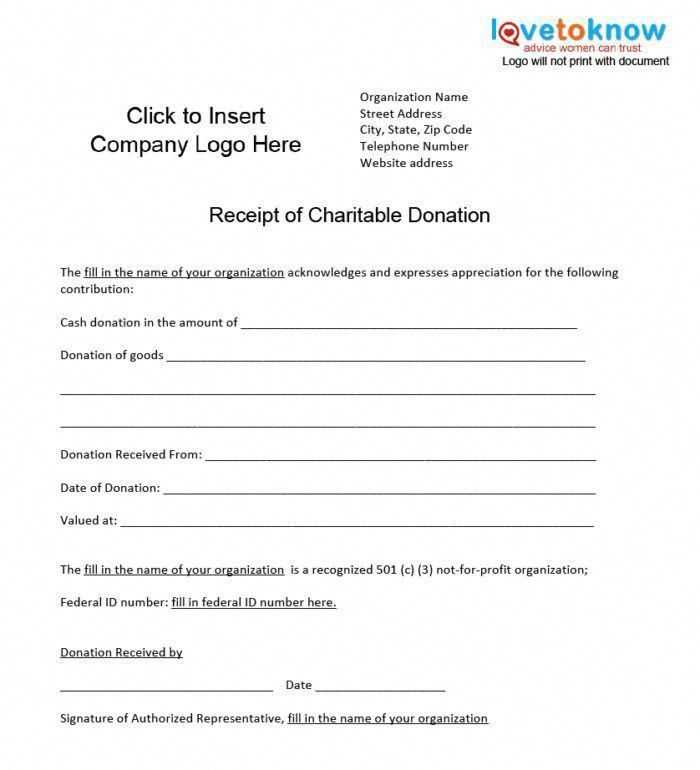

To create a charitable donation receipt in Canada, make sure the template includes key details that ensure it is valid for tax purposes. Begin with the name of the charity and its registered charity number, which must be listed according to the Canada Revenue Agency (CRA) guidelines. The receipt should also specify the date of the donation and the amount given. If the donation includes property or goods, an accurate description and the fair market value should be included as well.

Ensure that the receipt states whether the donation was made in cash or through other means, such as goods or services. It’s crucial to include the signature of an authorized individual from the charity, along with the charity’s contact information. If a donation was made anonymously, this should be noted clearly on the receipt.

