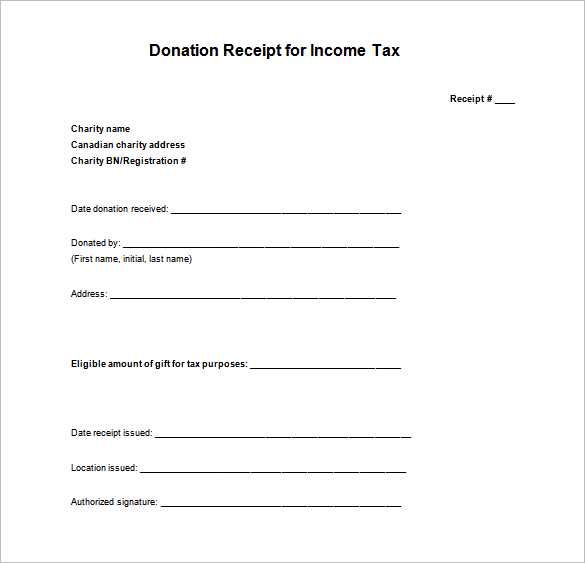

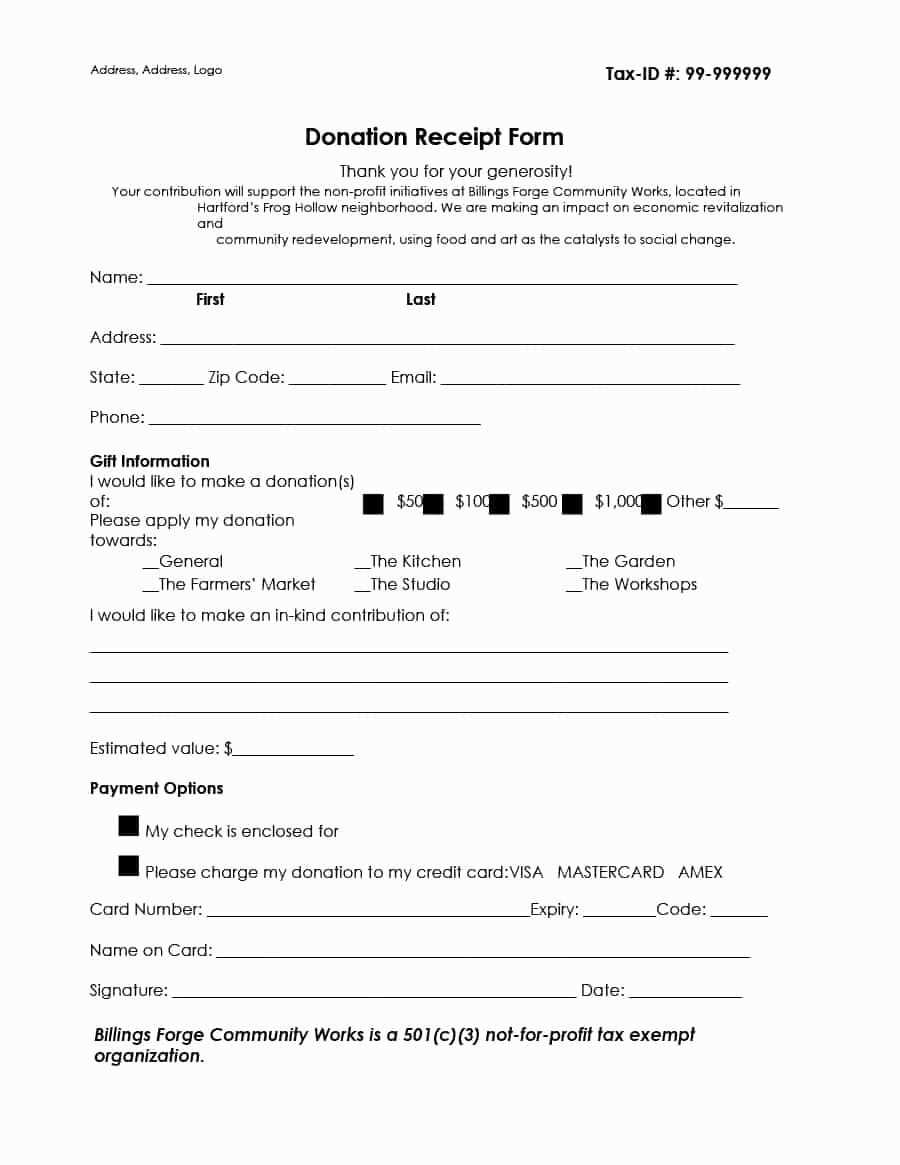

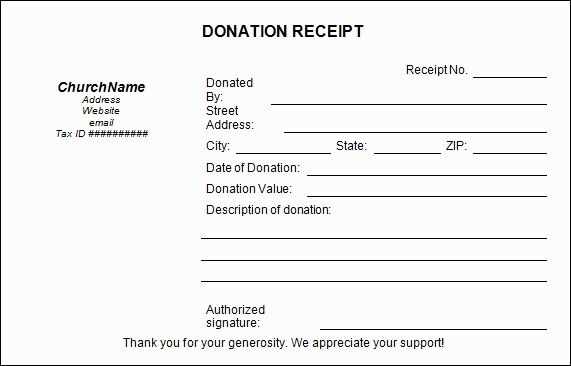

Use this template to create a clear and concise donation receipt for your records. It ensures the donor receives proper acknowledgment of their contribution, which is necessary for tax purposes.

Donor Information: Include the donor’s full name, address, and the date of the donation. This helps in confirming their identity and the timing of the contribution.

Donation Details: Specify the type of donation, such as cash, goods, or services. Mention the value of the donation if applicable. If the contribution is non-cash, describe the donated items and their estimated value.

Organization Information: Provide the name, address, and contact details of your organization. This establishes the legitimacy of the receipt and allows the donor to verify the information easily.

Tax-Exempt Status: If your organization is tax-exempt, include the relevant IRS or tax identification number. This ensures the donor can claim deductions appropriately.

Finish the letter with a statement expressing gratitude for the donor’s support. Acknowledge their contribution’s impact on your cause, reinforcing the positive effect of their generosity.

Here is the improved version with reduced repetition of words:

To improve the clarity of your donation receipt letter, focus on concise language and eliminate redundancies. Instead of repeating similar phrases, use varied sentence structures to convey the same message more effectively.

Be Clear and Direct

Start with a clear statement of the donation’s purpose. Acknowledge the contribution by specifying the amount and date of the donation. This sets the tone without overusing the word “donation” or “thank you.”

Provide Relevant Details

Instead of reiterating the same information, include relevant details that highlight the impact of the contribution. For example, describe how the donation will be used without constantly repeating terms like “support” or “help.” This avoids redundancy while maintaining focus on the purpose of the receipt.

- Donation Receipt Letter Template

A donation receipt letter should be clear, concise, and contain all the necessary information to confirm a donor’s contribution. Below is a recommended structure for your letter:

- Header: Include your organization’s name, logo, and contact information at the top of the letter.

- Date: Add the date when the donation was received.

- Donor Information: List the donor’s full name and address to ensure accuracy.

- Donation Description: Clearly describe the item(s) or amount donated, including a brief mention of the purpose (if applicable).

