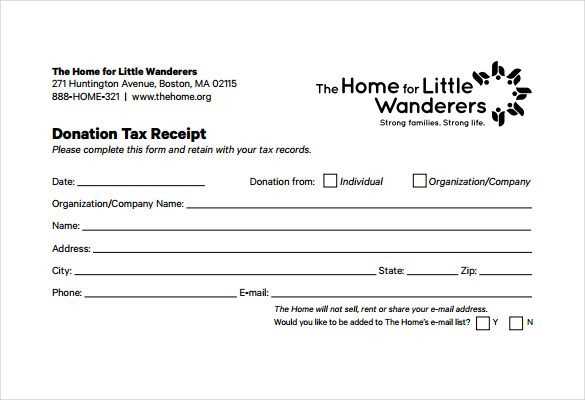

Creating a donation receipt template for CRA purposes requires accuracy and clarity. A well-structured receipt ensures your donors can claim their charitable contributions on their tax returns. Start by including the charity’s full legal name and address at the top of the receipt. Make sure to list the donor’s name and address, along with the date and amount of the donation.

Donor Information should be clearly stated. It’s critical to include their full name and address to avoid confusion during tax filing. Be specific about the donation amount and the date it was made. For non-monetary gifts, provide a description of the items donated and their fair market value. This information is crucial for accurate tax claims.

Ensure that your charity’s registration number with the CRA is printed on the receipt. This establishes that your organization is eligible to issue tax receipts. If applicable, indicate if the donation was a cash, non-cash, or in-kind donation, as the rules may differ depending on the type of contribution.

Finally, always include a thank-you note for the donor’s contribution. It’s a simple yet important gesture that helps maintain positive relationships with your supporters. A donation receipt template that includes these elements will keep everything clear and compliant with CRA guidelines.

It looks like you’re working on articles involving product manuals and guides, focusing on avoiding specific terms and using varied phrasing. If you need help drafting some sections or creating HTML content in Finnish, feel free to share more details or let me know how I can assist you today!

- CRA Donation Receipt Template Guide

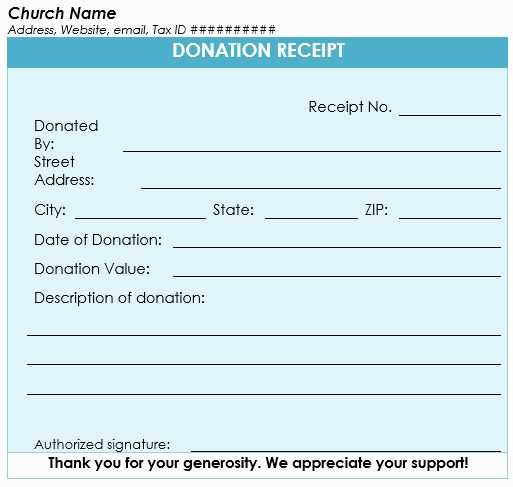

The CRA donation receipt template must include specific details to meet legal requirements. Begin with the official charity’s name, address, and registration number. This ensures that the donation is properly recorded for tax purposes.

Date: Always include the date of the donation. This is critical for the donor’s records and for accurate tax filing.

Donor’s Information: Include the donor’s name and address. This is necessary to ensure the receipt is tied to the correct individual.

Amount of Donation: Clearly state the total value of the donation. If the donation includes both cash and goods, list them separately, specifying the monetary value of non-cash items, based on fair market value.

Charity’s Acknowledgement: The receipt should contain a statement confirming that no goods or services were provided in exchange for the donation. If any goods or services were provided, their value should be noted.

