If you’re donating clothing to AMVETS, using a donation receipt template is a straightforward way to document your contribution for tax purposes. A well-structured receipt helps you track your donations and provides AMVETS with the necessary information to process your items efficiently. The key details on the template should include the donor’s name, date of donation, a description of the items, and their estimated value.

Be sure to include the AMVETS organization’s name and address at the top of the receipt. This confirms that the donation is being made to a recognized nonprofit. The description of donated items should be clear and concise, listing categories like “gently used clothing” or “winter coats.” It’s also helpful to include an estimated value for each item or group of items. If you’re unsure of the value, online tools like IRS donation calculators can provide an estimate based on the condition and type of clothing.

Finally, ensure that the receipt includes a signature from an AMVETS representative, if possible. This adds legitimacy and helps prevent any future confusion. For tax purposes, the IRS requires that donations of clothing be properly documented with a receipt like this one, so it’s a good idea to keep a copy for your records. A simple and accurate template can save time and ensure everything is in order when filing taxes.

Here’s the corrected text according to your requirements:

For a proper clothing donation receipt template for AMVETS, ensure the following key elements are included. The receipt should clearly specify the donor’s name, donation date, and a brief description of the donated items. Use clear categories like “shirts,” “pants,” or “jackets” for clothing donations. Avoid using vague terms like “miscellaneous” as this can cause confusion during tax filing. Include the estimated value of the items, as this helps the donor with tax deductions.

Key Information to Include:

- Donor’s name and contact details

- Donation date

- Description of donated items (detailed categories)

- Estimated value of items (if possible)

