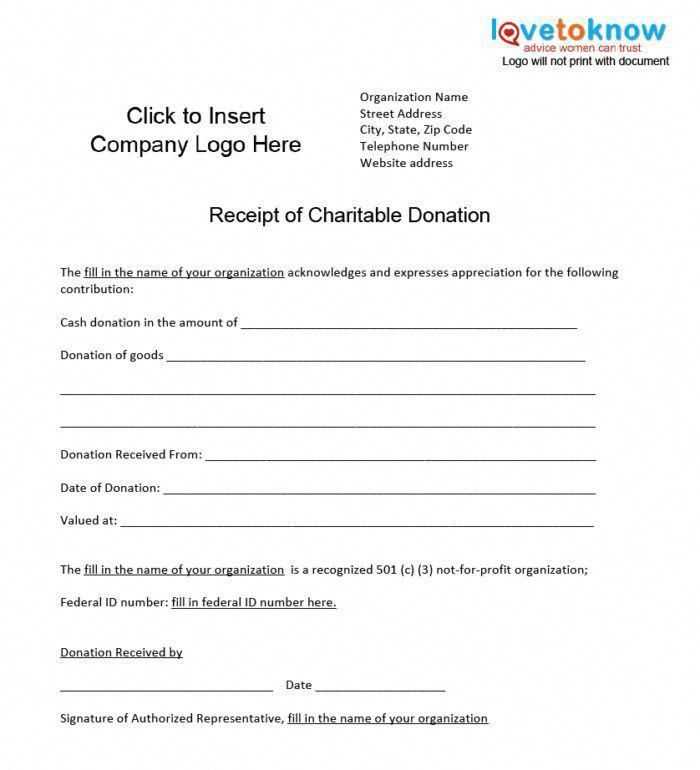

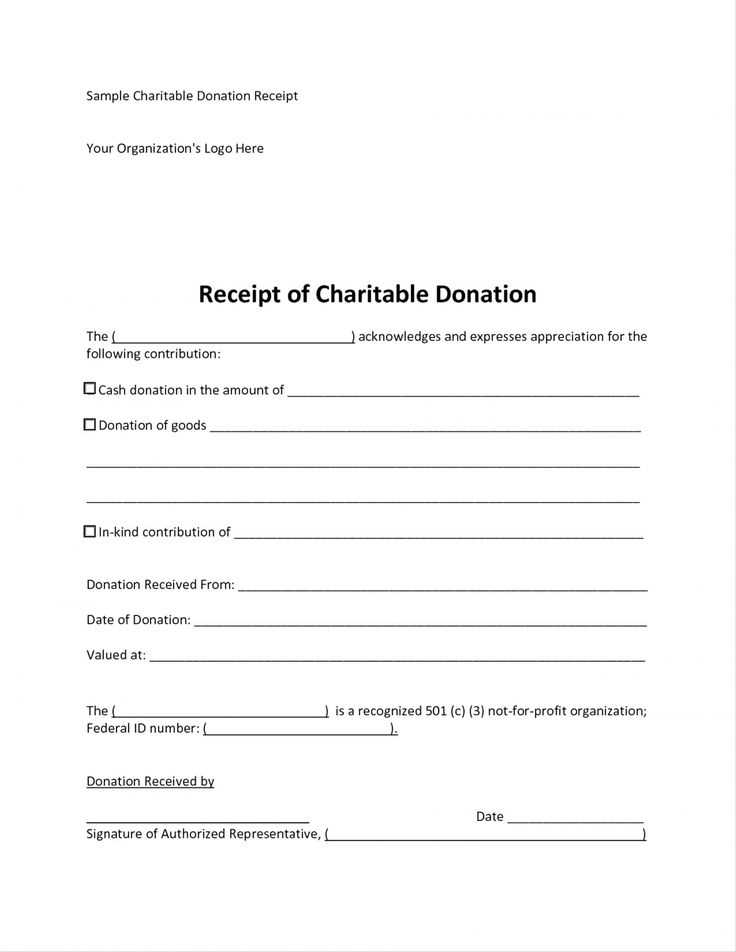

Creating an accurate and professional year-end donation receipt for church contributions is vital for both donors and the organization. A well-crafted receipt not only provides transparency but also serves as a valuable tax document. Start by clearly listing the donor’s name, the church’s name, and the date of the contribution. This basic information helps establish the receipt’s authenticity and ensures proper recordkeeping.

