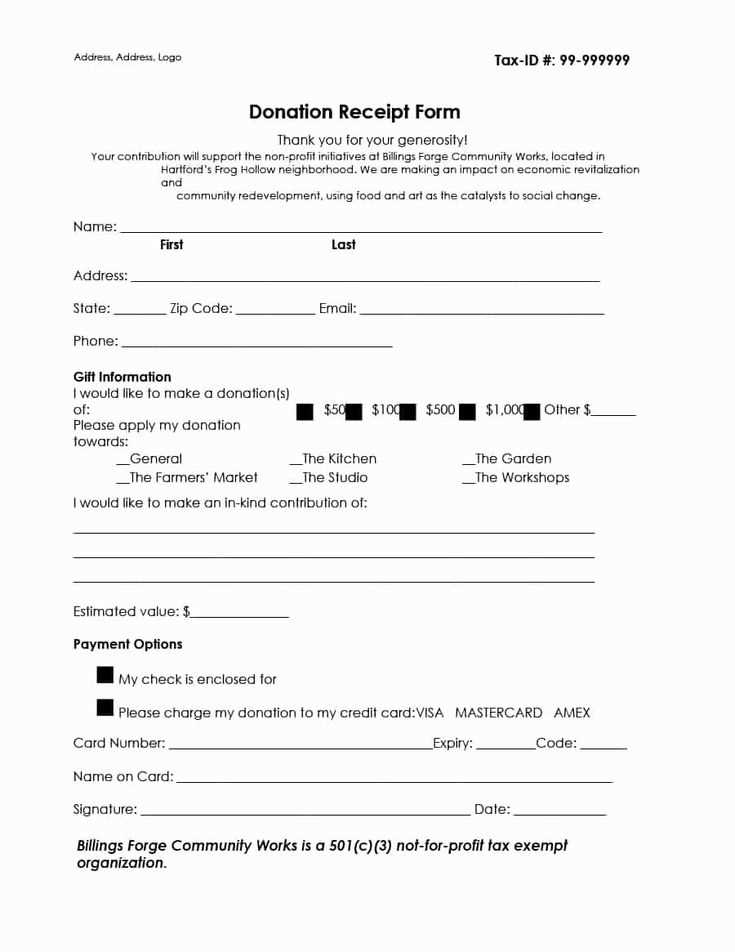

Lastly, make sure to format the receipt cleanly. Use simple templates to keep things organized and easy to read. A well-presented receipt enhances the professionalism of your organization while making the process smooth for the donor. This small effort can help maintain positive relationships with donors and encourage future contributions.

Here’s the revised version with minimal word repetition:

Use clear, concise language when creating a donation receipt template. Include the donor’s name, donation amount, and the charity’s details, such as its tax-exempt status. Avoid unnecessary phrases that clutter the document.

Donation Information

Specify the exact amount donated, whether it’s a monetary sum or goods, and note any non-cash contributions. Ensure the receipt reflects the donation’s value and that both the donor and charity information are accurate.

Tax Considerations

Clearly state the charity’s tax-exempt status and include any relevant tax identification numbers. This helps the donor claim deductions and ensures compliance with tax regulations.