- AMVETS contact information

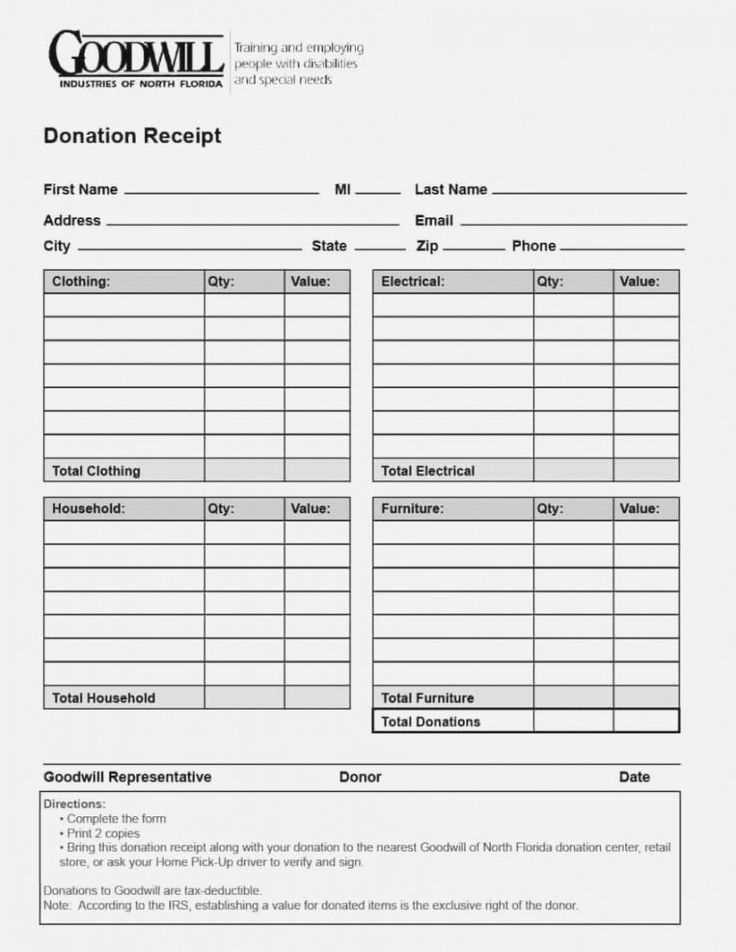

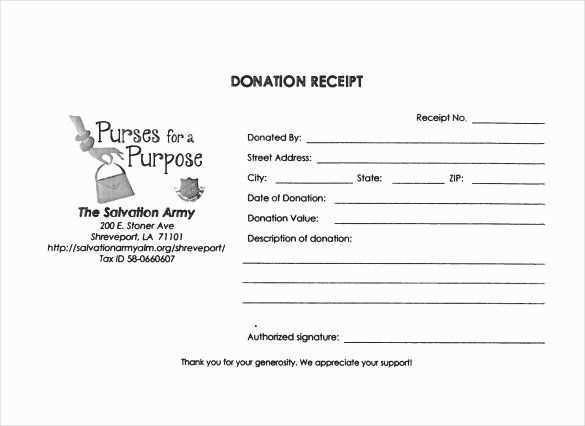

For tax purposes, it is beneficial to provide a value estimate for each type of item, which can be done by referring to guidelines like those from the Salvation Army or Goodwill. The more specific the receipt, the easier it will be for donors to file their tax deductions.

Best Practices

Make sure the receipt is signed by an AMVETS representative and provides a unique identifier or donation number. This helps both parties track the donation and adds authenticity to the receipt. Always print the receipt on AMVETS letterhead or branded paper to maintain professionalism and clarity.

- Clothing Donation Receipt Template for AMVETS

Here is a simple template for a clothing donation receipt to AMVETS:

AMVETS Clothing Donation Receipt

Donor Information:

Donor’s Full Name: [Insert Donor Name]

Address: [Insert Donor Address]

Phone Number: [Insert Donor Phone Number]

Donation Details:

Donation Date: [Insert Donation Date]

Clothing Items Donated: [List the clothing items donated, e.g., shirts, pants, jackets]

Condition of Items: [Specify condition, e.g., gently used, new, etc.]

Estimated Value: [Insert value of the items based on the fair market value]

AMVETS Chapter Information:

AMVETS Chapter Name: [Insert Chapter Name]

AMVETS Chapter Address: [Insert Chapter Address]

Tax Deduction Notice:

No goods or services were provided in exchange for this donation. The value of the items is determined by the donor.

Signature:

Donor’s Signature: _________________________

This receipt is issued for tax purposes. Please keep this document for your records.

To complete an AMVETS clothing donation receipt, follow these steps:

1. Donor Information

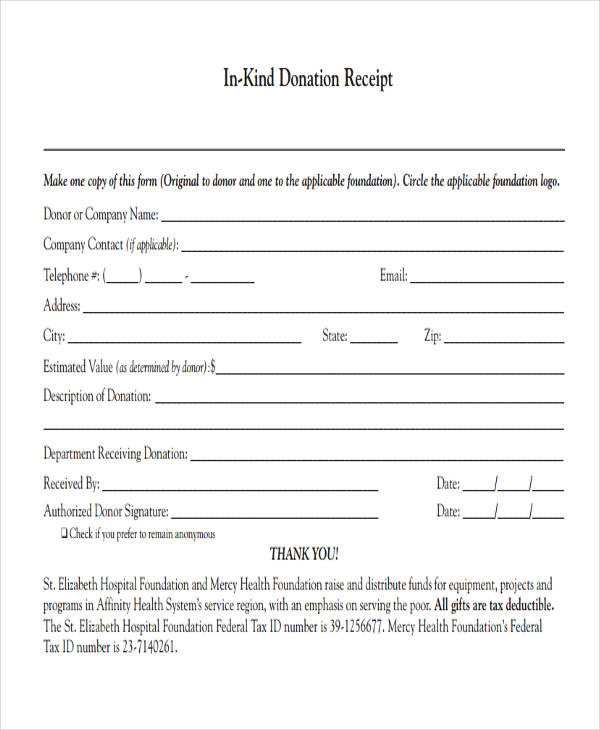

Fill in the donor’s full name, address, and contact details. This information ensures the receipt is linked to the right person and allows AMVETS to confirm the donation.

2. List the Donated Items

List each item donated with a brief description, such as “winter jacket,” “pair of jeans,” or “sneakers.” Clearly note the quantity and types of clothing to ensure accuracy.

