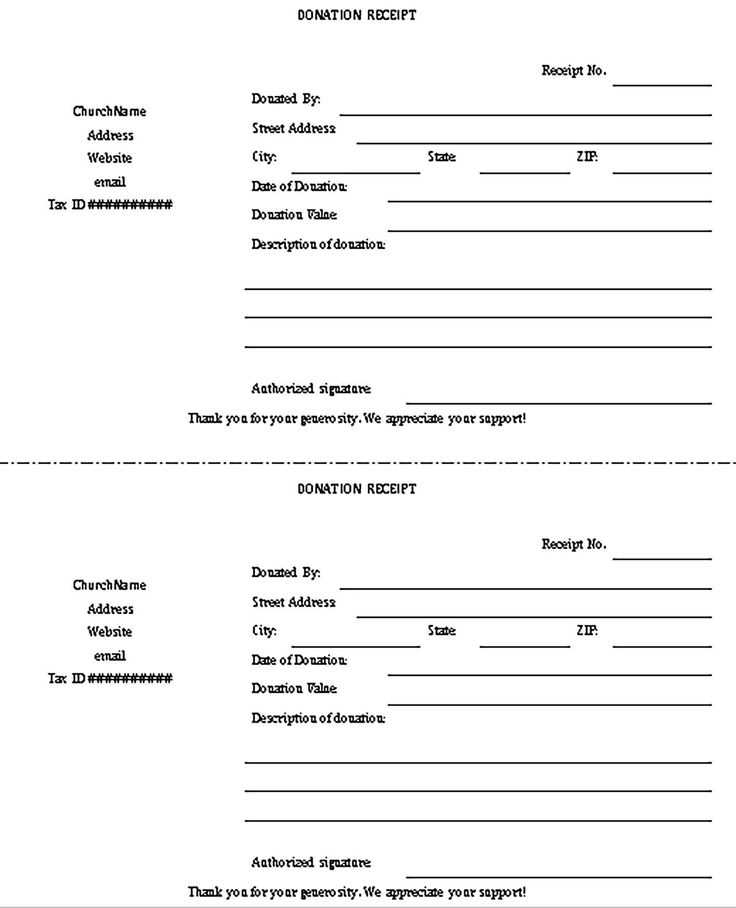

To streamline donation tracking, a well-structured donation receipt is key. Customize your template with essential fields such as donor’s name, amount donated, date, and the purpose of the contribution. Keep the design simple but clear, ensuring that the church’s name, contact details, and tax-exempt status are visible for transparency.

Include clear language regarding whether the donation is tax-deductible. This will help donors properly account for their contributions during tax season. If the church is legally required to provide specific statements, ensure that these details are included in your template to avoid confusion or issues down the line.

Organize receipts sequentially for easier record-keeping and quick retrieval. You can also create separate templates based on donation types–such as one-time gifts versus recurring donations–making it simpler for donors to track their giving history.

Church Receipts for Donations Template

To create a straightforward church receipt for donations, include the following key details: the donor’s name, donation date, amount, and the purpose of the contribution. Clearly state that the church is a registered charity, and provide the church’s tax ID number for tax purposes. If the donation was made in cash, specify this, and if it was by check or electronic transfer, provide the transaction reference or check number.

Donor Information and Acknowledgement

Always include the donor’s full name or organization name, and ensure that the receipt acknowledges the donation in writing. For tax purposes, a statement like “No goods or services were provided in exchange for this donation” is necessary if it’s a charitable gift.

Receipt Template Example

Here’s a simple structure for a donation receipt:

Church Name

Address

Phone Number

Email Address

Receipt for Donation

Received from: [Donor’s Name]

Date: [Donation Date]

Amount: $[Amount]

Purpose: [Purpose of Donation]

Tax ID Number: [Church Tax ID]

Statement: No goods or services were provided in exchange for this donation.

Thank you for your support!

