Creating a donation bequest receipt is straightforward when you have the right template. This receipt serves as proof for both the donor and the organization, ensuring transparency and compliance with tax regulations. A clear and accurate template is key to maintaining trust and avoiding confusion later on.

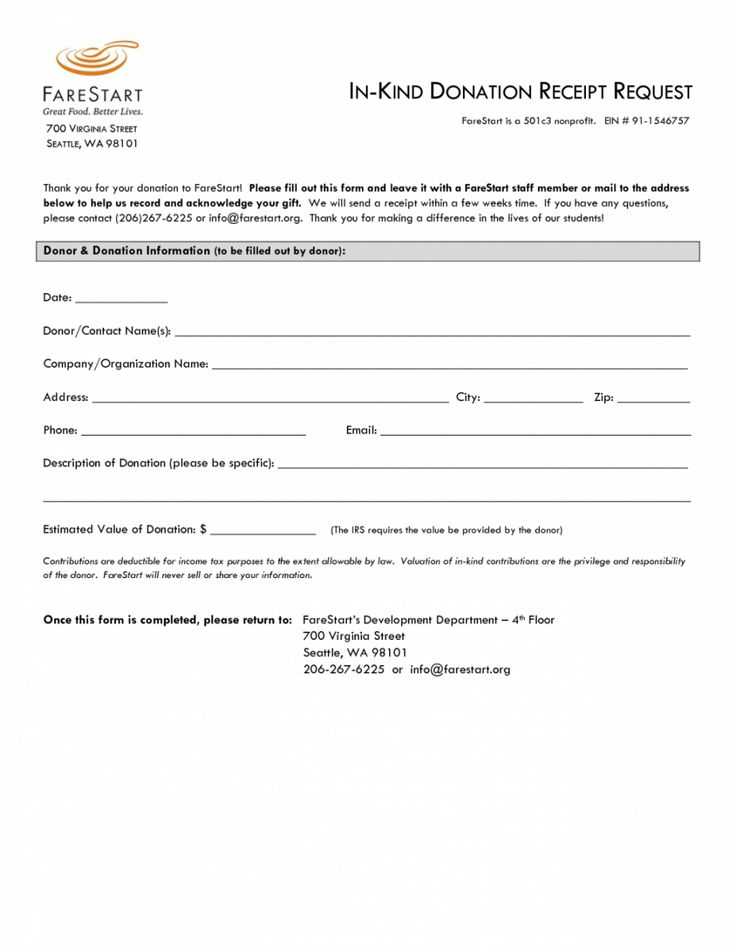

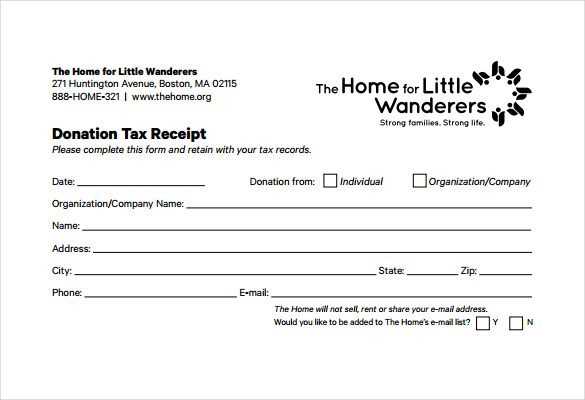

Include the donor’s full name, address, and contact details at the top. Ensure the donation amount or description of property is clearly listed, along with the date received. It’s also important to mention whether any goods or services were exchanged in return for the donation. This helps to clarify whether the contribution qualifies for tax deductions.

Don’t forget to include your organization’s name, address, and tax ID number. A simple statement confirming that no goods or services were provided in exchange for the donation can go a long way in making the receipt valid for tax purposes.

Finally, always leave space for the signature of an authorized representative from your organization and the date the receipt is issued. These details confirm the authenticity and official nature of the receipt, ensuring your donor has the documentation they need for tax purposes.

Here’s how sentences might look with reduced word repetition:

Focus on simplifying and shortening sentences to avoid redundancy. Instead of repeating similar words or phrases, use synonyms or restructure the sentence for clarity.

Example: “The donation was given as a bequest in the will. The bequest was very generous.” can be revised as: “The donation was a generous bequest in the will.”

Eliminate unnecessary word pairs that convey the same meaning. Use concise language that communicates the idea clearly and efficiently.

Example: “A gift donation was made as a bequest in the will” can be simplified to: “A gift was made as a bequest.”

This approach keeps the message clear and precise while avoiding repetition of similar ideas.

- Donation Bequest Receipt Template

A donation bequest receipt serves as a formal acknowledgment of a charitable donation made through a will or estate plan. This document is vital for both the donor and the receiving organization. Here’s a simple, clear template to ensure you provide the necessary details for proper tax filing and record-keeping.

