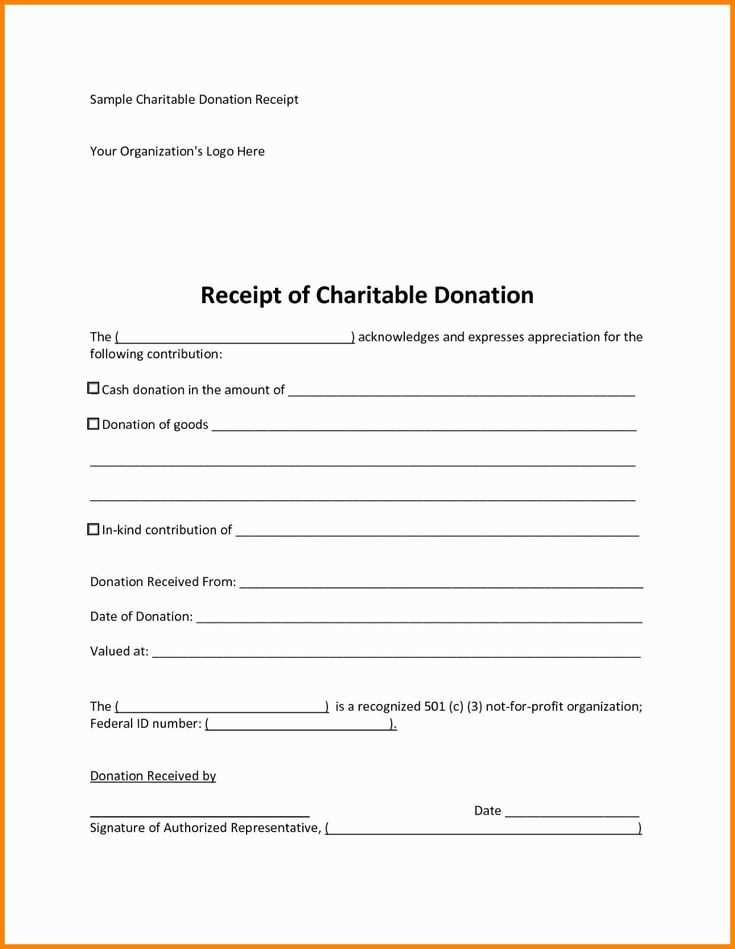

When preparing a charitable donation receipt letter, be sure to include key details that are both legally required and useful for the donor’s records. The letter should confirm the amount donated, the date of the donation, and the name of the organization receiving the contribution. It’s important to include a statement specifying that no goods or services were exchanged for the donation, unless applicable.