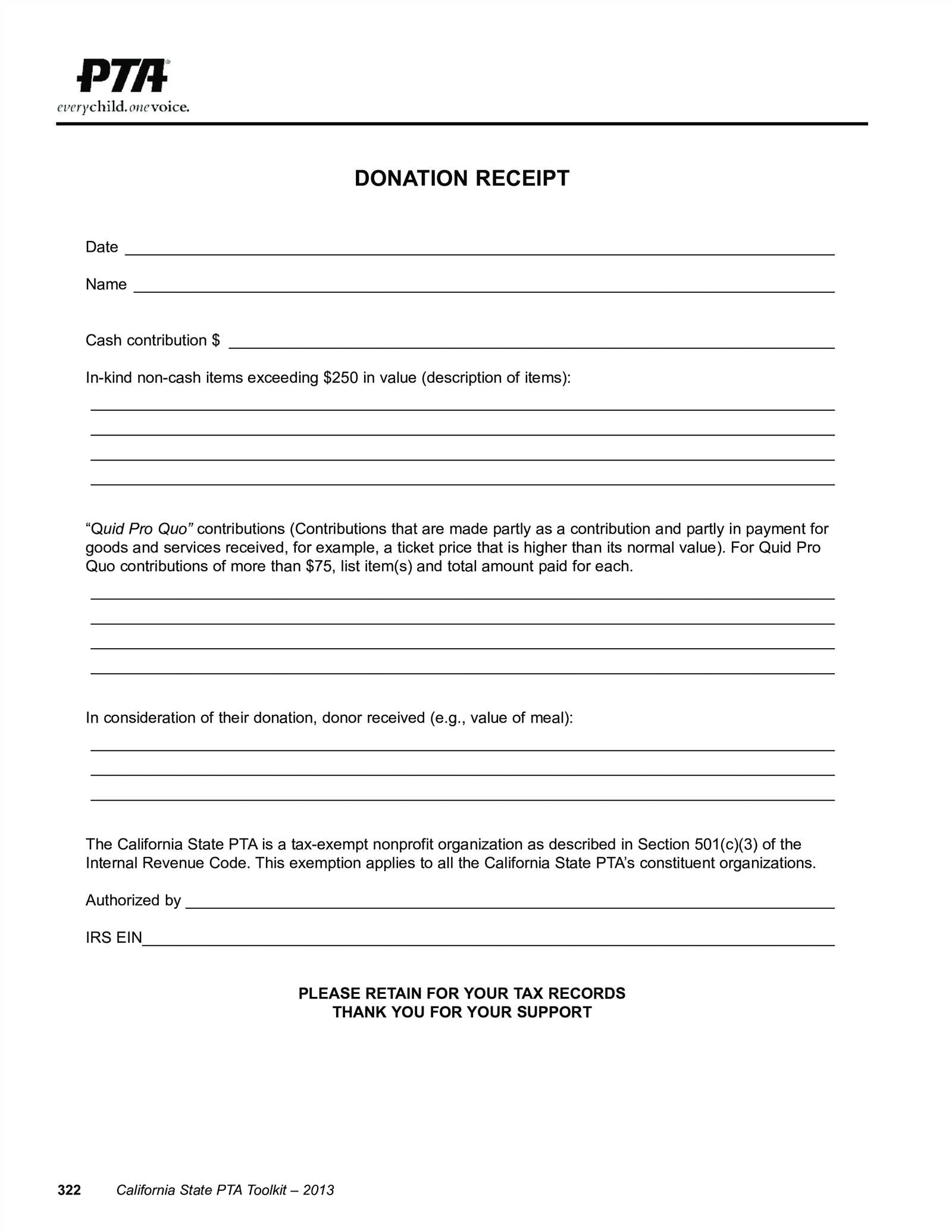

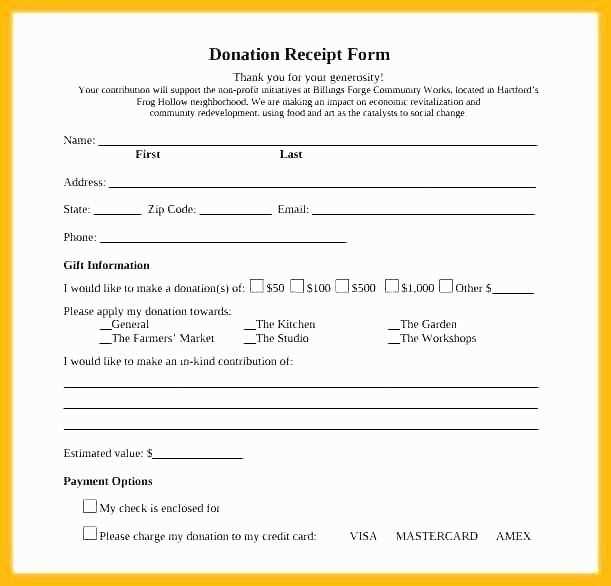

Next, include a detailed breakdown of the donations made throughout the year. List each contribution separately, along with the date, amount, and method of donation (whether it was cash, check, or in-kind). If applicable, indicate whether the donation was eligible for tax deduction, ensuring that all necessary details are present to avoid any confusion during tax filing.

It is also important to acknowledge any non-monetary donations, such as goods or services. For in-kind donations, provide a description of the items donated and their estimated value. This ensures that the donor receives the proper recognition and can claim the appropriate deductions.

Finally, close the receipt with a formal thank you message from the church, emphasizing gratitude for the donor’s support. This not only expresses appreciation but also encourages continued generosity. Using this template will streamline the process of creating year-end donation receipts, making it easier for churches to maintain accurate records while providing donors with the necessary documentation for tax purposes.

