Creating a donation receipt letter is simple when you have the right template. A donation letter receipt confirms the contribution made to a charitable organization, providing the donor with the necessary documentation for tax purposes. The template should include specific details to make it clear, concise, and legally valid.

Start with the donor’s name, address, and the donation amount. Be sure to specify if the donation was monetary or if it involved physical goods. Include the date of the donation and, if applicable, mention any conditions attached to it. A statement confirming that no goods or services were exchanged for the donation, when true, can help the donor receive a tax deduction.

For clarity, use a simple structure that includes these key elements: the donor’s details, the contribution type, the amount or value, and an acknowledgement of the donation. Customizing the template according to your organization’s specific needs ensures accuracy and consistency across all receipts issued.

End with a note of appreciation. Donors should feel valued, and a sincere thank-you message can help foster a positive relationship with those who support your cause.

Here is the revised version with minimal repetition:

Keep your donation receipt clear and concise by including only relevant information. Include the donor’s name, the date of donation, the amount donated, and the organization’s details. Ensure that each receipt reflects the specific donation to avoid confusion. Use unique identifiers for each donation, such as transaction numbers or event names, for easy tracking.

Key Elements of a Donation Receipt

A well-structured donation receipt should cover these core aspects:

| Information | Details |

|---|---|

| Donor’s Name | Full name or organization name of the donor |

| Date of Donation | The exact date the donation was made |

| Donation Amount | Specific amount or item value donated |

| Organization’s Details | Full name, address, and contact of the receiving organization |

| Transaction Number (if applicable) | Unique identifier for the donation |

Best Practices for Clarity

Use straightforward language, avoid repeating donation amounts, and ensure that every detail is easy to locate. Keep the format clean and readable for quick reference. This will make the receipt useful for both the donor and your organization.

- Donation Letter Receipt Template

A donation letter receipt serves as confirmation of a contribution made by a donor. It provides both the donor and the organization with an official record for tax purposes. The template for such a receipt should be clear, concise, and include specific details for accuracy.

The following elements should be included in the donation letter receipt:

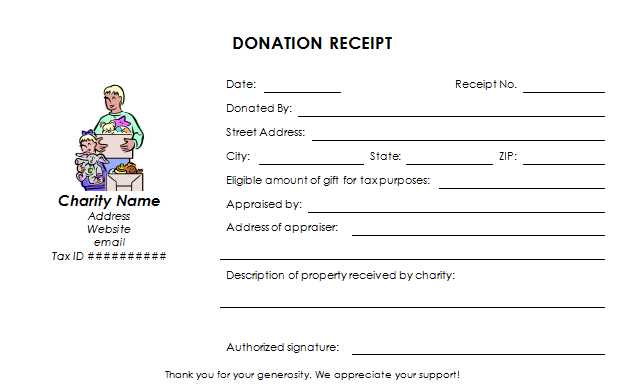

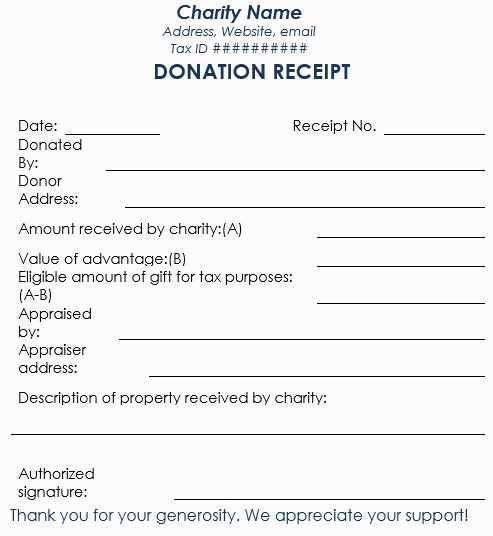

- Organization Information – Include the name, address, and contact details of your organization. This establishes the credibility of the receipt.