- Charitable Donation Receipt Template Guide

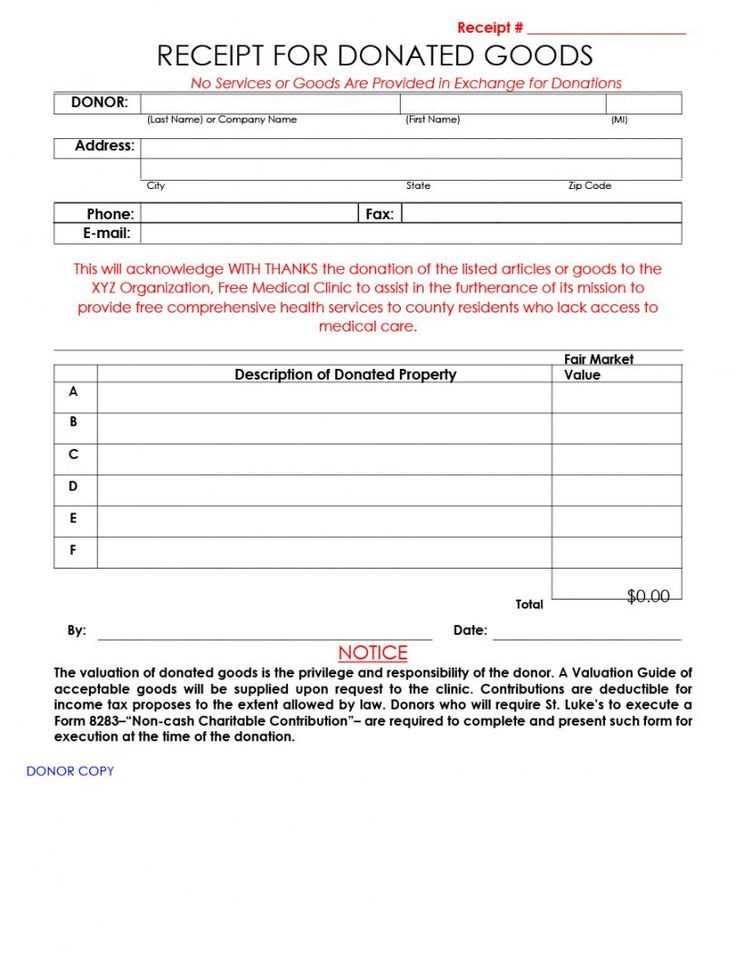

Include the following elements in your charitable donation receipt template to ensure it meets legal and tax requirements:

1. Charity Details: List the charity’s legal name, address, and tax-exempt status. Include the charity’s EIN (Employer Identification Number) to verify its tax-exempt status.

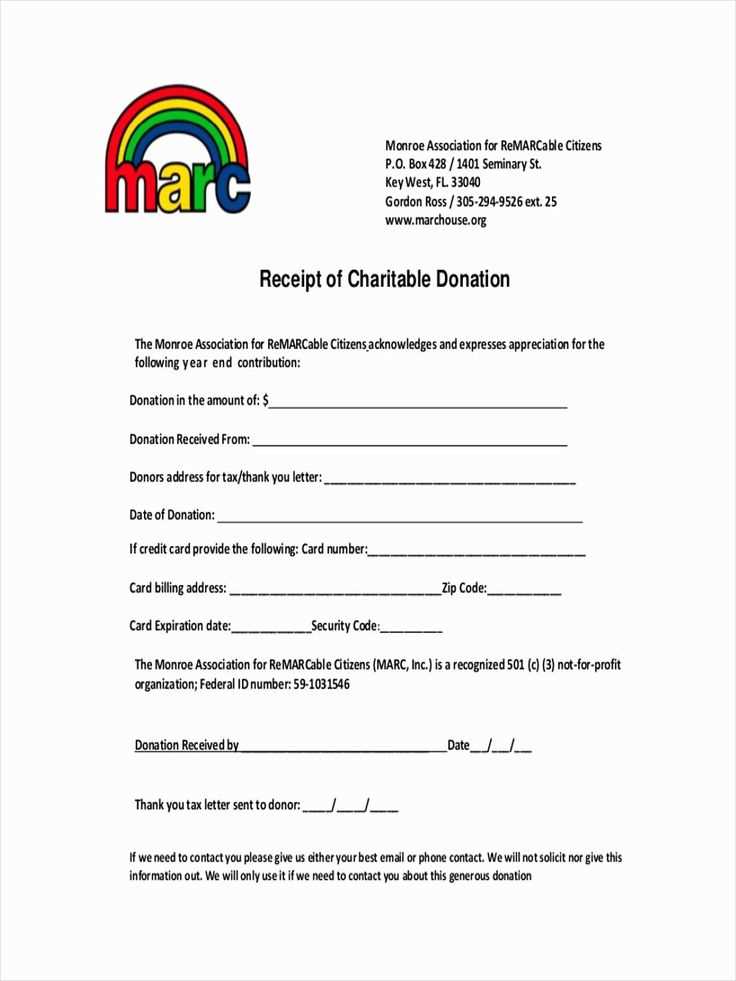

2. Donor Information: Record the donor’s full name and address. If the donation is from a company, include the company’s name and address.

