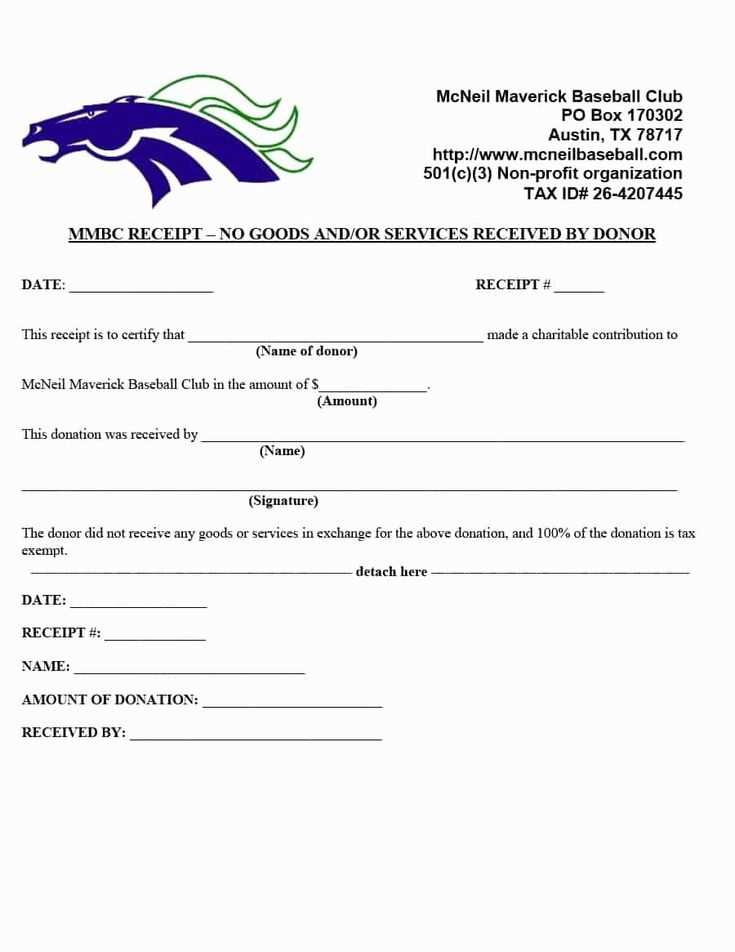

To ensure compliance with IRS guidelines, it’s important that a 501(c)(3) nonprofit provides a clear and concise donation receipt for in-kind contributions. This receipt must include specific details such as a description of the donated items, the date of the donation, and the statement that no goods or services were exchanged in return, if applicable.

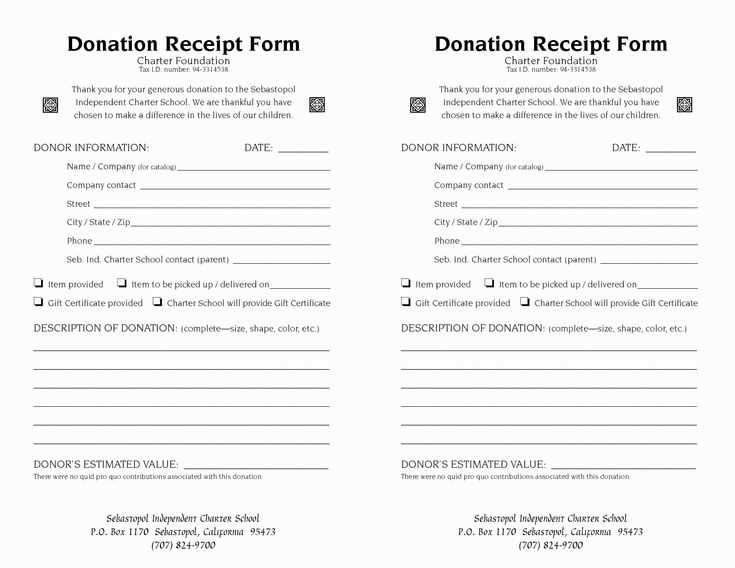

Begin by listing the donor’s name and address, followed by the organization’s name and address. Make sure to specify the date of the donation and describe the donated items. If the donation is a non-cash contribution, a description of the items should suffice; however, if the items are valued above $500, the donor is required to complete Form 8283 for tax purposes.