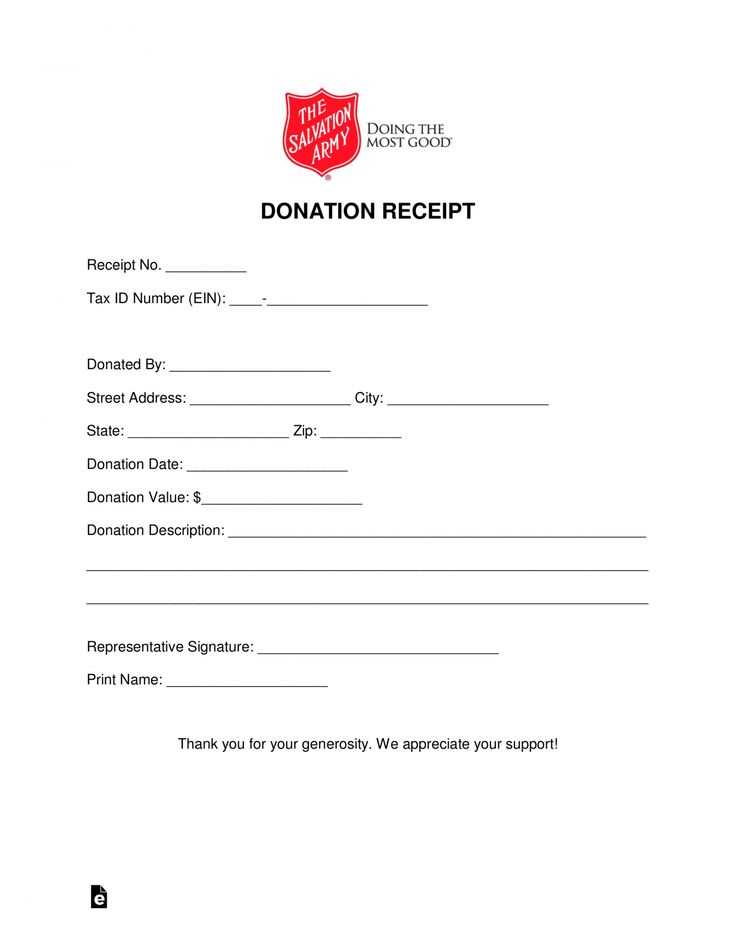

Signature: A signature from a representative of the charity is often required. This can be either a physical or electronic signature, depending on the charity’s method of issuing receipts.

Additional Information: Some receipts may need to include additional details, such as the charity’s tax-exempt status or specific language regarding the charitable nature of the donation. Ensure the template adheres to CRA guidelines for compliance.

A CRA donation receipt must include several mandatory details to be valid for tax purposes. These details ensure the donor can claim their tax credits efficiently and avoid delays or rejections from the Canada Revenue Agency.

1. Official Registration Number of the Charity

Each registered charity in Canada is assigned a unique registration number by the CRA. This number must be displayed clearly on the receipt. It verifies that the organization is officially recognized and eligible to issue tax-deductible receipts.

2. Date of Donation

Including the exact date of the donation ensures that the donor’s claim is linked to the correct tax year. This is crucial for accurate tax reporting and claiming deductions.

3. Amount and Nature of Donation

The receipt must specify the amount donated and whether it was a cash gift or an in-kind donation. In the case of non-cash donations, a description of the items or services donated, including their fair market value, must be included.

4. Donor Information

Accurate details of the donor, such as their full name and address, must be included to verify their identity. This ensures that the donation is correctly attributed to the right individual for tax purposes.

5. Signature of an Authorized Representative

The signature of a person authorized to issue receipts on behalf of the charity is a requirement. This validates the receipt and assures that the charity acknowledges the donation.

Ensuring these components are properly included helps both the charity and the donor maintain compliance with CRA guidelines, ensuring that the donation is processed smoothly for tax purposes.

Make sure to include the donor’s full name, address, and contact details. This ensures accurate record-keeping and helps both parties in case of any questions regarding the donation.

Donor’s Name

Include the full name of the donor as it appears on their records. This is important for tax purposes and allows the donor to easily track their contributions.

Donor’s Address

Ensure the donor’s address is clearly stated, especially if they wish to receive a thank-you letter or any future communications regarding the donation.

Donation Amount and Date

Clearly state the donation amount and the date on which the donation was made. For non-monetary donations, specify the item’s description and value.

Tax-Exempt Status Information

If applicable, include the tax-exempt status of the organization so the donor can claim tax deductions. Add a short statement such as, “Your contribution is tax-deductible to the extent permitted by law.”

Receipt Number

Assign a unique receipt number for tracking purposes. This will help in identifying and referencing a specific donation in case of any inquiries.

Table Example

| Donor Name | Address | Donation Amount | Date |

|---|---|---|---|

| John Doe | 123 Main St, Anytown, USA | $100 | January 15, 2025 |

Charitable organizations must include specific information when issuing donation receipts, as outlined by the CRA. Here are the key details required:

- Legal Name of the charitable organization, as registered with the CRA.

- CRA Registration Number confirming the organization’s charitable status.

- Official Receipts must contain a unique identifier, such as a serial number, to ensure each receipt can be tracked.

- Complete Address of the organization, including postal code.

- Details of the Donation including the date, amount, and nature of the donation (monetary or in-kind).

- Signature of an authorized person within the charity, confirming the validity of the receipt.

Make sure to accurately reflect these details to comply with the CRA’s requirements for charitable receipts. Missing or incorrect information may cause delays or issues during tax filing.