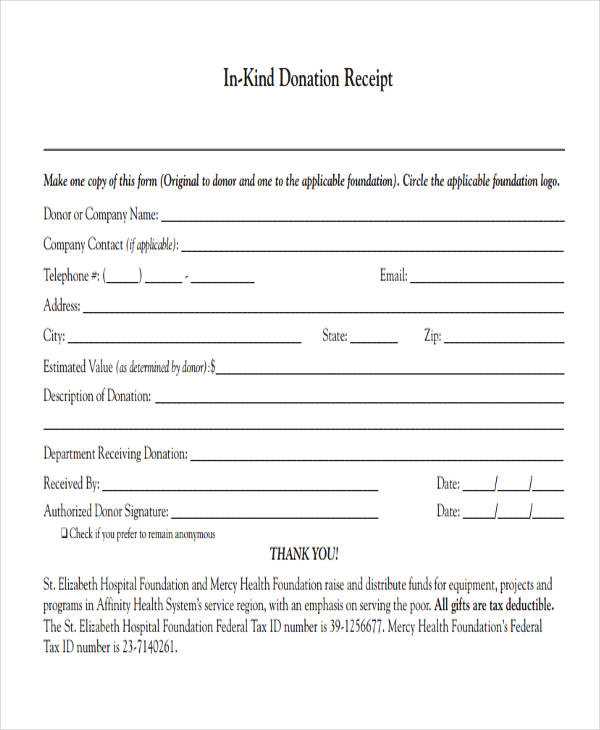

- Donor Information – Clearly list the donor’s name, address, and any other contact information available.

- Donation Details – Specify the type of donation (monetary or in-kind), the amount (or estimated value for in-kind donations), and the date of the donation.

- Statement of No Goods or Services – Include a statement such as: “No goods or services were provided in exchange for this donation,” or outline what was provided if applicable.

- Tax ID Number – Your organization’s tax ID number should be clearly listed for verification purposes.

- Signature – Include the signature of an authorized representative of the organization, along with their title, to validate the receipt.

- Thank You Message – Always add a note of appreciation to reinforce the value of the donation to your cause.

Using a simple and structured format for the donation receipt will ensure donors have all necessary information for their records and tax filing. It also demonstrates professionalism in managing donations.

A well-structured donation receipt letter should be clear, concise, and professional. Begin by including the organization’s name, address, and contact information at the top, followed by the donor’s name and address. This establishes a formal connection and makes it easier for both parties to reference the receipt later.

Key Information to Include

Start the letter with a clear acknowledgment of the donation. For example: “Thank you for your generous contribution of $X on [Date].” Specify the amount donated and whether it was a cash or non-cash donation. If the donation is non-cash, include a description of the items donated.

If applicable, confirm that the donor received no goods or services in exchange for the donation. This is critical for tax purposes and should be stated clearly. For instance: “No goods or services were provided in exchange for your donation.”

Closing the Letter

End with a warm closing, reinforcing your gratitude for their support. A simple “Thank you again for your generosity” works well. Include the name and title of the person issuing the receipt, as well as any additional contact details, should the donor need to reach out for further information.

Begin with the donor’s full name, as it appears on the donation record. This ensures clarity and avoids any confusion. If the donation is made in honor or memory of someone else, include their name as well.

Donation Details

Include the donation amount or a description of the donated items. If it is a monetary donation, specify the amount, and for in-kind donations, offer a detailed list of items. For donations made online, include the transaction number or reference ID to aid in tracking.

Organization Information

Clearly state the organization’s name, its tax-exempt status (e.g., 501(c)(3) in the U.S.), and its address. This provides verification for both the donor and the IRS or equivalent tax authority if applicable. Always include a note that the donation was received in a way that aligns with the organization’s mission.

Finally, thank the donor for their generosity. A personalized note can help maintain positive relations and encourage future support.

Tailor your acknowledgment to the donation’s nature and size. This shows appreciation and fosters lasting relationships with your supporters.

