For accurate record-keeping, use a donation in kind receipt template that clearly outlines the donor’s contribution. This document provides transparency for both the donor and recipient, ensuring proper acknowledgment of the goods or services received.

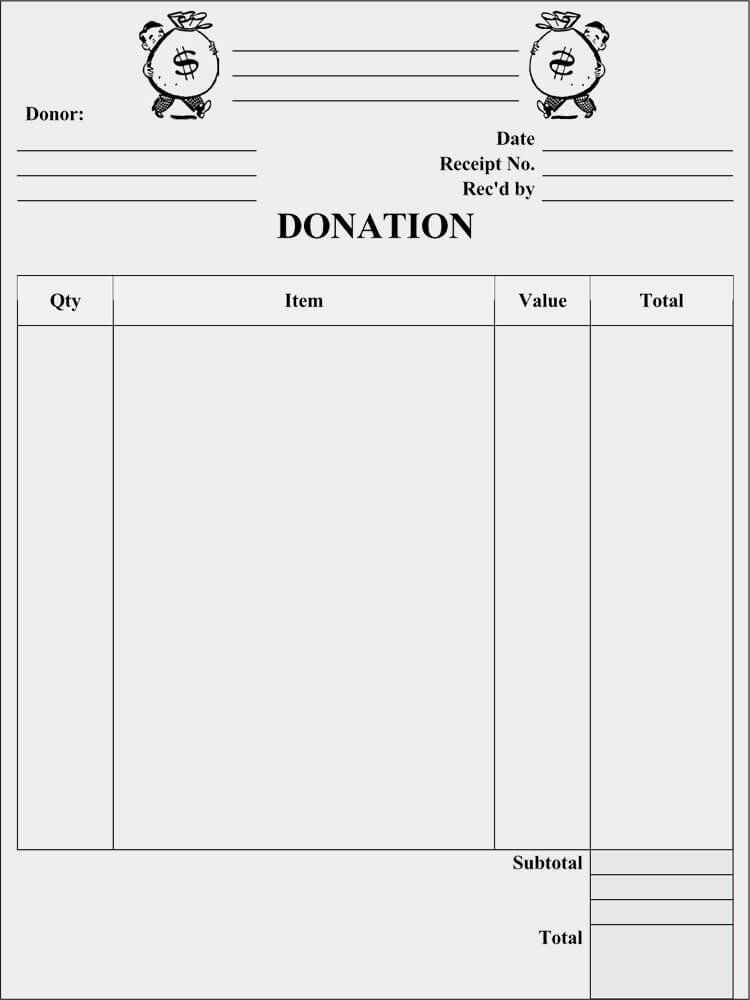

Start by detailing the date and location of the donation. Include the donor’s full name, address, and contact details. Specify the item(s) donated, describing them with as much detail as possible. Note the estimated value of the donation, which may require an appraisal or fair market value estimation if not directly provided by the donor.

