If you are a church or religious organization accepting donations, providing a tax deduction receipt is a straightforward but crucial part of the process. A well-crafted template ensures donors can easily claim deductions on their taxes, while keeping your records organized and compliant with IRS requirements. Below, you’ll find a simple, customizable template that covers all the necessary details.

The donation receipt should include specific information like the donor’s name, donation date, amount, and a statement confirming whether the donation was in cash or in kind. Including your church’s tax-exempt status number is also essential, as it confirms the legitimacy of the donation. To avoid any confusion, it’s advisable to issue a receipt for each donation, no matter how small, to keep a clean and transparent record.

Incorporating these elements into your church donation receipt template will not only make the process easier for both you and the donor but also ensure smooth tax filing at the end of the year. By offering clear and accurate documentation, you help donors with their tax filings and strengthen your organization’s financial integrity.

Here’s a revised version with reduced repetition of words:

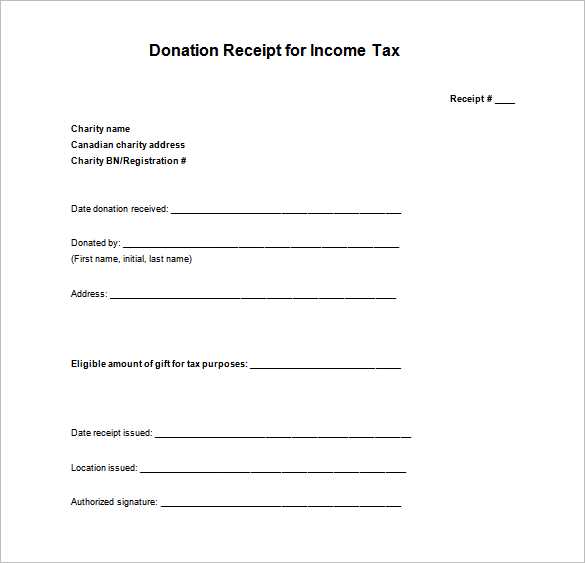

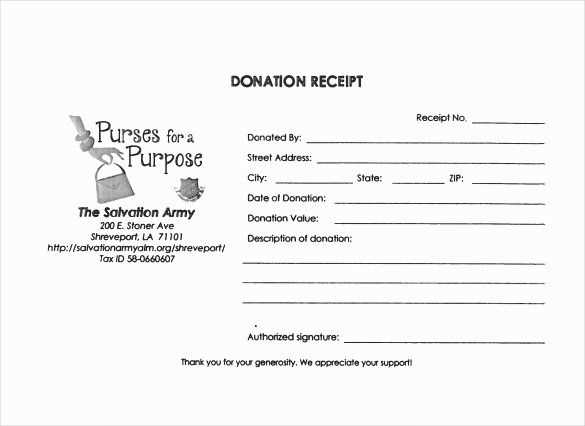

A church donation tax deduction receipt must include several key details to ensure its validity for tax purposes. Make sure to include the donor’s full name, address, and donation date. The receipt should specify the amount donated, or if it was a non-monetary contribution, a description of the items donated. Be clear whether the donation was cash, check, or property. Also, indicate the church’s name, tax-exempt status (such as IRS 501(c)(3) for U.S. charities), and the charity’s identification number, if applicable. Finally, ensure the receipt is signed by an authorized representative of the church for proper documentation. This format ensures compliance with tax laws and provides clarity for the donor when claiming their deduction. Ensure that the receipt is issued promptly after the donation to avoid any complications during tax season.

- Church Donation Tax Deduction Receipt Template

A church donation tax deduction receipt should include specific details for it to be valid for tax purposes. The template should clearly indicate the donor’s name, address, and the amount donated. Include the church’s name, address, and tax-exempt status number. Also, mention the date of the donation and the donation type–whether it was cash, check, or property.

Key Information to Include:

- Donor’s name and contact information.

- Church’s name, address, and tax-exempt ID number.

- Donation amount or description of donated goods.

- Exact date of the donation.

- Statement clarifying whether the donation is tax-deductible.

- Signature of a church representative or authorized person.

Be sure to issue the receipt by the end of the year for the donor to claim deductions on their tax return. Providing this receipt in a timely manner will help ensure a smooth tax filing process.

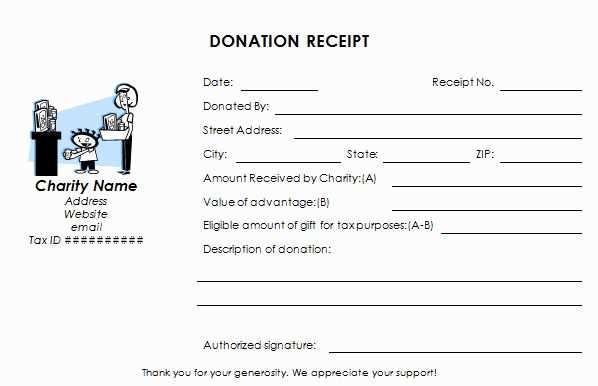

Ensure the donation receipt includes all the required elements to be legally compliant. The IRS outlines specific criteria for charitable donation receipts, especially for tax deductions. Follow these steps to create a valid and complete receipt:

| Information to Include | Details |

|---|---|

| Church’s Name and Address | Clearly state the full name and physical address of the church receiving the donation. |

| Donor’s Name | Include the full name of the donor who made the donation. |

| Donation Amount | Specify the exact dollar amount of the monetary donation. For non-monetary donations, provide a description of the donated goods. |

| Tax-Exempt Status | Include the church’s IRS tax-exempt number to verify the organization’s eligibility to issue tax-deductible receipts. |

| Date of Donation | Clearly mark the date when the donation was made. |

| Statement of No Goods or Services Received | If the donor didn’t receive anything in exchange for the donation, include a statement such as “No goods or services were provided in exchange for this contribution.” |

Use clear and precise language to avoid ambiguity. Also, ensure the receipt is signed by an authorized representative of the church, confirming its validity. The IRS requires that receipts for donations over $250 include specific information, so it’s best to double-check the guidelines to ensure the document meets all requirements.