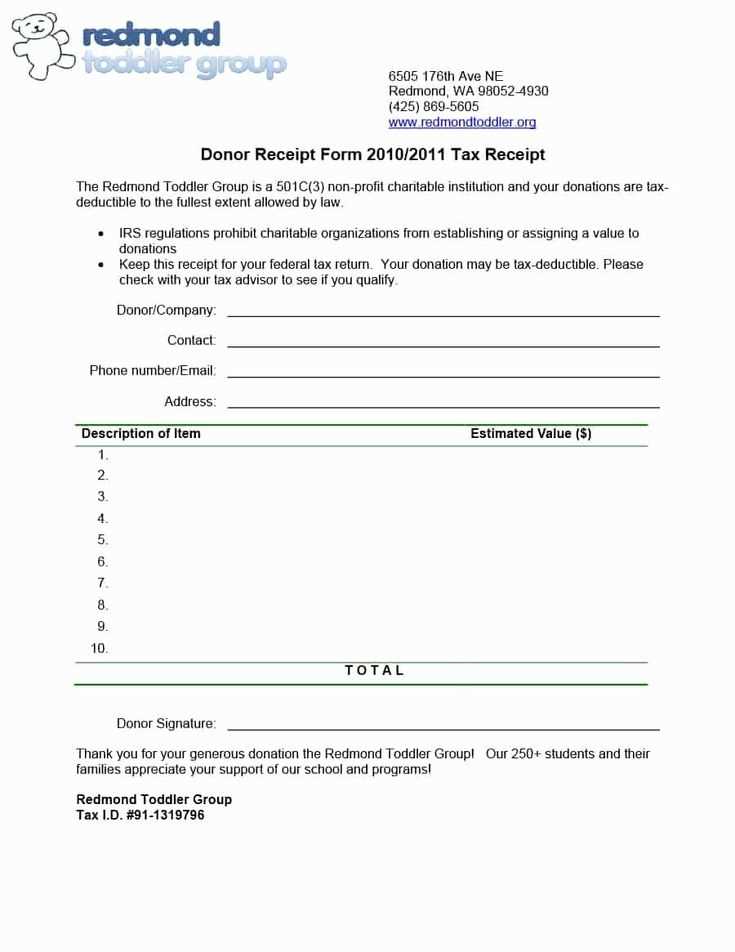

A simple yet clear structure helps maintain transparency. Begin with a warm acknowledgment of the donor’s contribution and express gratitude. Then, outline the specifics of the donation. If the gift was monetary, note the amount given. If it was a non-cash donation, provide an itemized list and, if possible, an estimated value for each item.

Make sure to include the organization’s tax-exempt status or the IRS identification number, as this information is often necessary for the donor’s tax filings. Close the letter with a reiteration of thanks and an invitation to reach out for any questions. Providing this information in a concise, organized manner helps ensure both the donor and the charity stay compliant with tax regulations.

Here’s the revised version:

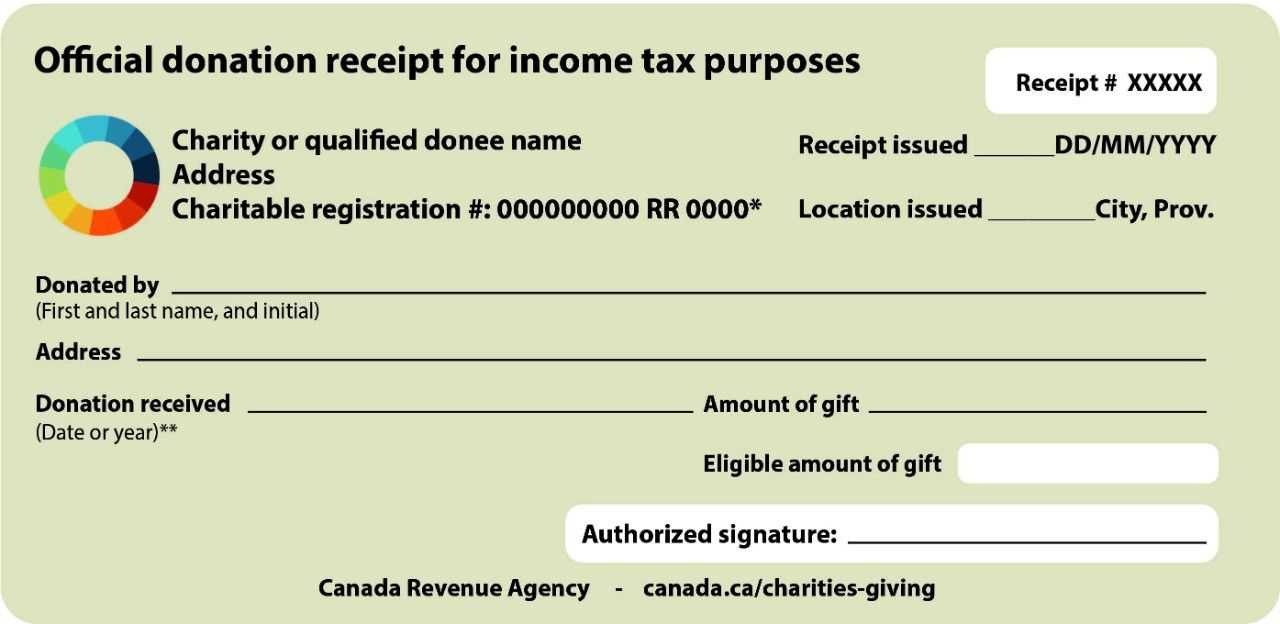

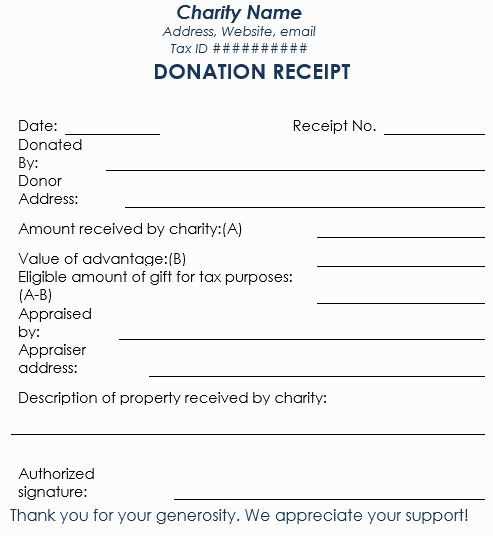

Make sure the donation receipt includes all required details for the donor to claim their tax deduction. This includes the charity’s name, address, and tax-exempt status. You should also mention the donor’s name, the amount donated, and the date of donation. If goods or services were provided in exchange for the donation, their value should be listed separately.

Key Points to Include:

- Charity’s name and tax-exempt status.

- Donor’s name and address (optional, but recommended).

- Donation amount and date.

- Any goods or services provided, with their fair market value.

- A statement confirming no goods or services were exchanged (if applicable).

Format for a Clear and Concise Letter:

- Start with a clear subject line: “Charitable Donation Receipt”.

- Begin with a thank you message for the donation.

- Clearly list the donation details, including a description of any goods or services received in return.

- Close with another thank you statement and the charity’s contact details.

This approach ensures that all necessary information is communicated clearly and accurately, allowing the donor to properly use the receipt for tax purposes.

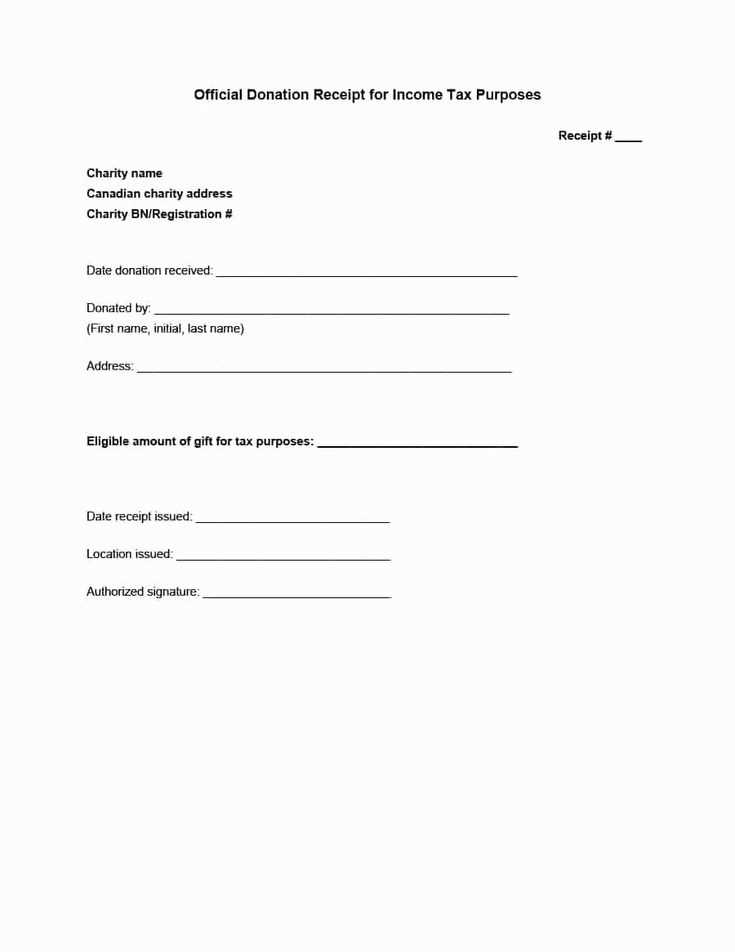

- Charitable Donation Receipt Letter Template

Providing a clear and accurate donation receipt is key for both the donor’s tax purposes and for maintaining transparency in your charity’s operations. A well-structured donation receipt letter includes specific details that confirm the donor’s contribution and provide them with the necessary information for their records.