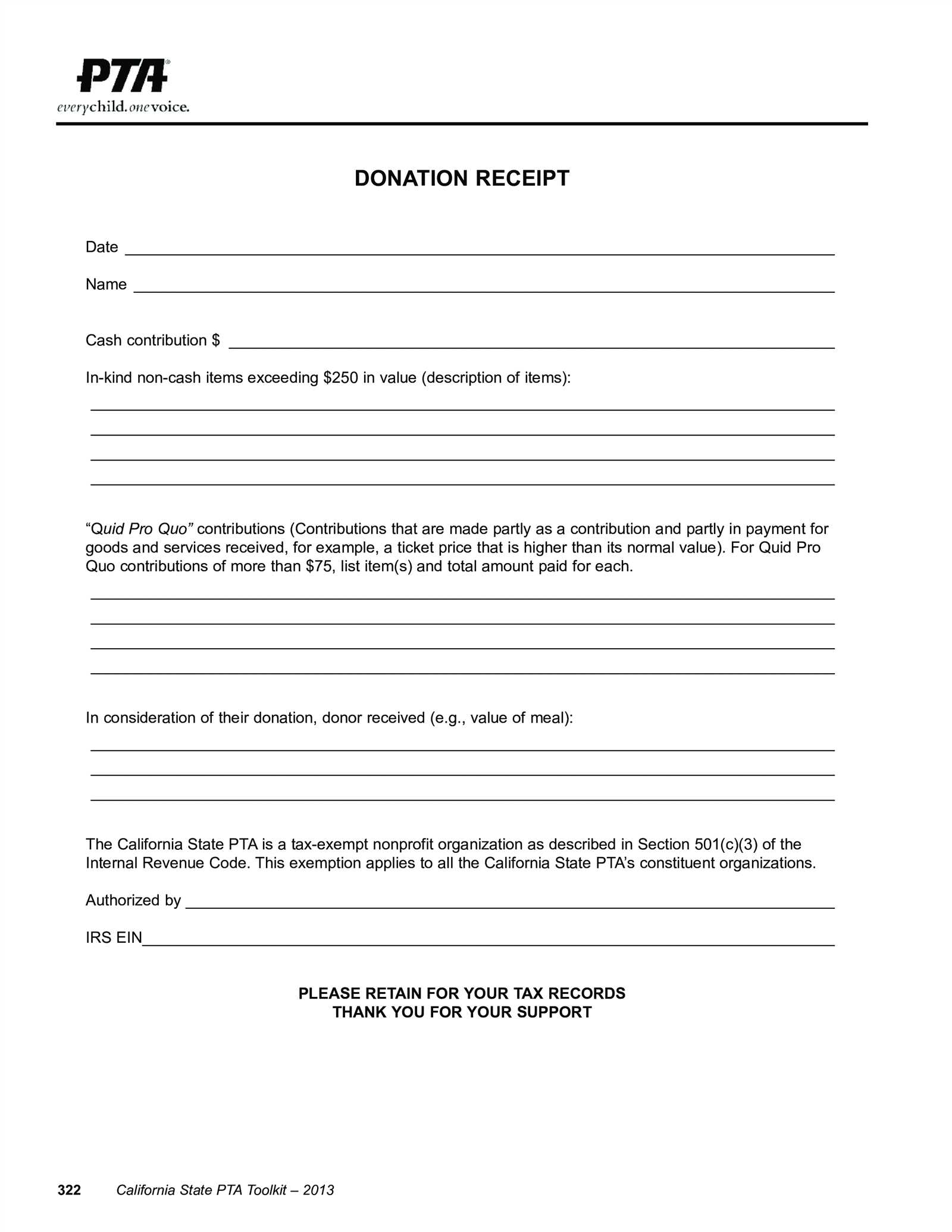

Ensure the template includes a statement indicating that no goods or services were provided in exchange for the donation, as required by tax regulations. This will allow the donor to claim a charitable deduction if applicable.

Keep a copy of the completed receipt for your records and offer the donor a copy as well. This will help avoid any potential issues during tax filing or future audits.