Church Contribution Statement Year End Donation Receipt Template

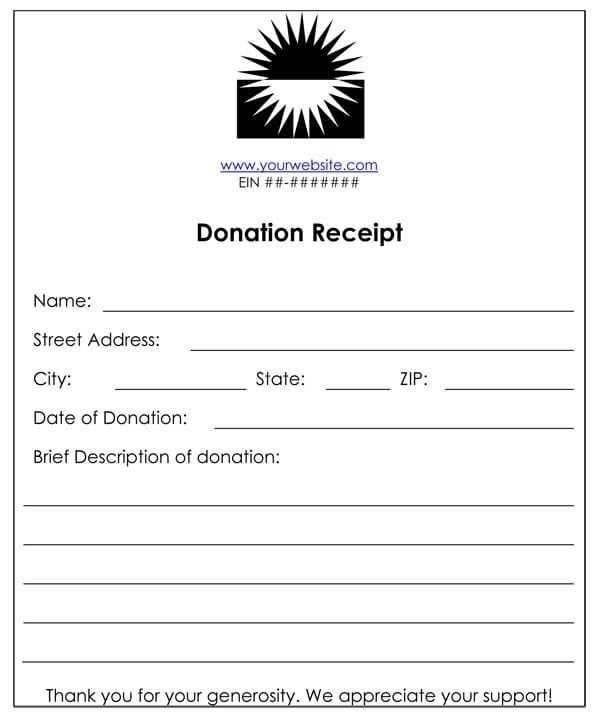

To streamline the year-end donation process, create a clear and organized template for your church contribution statement. The template should include the donor’s name, the donation date, and the amount donated. Include a brief thank-you note to express appreciation for their contribution. Make sure the statement adheres to IRS guidelines for tax deductions.

Key Elements to Include

Start with the church’s name and contact information at the top. Clearly state the purpose of the document–”Year End Donation Receipt”–so donors know its intent. List each donation with the date and amount given. If applicable, categorize the donation (e.g., general fund, building fund, special offerings) for clarity. Additionally, indicate whether any goods or services were provided in exchange for the donation.

