Use this donation receipt template to ensure that all charitable contributions are documented correctly for tax purposes. A well-structured receipt provides both the donor and the receiving organization with a clear record for tax deductions. This simple yet efficient format helps maintain compliance with tax regulations while offering transparency.

Include the donor’s name, date of the donation, amount or value of the donation, and a statement confirming whether the donation was in cash, goods, or services. If goods or services were provided in exchange for the donation, this should be clearly stated with an estimated value. Make sure to sign and date the receipt to validate the transaction.

For accurate reporting, avoid vague descriptions. Specify the exact nature of the donation, especially for non-cash items. If needed, attach an inventory or list to provide further detail. This clarity helps the donor properly claim the tax deduction.

Keep your template simple, professional, and consistent. Ensure that each receipt matches the formatting and required information to make the process smooth for both parties. With these steps, you’ll have an organized and reliable donation receipt that serves its tax purposes efficiently.

Sure! Here’s the modified version:

To create a donation receipt for tax purposes, include the donor’s full name, address, and the date of the donation. Specify the amount donated or describe the items donated, along with their estimated value. Clearly state whether the donation is tax-deductible. If the donation includes goods or services, provide an acknowledgment of their value.

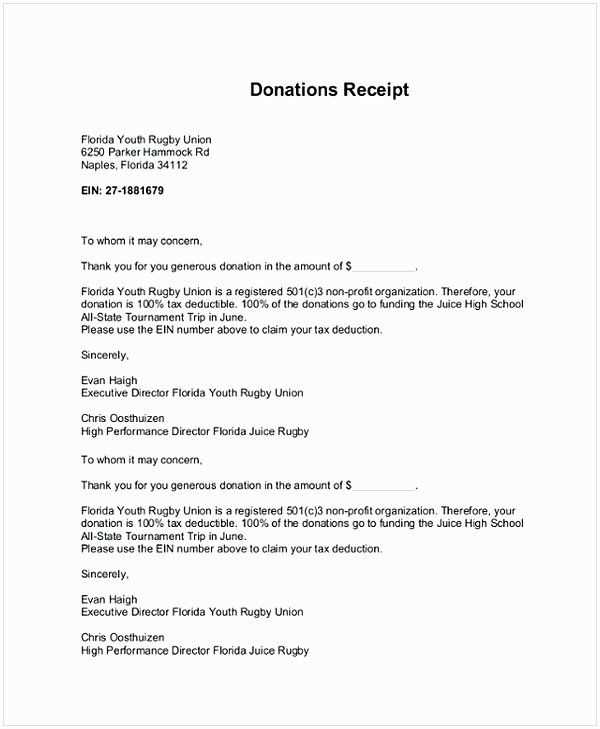

Make sure to mention your organization’s tax-exempt status and include your EIN (Employer Identification Number). If goods or services were provided in exchange for the donation, include a statement on their value, ensuring it’s clear how much of the donation is deductible. This detail is required by the IRS for tax purposes.

Template Example:

“This receipt certifies that [Donor Name] made a donation of [amount/items] to [Organization Name] on [date]. The donation was [tax-deductible/not tax-deductible]. [Optional: A description of goods or services provided in exchange for the donation]. Thank you for your support!”

Keep the receipt simple, accurate, and free of unnecessary details. It should act as clear evidence for the donor to claim deductions on their tax return.

- Donation Receipt for Tax Purposes Template

Ensure that your donation receipt for tax purposes includes key details to meet tax requirements. These components will help donors claim their tax deduction accurately.