Donation Receipt Template Components

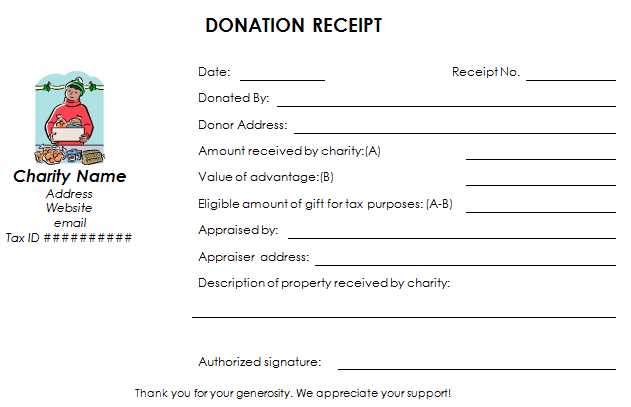

- Organization Information: Include the name, address, and contact details of the receiving charity.

- Donor Information: List the full name and address of the donor, ensuring all details match their legal documents.

- Date of Donation: Specify the date when the bequest was made or formally acknowledged.

- Description of Donation: Provide a brief, clear description of the donated property, including its nature (e.g., real estate, cash, stocks, etc.).

- Value of Donation: State the estimated or appraised value of the donation, if applicable. In the case of assets, an independent valuation may be required.

- Statement of No Goods or Services: If the donation was purely a gift with no goods or services in return, include a statement like: “No goods or services were provided in exchange for this donation.”

- Signature: Ensure the document is signed by an authorized representative of the receiving charity. This can be a board member or another recognized officer.

Sample Template

- Organization Name: [Charity Name]

- Organization Address: [Street Address, City, State, ZIP]

- Donor Name: [Donor’s Full Name]

- Donor Address: [Donor’s Address]

- Donation Date: [MM/DD/YYYY]

- Donation Description: [Brief description of the donation]

- Donation Value: [Appraised Value, if applicable]

- Statement of No Goods or Services: No goods or services were provided in exchange for this donation.

- Authorized Signature: [Signature of Charity Representative]

Ensure that your receipt is clear and concise, and always consult with a legal or tax professional for donations involving complex assets or large sums. This helps maintain accuracy and compliance with tax regulations.

To tailor a bequest receipt for different types of donations, adjust the details based on the nature of the gift. For cash donations, simply include the amount given and confirm whether it was a one-time or recurring gift. If the donation is in-kind, list the items received along with an estimate of their fair market value, noting that the donor is responsible for providing this valuation.

For stocks or securities, detail the type and number of shares, along with the date the donation was processed. If the bequest involves real estate, include the address and a rough market value based on an appraisal or public records. This will ensure the donor gets accurate documentation for tax purposes.

If the donation is a planned gift, such as a charitable remainder trust or a life insurance policy, provide the terms of the bequest, including the donor’s intention and any specific instructions related to the disbursement of funds or assets. Include clear wording that acknowledges these gifts without attaching a dollar value, as they may not be fully realized until later.

Be sure to express gratitude for all donations, regardless of type. Ensure that the language used aligns with the specific donation’s nature, whether it’s a tangible gift, a future pledge, or a financial contribution.

Each jurisdiction has its own set of legal requirements for bequest receipts. These regulations govern what must be included on receipts to ensure compliance with local tax laws and charitable organization regulations.

In the United States, charitable organizations must provide a written acknowledgment of any donation over $250, including a bequest. This acknowledgment should specify the amount or description of the donation and confirm that no goods or services were exchanged in return for the contribution. For bequests, the receipt must be issued within a reasonable period after the donation has been received and processed.

In the United Kingdom, the receipt requirements are similar but may also include a statement confirming whether the donation was a gift aid contribution. Bequests, when received, should be acknowledged promptly with clear details about the nature of the gift, its value, and any conditions attached to the donation. A failure to comply with these regulations could impact the charity’s tax relief status.

Canadian law requires that all charitable donations, including bequests, be accompanied by a formal receipt for tax purposes. The receipt should include the donor’s name, address, and the charity’s registration number, along with the date and amount of the donation. In the case of bequests, the receipt may also include details about the will and the date of bequest execution, if relevant to the transaction.

Australian tax law mandates that bequest receipts must clearly indicate that the donation is a charitable gift and not a personal or family transaction. Bequests may be subject to specific exclusions or deductions, and it’s important that these be reflected on the receipt for tax purposes. Charitable organizations must keep detailed records of all bequests, especially those over certain thresholds.

In some jurisdictions, such as in Germany, the receipt must not only include the value of the donation but also comply with specific format requirements set forth by the tax authorities. These receipts are critical for donors to claim tax deductions related to their gifts, and the charity must issue them in a timely manner to ensure eligibility.

