A church donation tax receipt template should include specific elements to ensure compliance with tax regulations. Begin with the name and address of the church, clearly stating its nonprofit status. This information will confirm the legitimacy of the church for tax purposes.

Next, include the donor’s details such as their full name and address. Ensure that the amount donated, the date of donation, and a brief description of the gift (whether monetary or in-kind) are listed. A separate section should verify if any goods or services were provided in exchange for the donation, as this affects the deductible amount.

It’s important to ensure the template has a statement confirming that no goods or services were provided in exchange for donations over a certain value. If applicable, include a statement of appreciation, which also adds a personal touch to the receipt.

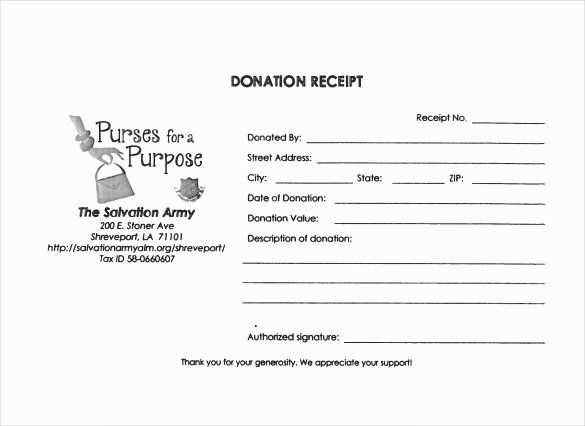

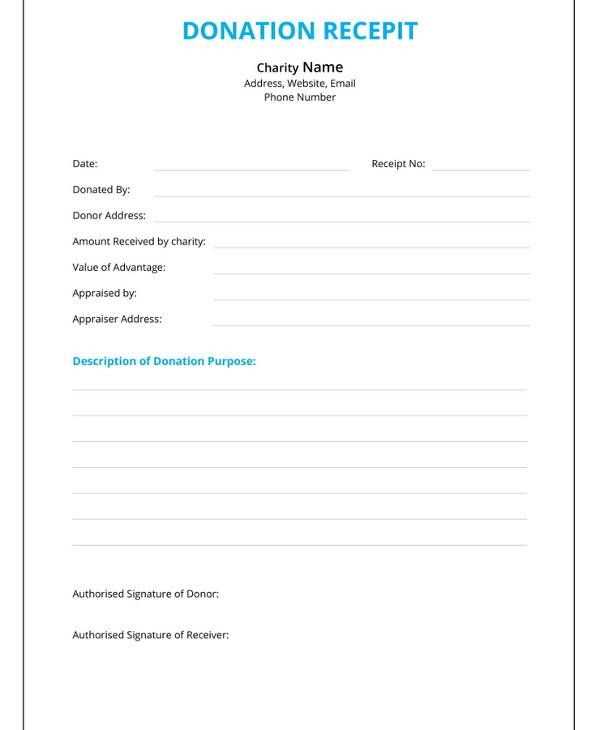

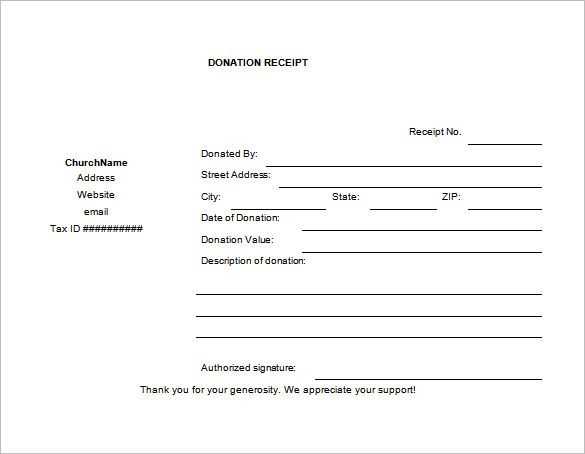

Church Donation Tax Receipt Template

Creating a clear and concise donation tax receipt template for your church is important for ensuring transparency and compliance with tax laws. The receipt should include all necessary details that donors need for tax purposes. Below is a recommended template structure for a church donation tax receipt.

| Section | Details |

|---|---|

| Church Name and Address | Name of the church, street address, city, state, and zip code. |

| Receipt Number | A unique number assigned to the receipt for tracking purposes. |

| Donation Date | The date the donation was made. |

| Donor’s Name | Full name of the donor as registered in the church’s records. |

| Donation Amount | The total amount of the donation, in dollars or the equivalent value of donated goods. |

| Non-Cash Donations | If applicable, describe the donated items and their estimated value. |

| Tax-Exempt Status Statement | A statement confirming the church’s tax-exempt status (e.g., “This church is a 501(c)(3) tax-exempt organization.”) |

| Signature | Signature of the authorized church representative who issues the receipt. |

| Additional Notes | Any other relevant information, such as the purpose of the donation (e.g., special project, general fund). |

Ensure that receipts are issued for every donation of $250 or more. For smaller donations, a receipt may not be required, but it’s always best to issue one to maintain good recordkeeping. Customize the template to fit your church’s needs and be sure it complies with local tax laws. This helps both the church and its donors stay organized and compliant.