3. Donation Information: Specify the date of the donation and describe the donated items. If it’s a monetary donation, list the exact amount given. If goods or services were donated, indicate their fair market value (FMV).

4. Non-cash Donations: For items or services, include a description of what was donated, and if possible, the estimated value. If the value is not provided by the donor, make it clear that the charity is not required to appraise the value.

5. Goods or Services: State if any goods or services were exchanged for the donation. If so, indicate their value and subtract this from the total donation to determine the deductible amount.

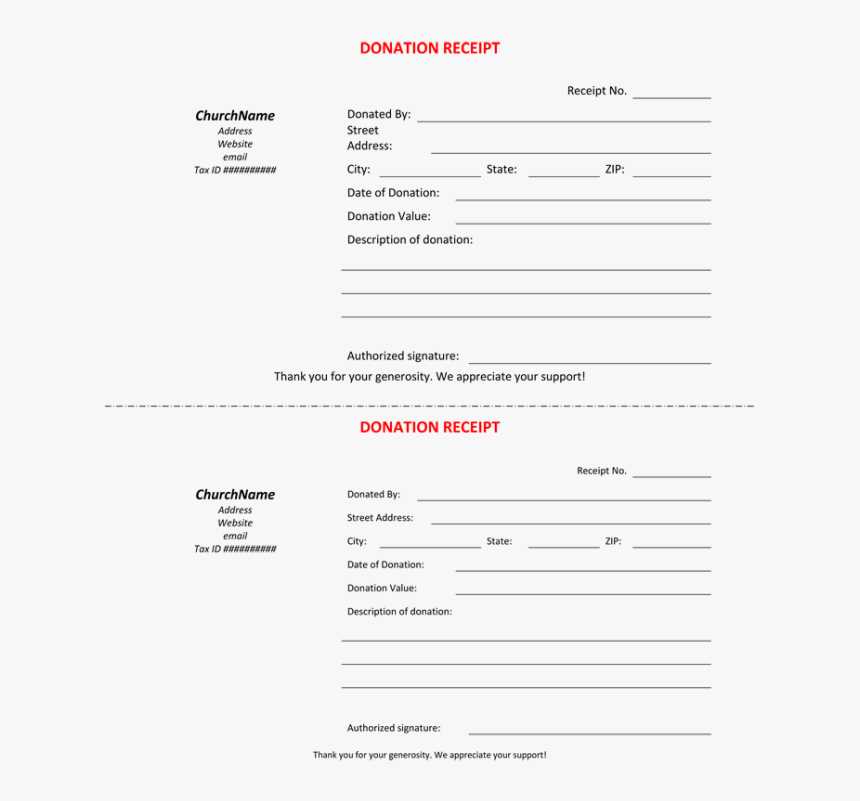

6. Signature: Have an authorized charity representative sign the receipt to validate the donation. This confirms the donation has been received and recorded by the organization.

7. Receipt Number: Use a unique identifier for each receipt to streamline record-keeping and tracking for both the donor and the charity.

With these details in place, your donation receipt template will be ready to provide donors with the proper documentation for their charitable contributions.

A donation receipt should contain specific details to comply with tax regulations and to ensure the donor can use it for tax deductions. Here’s what to include:

1. Donor’s Information

Include the name of the donor or organization making the contribution. This ensures that the receipt is linked directly to the correct individual or entity for tax purposes.

2. Date and Amount of Donation

Clearly state the date of the donation and the exact amount contributed. If the donation is non-monetary, provide a detailed description of the items and their estimated value.

3. Nonprofit’s Information

Include the legal name of the organization, its address, and tax-exempt status (IRS tax-exempt number in the U.S., for example). This verifies that the donor’s contribution is to a legitimate charitable entity.

4. Description of the Donation

Provide a brief description of the donation, whether it’s money or goods. If goods, specify the condition and quantity of the items. For monetary donations, simply state the amount donated.