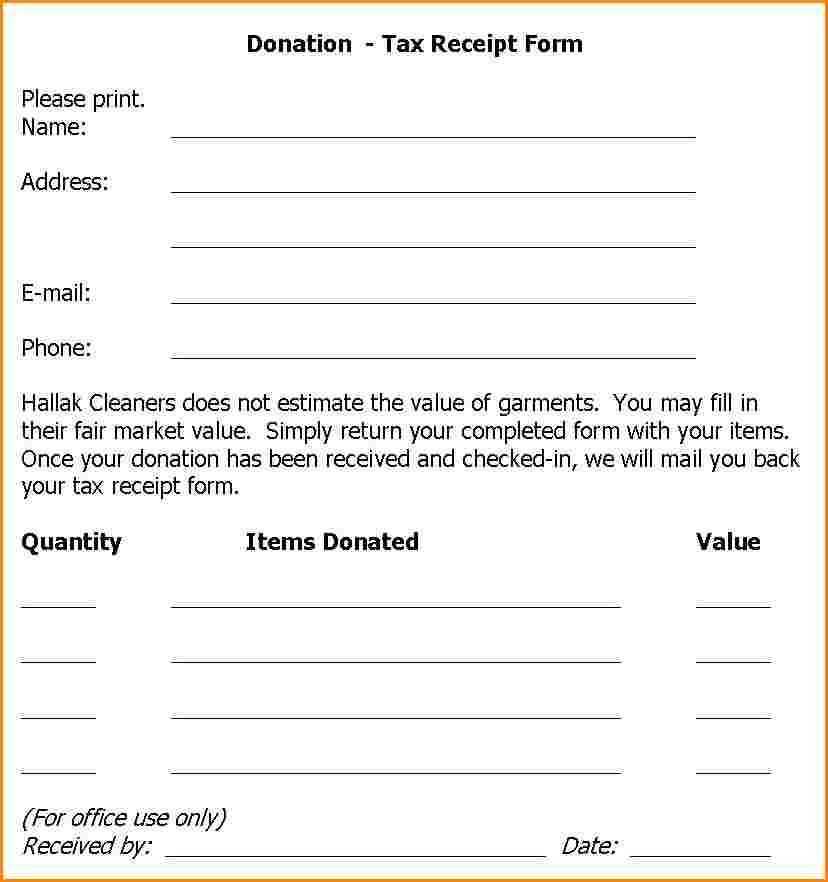

When formatting your template, include spaces for all these necessary details, and make sure that each field is easy to fill out and clearly labeled. For added clarity, consider including a brief statement confirming that no goods or services were provided in exchange for the donation, as this is a requirement for the receipt to be tax-deductible.

Here’s a revised version with reduced word repetition, maintaining the original meaning:

For a charitable donation receipt in Canada, make sure to include the donor’s name, donation amount, and the donation date. State clearly that no goods or services were received in exchange for the contribution. The receipt must also feature the charity’s legal name, its registration number, and a confirmation that it is a registered charity under Canadian law.

Important Details to Include

1. Donor’s full name or organization name

2. Date and amount of the donation

3. A statement confirming no goods or services were provided

4. Charity’s registration number

Final Steps

Ensure all information is accurate before issuing the receipt. If issuing digitally, use a formal format or print it on your charity’s letterhead. This ensures it meets tax deduction requirements.

Here’s a detailed HTML plan for an article on the topic “Charitable Donation Receipt Template Canada” with six headings that focus on practical aspects of the subject.

