To create a donation receipt for a charity in the UK, ensure that it includes specific details required by HMRC for tax purposes. A proper donation receipt should mention the charity’s name, its registration number, and a statement confirming the donor’s contribution. It’s important to specify the date of the donation and the amount donated, whether in cash or goods. If the donation is a gift aid donation, a declaration must be included stating that the donor is a UK taxpayer and understands the implications of gift aid.

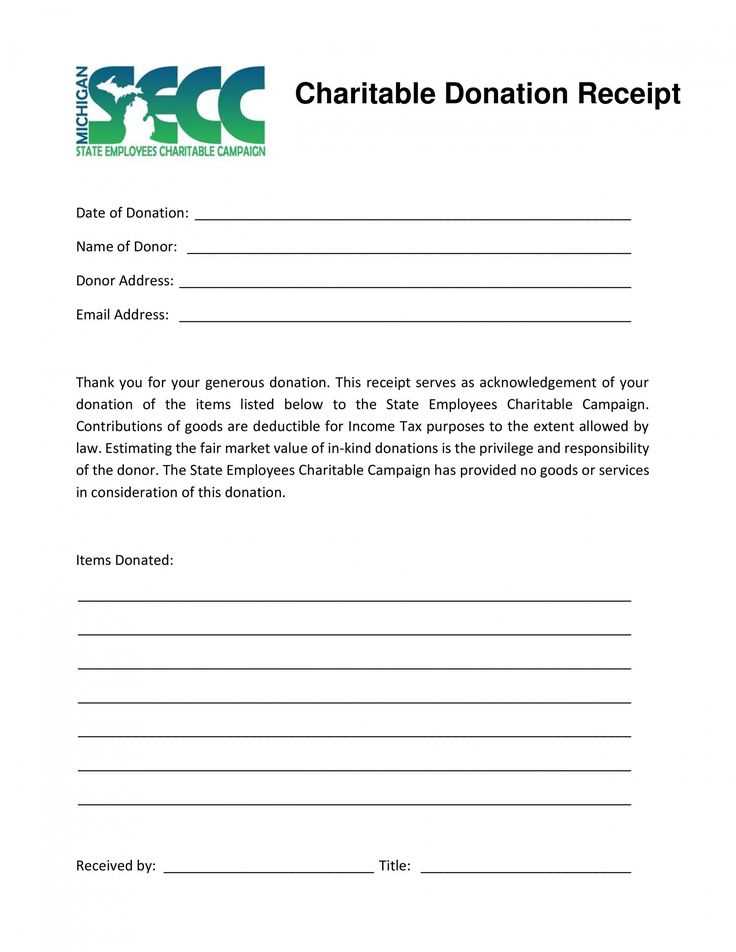

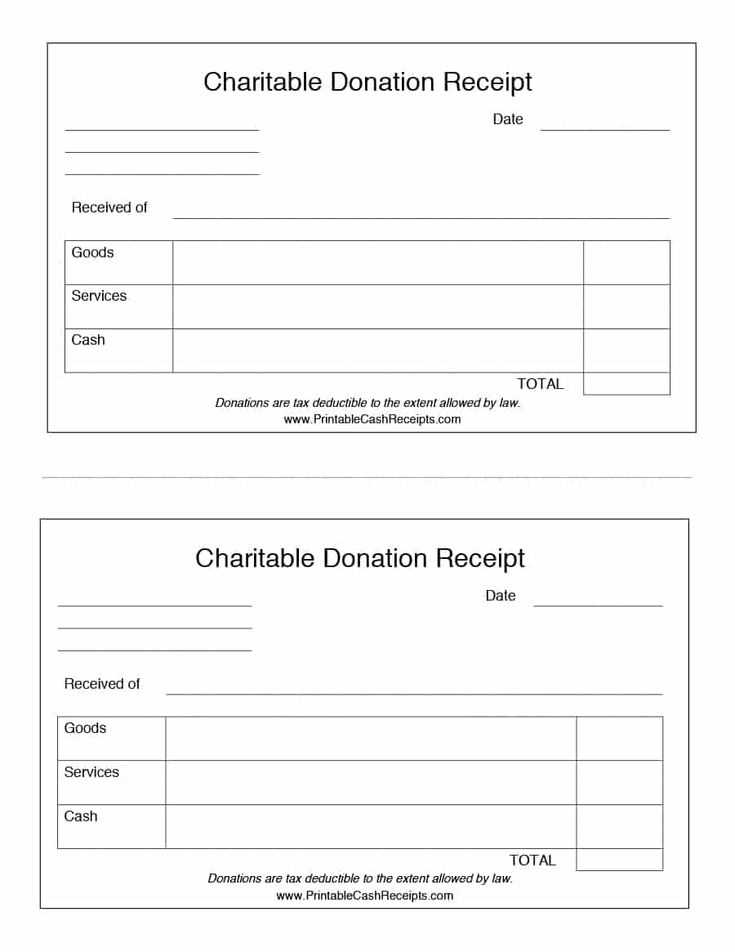

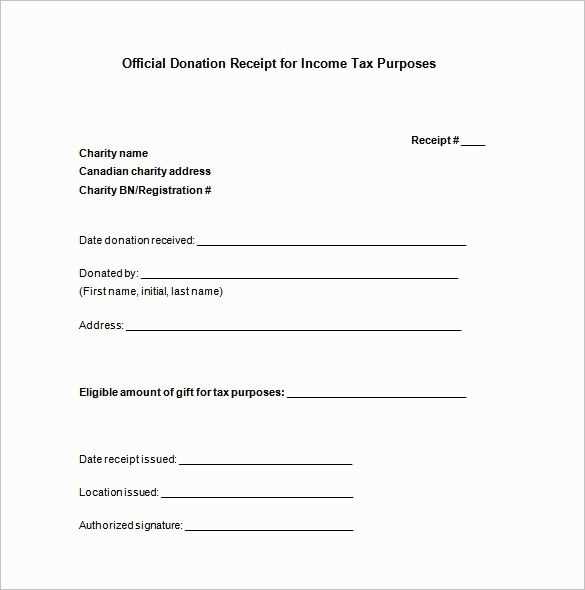

Use a clear, simple format for your receipt. Begin with the charity’s official information, followed by the donor’s details, including their full name and address. For transparency, list the donation details separately, mentioning if it was a one-off contribution or part of an ongoing pledge. This ensures the donor has all the necessary information for their records and potential tax relief claims.

For Gift Aid donations, remember that a signed declaration from the donor is required to claim tax back on their donations. Including a reminder about this in your receipt can help streamline the process for both the charity and the donor. Don’t forget to thank the donor for their contribution, as this personal touch reinforces the charitable relationship.

Sure! Here’s the revised version:

When creating a charity donation receipt, make sure it includes all the necessary details to ensure clarity and compliance. Here’s a straightforward guide on what should be included:

- Charity Name: Clearly state the full name of the charity.

- Donor Information: Include the name and contact details of the donor.