- Non-taxable Status: State whether the donation is tax-deductible and include your tax identification number if applicable.

- Thank You Note: Express gratitude for the donation and mention its impact.

- Signature: End the letter with a signature from an authorized person in your organization.

Here is an example template:

[Organization Name] [Organization Address] [City, State, ZIP Code] [Phone Number] | [Email Address] | [Website] [Date] [Donor's Name] [Donor's Address] [City, State, ZIP Code] Dear [Donor's Name], Thank you for your generous donation of [Description of Donation] on [Date]. Your contribution will help us [mention specific cause or purpose]. This donation is tax-deductible. Our tax identification number is [Tax ID Number]. Please keep this letter as a record of your donation. We appreciate your continued support and commitment to our mission. Sincerely, [Authorized Signature] [Name] [Title]

Begin with a clear header that includes your organization’s name and address, followed by the donor’s name and address. This ensures both parties have the necessary contact information for reference.

Next, specify the donation details. Clearly state the amount donated and the date the donation was received. If the donation is in-kind, provide a brief description of the item(s) donated.

Include a statement of acknowledgment. Let the donor know that their contribution is appreciated, and clarify that the donation is tax-deductible, if applicable. However, avoid providing a value for in-kind donations unless your organization is authorized to do so.

Make sure to reference any special conditions of the donation, such as whether it was restricted to a specific purpose or general use.

Close the letter with a polite sign-off, offering gratitude again for the donor’s generosity, followed by a signature and the title of the person issuing the receipt. This adds a personal touch and credibility to the document.

Ensure the acknowledgment includes the donor’s full name and address for accurate records. List the exact amount or description of the donation, whether cash, goods, or services. This ensures the donor understands what was contributed.

Always mention the date of the donation to avoid confusion when referencing past contributions. If applicable, note any restrictions or specific purposes for the donation. This helps clarify any special conditions attached to the gift.

Include a clear statement that the donation is tax-deductible, as this information is vital for the donor’s records. Provide your nonprofit’s name and tax-exempt status number to support this claim.

Express sincere thanks for the donor’s generosity. A personalized message makes the acknowledgment feel more genuine and appreciated.