Don’t forget to include a statement confirming that the nonprofit did not provide anything in exchange for the donation, unless it was a quid-pro-quo contribution. For donations valued at over $250, the receipt should also mention the value of any goods or services provided in exchange.

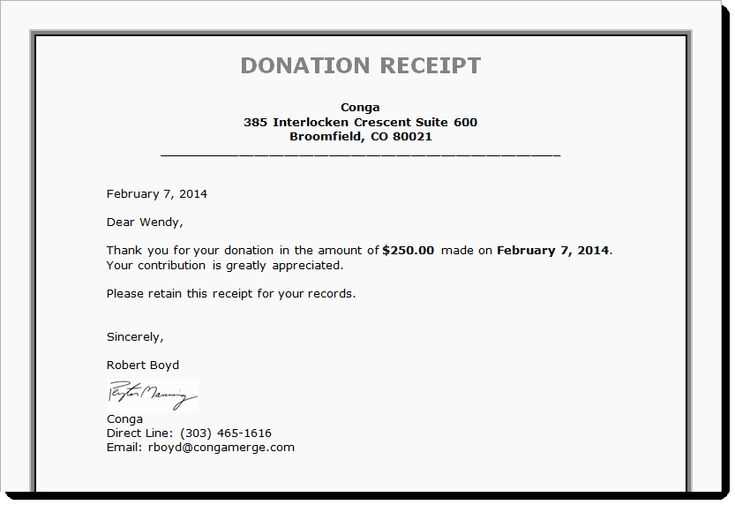

Ensure the donor has a copy for their records, and always keep a record of each transaction for your own. Proper documentation simplifies the year-end tax reporting for both parties, reducing the risk of errors and potential issues during audits.

Here’s the revised version with no word repetition beyond 2-3 times:

Ensure that your donation receipt clearly outlines the details of the gift. For donations in kind, include a description of the items received, the condition they were in at the time of donation, and an estimate of their fair market value. Acknowledging the donor with a statement such as “No goods or services were provided in exchange for this donation” is important for tax purposes.

Consider listing the donor’s name, address, and the date the gift was received. This helps establish a record of the transaction for both your nonprofit and the donor. Make sure to indicate the nonprofit’s 501(c)(3) status to avoid confusion with non-exempt organizations.

It’s also wise to add a statement about how the items will be used, reinforcing the nonprofit’s mission. While this is not a tax requirement, it provides clarity on the donation’s purpose and the donor’s impact.

Finally, always include the signature of an authorized representative from your organization to validate the receipt. This assures the donor that their contribution has been properly documented and recognized.

- Donation Receipt Template for 501(c)(3) Organizations

For a 501(c)(3) organization, providing a clear and accurate donation receipt is crucial for both legal and tax purposes. The receipt should include specific details to ensure compliance with IRS guidelines. Here’s a simple template you can follow:

Donation Receipt Template

Organization Name: [Your Organization’s Name]

Address: [Your Organization’s Address]

Tax-Exempt Number: [Your Tax-Exempt Number]

Date of Donation: [Date]

Donor’s Name: [Donor’s Full Name]

Donation Description: [Detailed Description of Donated Item(s) or Cash Amount]

Donation Value: [Estimated Fair Market Value of Donated Goods or Cash]

Non-Cash Donations: [A statement confirming the donor is responsible for determining the value of non-cash donations]

Statement of Goods or Services Provided: [Describe any goods or services provided in exchange for the donation, if applicable]

Signature: [Authorized Signature]

Organization’s Name: [Your Organization’s Name]

Contact Information: [Your Organization’s Contact Info]

Ensure the donor receives this receipt by the end of the year to allow them to use it for tax deductions. If any goods or services were exchanged, include that information clearly on the receipt. This transparency keeps both the donor and your organization compliant with IRS requirements.