Bequest receipts play a significant role in ensuring that charitable donations are processed correctly for both the donor and the receiving organization. Charities must be aware of these legal requirements to avoid any risk of penalties or issues with tax deductions for their donors.

| Jurisdiction | Key Legal Requirements |

|---|---|

| United States | Written acknowledgment for donations over $250, confirmation that no goods/services were exchanged |

| United Kingdom | Clear indication of gift aid status, prompt acknowledgment of bequests |

| Canada | Receipt includes donor’s details, charity’s registration number, and donation value |

| Australia | Charitable gift indication, possible exclusions/deductions for tax purposes |

| Germany | Compliance with tax authority format and timely issuance for tax deductions |

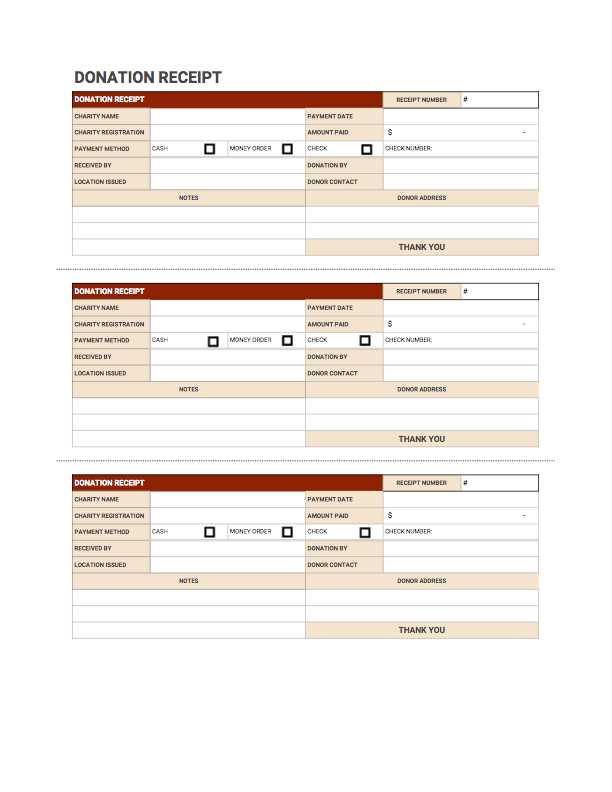

To create a donation receipt template, follow these steps for a clear and professional result:

1. Open a Word Document or PDF Editor: Start by choosing the platform you prefer. Microsoft Word is a common choice for templates, but if you need a non-editable format, use a PDF editor.

2. Set the Document Layout: Adjust the page size and margins. For receipts, a standard letter size (8.5” x 11”) works best. Set the margins to 1 inch on all sides for a clean appearance.

3. Add the Organization’s Header: At the top, include your organization’s name, logo, address, contact details, and website. Ensure this section is clear and easy to read.

4. Date and Receipt Number: Below the header, insert a field for the date of the donation and a unique receipt number for tracking purposes. Use a simple numbering system like “2025-001” for easy identification.

5. Donor Information: Include a space for the donor’s name, address, and contact information. This should be clearly separated from the rest of the receipt content.

6. Donation Details: Specify the donation amount (either cash or in-kind), including a description if applicable. If the donation is a product or service, list the item(s) and their fair market value.

7. Acknowledgment Statement: Add a line that confirms the donor received no goods or services in return for the donation, as required by the IRS for tax-exempt organizations.

8. Legal Disclaimers: Include any necessary legal statements, such as your tax-exempt status number and a brief disclaimer about the donor’s responsibility for tax reporting.

9. Footer Section: Add a footer with any additional details, such as your nonprofit’s mission statement, or a thank you message to the donor.

10. Save the Template: Once completed, save the document as a template. In Word, save it as a .dotx file. For PDF, save it as a fillable document or non-editable version based on your needs.

Using this format, you can create a simple, professional donation receipt template that meets both organizational and legal requirements.

Ensure clarity and compliance when creating a donation bequest receipt template. The receipt should be structured clearly, including the donor’s name, the donation amount or description, and the date of the contribution. List the charity’s name and legal information, such as its tax identification number, to confirm its nonprofit status. This helps in providing transparency and confidence to the donor.

Key Elements of the Template

Each receipt should include the following specifics:

- Donor’s full name and address

- Amount donated or a detailed description of in-kind gifts

- Receipt date

- Tax-exempt organization details (name, address, tax ID number)

- A statement that no goods or services were provided in exchange for the donation, if applicable

Best Practices

Keep the language simple and direct. When detailing the contribution, avoid ambiguous terms and specify whether it was cash, securities, property, or services. For large donations or bequests, clarify whether the organization has received the full amount or is still awaiting parts of the donation. Ensure the receipt is signed by an authorized person within the organization.