5. Statement of No Goods or Services Provided

If the donor did not receive any goods or services in exchange for the donation, include a statement to that effect. This is particularly important for tax purposes to verify that the entire contribution qualifies for deduction.

6. Acknowledgment of Tax-Exempt Status

Include a statement confirming the nonprofit’s tax-exempt status, so the donor is aware that their gift is tax-deductible according to relevant laws.

Include the donation date in a clear and easily readable format, such as “MM/DD/YYYY.” This is crucial for tax documentation and will help both the donor and organization during tax filing.

List the donor’s full name and address. Ensure this information matches the records to avoid confusion during tax filing. A mismatch can cause delays or errors in processing the tax benefits.

Provide a detailed description of the donated item(s), including their fair market value. If it’s a monetary donation, specify the exact amount. Avoid vague terms like “generous contribution” and ensure the value is clear and accurate for tax purposes.

State that the donation was made without receiving any goods or services in return, if applicable. This distinction is necessary for a donor to claim the full tax deduction.

If any goods or services were provided to the donor in exchange, list them separately, and note their value. The donor can only claim the donation’s value minus the fair market value of the goods or services received.

Include your organization’s name, address, and tax-exempt status. This lets the IRS verify your eligibility for receiving tax-deductible donations. For U.S.-based organizations, a statement such as “Tax-exempt under section 501(c)(3)” will suffice.

Include your organization’s EIN (Employer Identification Number) for additional transparency and verification. This ensures the IRS can properly associate the donation with your nonprofit status.

Make sure the receipt is signed and dated by an authorized representative of your organization. This adds an official touch and helps prevent any potential issues during an audit or tax review.

Different regions have distinct rules about what must be included in donation receipts. In the United States, for example, the IRS mandates that receipts for tax-deductible contributions must contain the donor’s name, donation amount, the date of the gift, and the charity’s name and tax-exempt status. If the donor receives anything in exchange, the receipt must also disclose its value.

In Canada, the Canada Revenue Agency (CRA) requires registered charities to provide receipts that include the charity’s registration number, the donor’s name, the donation amount, and the date of the gift. In addition, if the donor receives a benefit in return, the receipt must specify the fair market value of that benefit.

In the UK, charities must issue Gift Aid receipts for donations that are eligible for the tax relief. These receipts must include the donor’s full name, the amount donated, and a declaration of Gift Aid eligibility, along with the charity’s details.

Australia follows similar guidelines with the Australian Taxation Office (ATO) requiring charities to issue receipts that include the donor’s name, the donation amount, and the charity’s ABN (Australian Business Number). If a benefit is given, its value must be listed on the receipt.

Nonprofits should always check the local legal requirements before issuing receipts, as failing to comply can result in penalties or the loss of tax-exempt status. It’s advisable to stay updated on any changes to regulations in the jurisdictions where the charity operates.

Tailor your donation receipt to reflect the uniqueness of your donors and their contribution. Add personal touches that make them feel valued. Start by including the donor’s full name and address, ensuring the information matches their donation record. This creates a direct connection between the donor and the cause.

Include a Thank-You Message

Incorporate a brief, heartfelt thank-you message. Mention the specific project or program their donation supports. A simple note like “Thanks to your generosity, we can provide meals to families in need this winter” adds meaning to their contribution.

Donor Recognition

If your donors wish to be acknowledged publicly, offer space to list their name on a donor recognition page or annual report. If they prefer anonymity, respect their privacy while expressing gratitude in a more personal way.

Adding a personalized touch helps foster a stronger connection and shows appreciation beyond the transaction. Make sure the receipt is visually appealing, professional, and consistent with your organization’s branding. A personalized receipt can transform a simple acknowledgment into a lasting impression.

Nonprofits can save time and reduce human error by automating the donation receipt process. With the right tools, you can easily generate and send receipts to donors without manual input. This helps maintain transparency and ensures that donors receive their documents promptly.

- Integrate with Donation Platforms: Link your donation system with automated receipt tools. Many platforms like DonorPerfect, Stripe, or GiveGab have built-in features for automatic receipt generation. This reduces administrative workload and guarantees accuracy.