Donation in Kind Receipt Template

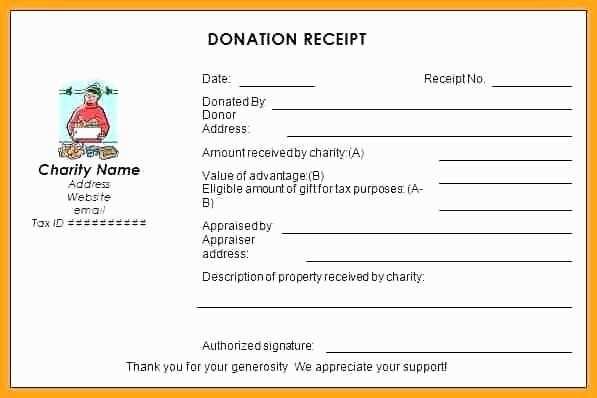

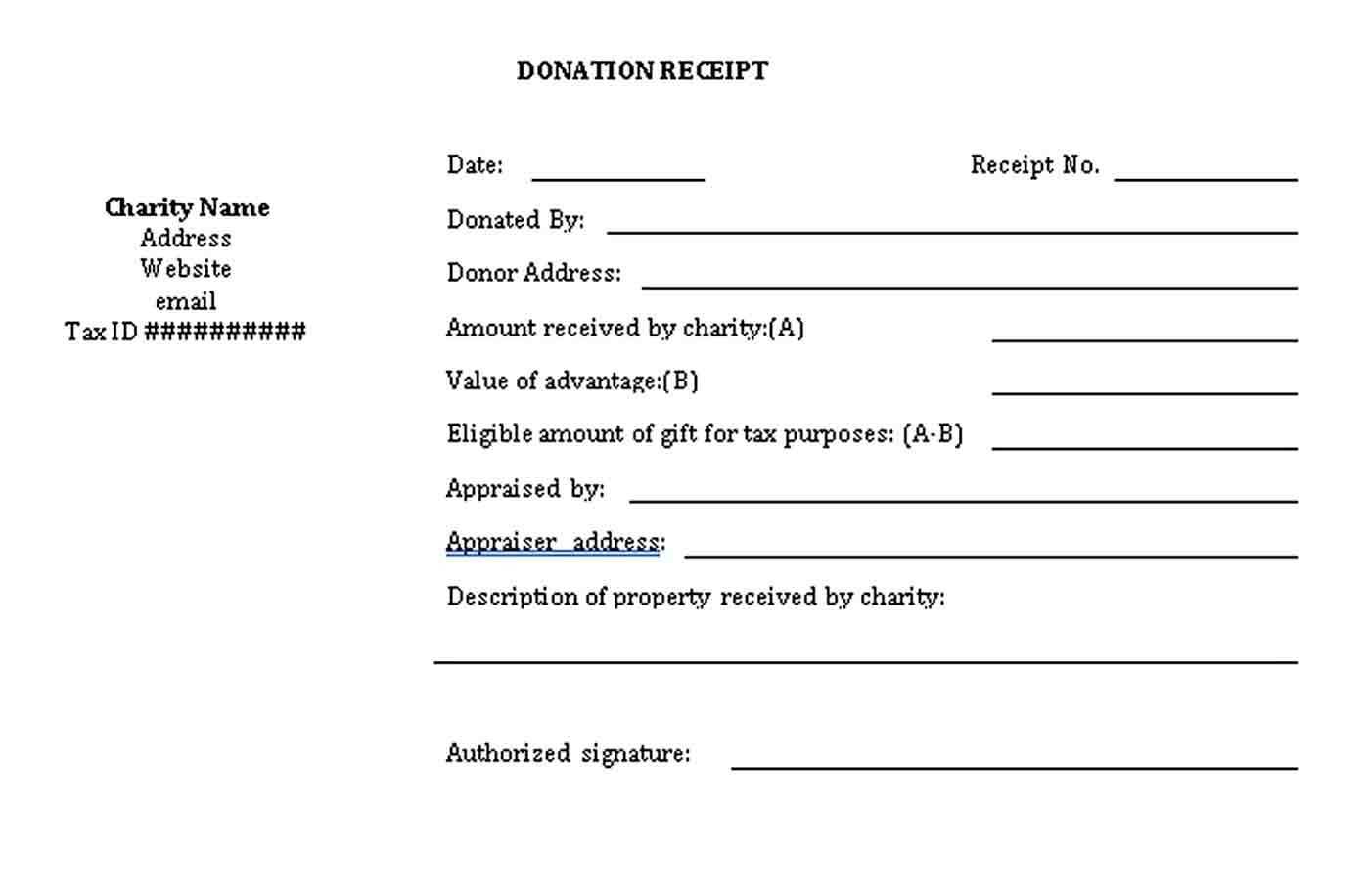

When creating a donation in kind receipt, be sure to include the following key elements: the name of the organization receiving the donation, the donor’s full name, a description of the donated items, the date of donation, and a statement about the value of the items. The receipt should not provide an exact monetary value, but rather indicate that the donor is responsible for valuing the goods donated. It is important to note that the receipt serves as proof for the donor’s records and tax purposes.

