Creating a church year-end donation receipt template is a practical way to show gratitude and maintain transparency for your donors. A well-designed receipt helps ensure compliance with tax regulations while making the donation process smoother for everyone involved. It’s simple, yet powerful in conveying appreciation and transparency.

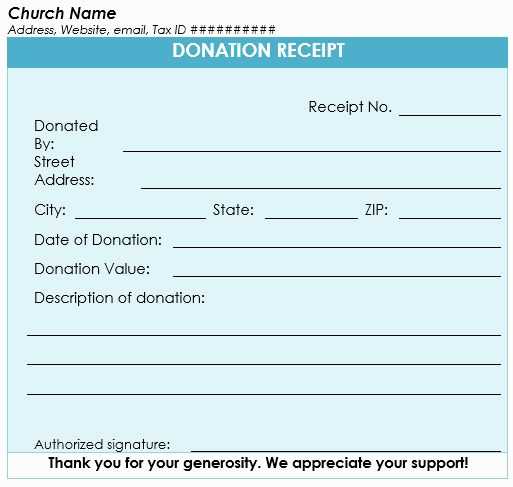

Start by including key details such as donor name, date of donation, and the total donation amount. Be sure to specify whether the gift was cash or in-kind. If the donation includes goods, list their description and approximate value. This clarity ensures that the donor has everything needed to claim a deduction when filing taxes.

Don’t forget to add your church’s contact information and tax-exempt status number. This information is vital for both record-keeping and legal purposes. A template should also allow space for a personalized thank-you note, which strengthens donor relations and fosters future giving.

Keep the template simple and consistent from year to year to minimize errors and confusion. A standardized format that includes all necessary elements will save time and provide a professional touch that your donors will appreciate.

Here is the corrected version without repetition:

Ensure the church year-end donation receipt clearly reflects the donor’s contribution details and complies with tax regulations.

Key Components to Include:

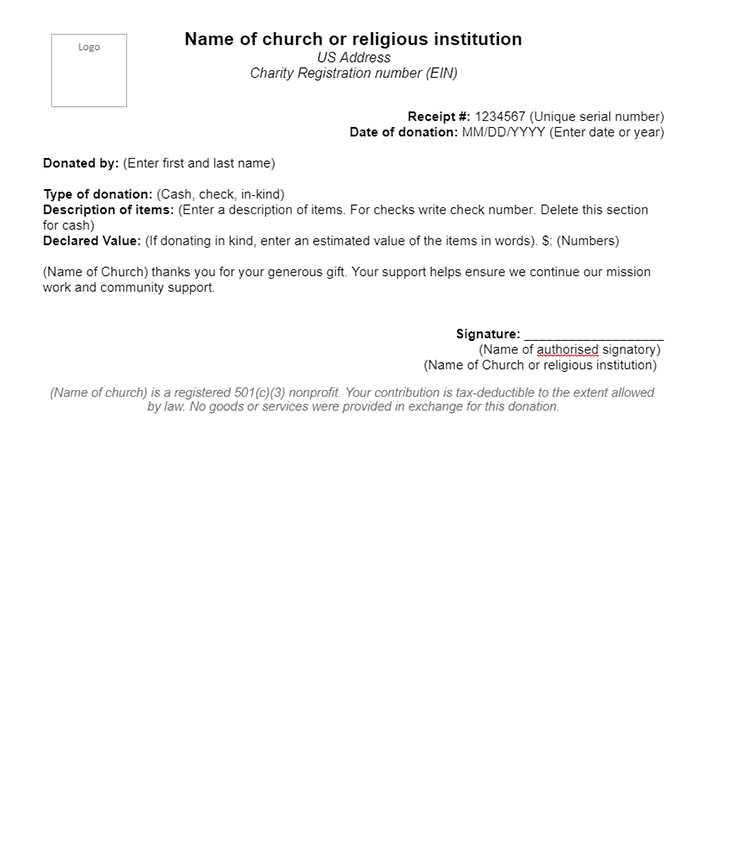

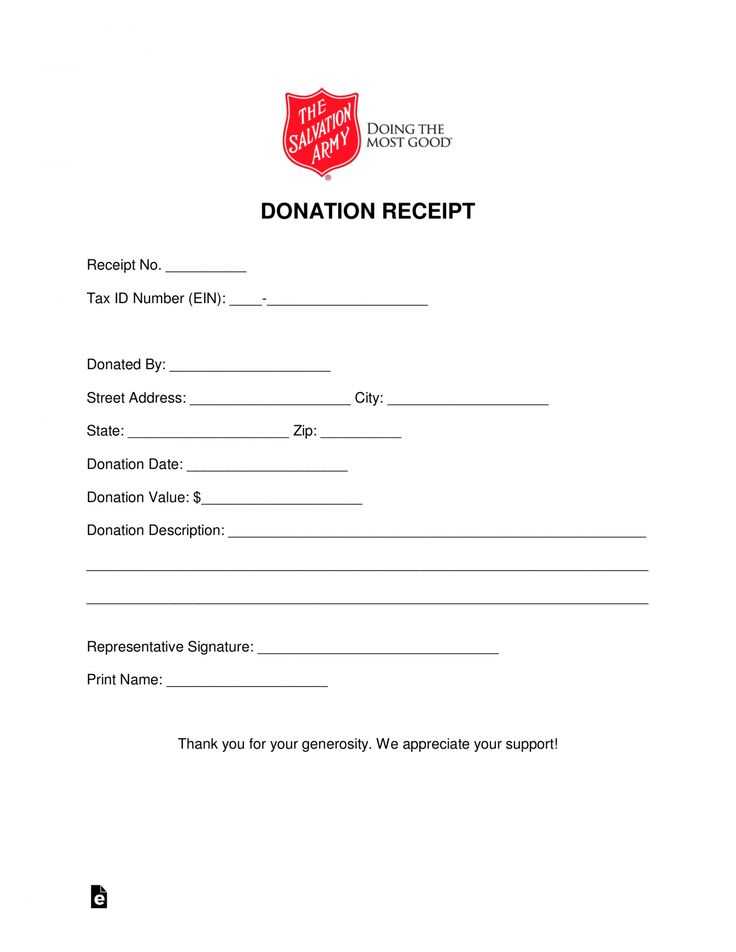

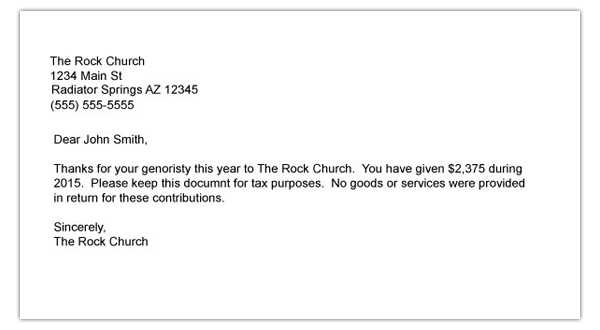

- Church Name and Contact Info: Provide the full name, address, and contact details of the church.

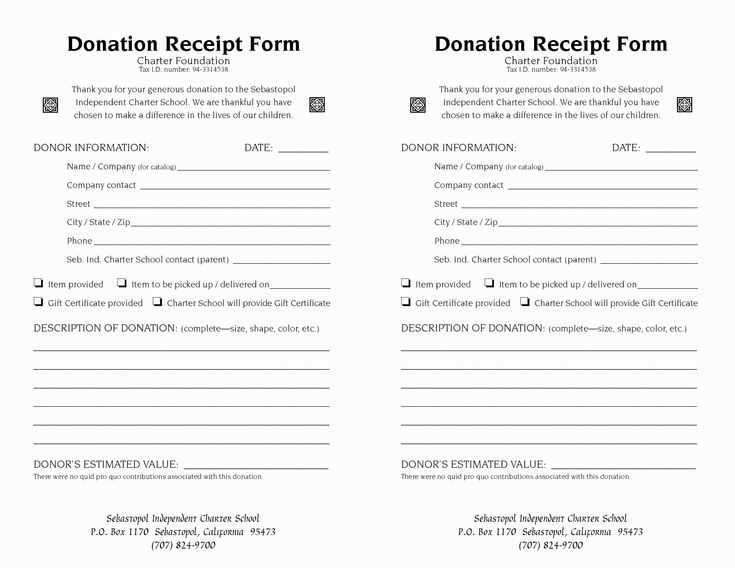

- Donor Information: Include the donor’s full name and address.

- Donation Date: Specify the exact date the donation was made.

- Donation Amount: State the donation’s value. For cash, mention the amount; for in-kind donations, describe the item and its estimated value.

- Tax-Exempt Status: Confirm the church’s 501(c)(3) status, ensuring the donation is tax-deductible.

- Authorized Signature: Have a church representative sign the receipt to validate the donation.

Formatting Recommendations:

- Clear and Organized Layout: Keep the receipt simple with sections for each piece of information. Avoid overcrowding.

- Limit Excessive Design: Use minimal design elements. Focus on the donation details rather than graphics.

- Provide Multiple Formats: Offer the receipt in both printed and digital formats to accommodate different preferences.

By following these guidelines, you’ll produce a receipt that is both legally compliant and easy for donors to understand and use for tax purposes.

- Church Year-End Donation Receipt Template

A year-end donation receipt is a necessary document for both churches and their donors. It provides donors with proof of their charitable contributions for tax deduction purposes. Make sure to include these key details in your receipt:

- Church Name and Address: Include the full name, physical address, and contact details of your church. This makes it clear where the donation is coming from.