Lastly, if possible, mention how the donation will be used. This transparency builds trust and strengthens the relationship between the donor and your organization.

| Element | Description |

|---|---|

| Donor Name & Address | Accurate donor information for record-keeping. |

| Donation Amount/Description | Clearly state the contribution, whether monetary or in-kind. |

| Date of Donation | Include the donation date for reference. |

| Tax-Deductibility Information | State if the donation is tax-deductible and provide necessary details. |

| Personal Thank You | Acknowledge the donor’s generosity with a heartfelt thank you message. |

| Usage of Donation | Explain how the donation will be utilized to build trust. |

Clearly recognize the different types of donations in your letters. Whether the contribution is financial, in-kind, or a volunteer effort, tailor your acknowledgment to reflect the specific value of that contribution.

1. Financial Contributions

- Be specific about the amount or range of the donation to ensure transparency.

- Include a statement regarding the tax-deductibility of the donation, if applicable.

- Express gratitude by detailing how the funds will be used to support your cause.

2. In-Kind Contributions

- List the items donated and provide an estimated value if appropriate for tax purposes.

- Describe the impact these items will have on your organization’s operations or goals.

- Send a thank-you letter promptly after receiving the donation, regardless of its size or value.

3. Volunteer Time

- Thank volunteers for their time and energy. Highlight specific contributions they made during their service.

- Provide details of the positive impact their actions have had on your mission or project.

Begin by addressing the donor by their full name at the start of the letter. This creates a more personal and respectful tone. Avoid generic terms like “Dear Donor” or “To Whom It May Concern.” Acknowledge their contribution by specifically referencing the donation amount and the date it was received, ensuring it’s clear and precise.

Include a Personal Thank-You Note

Incorporate a heartfelt thank you that speaks directly to the donor’s generosity. Referencing the purpose of the donation and how it will be used adds meaning. You can mention a specific project, event, or cause that their donation supports, highlighting its direct impact.

Offer Future Engagement Opportunities

Invite the donor to stay connected by suggesting future ways to engage. This could include signing up for newsletters, attending upcoming events, or volunteering. Personalizing this section shows you value their ongoing support and keeps them involved in your cause.

In the United States, donation receipts must meet specific criteria to comply with IRS guidelines. The receipt must include the donor’s name, the charity’s name, the donation amount, and the date of the donation. For donations of $250 or more, a written acknowledgment from the charity is required. This acknowledgment must state whether the donor received any goods or services in exchange for the donation. If the donor received something of value, the receipt must provide an estimate of the item’s value.

For non-cash donations, such as goods or property, the receipt must describe the items donated in detail. If the value exceeds $500, the donor is required to complete IRS Form 8283 and attach it to their tax return. For donations exceeding $5,000, a qualified appraisal is needed.

Nonprofit organizations should issue these receipts promptly to ensure donors can use them for tax purposes in the correct year. Keeping records of donations is also important for both the donor and the nonprofit for tax filing and auditing purposes.

Send a donation receipt promptly after receiving a donation. Ideally, issue it within a few days or weeks, depending on the organization’s workflow. The receipt should be sent immediately for cash donations or any gift with a tangible value. For recurring donations, you can send a receipt at the end of the year, summarizing all contributions made during the period.

Common Mistakes to Avoid

- Delaying the receipt: Donors should receive receipts in a timely manner. A delay can cause confusion or frustration.

- Incomplete information: Ensure that the receipt includes all necessary details such as donor’s name, donation date, amount, and organization’s tax identification number.

- Forgetting to mention if the donation was tax-deductible: It’s crucial to specify whether the gift is tax-deductible or not.

- Not acknowledging non-cash donations properly: If the donation is in-kind, include a description of the item(s) donated and, if applicable, the fair market value.

- Incorrect tax value: Never assign a value to a non-cash donation unless it has been properly appraised or is clearly specified by the donor.

Provide clear and accurate information in your donation receipt letter. A well-structured letter ensures the donor feels appreciated and acknowledges the value of their contribution.

Key Elements to Include

| Element | Description |

|---|---|

| Donor’s Name | Ensure the donor’s full name is included and spelled correctly. This personalizes the receipt. |

| Donation Amount | Clearly state the amount donated. If it was an in-kind donation, describe the item and its estimated value. |

| Date of Donation | Include the exact date the donation was received. This is important for the donor’s tax records. |

| Nonprofit’s Details | Include the name of your organization, its address, and contact information for future reference. |

| Tax-Exempt Status | If applicable, mention your nonprofit’s tax-exempt status and the IRS 501(c)(3) number. |

Ensure to send the receipt promptly to avoid any confusion or delays for the donor’s tax filing. This also demonstrates professionalism and respect for their contribution.