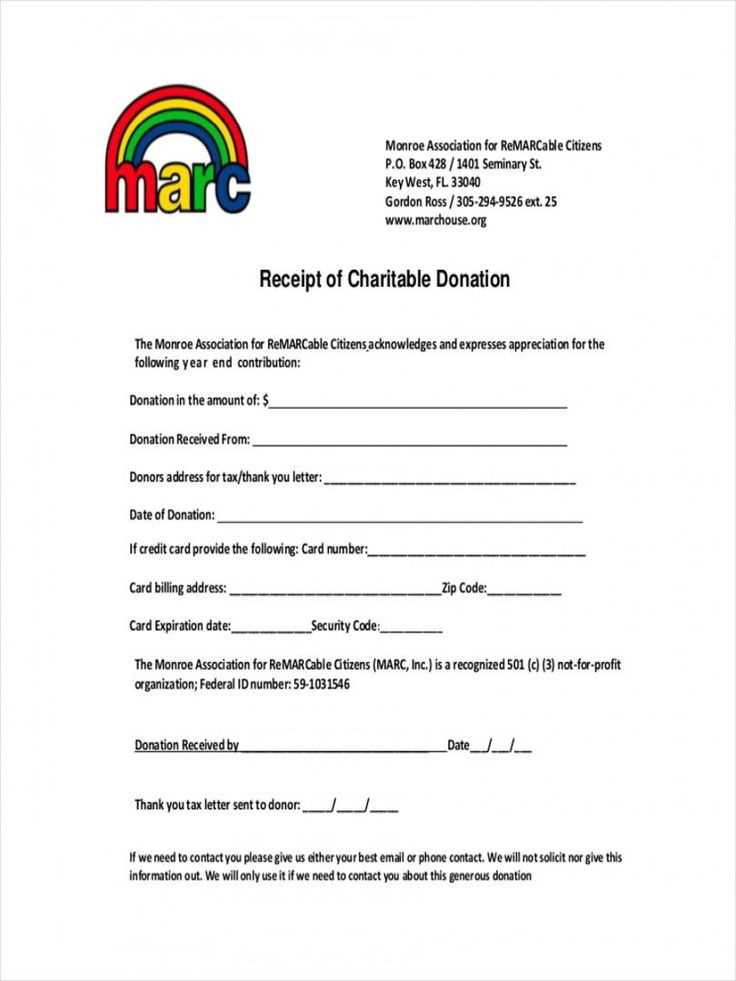

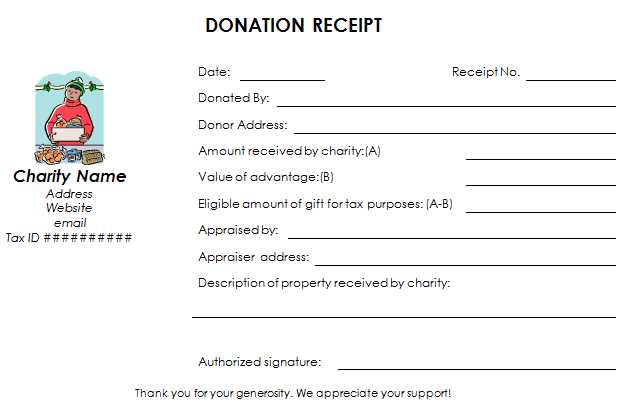

- Donation Amount: Specify the exact donation amount, whether monetary or in-kind.

- Donation Date: Clearly mention the date of the donation.

- Gift Aid Status: Indicate whether Gift Aid applies to the donation.

Additional Elements to Consider

- Charity Registration Number: If applicable, include the charity’s registration number.

- Thank You Message: A short note of appreciation can be added at the end of the receipt.

By including these details, you can ensure that the receipt is complete and useful for both the donor and the charity for future reference or tax purposes.

- Charity Donation Receipt Template UK

Ensure your charity donation receipts meet UK standards by including key details. Start with the charity’s name and registered address, followed by the donation amount, and the date of the donation. If the donation is in-kind, describe the items clearly. If applicable, include the donor’s full name and contact information. Add a unique reference number to keep records organized and transparent.

Include a statement confirming that no goods or services were provided in exchange for the donation, ensuring compliance with HMRC regulations. For donations above £100, some charities may provide a separate gift aid declaration, which should be referenced or attached to the receipt if required. Keep receipts brief, clear, and well-organized for both the charity’s and donor’s records.

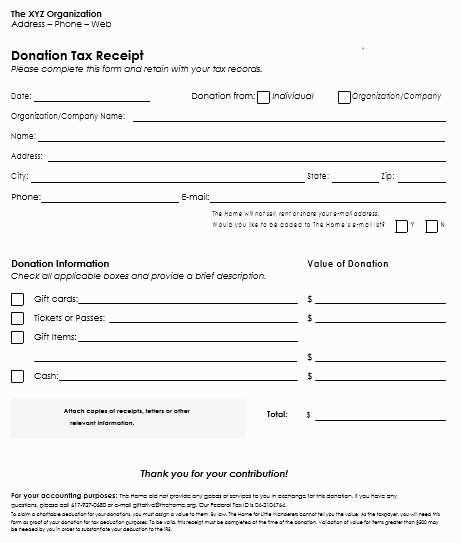

Begin by including the name and contact information of your charity or nonprofit organization at the top of the receipt. This should include the full name, address, phone number, and email address. If applicable, add your charity registration number to ensure legitimacy.

Donation Details

Clearly state the amount donated, including any currency details. If the donation was in-kind (such as goods or services), describe the items or services donated, along with their approximate value. If the donation was anonymous, omit personal details but still acknowledge the donation type.

Tax Information

If the donation is tax-deductible, include a statement to confirm this status. Mention the tax year for which the donation applies and any conditions that the donor needs to be aware of for tax purposes. You may also include a reminder to keep this receipt for tax filing purposes.

Donation receipts in the UK must meet specific legal requirements to ensure tax relief for both donors and charities. These receipts must provide clear evidence of the donation, including essential details for proper record-keeping. Here’s what needs to be included:

- Charity Details: The charity’s name, registration number, and address must appear on the receipt.