Nonprofits must comply with specific IRS rules when issuing donation acknowledgements. For donations exceeding $250, a written acknowledgment is required, detailing the donation amount, description, and the nonprofit’s name. If goods or services were received in exchange, this must be stated as well.

Key Information for Donation Acknowledgements

- The name of the nonprofit organization

- The date of the donation

- The amount of the cash donation or a detailed description of non-cash donations

- A statement indicating whether any goods or services were provided in exchange for the donation

- A description and good faith estimate of the value of goods or services provided, if applicable

Special Considerations for In-kind Donations

- For in-kind donations, a description of the donated items is required rather than a cash value, as the nonprofit cannot assign a value to donated property.

- Donors are responsible for determining the fair market value of non-cash gifts, and nonprofits should provide guidelines or resources to help them.

Include the donor’s name and contact information at the top of the receipt. Ensure the donor is identified clearly for tax purposes. Next, list the organization’s name, address, and EIN (Employer Identification Number), which is required for IRS reporting.

Detail the description of the donation, whether it’s goods or services. For donated goods, describe the items received, including their condition. For non-cash donations, be specific about their value or refer to the donor’s estimation.

State the date of the donation and the value assigned to the donation. If the donor provides an estimated value, note that it was their valuation. If no goods or services were provided in exchange for the donation, indicate that the contribution is fully deductible.

If applicable, include a statement confirming that no goods or services were exchanged for the donation. If any goods or services were given in exchange, provide their fair market value to help the donor calculate the deductible portion of the contribution.

Finally, include a thank you statement to acknowledge the donor’s generosity. A simple expression of gratitude adds a personal touch and shows appreciation for their support.

To accurately assess the Fair Market Value (FMV) of a donated item, review its condition and compare it with similar items currently being sold. Online marketplaces, thrift stores, and auction sites provide a reliable reference for pricing. Be sure to check both the condition and the current market trends for similar goods to arrive at a fair price.

For used items, consider the depreciation factor. FMV takes into account how the item has worn over time. For example, a used television may have significantly less value than a new one, even if it’s in working condition. Always look for comparable items with similar age and usage patterns to gauge the correct value.

In cases of unique or rare items, appraisals from professionals in that field may be required to establish a reasonable FMV. If the donation involves property, artwork, or high-value items, professional evaluation ensures accurate reporting for both tax and legal purposes.

Documenting the process of determining FMV is critical. Keep a record of the sources you used to establish the value, including online listings, appraisals, or other references. This documentation can be helpful for both tax purposes and transparency with donors.

For donations exceeding $500 in value, it’s critical to follow IRS guidelines for proper documentation. Ensure that a qualified appraisal is obtained for non-cash gifts. This is required to substantiate the value of the donation when filing taxes.

Record Keeping and Acknowledgment

Maintain detailed records of the donated items, including descriptions, the date of receipt, and the donor’s contact information. Provide a written acknowledgment of the donation, which should include a description of the items received and a statement that no goods or services were provided in exchange for the donation.

Filing Requirements

When reporting non-cash donations exceeding $500, donors must file Form 8283, “Noncash Charitable Contributions,” with their tax return. The form includes sections for both the donor’s and charity’s information, and it must be signed by both parties. For donations valued at over $5,000, a qualified appraisal must also be included.