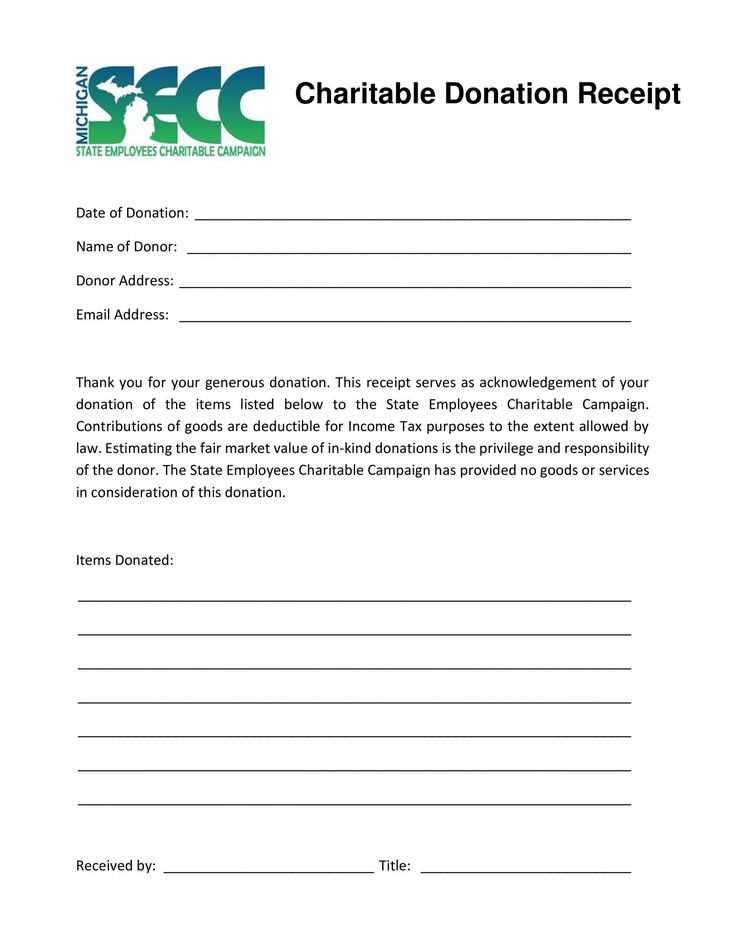

For a donation receipt in Canada, it’s important to include the charity’s legal name, the official registration number, and a clear description of the donation, whether it’s money, goods, or services. Ensure the receipt includes the donor’s name, the date of the donation, and the amount or value of the donation. This should be done in compliance with Canada Revenue Agency (CRA) guidelines.

Make sure the donation receipt is provided in a timely manner. Receipts should be issued for donations of $20 or more to qualify for tax credits. Providing receipts on time allows donors to claim their charitable donations on their income tax returns.

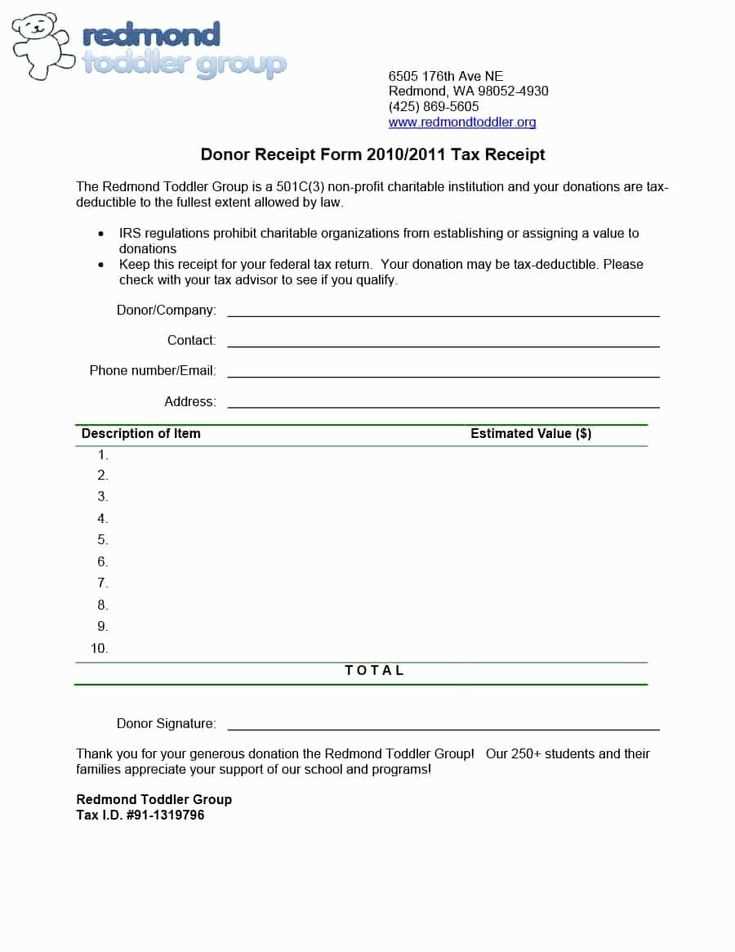

Use a template that is easy to modify and keeps track of all necessary information, like donation dates and amounts. This helps ensure consistency and accuracy across all receipts. Customize the template to fit your organization’s specific needs while adhering to CRA requirements.

Ensure the template clearly states that the receipt is for tax purposes. For monetary donations, include the amount given. For gifts-in-kind, provide a description of the items donated and their estimated fair market value. Keep in mind that the CRA requires the value of donated goods to be determined reasonably.

Include a signature from an authorized individual, such as a director or officer, to authenticate the receipt. This is an important part of the process for validating the receipt under CRA rules.

Make sure to retain copies of all receipts issued, as you may need to provide proof during audits or other CRA-related inquiries. A simple digital record-keeping system can help organize and maintain these receipts efficiently.