Donor Information

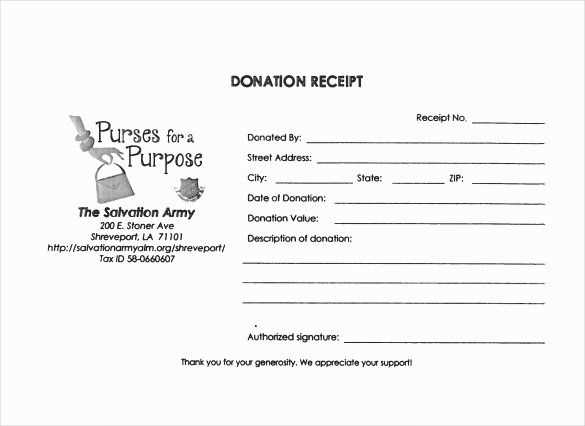

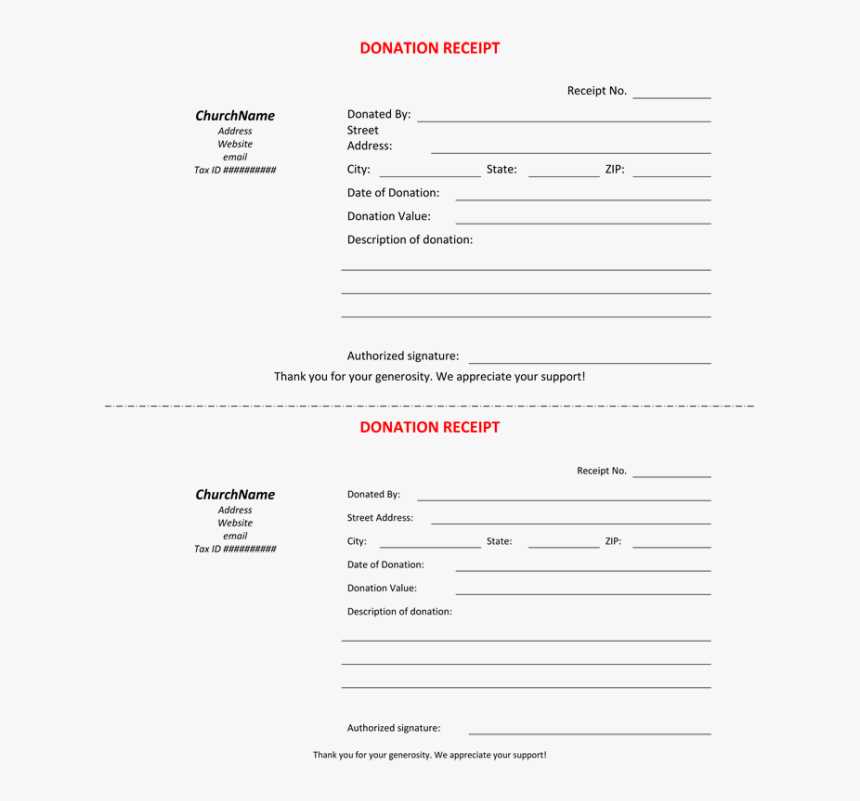

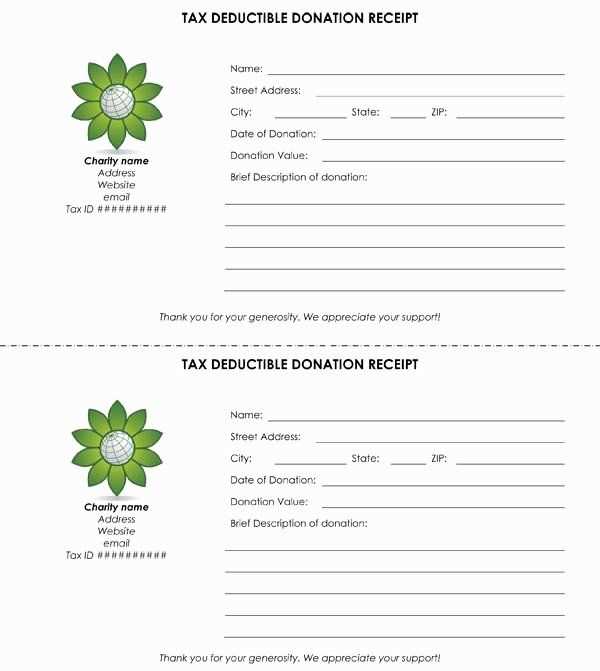

List the donor’s full name, address, and any relevant contact information. If the donor is a business, include the business name and tax identification number.