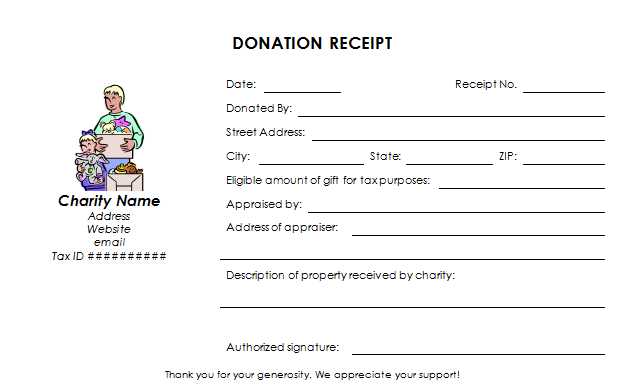

To determine the fair market value (FMV) of donated goods, first assess the condition of each item. Check for damage or wear, as these factors directly impact the value. Use online resources such as resale websites or donation value guides to find comparable items. If the item is unique, contact local second-hand stores to get an estimated resale price. For more valuable items, you may want to get an appraisal from a qualified expert.

If the item is brand new or still in its original packaging, its value may align with the retail price. However, if the item is used, adjust the price based on its condition, age, and functionality. This ensures that the reported FMV is realistic and reflective of the actual worth of the goods at the time of donation.

Finally, keep records of how you arrived at the FMV, such as screenshots of comparable listings or notes from appraisals. This documentation will be helpful for tax purposes and ensuring compliance with CRA guidelines.

For non-cash donations, accurate valuation and clear documentation are critical. When issuing a receipt, make sure to list the donated items and provide a fair market value (FMV) for each. If necessary, refer to IRS guidelines or relevant tax authorities to determine the appropriate valuation method for specific types of donations.

Donor Information

Include the donor’s full name and address on the receipt. This allows both the donor and the charity to keep accurate records. A donation date is also crucial for record-keeping, especially around tax time. Avoid vague descriptions like “miscellaneous items”–be specific to ensure the donor receives the correct tax credit.

Appraisal for High-Value Donations

If the donation involves valuable items such as artwork, jewelry, or real estate, obtaining a professional appraisal is necessary. This helps in determining the correct FMV, which is essential for both the donor’s and charity’s tax filings. Include the appraiser’s details on the receipt, and ensure the appraisal is done before the donation is processed.

Ensure you list all required details clearly, such as the donor’s name, donation amount, and the date. Missing information can cause confusion for both parties and may invalidate the receipt. Double-check the accuracy of all entries before issuing the receipt.

- Incorrect or Missing Donation Amount: Double-check the total amount donated. Even small mistakes can lead to complications when filing taxes or receiving tax deductions.

- Omitting the Organization’s Information: Your receipt must include the full name and address of the charitable organization. This is important for tax reporting purposes.

- Not Including the Purpose of the Donation: If the donation is designated for a specific purpose, include that information clearly on the receipt. This helps ensure transparency for both the donor and the charity.

- Failure to Provide a Thank-You Message: A brief thank-you note adds a personal touch and shows appreciation for the donor’s generosity. It’s an easy step that shouldn’t be overlooked.

- Not Using the Correct Tax Status Language: Ensure the receipt contains the correct tax-exempt status language, particularly if the donation is tax-deductible. The IRS requires specific wording to qualify the donation for a tax deduction.

- Issuing Receipts Without a Donation Record: Always maintain a clear record of all donations before issuing a receipt. This ensures you have a paper trail for tax and financial reporting.

Make sure to include key details in your CRA donation receipt template. Follow these steps to ensure clarity and accuracy:

- Donor Information: Clearly state the donor’s name, address, and contact details. This ensures that the receipt can be traced back to the right individual.

- Donation Amount: Include the exact monetary value of the donation. If the gift is non-monetary, specify its fair market value.

- Date of Donation: Always mention the date the donation was made. This is crucial for tax purposes and future reference.

- Charity’s Information: Provide the charity’s legal name, address, and CRA number. This helps confirm the legitimacy of the donation.

- Receipt Number: Assign a unique identifier to each receipt. This helps in tracking and managing records.

- Statement of Non-Returnability: Add a note that the donation is non-refundable. This helps avoid confusion in the future.

- Thank You Message: Include a short message expressing gratitude. It fosters a positive relationship with donors.

Ensure all these points are covered for a smooth and compliant donation receipt process. It’s key to keep things organized and transparent for both the donor and the organization.