The receipt should start with a clear statement that the organization acknowledges the donation. For example: “This is to acknowledge the donation of goods listed below.” Then, list the donated items with a brief description, including quantities and conditions if applicable. Include a statement like “The donor affirms that no goods were sold in exchange for this donation.”

At the end of the receipt, it is recommended to provide a space for both the donor’s and the organization’s signatures. This helps confirm the transaction and provides a point of contact for follow-up. Always keep a copy of the receipt for your records, as both the donor and the recipient may need it for tax filings.

How to Create a Legally Compliant Donation Receipt

Ensure your donation receipt includes the donor’s full name, address, and the date of the donation. This information is critical for tax purposes and for maintaining accurate records.

Include a Detailed Description of the Donation

For non-cash donations, describe the items donated, their condition, and, if possible, their estimated value. Avoid providing a valuation for the donor; leave that responsibility to them, unless a qualified appraiser is involved.

Specify the Organization’s Information

Clearly list your organization’s legal name, tax identification number (TIN), and address. This helps validate your nonprofit status and supports the donor’s claim for tax deductions.

Ensure the receipt reflects whether the donation was a gift or if any goods or services were provided in return. If goods or services were exchanged, the receipt must state the value of those items or services provided.

Finally, always ensure that the receipt meets the specific legal requirements in your jurisdiction to avoid compliance issues.

Key Information to Include in the Template

Include the donor’s full name and address. This ensures you can easily identify the source of the donation and provides a point of contact if necessary.

Item Description

Clearly list the donated items with brief descriptions. For example, include the type, quantity, and condition of each item. This helps avoid any confusion and creates a record of what was donated.

Value of the Donation

If applicable, provide an estimated value of the items. This can be crucial for tax reporting purposes. If a professional appraisal isn’t available, use reasonable estimates based on market value.

Date of Donation

Record the exact date the donation was made. This ensures an accurate timeline for any future accounting or reporting needs.

Signature and Acknowledgement

Both the donor and recipient should sign the document. The donor’s signature confirms the donation, while the recipient’s signature acknowledges receipt of the items.

| Item Description | Quantity | Condition | Estimated Value |

|---|---|---|---|

| Used Furniture | 3 pieces | Good | $150 |

| Books | 20 books | Like new | $50 |

Examples of Donation in Kind Receipts for Different Purposes

Donation in kind receipts must be tailored to the specific purpose and nature of the donation. Here are examples for different scenarios:

1. Clothing Donations for Charitable Purposes

For donations of clothing, the receipt should include details of the items and their general condition. Here’s an example:

- Donor Name: John Doe

- Organization Name: ABC Charity

- Date of Donation: January 15, 2025

- Items Donated: 5 coats, 10 pairs of shoes, 15 shirts

- Condition: Gently used

- Estimated Value: $150

- Purpose: To support local homeless shelters

- Signature of Authorized Representative: Sarah Lee

2. Food Donations for Food Banks

For food donations, a simpler receipt is required but still needs to list the quantity and type of items donated:

- Donor Name: Jane Smith

- Organization Name: XYZ Food Bank

- Date of Donation: February 10, 2025

- Items Donated: 50 cans of soup, 30 bags of rice, 20 boxes of cereal

- Estimated Value: $120

- Purpose: To provide meals for families in need

- Signature of Authorized Representative: John Watson

3. Furniture Donations for Nonprofit Organizations

Furniture donations often involve larger items and should include detailed descriptions:

- Donor Name: Mark and Laura Green

- Organization Name: Home for the Homeless

- Date of Donation: March 5, 2025

- Items Donated: 1 sofa, 2 armchairs, 1 coffee table, 1 dining set

- Condition: Good condition, no damages

- Estimated Value: $500

- Purpose: To furnish new apartments for families

- Signature of Authorized Representative: Emily Richards

These examples show how donation receipts should reflect the purpose and the items donated. Being specific ensures the donor gets proper recognition, and the organization maintains accurate records for tax and reporting purposes.