- Monetary Donations: Send a personalized thank-you note with a breakdown of the donation amount, the impact of the gift, and a tax-deductible receipt. Be sure to acknowledge the donor by name to make them feel valued.

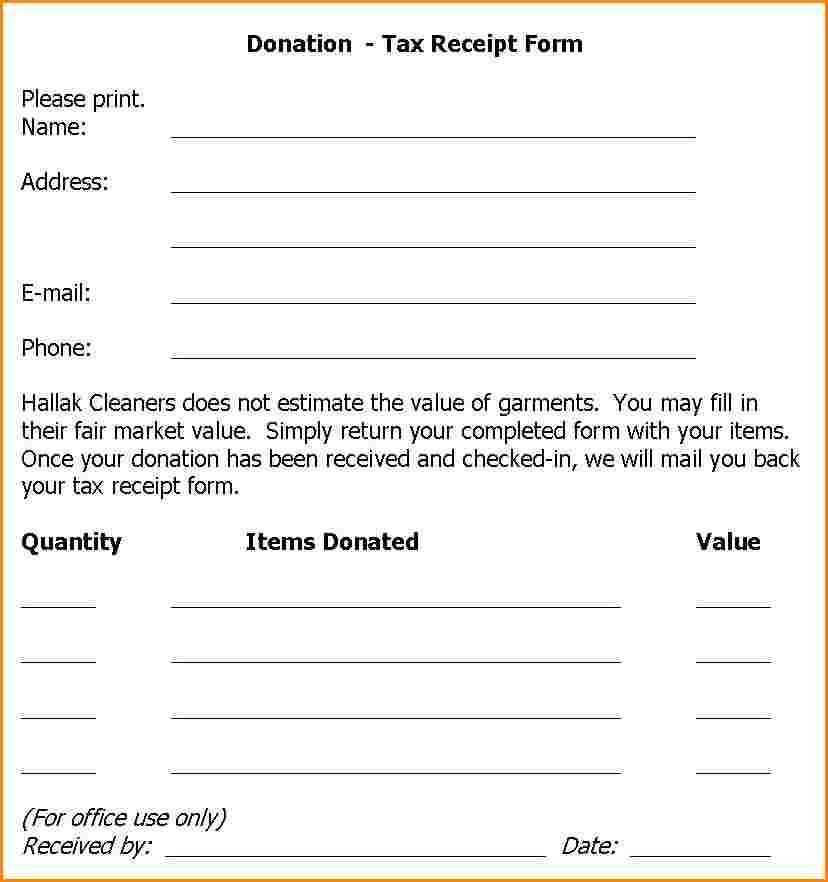

- In-Kind Donations: Provide a detailed receipt describing the item(s) donated, including an estimated fair market value if appropriate. Offer a heartfelt message expressing gratitude for the specific goods, as these gifts can be as valuable as financial contributions.

- Corporate Donations: For large gifts, issue a formal thank-you letter that recognizes the company’s commitment to social responsibility. Include how their contribution supports your cause and the tangible results it will help achieve.

- Recurring Donations: Acknowledge ongoing contributions with regular updates, and provide an annual summary that highlights the donor’s cumulative impact. Recognize the donor’s long-term commitment to your mission.

- Volunteer Contributions: While not a monetary donation, volunteer time is invaluable. Recognize their effort with a personalized thank-you letter and, if applicable, a record of the hours worked, which they may use for tax purposes in some regions.

- Bequests or Legacy Gifts: Acknowledge legacy gifts with a deeply appreciative and respectful letter. Ensure the donor’s family is included in the recognition, as these gifts often reflect long-term intentions and loyalty to your cause.

By tailoring your acknowledgments appropriately, you maintain transparency and show your donors the impact of their contribution.

In many countries, issuing a donation receipt involves specific legal standards. Nonprofits must adhere to these requirements to ensure that donors can claim tax deductions and the organization complies with the law. Understanding these requirements can help avoid costly mistakes and maintain transparency in fundraising activities.