Basic Information to Include

Start with the charity’s name, address, and contact details. This will help the donor easily identify your organization. Then, add the donation date, the donor’s name and address, and a description of the contribution. If it’s a monetary donation, specify the amount. If it’s a non-monetary donation, describe the items donated along with their estimated value (if possible). Include a clear statement that no goods or services were exchanged for the donation, or list what was provided in exchange if applicable.

Sample Template

Here’s a simple format to follow:

[Charity's Name] [Charity's Address] [Charity's Contact Information] [Date] [Donor's Name] [Donor's Address] Dear [Donor's Name], Thank you for your generous donation to [Charity's Name]. We appreciate your support in helping us further our mission. Your donation details are as follows: - Date of donation: [Date] - Amount of donation: [Amount] - Description of donated items: [Item description] No goods or services were exchanged for your contribution. Your gift is tax-deductible as allowed by law. We truly appreciate your generosity and continued support. If you have any questions, please don't hesitate to contact us. Sincerely, [Name of person or department] [Title] [Charity's Name]

Ensure the donor receives this receipt for their records, and keep a copy for your organization. This process guarantees both parties are aligned and compliant with tax regulations.

Begin with clear identification of your organization and the donor’s information. The first part should include the name, address, and contact details of your organization, followed by the donor’s full name and address.

1. Include the Donation Date and Amount

State the date the donation was received, and specify the amount or value of the donation. For cash donations, write the exact amount given. For in-kind contributions, describe the item(s) and their estimated value.

2. Acknowledge the Donor’s Contribution

Thank the donor for their generosity in a warm, personalized way. Mention how their donation will make an impact or support your cause. Be specific but concise in expressing appreciation.

3. Include Your Tax-Exempt Status

If applicable, note your tax-exempt status and provide the corresponding federal tax ID number. This assures the donor that the donation is eligible for tax deductions.

4. Clarify No Goods or Services Were Provided (if applicable)

If the donation was fully tax-deductible (i.e., no goods or services were provided in return), clearly state that no goods or services were exchanged in exchange for the contribution.

5. Use a Closing Statement

Conclude with a positive statement that reiterates your gratitude and highlights the significance of the donor’s support. Include a polite call to action or reminder of upcoming events or opportunities to engage further with your organization.

6. Format for Easy Reading

- Use simple language.

- Ensure the letter is professional but friendly.

- Keep it concise but thorough.

- Maintain consistent formatting (e.g., fonts, alignment).

Proper formatting helps ensure that your letter is easy to read and that all key points are included for the donor’s records.

Include the following details to ensure a valid charitable donation receipt:

Donor’s Information: Clearly state the name of the donor and their contact details. This is crucial for record-keeping and future communication.

Organization’s Information: Include the name, address, and tax identification number (TIN) of the organization receiving the donation. This confirms the legitimacy of the charitable organization.

Date of Donation: Record the exact date the donation was made. This is essential for tax purposes and tracking donations over time.

Description of Donation: Provide a brief description of the donation, including the items donated (if applicable) or the amount of the cash donation. Avoid listing the value of non-cash donations unless professionally appraised.

Donation Amount: Clearly state the monetary value or the estimated value of non-cash items donated. If the donor received anything in exchange, this must be noted and deducted from the total donation value.

Statement of No Goods or Services Received: If the donation is purely voluntary and no goods or services were exchanged, include a statement confirming this. This is particularly relevant for tax deductions.

Signature of Authorized Representative: Include the signature of someone from the organization who can verify the details of the donation. This adds credibility and authenticity to the receipt.

Charitable organizations must adhere to specific legal standards when issuing donation receipts to ensure compliance with tax laws. These requirements vary by country and jurisdiction, but some general principles apply universally.

- Organization Information: The receipt must include the name and contact details of the charitable organization, including its registered charity number or tax identification number (TIN) if applicable.