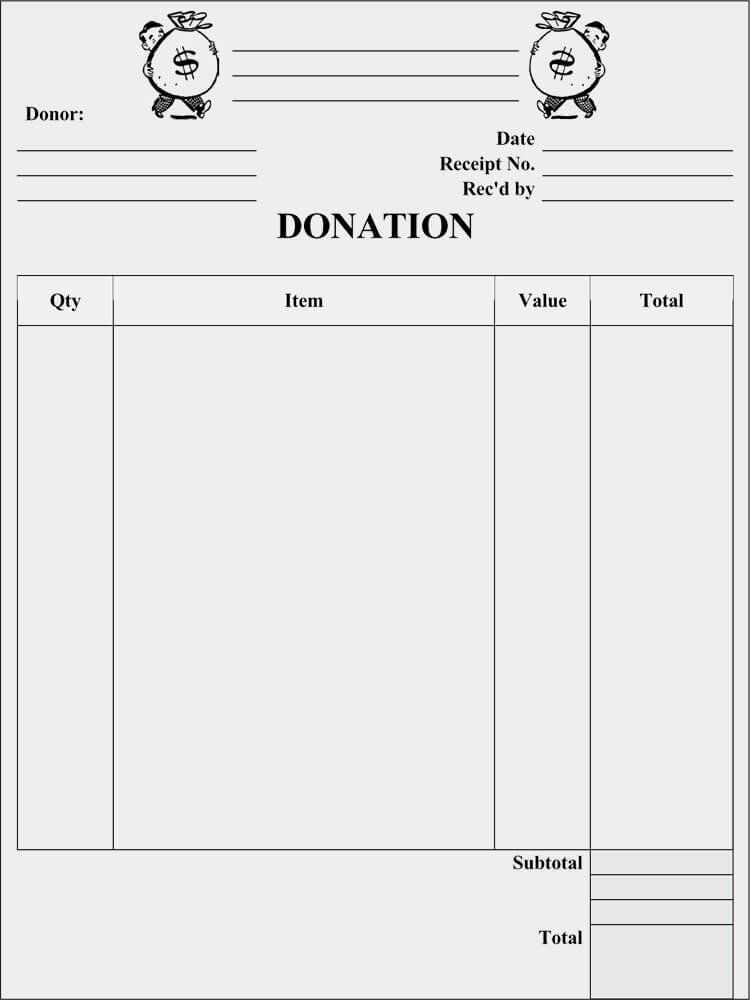

In-kind donations often include a wide range of items. It is important to record these donations accurately on receipts to ensure compliance with IRS regulations. Below are some examples of common in-kind gifts and the formats for their receipts:

Clothing Donations

For clothing donations, the receipt should list the donated items, their condition (new or gently used), and an estimated value based on fair market value. The donor can provide their own estimation, or the organization may use guides like Goodwill or Salvation Army for valuation.

Furniture and Appliances

Furniture and appliances typically require more detailed descriptions, including brand, model, and condition. A fair market value estimate is necessary to reflect the donation’s worth. In many cases, larger donations like furniture may require an additional acknowledgment of delivery or pick-up date.

Each receipt must include the name of the donor, the nonprofit organization’s details, and a statement confirming that no goods or services were provided in exchange for the donation.

Begin with clear identification of the nonprofit organization at the top of the template. Include the organization’s name, address, and federal tax identification number (EIN). This ensures compliance with IRS regulations and gives the donor all necessary details.

Provide Accurate Donation Details

List the donation’s specific value, including a brief description of the donated items or services. If the gift is in kind, avoid assigning a dollar value; instead, note that the donor should determine the value for tax purposes. Clearly indicate whether the donation is a cash gift, property, or other item, and specify the donation date.

Include a Statement of No Goods or Services

For tax deductibility, include a statement confirming that no goods or services were provided in exchange for the donation, unless a token or nominal gift was given. This is required for donations of $75 or more. Make this statement concise and straightforward.

Finish with the signature of an authorized representative of the organization, and optionally, a contact number or email address for questions. This validates the donation receipt and assures transparency.

Let me know if this works!

If you’re looking to create a donation receipt for a 501(c)(3) organization, follow this straightforward template structure. It ensures your document is both clear and meets IRS requirements.

Start with the name of the organization and its EIN (Employer Identification Number) at the top of the receipt. This helps donors identify the organization and is essential for tax purposes.

| Information | Details |

|---|---|

| Organization Name | [Your Organization’s Name] |

| EIN | [Your Organization’s EIN] |

| Donation Date | [Date of Donation] |

| Donor Name | [Donor’s Name] |

| Donation Description | [Brief Description of Donated Items] |

| Value of Donation | [Fair Market Value] |

| Organization’s Statement | The organization did not provide any goods or services in exchange for this donation. |

Always include a clear statement confirming that no goods or services were received in exchange for the donation, unless it is a quid pro quo donation. This is critical for the donor’s records and tax filing.

Finally, ensure the receipt is signed by an authorized representative of the organization. This step is key to validating the donation.

Let me know if this works!