Formatting Tips

Make the document easy to read by using a simple layout. List donations chronologically for each donor. Avoid unnecessary text and keep the design clean and professional. Add a signature field at the bottom for church representatives to sign, confirming the accuracy of the information.

By implementing these elements, you can ensure your church contribution statements are both functional and compliant with donation reporting standards.

Creating a Customizable Year-End Donation Receipt Template for Church Contributions

Start with clear fields for the donor’s name, address, and donation amount. Include space for the church’s name, address, and tax-exempt status, ensuring it complies with IRS requirements for charitable contributions.

In the template, add a section for the donation type, such as cash, check, or goods. For non-cash donations, include a description and estimated value. This ensures transparency and avoids confusion during tax filing.

Acknowledge the donor’s generosity with a simple thank you message that can be customized. For example, “Thank you for your generous contribution to [Church Name]. Your support enables us to carry out our mission and serve our community.”

Include the date of the donation and specify whether it was a one-time or recurring gift. This helps both the donor and the church track contributions accurately.

Offer a section for additional notes or reminders, such as upcoming events or specific programs funded by donations. This can encourage further giving and keep donors engaged.

Ensure the template is designed to be easily updated each year, with options to adjust for new IRS guidelines or church needs. By keeping the layout flexible, you can provide accurate receipts year after year without starting from scratch.

| Field | Description |

|---|---|

| Donor Name | Full name of the donor |

| Donation Date | The exact date of donation |

| Donation Amount | Amount donated (or estimated value for non-cash donations) |

| Donation Type | Specify cash, check, goods, or other |

| Church Information | Church’s name, address, and tax-exempt status |

| Thank You Message | A personalized thank you for the donor |

Ensuring Legal Compliance in Your Church Donation Receipts

Ensure your church donation receipts include the following elements for legal compliance:

- Organization Information: Clearly state the church’s name, address, and tax-exempt status. This confirms that the donation is made to a qualified organization.

- Donor Details: Include the donor’s name and address for proper acknowledgment. This will ensure they can claim tax deductions for their contributions.

- Date of Donation: Always list the specific date when the donation was made. This is necessary for accurate record-keeping and tax purposes.

- Donation Amount: Clearly state the exact amount of the contribution. For non-cash donations, include a description of the item(s) donated, including their fair market value.

- Written Acknowledgment: If the donation exceeds a certain threshold, provide a statement that the donor did not receive any goods or services in exchange for the contribution, or describe what was received, if applicable.

Non-Cash Donations

If your church receives non-cash donations, such as goods or services, it is crucial to include specific details. Ensure your receipts state the fair market value of these items. The donor should have a reasonable estimate of value, as your church is not allowed to appraise donations for tax purposes.

Keep Accurate Records

Always keep a record of all donations, including the receipts issued. These records must be available for IRS review and must be stored securely for a period defined by local regulations.

How to Automate the Process of Generating Year-End Receipts for Multiple Donors

Use donation management software that integrates with your church’s database. This allows automatic tracking of donor information and donation amounts. The software can generate receipts for all donors at once, saving time and reducing errors.

Set up automated reports in your system to pull donor data for the year. This ensures that every contribution is captured and included in the receipts without needing manual input. Choose software that allows customization of the receipt template so you can include relevant church details and tax information.

Integrate payment processors like PayPal, Stripe, or ACH into your system. These tools can automatically import donation details, making the receipt creation process seamless and eliminating the need for manual data entry.

Schedule the receipt generation to run automatically at year-end. Many platforms allow you to set this up so that it triggers on a specific date. After the process completes, the receipts can be emailed directly to each donor or made available for download through the church’s online portal.

Use email templates for receipt distribution. Set up a template that includes all necessary information such as the donor’s name, donation amount, church’s tax ID, and a thank you message. This can be automatically populated and sent to each donor.

Ensure your system can handle bulk email sending. If you have many donors, consider using an email service provider that allows for batch emailing, which can improve deliverability and prevent emails from being flagged as spam.

Keep the system updated with the latest tax regulations to ensure compliance and accuracy in receipts. Many donation management systems regularly update templates and tax rules, making it easier to maintain up-to-date documents.