3. Condition of Items

Indicate the condition of each item. Use terms like “new,” “gently used,” or “worn” to specify the state of each donation. This helps AMVETS with item categorization.

4. Date of Donation

Write the exact date of the donation. The date is key for tax purposes and ensures it’s connected to the correct year for deductions.

5. AMVETS Representative Signature

Ensure the AMVETS representative signs the receipt. This confirms the donation was accepted and recorded by the organization.

Keep a copy of the completed receipt for your records. Use it for tax deduction purposes when filing your taxes at the end of the year.

Be sure to include the following details on your AMVETS donation receipt for it to be valid and useful for tax purposes:

1. Donor Information

Start by including the donor’s name and address. This ensures proper identification and enables the organization to send acknowledgment letters or tax documents.

2. Date of Donation

List the exact date of the donation. This is critical for establishing the timeframe in which the donation was made, especially for tax filings.

3. Description of Donated Items

Provide a detailed list of the donated clothing or items. For example, include the number of bags, boxes, or specific items like jackets, shoes, or shirts. This helps with accurate valuation and record-keeping.

4. Estimated Value

Include an estimated value for the items based on fair market value. You can use resources such as IRS guidelines or donation value guides to assign appropriate values to each item.

5. Organization Information

The receipt should also feature AMVETS’ name, address, and tax-exempt status number. This establishes the legitimacy of the charity and is necessary for tax deduction purposes.

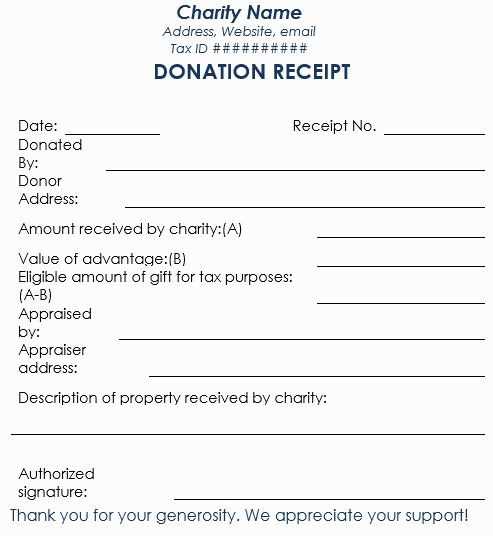

6. Statement of Goods and Services

Clearly state that no goods or services were provided in exchange for the donation, unless applicable. This distinction is vital for tax deduction eligibility.

Use AMVETS donation receipts to claim tax deductions by accurately documenting your contributions. Ensure that the receipt contains specific details such as the donation date, a description of the items donated, and an estimate of their value. This helps in reporting your charitable contributions to the IRS. If you donate clothing or goods, be sure the receipt includes whether you received anything in return, as that may affect your deduction. Keep your receipt organized and accessible for tax season, as you may need to provide proof of your donations during an audit.

Additionally, track your donations with a list of items and their value. The IRS recommends using fair market value to assess your donations. For instance, you can consult online resources or donation value guides to determine reasonable values for clothing or household goods. Accurate records make claiming your tax deduction smoother and ensure compliance with tax regulations.

Understanding AMVETS Clothing Donation Receipt Template

The AMVETS clothing donation receipt is an important document for tracking charitable contributions. It ensures donors can claim tax deductions for their donations, so accuracy is key. Keep the following tips in mind when filling out the receipt:

What to Include in the Receipt

- Donor’s Name: Always list the full name of the person making the donation.

- Date of Donation: Record the exact date the donation is made.

- Itemized List: Provide a detailed list of the items donated, including their condition (new, gently used, etc.).

- Estimated Value: Donors should estimate the fair market value of their items. Use online tools or guides for accurate estimations.

Tax Deductions and Reporting

- Tax Deduction: The IRS allows donors to claim a deduction based on the value of their clothing donations. Ensure that the receipt clearly outlines this to avoid complications during tax filing.

- Documentation: Keep a copy of the receipt for tax purposes, and consider taking photos of the donated items.

Using an accurate AMVETS clothing donation receipt template can streamline the donation process and ensure all necessary information is captured for both the donor and AMVETS organization.