United States

In the U.S., the IRS mandates that donations exceeding $250 require a written acknowledgment from the nonprofit. This receipt must include the organization’s name, the date of the donation, and the amount donated. If the donation is not a cash contribution, a description of the donated property is required. Nonprofits must also state whether any goods or services were provided in exchange for the donation.

United Kingdom

In the UK, receipts are essential for Gift Aid claims. The receipt must confirm that the donor is a taxpayer and that they have given consent for the charity to claim back tax on their donation. The charity needs to issue a receipt with the date and amount donated, and it must clearly state that no goods or services were provided in exchange for the donation, if applicable.

Canada

Canada requires that charitable organizations provide receipts for donations over $20. The receipt must include the charity’s registration number, the donor’s name, the donation amount, and the date. Additionally, if a benefit was provided to the donor, it must be disclosed along with the fair market value of that benefit.

Use the donor’s name on the receipt to make it feel personal and direct. A simple greeting such as “Thank you, [Donor’s Name], for your generous contribution” creates a stronger connection and shows that the gift matters to your organization. Tailor the content to acknowledge the specific cause or program the donation supports, emphasizing how their gift contributes to the mission.

Include Relevant Details

Incorporate specific information like the donation amount, the date, and the purpose of the contribution. This can be especially valuable for tax purposes and helps donors feel confident that their support is being used properly. Consider adding a brief note about the impact of their donation, such as “Your gift of $100 helps provide food for 50 families in need.” This not only personalizes the experience but also reinforces the value of their support.

Use a Friendly Tone

Maintain a warm and appreciative tone throughout the receipt. Phrases like “We are so grateful for your support!” or “Thanks to your generosity, we can continue our important work” make the donor feel valued. Keep the language sincere and avoid using formal or impersonal phrases, as this can make the receipt feel more like a transaction and less like a heartfelt thank you.

Don’t forget to include the donor’s full name and contact information. It’s important to clearly identify the donor in the acknowledgment letter. Omitting or misspelling their name can be seen as a lack of attention to detail and can leave the donor feeling undervalued.

Avoid generic or impersonal wording. Use specific language that reflects the donor’s contribution. Instead of simply saying “thank you for your donation,” try personalizing the message to highlight the impact of their support. A personalized acknowledgment shows that you care and are attentive to their generosity.

Provide clear donation details. Always include the donation amount, date, and purpose of the contribution. This makes it easier for the donor to track their gifts and can also help them with tax deductions. Missing this information can cause confusion and frustration.

Don’t delay sending the acknowledgment. Send the acknowledgment letter as soon as possible after receiving the donation. A prompt response lets the donor know their contribution is appreciated and encourages future support.

Failing to mention any tax-deductible information. If the donation is tax-deductible, include the necessary information, such as your organization’s 501(c)(3) status, and remind the donor that no goods or services were provided in exchange for their gift. This is a legal requirement in some cases and a valuable piece of information for the donor.

Avoid long or complicated language. Keep the acknowledgment short, clear, and to the point. Donors appreciate a straightforward message that acknowledges their support without unnecessary fluff or complexity.

Don’t forget to express gratitude in a meaningful way. Acknowledge the donor’s impact and the difference they are making with their contribution. An authentic expression of appreciation can strengthen the relationship and inspire ongoing support.

Donation Letter Receipt Template

To create a clear and concise donation receipt letter, follow these specific guidelines:

1. Include Key Details

- Donor Information: Name, address, and contact details of the donor.

- Organization Information: Name, address, and tax-exempt status of the organization receiving the donation.

- Donation Information: Date of donation, description of the item or monetary value donated, and the amount (if applicable).

- Confirmation: A statement confirming that no goods or services were provided in exchange for the donation, unless applicable.

2. Use Clear Language

- Avoid complex wording or jargon; make sure the donor understands the receipt easily.

- Be precise about the donation’s value, especially for non-monetary donations.

Following this format ensures that your donation receipt letter is clear, professional, and legally compliant, providing all necessary information to the donor.