Donation Details

State the exact value of the donation. For cash donations, include the amount. For in-kind donations, describe the item(s) donated, including quantity and condition. If the donor received something in exchange for their donation, mention the fair market value of those goods or services to adjust the tax-deductible amount.

Include the date of the donation, as well as a brief statement confirming that no goods or services were provided in return, unless applicable. This helps to clarify that the donation is fully tax-deductible.

Finally, add your organization’s name, address, and tax-exempt status number (EIN) to verify its eligibility for tax-deductible donations.

Begin by including the name and address of your organization at the top of the receipt. Make sure this is accurate to ensure donors can easily identify the recipient. Then, include the donor’s name and address. This establishes the donation’s recipient and the donor’s identity for tax purposes.

Details of the Donation

Specify the date of the donation. If the donation is in kind, describe the items donated. For cash donations, mention the amount. If the donation was made through a non-cash method (e.g., check, online transfer), indicate this as well. Keep records of the itemized value of goods donated for tax purposes.

Tax Information and Language

Include a statement confirming that no goods or services were provided in exchange for the donation, if applicable. This is crucial for the donor to claim a tax deduction. For example, “No goods or services were provided in exchange for this donation.” If any goods or services were exchanged, note the value of those items separately.

Ensure the donation receipt includes the donor’s name and address. This serves as proof for tax filing purposes. The date of donation is also crucial, indicating when the gift was given.

Donation Amount and Nature

Specify the exact value of the donation, whether it’s cash or non-cash. For non-cash donations, provide a description of the items, and if applicable, an estimate of their fair market value.

Organization’s Details

Include the organization’s legal name, address, and tax-exempt status or EIN (Employer Identification Number). This verifies that the donation was made to a qualifying entity.

If the donation was made in exchange for goods or services, include a statement clarifying the value of those items. This helps determine the eligible deduction amount for tax purposes.

One of the key errors to avoid is failing to include the required information on the receipt. Make sure to clearly state the donor’s name, donation amount, and the date of the contribution. Missing any of these can make the receipt invalid for tax purposes.

- Ensure the donation amount is listed correctly, reflecting the total value of the gift given. Mistakes in this area can cause complications during tax filing.

- Double-check the date of donation. Receipts issued for the wrong year or incorrect date may cause confusion during tax time.

- Omitting the organization’s name, address, and tax identification number is another mistake to avoid. This information is necessary for the donor’s records and can help validate the donation.

Another issue to be mindful of is the absence of a clear statement of the donation’s non-refundable nature. If the donor received goods or services in exchange for their donation, indicate the fair market value of these items. Failing to do so may result in the deduction being disallowed.

- For example, if a donor receives a ticket to an event or a small gift in return, subtract that value from the total donation amount listed on the receipt.

- Specify any benefits received in a separate line item and ensure the donor understands the deduction should only apply to the portion of the donation that is not linked to these benefits.

Lastly, using non-standard formats or vague language can confuse donors or tax authorities. Use clear and standardized terms, avoiding abbreviations or jargon that might lead to misinterpretation.

Donation Receipt for Tax Template

Ensure your donation receipts include the donor’s full name, donation date, amount given, and a statement confirming that no goods or services were provided in return. Include your organization’s name and tax identification number. Make sure the language clearly specifies the charitable nature of the donation, which is required for tax deduction purposes.

Key Elements of a Valid Donation Receipt

A valid receipt must have the donor’s details, donation amount, and date. Additionally, it should include a statement confirming whether the donation is tax-deductible. Provide your organization’s contact information and ensure that the receipt is signed by an authorized representative. Always issue receipts promptly to maintain accurate records for both the donor and your organization.

Tax Deductibility Statement

It’s essential to clearly state that the donation is tax-deductible, if applicable. Use wording such as, “No goods or services were provided in exchange for this donation.” This helps donors claim the deduction on their tax returns and ensures compliance with tax laws.