How to Create a Legally Compliant Donation Receipt for Your Church

To ensure your church donation receipts are legally compliant, follow these key guidelines:

Include Required Information

Your receipt should clearly state the donor’s name, the church’s name, and the donation amount. If the donation is in-kind, specify the description of the items donated. Include the date of the donation, and make sure the receipt is signed by an authorized representative of the church.

State Whether the Donation is Tax Deductible

Clearly indicate whether the donation is tax-deductible. If no goods or services were provided in exchange for the donation, include a statement such as: “No goods or services were provided in exchange for this donation.” This is required by the IRS to validate the donation’s tax status for the donor.

By following these steps, you’ll ensure your donation receipts are both legally compliant and accurate. This minimizes the risk of tax issues for both your church and the donor.

Choosing the Right Format for Your Church’s Donation Receipts

Selecting the appropriate format for your church’s donation receipts is crucial for both ease of use and compliance with tax regulations. The format should be simple to understand, clear, and easily adaptable to different types of donations. A well-organized receipt ensures that donors can properly claim tax deductions, while also making record-keeping seamless for your church.

Paper Receipts vs. Digital Receipts

When deciding on the format, consider the preferences of your congregation. Paper receipts are still widely used, especially by older donors, and provide a tangible record. However, digital receipts are gaining popularity due to their convenience, environmental benefits, and ease of tracking. Both formats should contain the same key elements:

- Church name, address, and contact information

- Donor’s name and contact details

- Date of the donation

- Donation amount or description of goods donated

- Statement that the donation is tax-deductible

- Signature of a church representative (for paper receipts)

Printable Templates vs. Customizable Software

For paper receipts, printable templates offer a straightforward solution. These templates can be filled out manually or pre-printed with most of the information, leaving only donation details to be added. However, for more flexibility, customizable software allows your church to automate the generation of receipts, reducing the risk of errors and saving time. Many accounting or church management software programs offer this feature, where receipts are generated and stored digitally, ready to be sent to donors with just a few clicks.

Ultimately, the format should align with your church’s operational needs and donor preferences. Whether opting for paper or digital, consistency and clarity will ensure a smooth process for everyone involved.

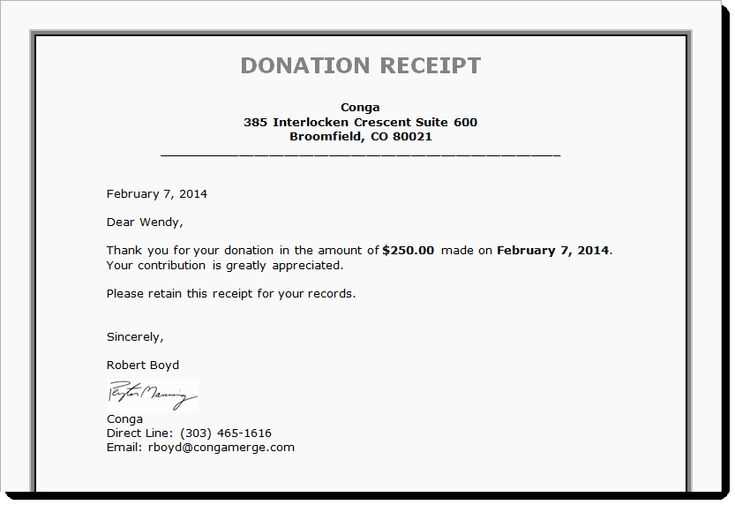

Best Practices for Sending Tax Receipts to Donors

Always send tax receipts within a reasonable time frame after receiving a donation. Donors appreciate receiving receipts promptly, ideally within 48 hours for online donations and no longer than two weeks for offline contributions. This helps donors keep track of their contributions for tax purposes and shows that their support is valued.

Clear and Accurate Information

Ensure that each receipt includes the donor’s full name, address, donation date, donation amount, and a clear statement that the donation is tax-deductible. Any additional details, such as the church’s tax-exempt status, should be included to provide legal clarity. Double-check the figures for accuracy to avoid confusion or complications later.

Choose the Right Format

Whether sending a paper receipt or an electronic one, ensure that the format is easy to understand and professional. For email receipts, provide a downloadable PDF copy. Make sure that your church’s branding is present on the receipt to enhance professionalism and recognition. For paper receipts, use quality materials that reflect the importance of the donation.

Ensure that your contact information is included in case donors need further clarification. Offering clear instructions on how donors can obtain a duplicate receipt or correct an error demonstrates reliability and transparency.