How to Create a Simple Donation Receipt Template for Your Church

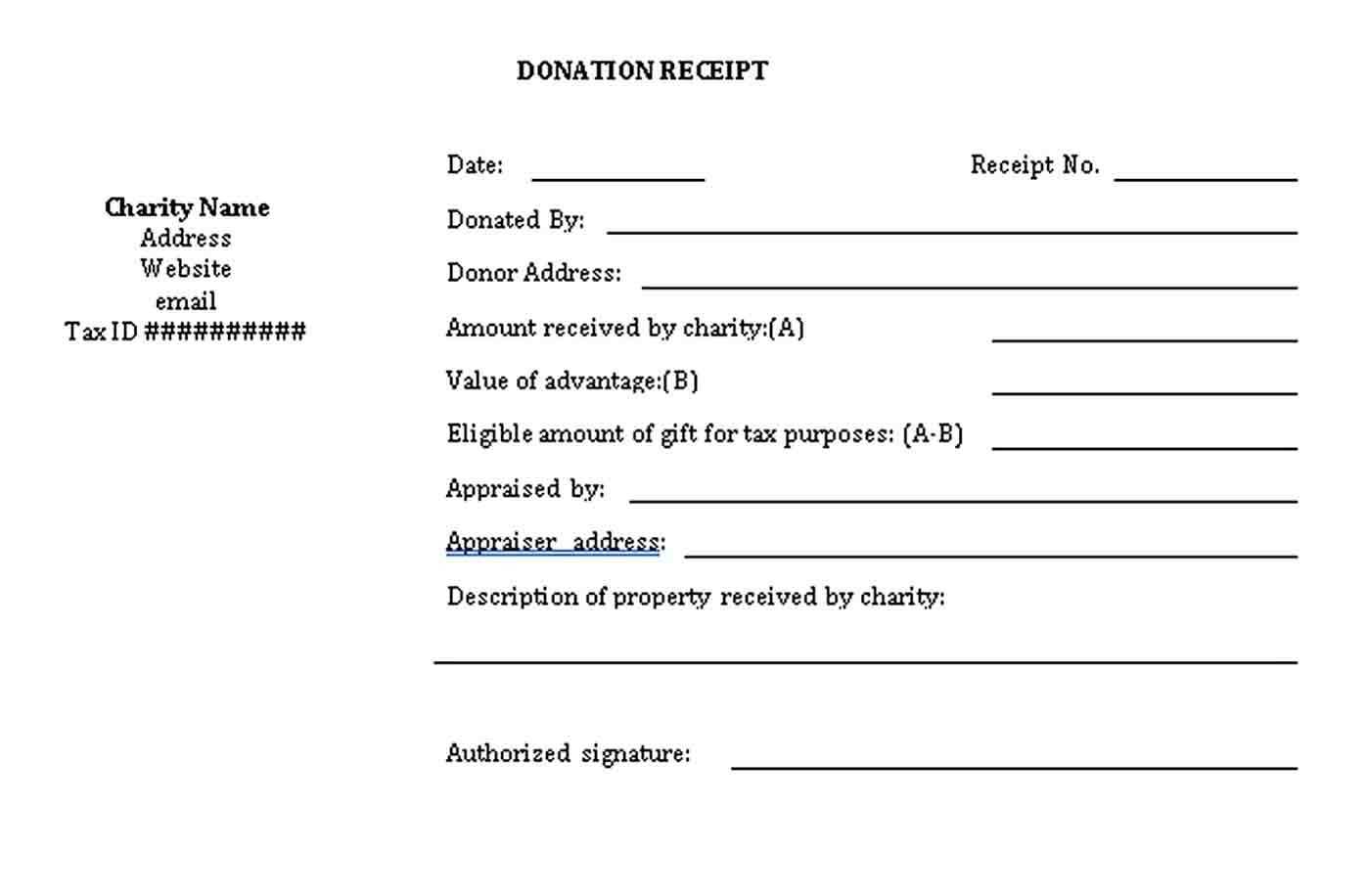

To create a donation receipt template for your church, include basic details such as the donor’s name, donation amount, date, and the church’s information. Ensure the receipt clearly states whether the contribution was monetary or in-kind. Acknowledge any goods or services provided in exchange for the donation.

Include a statement that confirms the donation is tax-deductible, as required by law, and add a line for the donor’s signature if applicable. Keep the design clean and easy to read, focusing on essential details only.

A simple layout might look like this:

- Church Name and contact details (address, phone number, email)

- Receipt Number for tracking purposes

- Donor’s Name and contact details

- Donation Amount or description of items donated

- Date of donation

- Confirmation of no goods or services exchanged

- Tax Deductibility statement

- Signature Line for donor, if needed

Be sure to store copies of all receipts for your church’s records. This ensures you can easily reference donations during tax season or if a donor requests a copy.

Key Information to Include in a Church Donation Receipt

A church donation receipt should provide clear and specific details to ensure both the donor and the church have accurate records for tax purposes. Include the following key elements:

| Information | Description |

|---|---|

| Donor’s Name | Include the full name of the person or organization making the donation. |

| Donation Amount | State the exact amount donated, whether it is a monetary gift or a non-monetary donation. |

| Date of Donation | List the date the donation was received. This helps in tracking the donation within the correct year. |

| Church Information | Include the full name, address, and contact information of the church. |

| Statement of Tax-Deductibility | Include a statement confirming that the church is a tax-exempt organization, allowing the donor to claim the donation as a tax deduction. |

| Type of Donation | Specify whether the donation was in the form of cash, check, property, or another asset. |

| Statement of No Goods or Services Provided | If applicable, include a note confirming that no goods or services were provided in exchange for the donation, which is important for tax reporting. |

How to Customize a Template for Different Donation Types

Adjust your donation receipt template based on the type of donation you receive. Customize key fields to reflect the nature of each contribution.

- Monetary Donations: Include the exact amount donated, date, and donor details. Acknowledge the method (cash, check, or online) to maintain clarity.

- Material Donations: Describe the donated items with their estimated value. Add space for donors to specify the condition of the items provided.

- Recurring Donations: Track the frequency of donations (monthly, quarterly) and include a section for the donor to choose their next donation date.

- In-Kind Donations: Specify the type of service or support offered and provide space to list any expenses covered by the donation.

Ensure your template is flexible, allowing for easy adjustments depending on the donation type. Highlight key information for each donation category to avoid confusion and improve record-keeping.