- Donor Information: Include the donor’s name and address as provided on the donation form. You may also add the donor’s email for follow-up purposes.

- Date of Donation: Specify the exact date when the donation was made. This helps in determining the tax year to which the donation applies.

- Amount Donated: Clearly state the total monetary value of the contribution. If it’s a check or cash, specify this along with any other forms of payment.

- Description of Non-Cash Donations: If the donation is in kind (e.g., items or services), describe each item along with an estimated value. Do not assign a value to the donation if it’s difficult to determine.

- Statement of Goods and Services: If any goods or services were provided in exchange for the donation, list them along with their fair market value. This helps clarify the portion of the donation that is tax-deductible.

- Statement of No Goods or Services Received (if applicable): Include a statement confirming that the donor received no goods or services in exchange for the donation, making the entire amount deductible.

- Signature of Authorized Person: Have an authorized church representative sign the receipt. This could be the church administrator, treasurer, or minister.

Always ensure the receipt is provided in a timely manner. It’s also a good idea to send receipts in bulk after the close of the year so donors have the necessary paperwork for their taxes.

Include the donor’s name, church’s name, contribution date, and donation amount on every receipt. Specify whether the donation is cash or non-cash. If it’s a non-cash donation, list the items and their fair market value. Ensure you subtract any value for goods or services provided in exchange for the donation.

Required Information

Each receipt must contain:

- Donor’s full name

- Church’s full name and address

- Date of the donation

- Amount donated (cash or description of items for non-cash donations)

- If goods or services were received, note their fair market value

Handling Non-Cash Donations

For non-cash donations, describe the items and include their estimated value. State clearly that the church is not responsible for appraising the items and that the donor is responsible for determining their value for tax purposes.

For donations over $250, include a statement confirming no goods or services were received, or provide a description and the fair market value if something was given in return. This helps ensure compliance with IRS rules.

A year-end donation receipt must include specific details to comply with tax regulations and ensure donors can claim deductions. Include the following key information:

| Required Information | Description |

|---|---|

| Organization Name and Address | List the full legal name and address of the organization receiving the donation. |

| Donor’s Name | Include the donor’s full name as it appears on the donation record. |

| Donation Date | Specify the exact date the donation was made. |

| Donation Amount | Provide the exact dollar amount of the cash donation. For non-cash donations, describe the items donated and their estimated fair market value. |

| Tax-Exempt Status | Confirm the organization’s IRS tax-exempt status (e.g., 501(c)(3)) and include its EIN (Employer Identification Number). |

| Statement of No Goods or Services | If the donor did not receive anything in exchange for the donation, include a statement to this effect. If goods or services were provided, state their fair market value. |

| Donation Acknowledgment | Include a clear statement acknowledging the donation and its tax-deductible status. |

Ensure these details are clearly visible to help donors with tax filings and to confirm their support of your cause.

To tailor your donation receipt template for different contribution types, start by clearly identifying the nature of the donation: monetary, in-kind, or recurring. This distinction will guide the customization of both the content and format of the receipt.

For monetary donations, include the amount given, the date of the transaction, and the donor’s information. Add a line that confirms the donation was received and specify that no goods or services were exchanged in return, especially for tax purposes.

When processing in-kind donations, describe the donated item(s) in detail, including quantity, condition, and estimated value. It’s also helpful to provide a section where the donor can verify this information.

For recurring donations, set up a section to list the frequency and total amount contributed to date. Make sure to show the recurring schedule (e.g., monthly, quarterly) and include specific details for each transaction made within the reporting period.

Adjust the template layout as needed for each type. Monetary donations typically benefit from a clean, simple format, while in-kind donations may require more space for descriptions. Recurring donations should highlight transaction history with clear sectioning for each payment cycle.

Finally, always include a thank you note or acknowledgment to show appreciation, but keep it concise and relevant to the type of donation made. This will make your template feel personalized and build a stronger connection with your donors.

Church Year End Donation Receipt Template

The key to creating a donation receipt template for the church year-end is clarity and accuracy. Make sure each donor receives a detailed record of their contributions, highlighting the total amount, donation date, and any special designations (such as memorial gifts or specific funds). This makes tax reporting easier for donors while ensuring the church complies with IRS requirements.

Donation Amount and Date

For every donation, include the exact monetary value given. Use clear formatting, separating the amount from the rest of the details. Always include the date of donation as well, so donors can match their contributions to specific tax periods.

Additional Information

If donations are designated for particular projects or events, make this clear in the receipt. Donors may need to refer to this information when filing taxes, especially if they contributed to restricted funds or one-time campaigns.

Each year, update the receipt template to reflect any changes in tax laws or donation policies. This ensures that the church remains compliant while providing donors with a seamless giving experience.