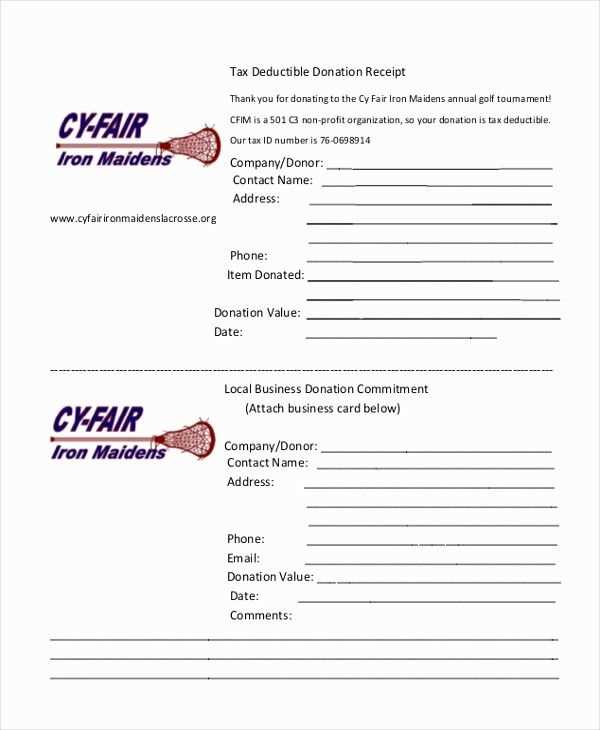

Include these key details in your church donation record template for clarity and tax purposes:

Donor Information

- Donor’s Full Name: Include the complete name of the donor.

- Donor’s Address: Provide the full mailing address for the donor.

- Contact Details: Include the donor’s phone number or email.

Donation Information

- Donation Amount: Specify the total value of the donation.

- Donation Date: Mention the date when the donation was received.

- Payment Method: Indicate how the donation was made (e.g., cash, check, online transfer).

- Purpose of Donation: Note if the donation is designated for a specific fund or purpose.

Church Information

- Church Name and Address: Provide the full name and address of the church.

- Tax ID Number: Include the church’s tax-exempt ID number for verification.

Acknowledgment Statement

- No Goods or Services Provided: State that the donation was made without any goods or services in exchange.

- Receipt Acknowledgment: Confirm that the church acknowledges the donor’s contribution.

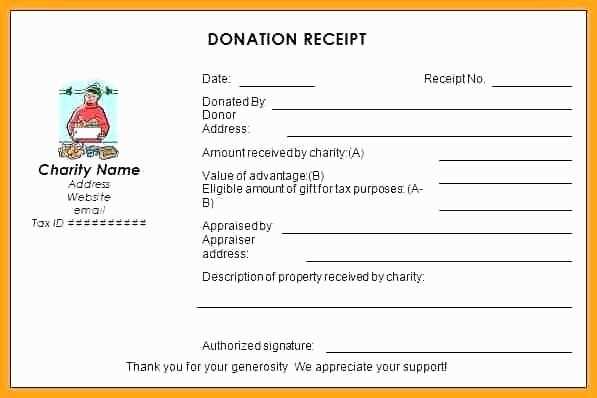

Distribute donation receipts promptly after a contribution is made. Ensure that the donor receives their receipt either immediately via email or within a few days by postal mail. This allows them to include the donation in their tax filings for the current year.

Organize receipts carefully by keeping accurate records of each transaction. This includes the donor’s name, donation amount, date, and the church’s tax-exempt status. It is also important to clearly state on the receipt that the donor did not receive any goods or services in exchange for the contribution, as this is necessary for tax deductions.

For donations of goods, itemize the donated items and assign a fair market value to them. This is especially important for non-cash contributions like clothing, furniture, or electronics. Donors will need this information to claim the appropriate deduction on their tax returns.

Ensure all receipts are signed by an authorized church representative. This adds legitimacy and verifies that the receipt is authentic. Donors must retain these receipts for their personal tax records and provide them in case of an audit.

Consider using an automated system to generate and track receipts. This can reduce administrative burdens and help maintain accuracy. The system should store all donor information securely and allow easy retrieval when necessary.

This revision preserves the meaning and intent while minimizing word repetition.

A church donation receipt should clearly reflect the details of the transaction for both tax purposes and donor records. To achieve this, include the donor’s name, the amount of the contribution, the date, and a statement confirming whether the donation was in cash or property. Be specific about any goods or services provided in return, and clarify if they had any monetary value that might reduce the tax-deductible amount. It’s also beneficial to mention that the church is a registered tax-exempt organization. This transparency ensures the donor can properly claim deductions while avoiding any confusion during tax filing.

Clarifying Donation Details

Accurate information is key. Always state the exact dollar amount of the donation, including any itemized donations of goods or services. If goods were donated, list their fair market value at the time of donation. A concise but clear receipt with all this data eliminates ambiguity when donors present the receipt for tax filing.