- Understanding Legal Requirements for Donation Receipts in Canada

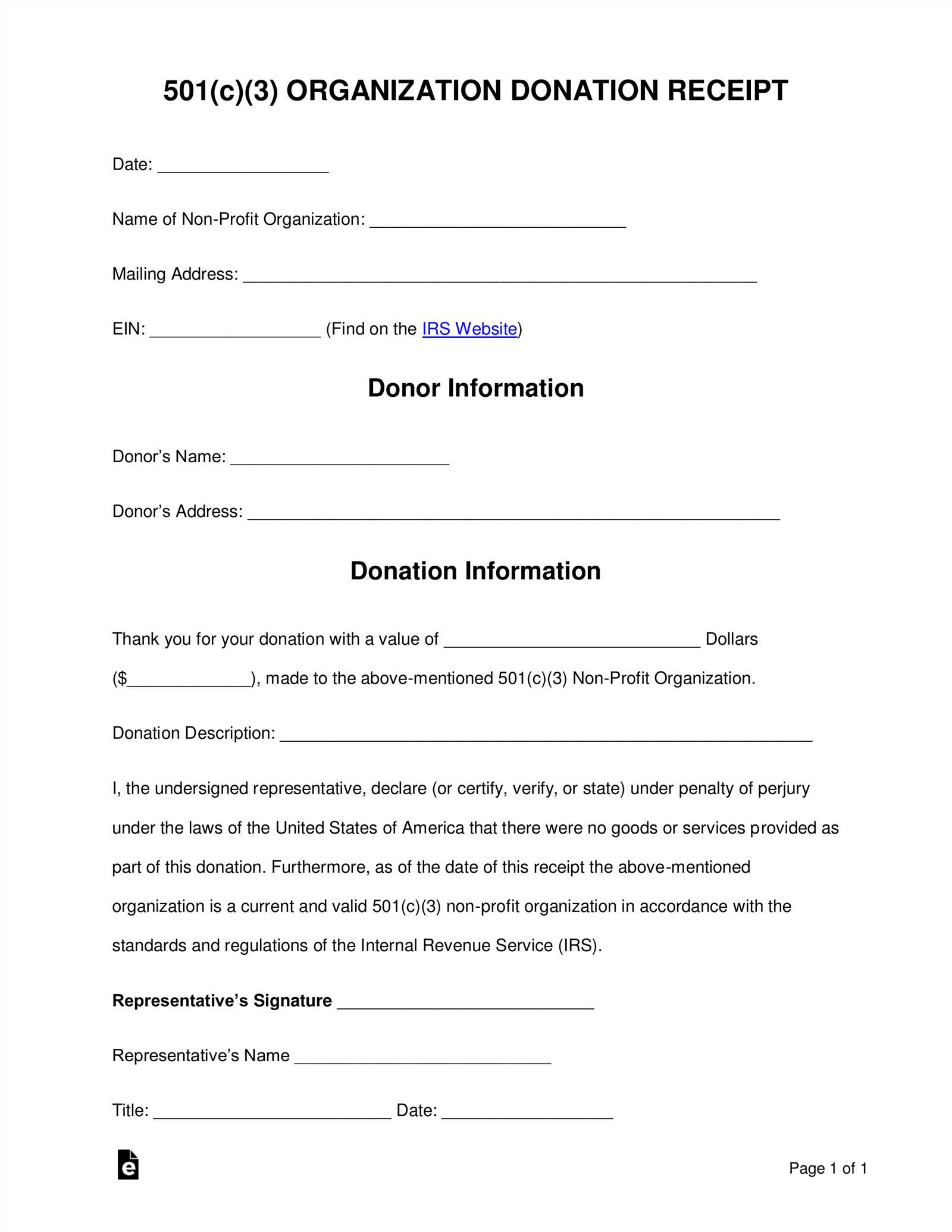

Donation receipts in Canada must meet specific criteria to be recognized by the Canada Revenue Agency (CRA) for tax purposes. These receipts enable donors to claim tax credits, reducing their taxable income. Nonprofit organizations and registered charities must follow clear guidelines to ensure that the receipt is valid.