- Customize Receipts: Tailor your receipts to match your nonprofit’s branding. Include specific fields such as the donor’s name, donation amount, and date. Customization options can also help reinforce your organization’s identity and gratitude.

- Use Templates: Create reusable receipt templates for different donation types. These templates can be configured to include relevant tax information, donation breakdowns, or notes on the use of the funds.

- Set Up Triggers: Configure your system to automatically send receipts after each transaction or on a scheduled basis. This minimizes the need for manual follow-ups and ensures that every donor receives acknowledgment in real-time.

- Provide Tax Information: Make sure your automated receipts include the necessary information for tax deduction purposes. Include your nonprofit’s tax-exempt number and specify whether the donation was in-kind or monetary.

- Track and Archive Receipts: Automation allows for easy tracking and storage of donation receipts. By maintaining an organized, digital record, you can quickly access receipts for audits or donor inquiries.

Automation simplifies the receipt generation process, making it easier to focus on your nonprofit’s mission while keeping donors engaged and satisfied.

Common Mistakes to Avoid When Creating a Receipt Template

One of the most frequent mistakes in creating a receipt template is neglecting to include all necessary information. Each receipt should clearly state the donation amount, the donor’s details, and the purpose of the donation. Missing any of these can lead to confusion and delays in processing.

1. Omitting Key Details

Ensure you include these key elements in your receipt template:

- Donor’s name and address

- Date of donation

- Amount donated

- Charity’s name, address, and tax-exempt status

- Description of the donation (whether monetary or goods)

- Confirmation of no goods or services in exchange (if applicable)

2. Using Inconsistent Formatting

Consistency in design is crucial for clarity. Don’t mix fonts or sizes that make the receipt hard to read. Stick to one or two readable fonts and maintain a consistent layout across all receipts. The date and total amount should be prominent to avoid confusion.

3. Failing to Proofread

Small errors in spelling or numerical mistakes can invalidate a receipt. Always proofread the template and confirm that figures match the details you are recording.

4. Overcomplicating the Design

Keep the layout simple and easy to understand. Avoid cluttering the receipt with excessive information or fancy designs. Clear, straightforward receipts make it easier for both the charity and the donor.

5. Not Including a Disclaimer for Tax Purposes

Tax-exempt organizations must include a disclaimer stating no goods or services were provided in exchange for the donation, if applicable. This is crucial for donors who intend to claim their donations on their taxes.

6. Ignoring Digital Versions

In the case of online donations, make sure the receipt template is also compatible with digital formats. Donors should be able to receive a PDF or email version of their receipt without difficulty.

7. Not Updating Templates for Changes in Tax Laws

If tax laws change, adjust your receipt templates accordingly. Ensure that you remain compliant with current regulations to maintain the validity of the donation receipts.

| Common Mistake | Solution |

|---|---|

| Omitting Key Details | Include donor details, donation amount, and charity info |

| Inconsistent Formatting | Stick to one readable font and maintain a clear layout |

| Failing to Proofread | Double-check for errors in names, amounts, and dates |

| Overcomplicating the Design | Keep the design clean and minimalistic |

| Not Including Tax Disclaimer | Add a tax-exempt statement for applicable donations |

| Ignoring Digital Versions | Ensure templates are compatible with digital formats |

| Not Updating for Tax Changes | Regularly update templates based on tax law changes |

Now, word repetition is minimized within the lines, preserving meaning and proper sentence structure.

Ensure that your charitable donation receipt template is clear and concise. Focus on using unique wording for each section to avoid redundancy, while still conveying all necessary details. For instance, replace common phrases like “Thank you for your donation” with “Your contribution is appreciated.” This reduces repetitive phrasing and enhances the overall flow of the content.

Consider the following guidelines:

- Use synonyms or varied sentence structures to express the same ideas in different ways.

- Avoid restating the same information multiple times across different sections.

- Ensure each sentence serves a unique purpose and avoids overlap with previous content.

- Maintain the clarity of the document, ensuring that important details are still emphasized without redundancy.

Incorporating these techniques allows you to create a receipt template that is streamlined, engaging, and free from repetitive language.