- Donation Information: Include the amount donated, whether it’s monetary or in-kind, and the date of the donation.

- Donor Details: It’s important to record the donor’s name and, in some cases, their address. This is particularly necessary for higher value donations and if the donor is claiming Gift Aid.

- Gift Aid Declaration (if applicable): For donations that qualify for Gift Aid, a statement confirming the donor’s consent to claim Gift Aid is required.

- Confirmation of No Benefit: If the donation was made without receiving any material benefit, this must be stated clearly.

Failure to meet these requirements could result in complications, particularly regarding Gift Aid claims or audit processes. It is advisable for charities to have a standardized template to ensure compliance and maintain accurate records for tax reporting purposes.

Include the donor’s name and address to identify them clearly. This helps both the donor and the charity organization maintain accurate records for tax purposes.

Donation Details

State the amount donated, specifying whether it was a monetary contribution or in-kind donation. If the donation was made in multiple installments, list each separately. For non-monetary donations, describe the items and their approximate value.

Charity Information

Clearly display the charity’s name, registered address, and charity number. Include contact information such as phone number and email for any follow-up or verification.

Lastly, include a statement confirming that no goods or services were provided in exchange for the donation, as this is important for tax deduction purposes.

Donation receipts in the UK must include specific details to be valid for tax purposes. A charity receipt should clearly state the charity’s name, address, and registration number with the Charity Commission. Additionally, include the donor’s name, address, and the date of the donation. If the donation is monetary, specify the amount given; if it’s in-kind, describe the item donated along with its estimated value.

Receipt Elements: The following are necessary for every donation receipt in the UK:

- Charity’s name and registered charity number

- Donor’s details (name and address)

- Donation amount or item description

- Date of the donation

- Confirmation that no goods or services were received in exchange for the donation

Additionally, receipts should mention the Gift Aid status, stating that the charity is registered for Gift Aid if applicable. This enables the donor to claim tax relief on their donation. Ensure that all receipts comply with HMRC standards to avoid issues with tax claims.

Practical tip: Make sure the receipt is signed or digitally verified for authenticity. Charities may use a simple template or automated systems to generate these receipts quickly for donors after a contribution is made.

Donors can benefit from tax relief when they make charitable contributions, but proper documentation is required to claim these benefits. The main tax advantages include Gift Aid and potential deductions on taxable income. Donors must keep accurate records to ensure their donations are eligible for these tax benefits.

The following documentation is essential for claiming tax relief:

| Document | Purpose |

|---|---|

| Receipt of Donation | Confirm the date, amount, and charity’s details, including their registered charity number. |

| Gift Aid Declaration | Allows the charity to reclaim the tax on donations made by a UK taxpayer. Must include donor’s name, address, and a declaration of their tax status. |

| Bank Statements/Payment Confirmation | Proof of transaction for online or bank transfers, supporting the donation amount. |

Ensure all receipts and declarations are stored securely and accessible for tax filing purposes. Without the necessary documentation, the tax relief may not be valid. Keep records for at least six years to comply with UK tax regulations.

Send receipts promptly after receiving a donation. Use email for quick delivery or post if the donor prefers physical copies. Ensure each receipt includes donor details, donation amount, and the charity’s registration number. For large donations, consider adding a personalized thank-you note to enhance the donor’s experience.

Email Distribution

For most donors, email is the preferred and fastest way to send receipts. Use an automated system that generates a personalized receipt once a donation is made. This method saves time, reduces administrative costs, and provides an instant record for both the charity and the donor.

Postal Distribution

Some donors may request or prefer a printed receipt. In these cases, ensure that the receipt is clearly formatted, includes all necessary details, and is sent in a timely manner. If your charity handles high volumes, you can prepare batches for mailouts at scheduled intervals to optimize workflow.

To create a donation receipt template in the UK, include the donor’s name, donation amount, and date. Clearly state that the donation is voluntary and not in exchange for goods or services. It is also important to specify the charity’s name, registered charity number, and address. You may also want to include a brief statement on the charity’s tax-exempt status and how the funds will be used.

Key Elements to Include

Ensure that your template has all necessary fields: Donor’s name, amount donated, and any specific reference to the donation purpose. Adding a unique reference number helps with record keeping.

Format and Delivery

Use a clean, professional design with clear fonts. Provide the receipt via email or post, depending on donor preferences. Ensure it meets the legal requirements for tax purposes, including charity registration details.