Key Information on Donation Receipts

A donation receipt should include the following details: the charity’s legal name and registration number, the date of the donation, the amount donated, and a statement that the donation is eligible for a tax credit. The receipt must also specify whether any goods or services were provided in exchange for the donation. This information ensures compliance with CRA regulations and helps the donor properly claim tax credits.

Common Mistakes to Avoid

Many charities inadvertently omit necessary details, such as the donation’s fair market value when goods or services were exchanged. Failing to include the official charity registration number or providing inaccurate information can lead to the receipt being disqualified, leaving donors unable to claim their tax benefits. To avoid these issues, charities should regularly review their receipt procedures and keep up to date with CRA guidelines.

Follow these guidelines to structure a clear and compliant charitable donation receipt:

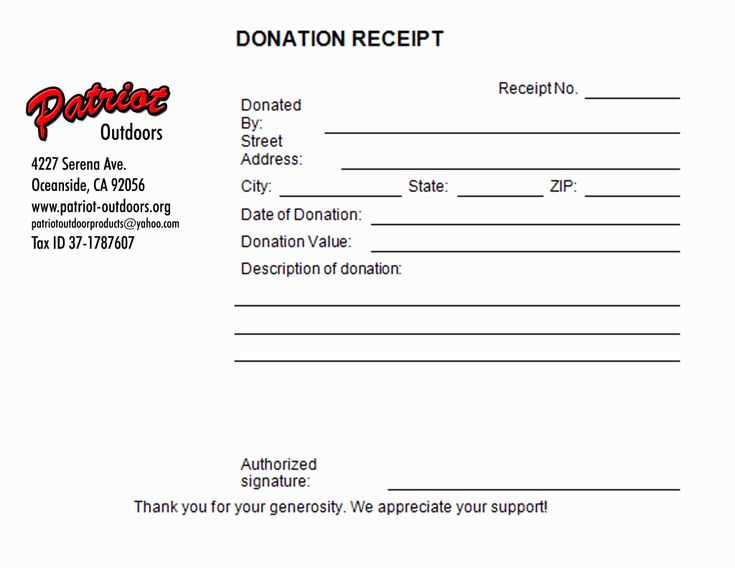

- Organization’s Name and Contact Details: Include the charity’s legal name, address, and phone number. Ensure this matches your registered name with the Canada Revenue Agency (CRA).

- Charitable Registration Number: This is a requirement for all registered charities in Canada. Include the charity’s unique number issued by CRA.

- Receipt Date: Clearly list the date the donation was received. This helps in tax reporting and tracking donations.

- Donor’s Name and Address: Include the full name and address of the donor to match their tax records.

- Amount Donated: Specify the donation’s monetary value or the fair market value for non-cash gifts. For goods or services donated, list both the amount donated and the value of any benefit received by the donor.

- Description of the Donation: If the donation is property or goods, briefly describe the item(s) donated and their estimated value.

- Signature of an Authorized Representative: The receipt should be signed by a person authorized by the charity, such as the executive director or treasurer.

- Official Receipt Number: A unique identifier for each receipt issued by the charity. This helps ensure proper tracking for both the charity and the donor.

Ensure that the structure of the receipt complies with CRA’s requirements. This will allow donors to claim their tax credits without issue.

The receipt must include the name of the charity organization, its official address, and its registration number. Ensure that the donor’s full name, address, and the date of donation are clearly stated. Specify the amount donated, and if applicable, describe whether the donation was in cash or property. It is also important to indicate whether the donor received anything of value in exchange for the donation. If the charity provides goods or services in return, the fair market value of those items should be mentioned. Include the charity’s tax ID number and any relevant receipts for tax purposes.