- Donor Information: The receipt should clearly list the name of the donor. For non-cash donations, it is crucial to provide details about the donor, such as their full name, to avoid any ambiguity.

- Donation Details: The receipt must specify the amount of money donated. If the donation is non-monetary (e.g., goods or services), a description of the item and its fair market value should be included.

- Non-quid Pro Quo Contributions: If the donor received something in return (such as tickets to an event or a gift), the receipt must indicate that the donation is a partial donation and mention the fair market value of the goods or services provided in exchange.

- Receipt Date: The date the donation was received is necessary to document the timing of the donation, especially for tax purposes.

- Tax-Exempt Status: It should clearly state that the organization is recognized as tax-exempt and that donations are tax-deductible, where applicable. This is vital for the donor’s tax filing process.

Failure to include these elements can result in penalties for the organization and complications for the donor when claiming deductions. Always double-check local regulations to ensure full compliance with the law.

Begin by providing a clear and accurate description of the donation. Include the exact amount or value of the contribution, and specify whether it was in cash, goods, or services. This information is necessary for the donor’s tax purposes.

Be Specific About the Purpose

Clarify how the donation will be used. Whether it supports a particular project, covers operational costs, or contributes to general funds, detailing the purpose shows transparency and assures donors that their contributions are making an impact.

Provide Personal Touch

Take a moment to personally thank the donor. Acknowledge their generosity and explain how their support helps advance the cause. A few personalized words can make the donor feel appreciated and valued, reinforcing their connection to your organization.

Conclude the letter by including your contact details in case the donor has any further questions or needs additional documentation. This allows for open communication and builds trust.

A donation receipt letter should include key information to ensure both the donor and the charity are clear on the details of the donation. Here is a straightforward template you can use:

| Donor’s Name | [Donor Name] |

| Donation Amount | [Amount Donated] |

| Donation Date | [Date of Donation] |

| Charity Name | [Charity Name] |

| Tax-Exempt Status | This donation is tax-deductible under IRS Section 501(c)(3). |

| Description of Donation | [Description of Donation if applicable] |

We appreciate your support and generosity. If you have any questions or need further documentation, feel free to contact us.

Sincerely,

[Charity Representative Name]

[Charity Contact Information]

Ensure that the donor’s name is correctly spelled. Mistakes in the donor’s name can lead to confusion or even invalidate the receipt for tax purposes.

Double-check the donation amount. Always verify if the donation sum is written correctly in both numbers and words to avoid discrepancies.

Missing or Incorrect Date

Donations must be dated accurately. A missing or incorrect date can create issues when filing taxes or claiming deductions.

Failure to Provide a Description of the Donation

For in-kind donations, provide a clear description of the items donated. Without this, the receipt may not meet tax guidelines for non-cash contributions.

| Common Mistakes | How to Fix It |

|---|---|

| Incorrect donor name | Verify the name before issuing the receipt. |

| Wrong donation amount | Check both the amount in figures and words. |

| No date or incorrect date | Always add the date of donation and verify it. |

| No item description for in-kind donations | Provide a detailed list or description of donated goods. |

Charitable Donation Receipt Letter Template

To ensure proper documentation for charitable donations, include key details in your receipt letter. Start by stating the name of the charity organization and its address. Make sure to mention the donor’s full name and the date of the donation.

Donation Details: Specify the donation type–whether it’s a monetary contribution or goods–and provide an accurate description. For in-kind donations, list the items donated along with their estimated value. If it’s a monetary donation, include the amount given.

Tax Information: Mention the tax-exempt status of the charity, referring to its IRS designation (e.g., 501(c)(3)). This helps the donor in claiming deductions during tax filing. Add a statement clarifying that no goods or services were exchanged for the donation, if applicable.

Gratitude Statement: Express your thanks in a concise yet genuine manner. This shows appreciation and maintains a positive relationship with the donor.

Signature: Conclude with the signature of an authorized representative of the charity. This formalizes the receipt and provides authenticity.

This template ensures the donor receives a clear and detailed receipt, keeping both parties in compliance with IRS regulations.