Ensure that the receipt includes all necessary details. Missing key information like the donor’s full name, donation amount, or date can lead to confusion and complicate tax filing for both parties. Double-check these details before issuing a receipt.

Failure to Include a Valid Charity Number

Charitable organizations must provide their registration number on receipts. Without it, the receipt may not be valid for tax purposes. Always verify that the number is clearly printed and accurate.

Incorrect Donation Amounts

Be accurate when recording donation amounts. Errors can cause complications for both the donor and the charity. This includes making sure that both cash and non-cash donations are listed with the correct value.

When issuing a receipt for a non-cash donation, ensure that you provide a description of the donated item(s) and assign an appropriate value. Inaccurate or vague descriptions can lead to issues during tax filings or audits.

Tailoring a donation receipt template for your charity helps ensure clarity and accuracy for your donors. Begin by incorporating your charity’s name, logo, and contact information at the top of the receipt. This establishes credibility and trust right from the start.

Next, include the donor’s name, address, and the donation amount. A clear breakdown of the contribution type (e.g., cash, cheque, or goods) ensures transparency. Don’t forget to add the date of the donation and the receipt number for record-keeping purposes.

For charities registered with the Canadian government, a tax receipt must include the charity’s registration number. Place this in a prominent spot, such as near the donation details, so it’s easy for donors to locate when filing taxes.

| Element | Description |

|---|---|

| Charity Name & Logo | Establishes authenticity and trust with your donors. |

| Donor Details | Include name, address, and contact information. |

| Donation Breakdown | Clarify donation type and amount. |

| Tax Receipt Number | Important for tax purposes and donor reference. |

| Charity Registration Number | Required for registered charities in Canada. |

Ensure the language is clear and simple to avoid confusion. A professional tone will help establish trust with your supporters while making the receipt easy to understand. Personalize the message to thank the donor, reinforcing their impact on your cause.

By following these steps, you can create a donation receipt template that is both functional and reflective of your charity’s mission. Keep the layout clean, and double-check all details for accuracy to maintain professionalism and compliance.

To comply with CRA requirements, include the donor’s full name, address, and donation amount on the receipt. Ensure the receipt contains your organization’s registration number, which verifies its charitable status. Always date the receipt, and list a brief description of the donation, including the nature of non-cash gifts.

Clearly state whether the donation is eligible for a tax credit. For cash donations, include the exact amount received, and for in-kind contributions, assess the fair market value. Additionally, state that the donation was received without any expectation of goods or services in return, except for minor benefits, which must be disclosed.

Be diligent about issuing receipts only for eligible donations. If any goods or services were provided in exchange, provide a breakdown of the value of the donation versus the value of the goods/services, ensuring transparency.

This version eliminates excessive repetition while keeping the content clear and correct.

Ensure the charitable donation receipt includes the full name and address of the charity, as well as the recipient’s information. This establishes the legitimacy of the donation. Confirm the date of the donation and provide a detailed description of the gift, whether cash, property, or services. For cash donations, specify the amount given. If donating goods, include their estimated value.

Important Details for Donation Receipts

- Include the charity’s official registration number to validate its status as a registered charity.

- If applicable, mention any advantages the donor may have received in exchange for the donation, such as tickets or other benefits.

- State that no goods or services were provided in exchange for the donation, if true.

- Provide a statement confirming that the donor has not received anything of value in return for their contribution, ensuring tax compliance.

Example Template for Charitable Donation Receipts

- Charity Name: [Name of Charity]

- Charity Address: [Complete Address]

- Donation Date: [Date of Donation]

- Donor’s Name: [Name of Donor]

- Amount Donated: $[Amount] (cash donation)

- Description of Donation: [Description of goods or services donated]

- Registration Number: [Charity Registration Number]

- Statement: “No goods or services were provided in exchange for this donation.”